Original | Odaily Planet Daily (@OdailyChina)

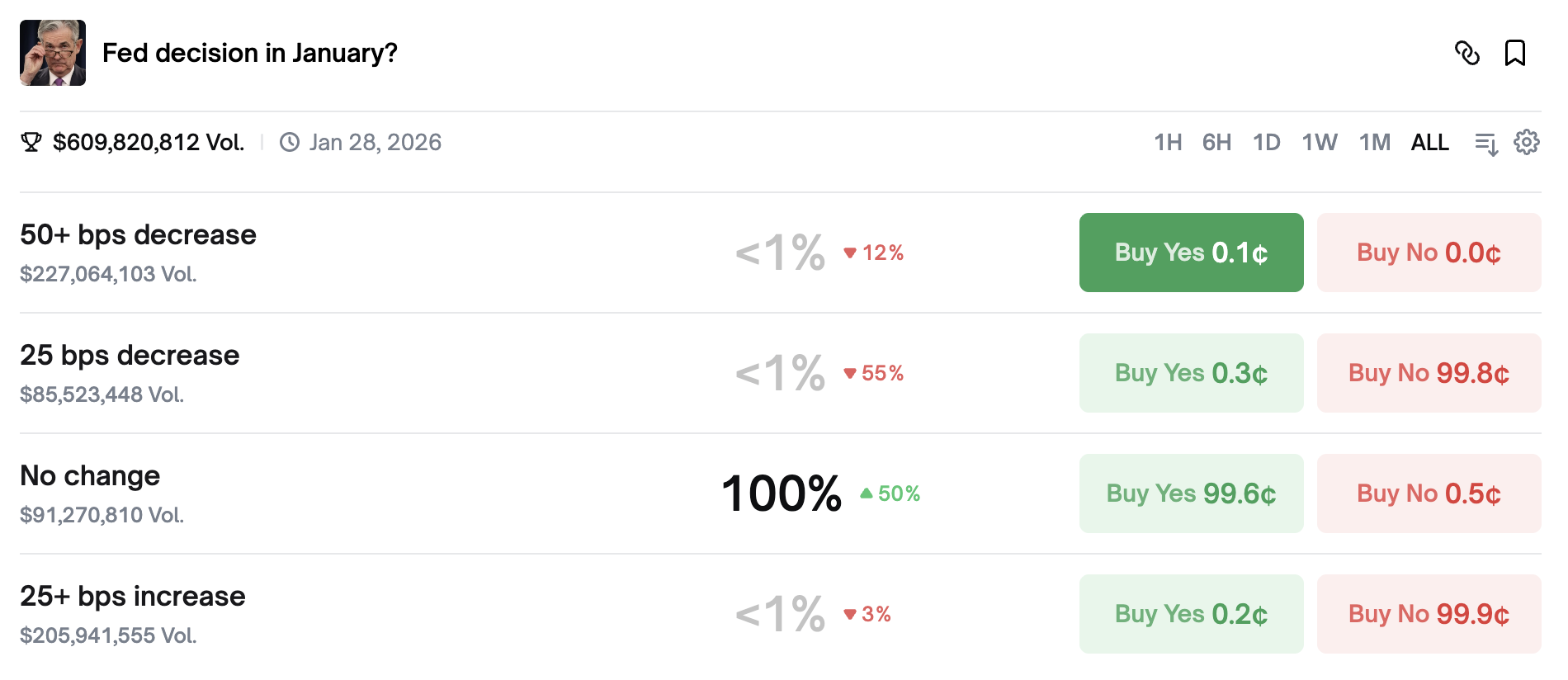

At 3 AM Beijing time on January 29 (this Thursday), the Federal Reserve is set to announce its first interest rate decision for 2026; half an hour later, current Fed Chair Powell will hold a monetary policy press conference. However, there is not much suspense surrounding this Fed interest rate decision, as the market generally believes that the Fed will decide to keep rates unchanged. Polymarket data shows that the probability of maintaining the current interest rate is close to 100%.

Such a high probability allows the market to digest the negative impact of the Fed's announcement of "no rate cut" in advance. OKX data shows that BTC has only dropped 0.39% in the past 7 days, remaining basically flat, but this "quiet period" may be broken tonight.

On one hand, while the market almost unanimously believes that the Fed will keep rates unchanged this week, there are significant differences regarding the fiscal path for the remainder of 2026, making this an important wait-and-see meeting. Whether the Fed will continue to cut rates in 2026, the frequency of rate cuts, and other future key policy tendencies will affect the market. If Powell makes hawkish statements such as "we need to continue to observe" during his speech, the market may "respond with a drop."

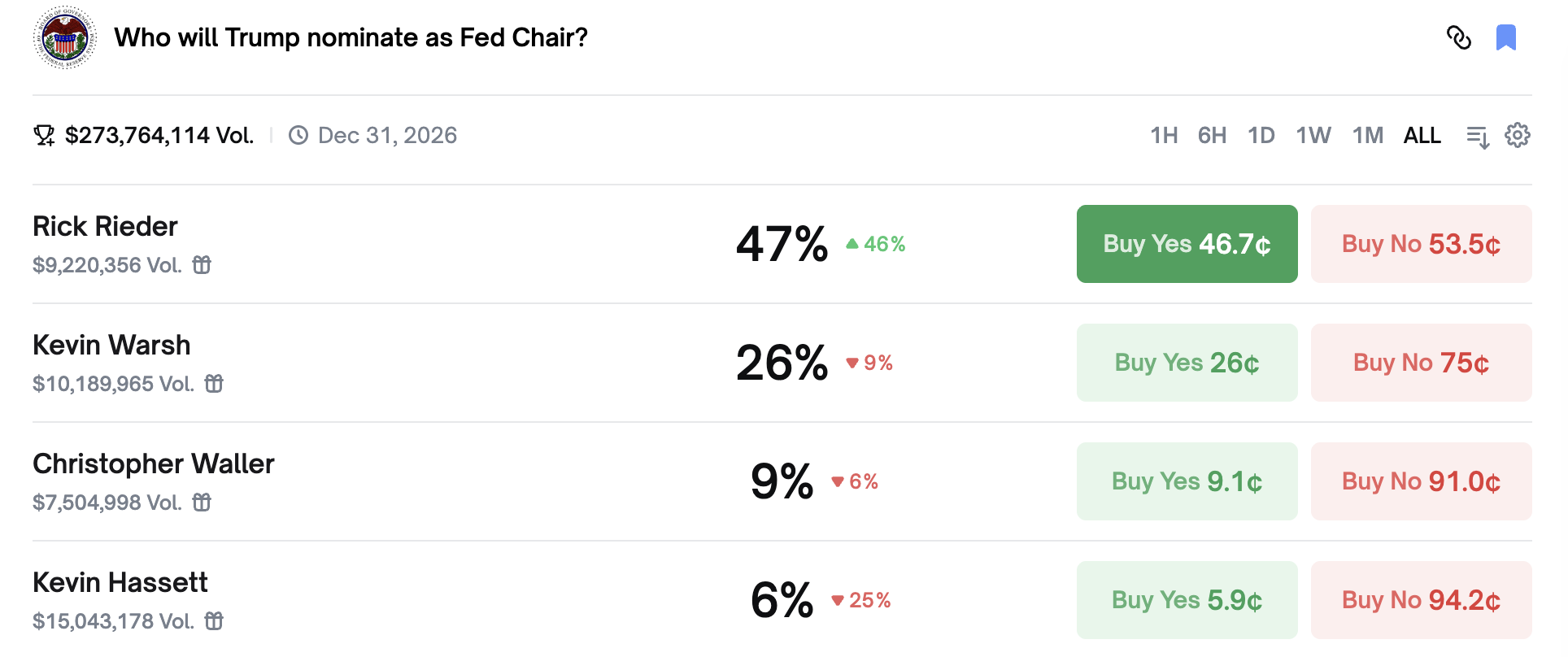

On the other hand, the announcement of the successor to the Fed Chair will also have a long-term impact on the market. The candidate pool has now narrowed to four individuals. Trump previously indicated he has a preferred candidate but will wait for the right time to announce, and that right time is likely to be tonight.

Uncertainty Remains on Rate Cuts in 2026

Since September of last year, the Fed has entered a new round of rate-cutting cycles, having cut rates three times in a row. If the Fed maintains rates this week, it will be the first pause since the start of the rate-cutting cycle. At this point, the market is not concerned about the reasons for keeping rates unchanged, but rather whether this is a brief pause in the rate-cutting pace or the beginning of a long-term pause in rate cuts, or even the start of a rate-hiking cycle?

Previously, the prevailing view in the market was that 2026 would be a year of further quantitative easing by the Fed.

One reason is that, from a data perspective, the U.S. labor market is indeed showing signs of weakness, with only 50,000 non-farm jobs added in December 2025 and an unemployment rate of 4.4%. Although there have been no "mass layoffs," the market is still in a state of "low hiring and cooling demand." Another reason is that the Fed may still believe that Trump's tariff policies will not have a long-term impact on inflation (Odaily: Powell cut rates in September 2025 based on this factor); a third reason is that Trump has previously publicly stated that he would choose a "dovish" figure to be the next Fed Chair.

However, there are also views in the market that uncertainty remains regarding the Fed continuing to cut rates in 2026. Some analysts believe that unless the job market significantly deteriorates, it will be difficult to see rate cuts before mid-year, as the pace of inflation decline is not sufficient to convince hawkish committee members.

The Fed's task, simply put, is to curb inflation and promote employment. However, in 2025, the U.S. experienced a phenomenon of both a weak labor market and high inflation. The Fed ultimately chose to prioritize solving employment issues, which is why it initiated the rate-cutting cycle. However, the reality is that the U.S. inflation rate remains stuck at 2.8%, far above the Fed's target of 2%, which forces the Fed to reconsider the impact of tariffs on inflation. If rates are maintained this week, it also indicates that the Fed is beginning to "wait and see."

On the other hand, while the next Fed Chair chosen by Trump is bound to be "dovish," the new rotating chair of the Fed's rate decision committee is predominantly "hawkish." At the beginning of each year, four of the twelve regional Fed presidents rotate into the rate decision committee and have voting rights in the next eight policy meetings. This year's rotation includes Dallas Fed President Logan, Cleveland Fed President Harmack, Philadelphia Fed President Paulson, and Minneapolis Fed President Kashkari.

Among them, Logan and Harmack are seen as "hawkish" individuals, both of whom have previously publicly stated that the Fed should focus on inflation issues. Paulson is viewed as "dovish," having publicly expressed a "cautiously optimistic" attitude towards inflation, while Kashkari's stance is more neutral. The addition of new "hawkish" individuals may disrupt the previous balance of policy tendencies within the Fed, and even if Trump chooses a "dovish" individual as chair, it may not sway the entire rate decision committee.

Moreover, the Fed Chair may not fully lead rate cuts according to Trump's wishes. Trump personally appointed Powell as Fed Chair before the New Year, but it seems that even though Trump promoted Powell, Powell has not "repaid" Trump through sustained significant rate cuts. Under U.S. law, the Fed operates independently and can make rate decisions based on economic conditions rather than government wishes. Therefore, even if the new Fed Chair verbally promises Trump to cut rates, they may still "go their own way" once in office.

This meaningless "political promise" is also a concern for Trump. Last week, during a speech at the World Economic Forum in Davos, Trump stated, "Once people get this job, they change; it's amazing," implying that candidates "say nice things" during interviews, but once confirmed, they emphasize their independence.

In summary, after tonight's FOMC meeting, Powell's speech will be closely watched by investors for hints on how long the Fed will pause rate cuts.

This Week's FOMC Meeting is One of the Best Opportunities for Trump to Announce the Successor to the Fed Chair

In addition to this week's FOMC meeting, the successor to the Fed Chair is also a macro event that can influence the market. The candidate pool has now narrowed down to Kevin Hassett, Kevin Warsh, Rick Rieder, and Christopher Waller. According to Polymarket data, Rick Rieder currently has the highest probability of being nominated by Trump at 47%, while Kevin Hassett has the lowest at 6%.

Rick Rieder is the Chief Investment Officer of Global Fixed Income at BlackRock. Although he does not have much government experience, he has consistently advocated for low interest rates based on market understanding rather than politics, which may attract Trump, who is concerned that the new Fed Chair may not "listen" once in office. Economists at Evercore ISI, including Krishna Guha, even believe that "if Rick Rieder becomes the new Fed Chair, he may advocate for three rate cuts this year." (Odaily Note: For more information on Rick Rieder, you can read the article What is Rick Rieder's stance on cryptocurrencies as the last candidate for Fed Chair?)

Hassett was once considered the most likely candidate for the new Fed Chair, with probabilities exceeding 80%. However, Hassett is an economic advisor to Trump, and there have been concerns that if Trump nominates Hassett, it would undermine the Fed's independence. Additionally, Trump has publicly stated that he does not want to lose Hassett in his administration, which has decreased Hassett's chances of being selected, although some still believe his nomination probability is higher than 6%.

Trump has repeatedly stated that he would announce his nominee in January. At the end of December 2025, Trump told reporters in Florida that he would announce the next Fed Chair at some point in January; on January 14, 2026, he told Reuters that he would announce the nominee in the coming weeks; and two weeks later, on January 27, Trump stated in Iowa that he would soon announce the new Fed Chair, but has yet to do so.

Although Trump has been vague in his responses, it is certain that the probability of announcing a nomination in January is very high, and it is even likely that the best timing for the announcement will be during this week's FOMC meeting.

As mentioned earlier, Powell's speech tonight will be a key focus for investors, and if Powell does not make dovish statements, the financial market may suffer, which is clearly a scenario Trump does not want to see. Therefore, if Trump wishes to shift market attention away from the uncertain Powell, he may announce his next Fed Chair nominee during tonight's FOMC meeting, providing the market with a "dovish chair" boost and reducing the market's focus on Powell's speech or mitigating potential negative impacts.

Tonight, let us wait and see!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。