Trump's remark about feeling "comfortable" with the depreciation of the dollar caused immediate chaos in the market, leading to a sharp drop in the dollar and heightened vigilance among global central banks. After President Trump expressed his comfort with the dollar's depreciation, U.S. Treasury Secretary Scott Basset urgently stepped in to stabilize the market, reiterating that the U.S. "consistently pursues a strong dollar policy."

This statement resulted in the dollar recording its largest single-day gain since last November, temporarily reversing the panic-driven decline triggered by the president's comments.

1. Emergency Market Support

● U.S. Treasury Secretary Scott Basset's urgent statement was seen as a clear intervention in the market. After President Trump made his comments about feeling "comfortable" with the dollar's depreciation, the market was thrown into chaos.

● In an interview with CNBC, Basset explicitly stated: "The U.S. consistently pursues a strong dollar policy," adding, "If we manage our policies well, funds will naturally flow in."

● When asked whether the U.S. would intervene in the foreign exchange market to sell dollars and buy yen, Basset firmly denied: "We absolutely do not intervene in the foreign exchange market to sell dollars and buy yen." This statement was interpreted by the market as an attempt to calm nerves and prevent a disorderly decline of the dollar.

2. The President's "Comfort Zone" and Policy Dilemma

● Trump's attitude towards the dollar's depreciation exposes the inherent contradictions in U.S. economic policy. President Trump stated he feels "comfortable" with the dollar's depreciation, which directly led to a 1.1% drop in the dollar—its largest single-day decline since market turmoil last April.

● Analysts believe Trump wants a weaker dollar to enhance U.S. export competitiveness, but at the same time, he needs a strong dollar to attract global capital inflows to finance the U.S.'s massive fiscal deficit. The core challenge for policymakers is to balance these conflicting goals: maintaining economic growth and export competitiveness while sustaining investor confidence in the dollar.

3. The Intrinsic Game of Three Policy Goals

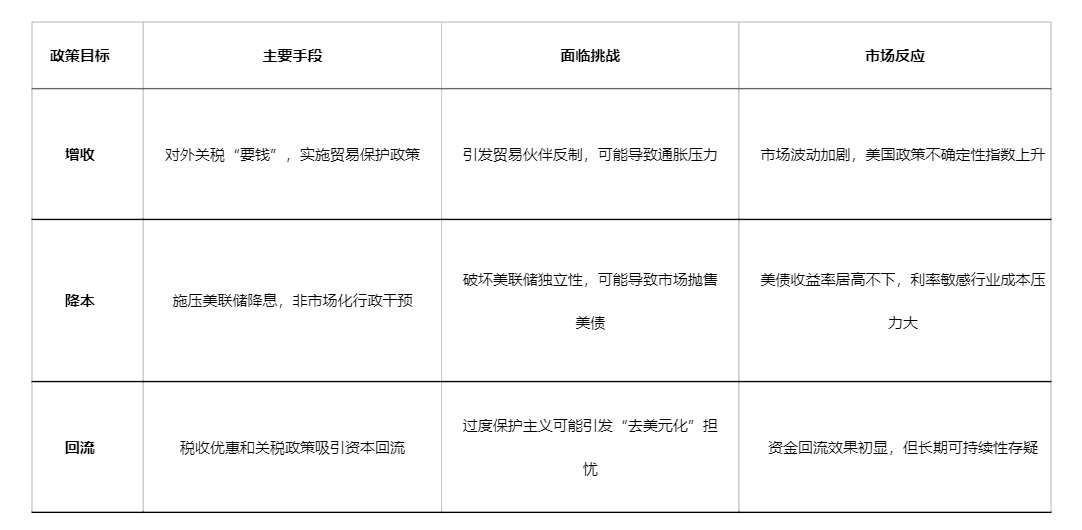

The macro policies of the Trump administration essentially revolve around three main goals: increasing revenue, reducing costs, and repatriation. There is a complex interplay between these three objectives, sometimes working in harmony and sometimes in conflict.

There is a clear tension between these three goals: revenue-increasing tariff policies may push up inflation, conflicting with the cost-reduction goal of interest rate cuts; while excessive protectionism may undermine confidence in the dollar and hinder capital repatriation.

4. The "Taco" Strategy: Probing and Tactical Retreat

● The policy style of the Trump administration is characterized by "Taco"—"Trump Always Chicken Out." The core of this strategy is to gain negotiation leverage through aggressive initial positions, then moderately retreat when the market reacts excessively.

● In the Greenland incident, the Trump administration quickly adjusted its stance, which the market viewed as a typical "Taco" behavior. Similarly, on tariff issues, Trump has repeatedly set aggressive targets but has postponed deadlines or lowered demands after severe market reactions.

● This pattern is also reflected in the attitude towards the dollar: the president makes comments that could weaken the dollar, followed by the Treasury Secretary stepping in to stabilize market expectations. This "one plays the bad cop, the other plays the good cop" approach tests the market's bottom line while avoiding an uncontrollable situation.

5. Divergence in Monetary Policies of U.S. and Japan

● The two major global bond markets are heading in different directions. The Bank of Japan has raised interest rates four times since ending negative rates in March 2024, with the market widely predicting two more hikes in 2026. This has pushed Japan's 10-year government bond yield above 2% for the first time since 2006. Meanwhile, the U.S. exhibits characteristics of a "blonde economy": low inflation coupled with high growth.

● The U.S. GDP growth rate reached 4.3% in the third quarter, while the CPI rose 2.7% year-on-year, providing room for the Federal Reserve's accommodative policies. The Fed has effectively initiated a form of "stealth easing" through interest rate cuts and shifting from "quantitative tightening" to "reserve management purchases."

● This divergence in monetary policy has led to a narrowing of the U.S.-Japan interest rate differential, but even in the context of the Bank of Japan's rate hikes, the U.S.-Japan government bond yield spread remains above 2.15%, indicating that the yen's carry trade model has not yet reached a "collapse" moment.

6. Global Impact of Japanese Bond Volatility

● The turmoil in the Japanese bond market is drawing global attention. The large-scale fiscal stimulus plan implemented by Japan's new Prime Minister, Sanae Takaichi, has raised concerns about Japan's high debt burden.

● Last week, Japanese government bond yields surged to historic highs. This volatility has potential spillover effects, as noted by PIMCO's Chief Investment Officer, who stated: "The weakness in the Japanese bond market, in a sense, will also have spillover effects on other countries' bond markets."

● The U.S. Treasury is also closely monitoring the trends in Japanese government bonds. Japan's Finance Minister, Shunichi Suzuki, has repeatedly warned that Japanese authorities are prepared to take action to address the yen's decline and stated they will "coordinate closely with U.S. authorities as needed."

7. The Market's Difficult Balance

● Financial markets are seeking direction amid multiple uncertainties. On one hand, the strong performance of the U.S. economy supports risk assets; on the other hand, policy uncertainty and global monetary policy divergence increase market volatility.

● For the dollar/yen exchange rate, analysts believe that as long as it remains above 139, the overall direction will not change, and the market will test 161 and encounter resistance. Only if it falls below the critical level of 139 could the current upward trend be reversed.

● The appeal of global bonds as a safe-haven asset is rising. PIMCO points out that when the cyclically adjusted price-to-earnings ratio (CAPE) of U.S. stocks exceeds 35, the median return of U.S. stocks over the next five years is negative, while the median return of the Bloomberg U.S. Aggregate Bond Index during the same period is positive.

● Currently, the CAPE of U.S. stocks has reached 40, and the valuation advantage of bonds relative to stocks is evident. Global fixed-income investors are reassessing asset allocations, turning their attention to diversified bond markets, including Japanese government bonds.

Basset's statement about "the U.S. consistently pursuing a strong dollar policy" has temporarily stabilized market sentiment, but the future direction of the dollar still depends on the interplay of multiple factors.

The market generally expects the Federal Reserve to continue its accommodative stance, while the Bank of Japan may tighten further. This divergence in monetary policy, combined with the fragile balance of U.S. finances and the unpredictable policy style of the Trump administration, makes the global foreign exchange market in 2026 destined to be full of uncertainties.

In the coming weeks, the market will closely watch the U.S. Supreme Court's ruling on presidential tariff authority, the nomination progress of the new Federal Reserve Chair, and the coordinated actions of the U.S. and Japan regarding exchange rate policies. The outcomes of these events will determine whether the dollar continues to rebound or returns to a downward trajectory.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。