Author: Max.s

Just yesterday, the Secretary for Financial Services and the Treasury of Hong Kong, Christopher Hui, announced with great fanfare that Hong Kong aims to become a globally trusted gold storage hub within three years, targeting a capacity exceeding 2,000 tons. Meanwhile, across the ocean, stablecoin giant Tether revealed in its recently disclosed Q4 2025 financial report that it has increased its gold holdings by approximately 27 tons.

On the surface, this seems to be an era of "gold revival." From the central banks of sovereign nations to the "central bank" of the crypto world, Tether, it appears that there is a frantic rush to acquire precious metals.

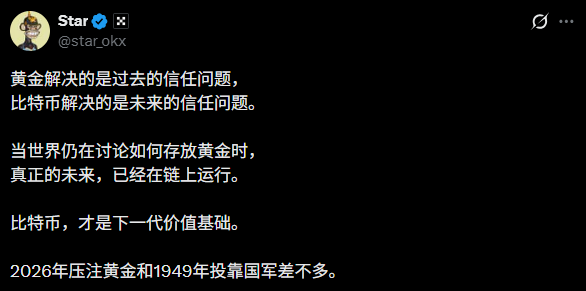

However, beneath this apparent prosperity, a more profound and brutal intergenerational asset transfer is taking place. As OKX Star stated: "Gold addresses the trust issues of the past, while Bitcoin addresses the trust issues of the future. Betting on gold in 2026 is akin to siding with the Nationalist Army in 1949."

This statement sounds sharp, yet it precisely pierces through the false prosperity of the current financial market: while the old world is still discussing how to build stronger vaults, the real future has already completed trillions of dollars in settlements on the blockchain.

By the end of 2025, the circulation of USDT issued by Tether has reached an astonishing $187 billion. To support this massive digital financial empire, Tether has hoarded $12.9 billion worth of gold on its balance sheet, equivalent to about 104 tons. This reserve amount is already comparable to that of some sovereign nation central banks. In comparison, the Polish central bank only increased its gold holdings by 35 tons in the fourth quarter of last year.

Why is Tether buying gold? Many mistakenly believe that Tether is optimistic about the future of gold. No, this is precisely Tether's compromise with the old world and a "dimensionality reduction attack."

Tether is essentially using the totem of the old world—gold—to back its new world "fiat currency" (USDT). This is a transitional strategy. If you look closely at the data, you will find a highly ironic phenomenon: Tether's gold token XAUT currently has a circulating market value of only $270 million, a mere drop in the bucket compared to its vast empire.

What does this mean? It means that the market does not need "digital gold." Although XAUT is backed 1:1 by 16.2 tons of physical gold, accounting for 60% of the global supply of gold stablecoins, it remains an insignificant marginal product in the face of the $187 billion USDT.

People use USDT to engage in high-frequency trading, lending, and payments on-chain through smart contracts, to enter the vast realm of DeFi (decentralized finance). Gold, whether lying in underground vaults in London or tokenized as XAUT, remains static and slow. Its only purpose is to serve as a last resort collateral, soothing those regulators and traditional institutions who have not fully grasped that "code is law."

Star's remark that "betting on gold in 2026 is akin to siding with the Nationalist Army in 1949" uses a metaphor with significant historical tension to reveal the civilizational conflict behind asset choices.

The historical turning point of 1949 was not just a change of regime but a reconstruction of the underlying social operating logic. At that time, even if you retreated to an island with a box full of gold bars, you were merely taking away "old value" while losing the right to participate in the future of the "new world."

Today, in 2026, the situation is remarkably similar.

Gold is a trust model based on physical attributes and violent endorsement. Its value depends on: your belief that the vault is strong enough, your belief that the government guarding the vault will not confiscate it, and your belief that the auditor's report is not fraudulent. Hong Kong's attempt to establish a 2,000-ton gold storage in three years is essentially an effort to attract capital by strengthening "physical security" and "institutional credibility." This is a typical industrial age mindset—building a moat by piling up resources from the atomic world.

In contrast, Bitcoin is a trust model based on mathematics and cryptography. It does not require vaults, guards, or auditors. Every transaction, every UTXO (unspent transaction output) is verified by the entire network's computing power and eternally etched on a distributed ledger.

While the world is still discussing how to store gold, the real future is already operating on-chain. Bitcoin is not just an asset; it is the foundational protocol of the next generation of the value internet.

In 2026, if we are still talking about "gold as a safe haven," we are actually discussing an outdated logic of hedging. This logic assumes that future crises can be weathered by hiding in bunkers. But in reality, in today's digital survival, the true crisis is being systematically excluded from the new financial network.

Data does not lie; it only reveals trends.

We can see that although Tether holds a large amount of gold, the growth of its core business entirely depends on the expansion of the crypto ecosystem. The $187 billion circulation of USDT represents the global demand for "on-chain dollars." This demand is not because the dollar itself is so great, but because of the efficiency of the "on-chain" medium.

If we view Bitcoin as "digital gold," its efficiency is billions of times that of physical gold. In today's 2026, transporting $100 million worth of physical gold from London to Hong Kong involves cumbersome processes such as insurance, transportation, customs clearance, and inspection, taking days or even weeks, along with significant friction costs.

In contrast, transferring $1 billion worth of Bitcoin takes only 10 minutes, and it cannot be frozen or intercepted.

In the current macro environment, with escalating geopolitical conflicts and increasingly strict capital controls, the traditional SWIFT system is being weaponized, which poses an unprecedented "liquidity trap" for assets like gold that heavily rely on physical delivery and centralized custody. Whether your gold is in Hong Kong, London, or New York may not be determined by you in extreme situations.

On the other hand, the private keys of Bitcoin are held by users, and its liquidity does not depend on any single sovereign nation. This is the true "sense of security" in 2026.

Returning to the news of Hong Kong's construction of gold storage, this is undoubtedly a very sound decision from a traditional financial perspective, as it will solidify Hong Kong's position as a traditional wealth management center. However, in a broader historical narrative, it resembles building a tomb for the financial system of the previous era.

We respect gold's status as the king of currency in human history spanning thousands of years, just as we respect the contribution of horse-drawn carriages in transportation history. But in an age where cars are ubiquitous, continuing to heavily invest in stables and hay is clearly not a wise investment. What we see today is not just Tether's balance sheet or Hong Kong's infrastructure plans; we see the stark stratification between the new and old worlds.

Some choose to believe in the atomic world of the physical, trusting that heavy metal blocks can withstand inflation; others choose to believe in the digital world of bits, trusting that immutable code can reshape contracts.

Star's viewpoint, though radical, points to the fundamental logic of investment: returns come from accurate predictions about the future, not from excessive nostalgia for the past.

If financial history is a long river, then in the early spring of 2026, we stand at a subtle fork in the road.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。