Good evening everyone, I am Xin Ya. Actually, I know that some people are not doing well, but I still hope everyone can get better. Yesterday, I tried to handle the market with a split strategy, but it turned out to be just different frequencies. I almost got caught.

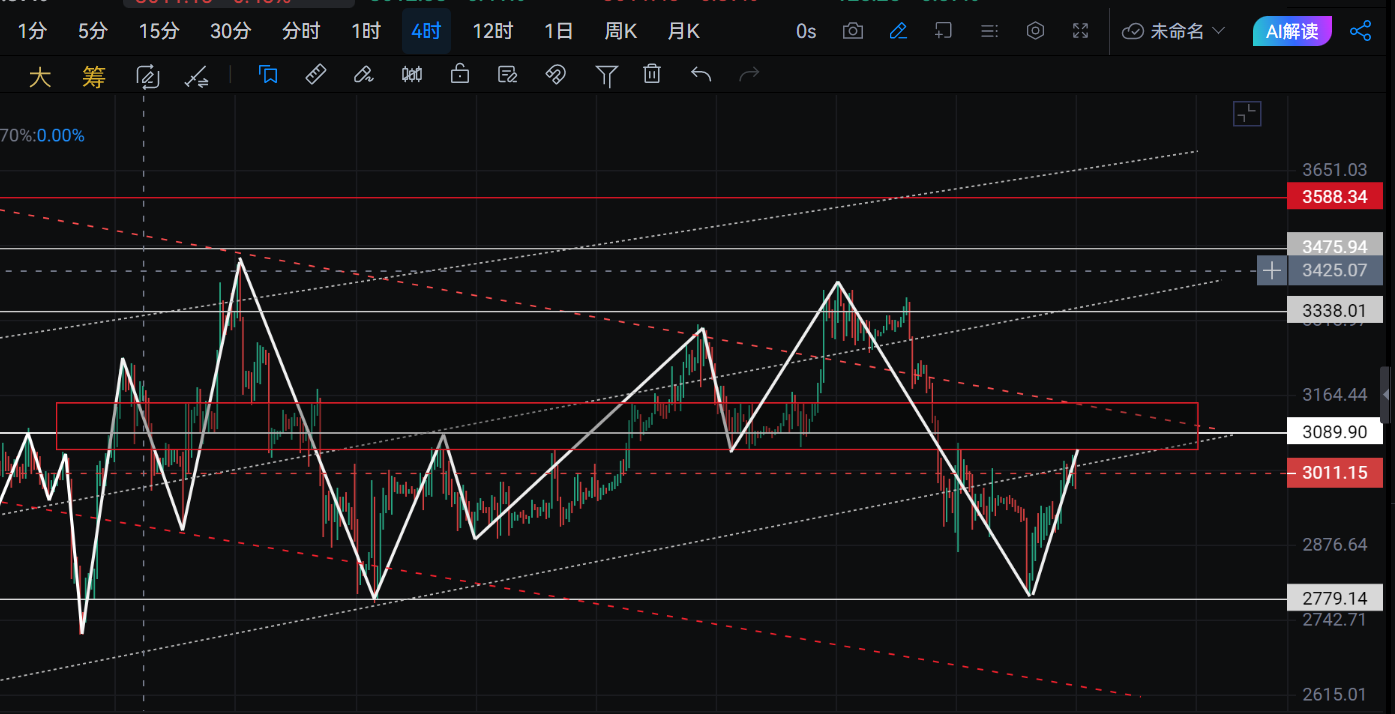

Bitcoin initially reached around 88,800 in the early hours of the day, and the next support level at the one-hour EMA120 was 87,200, which did not break the previous low. After that, three buying waves broke through EMA144 and continued to run above it. The first pullback touched around 89,500, while the afternoon's tug-of-war peaked around 90,500. This area has been a pressure zone multiple times in late December and a core pivot in early January. Due to the limited upward movement and sell-off, this creates a lot of uncertainty for the future market. The buying and selling that started around five o'clock in the afternoon have been synchronized and amplified. Breaking it down into fifteen-minute segments, only one part was ignited, while the selling pressure after the evening session has been continuous. However, it reached the one-hour EMA120 and EMA144 again, and this is also the four-hour EMA30. The upward movement was blocked by the four-hour EMA144, while the downward movement rebounded from the one-hour EMA120. The pressure and potential support levels are very close to each other, between 90,500 and 88,900. This means that whichever side breaks through first, the market direction will likely continue in that direction.

Ethereum's tug-of-war is a bit fierce. After breaking through the one-hour EMA120 in the early hours of the 28th, it reached around 3,000 but was pushed back by selling pressure at the whole number, returning to the one-hour EMA30 at 2,915. The subsequent rebound formed a doji star at 2,980, and we can mark this as a divergence point. The buying pressure is again pulling upwards, currently running above this level. We need to pay attention to the upper four-hour EMA120, 144, around 3,055, while the lower range is 2,980-2,060, which is the range of the doji star and the one-hour EMA120.

Yesterday's Ethereum movement was a bit chaotic, but since it has reached the pressure zone, our core strategy is still to short it. What we lost from it, we will take back from it. It is recommended to short Bitcoin in the range of 89,500-90,500 and to add positions, targeting 87,800-87,200. For Ethereum, shorting at the current price around 3,000 is fine, and adding positions at 3,055 to see if the market gives an opportunity to catch a needle. The lower level to watch is around 2,920; if it breaks, we can look at 2,860.

Walk with giants, WeChat public account: Xin Ya Talks about Chan

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。