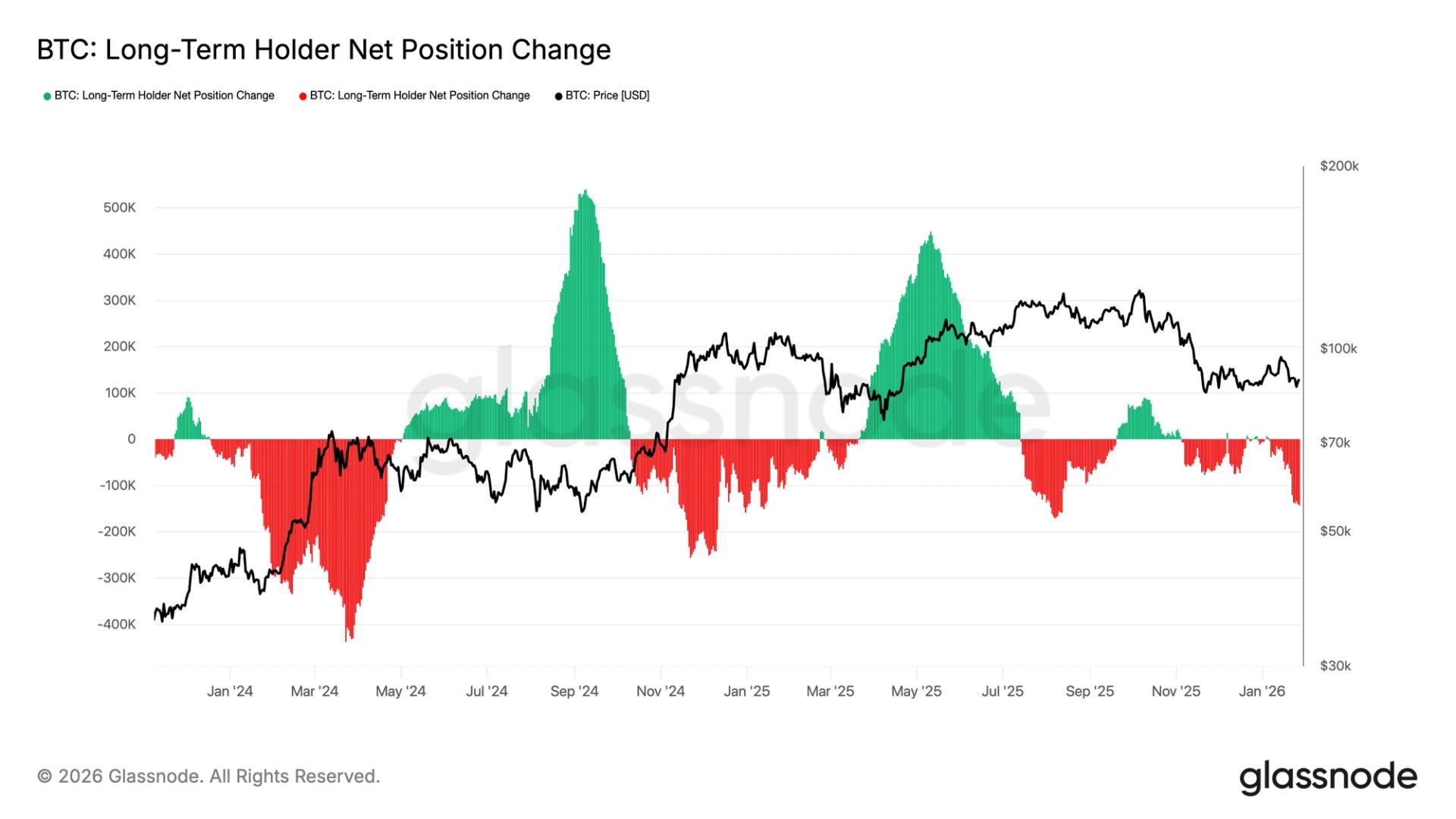

What to know : Long term bitcoin holders have sold roughly 143,000 BTC in the past 30 days, the most aggressive divestment since August. The reductions reverse a brief accumulation phase seen in late December and early January. Long-term distribution remains a headwind for the bitcoin price as broader financial markets rally.

Long term holders of bitcoin are again selling the largest cryptocurrency, with distribution now at the fastest pace in five months. Last year's action front-ran a market top that occurred, as many had expected, in October.

In the past 30 days, investors who've held bitcoin for at least 155 days — a cohort typically viewed as the most conviction-driven market participants — have sold roughly 143,000 BTC, according to Glassnode data.

Bitcoin's price is lagging behind broader financial assets, including metals such as gold and silver, which are trading at or near record highs. The discrepancy points to stress in the crypto market and raises the risk of further downside or an extended consolidation.

Their actions mirror the prior distribution peak in August, when around 170,000 BTC was sold over a 30-day period. At the time, the price was trading above $120,000 and bitcoin hit a record high two months later, reinforcing a narrative that the holders were selling into strength

The October peak was predicted by a theory that the BTC price follows a four-year cycle related to the periodic halving of rewards paid to bitcoin miners. The last 50% reduction took place in April 2024. Historically, each cycle has tended to see a peak in the fourth quarter followed by a prolonged drawdown and consolidation phase.

At the time, nearly the entire long-term holder supply, some 15 million coins, was in profit. After a sharp 36% drawdown from the October high through late November, there was a brief period from late December into early January when long-term holders shifted back to net accumulation.

This temporarily eased selling pressure and helped stabilize price action, with bitcoin jumping to as high as $97,000 and roughly 2 million of the coins are now sitting at a loss. Still, this group of investors currently owns about 14.5 million BTC, underscoring that long-term reductions remains a key headwind for price.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。