Original Title: The Crypto Market was Much Healthier 5 Years Ago

Original Author: Jeff Dorman (Arca CIO)

Original Translation: Shenchao TechFlow

Abstract:

Is the crypto market becoming increasingly dull? Arca Chief Investment Officer Jeff Dorman points out that while the infrastructure and regulatory environment have never been stronger, the current investment environment is "the worst in history."

He sharply criticizes the failed attempts by industry leaders to force cryptocurrencies into "macro trading tools," leading to extreme correlation among various assets. Dorman calls for a return to the essence of "tokens as securities," focusing on quasi-equity assets with cash flow generation capabilities, such as DePIN and DeFi.

In the current context of a surge in gold and relative weakness in Bitcoin, this in-depth reflective article provides an important perspective for re-evaluating Web3 investment logic.

Full text as follows:

Bitcoin is Facing an Unfortunate Situation

Most investment debates exist because people are on different time horizons, leading to frequent "talking past each other," even though both sides are technically correct. Take the debate between gold and Bitcoin as an example: Bitcoin enthusiasts tend to argue that Bitcoin is the best investment because it has outperformed gold over the past decade.

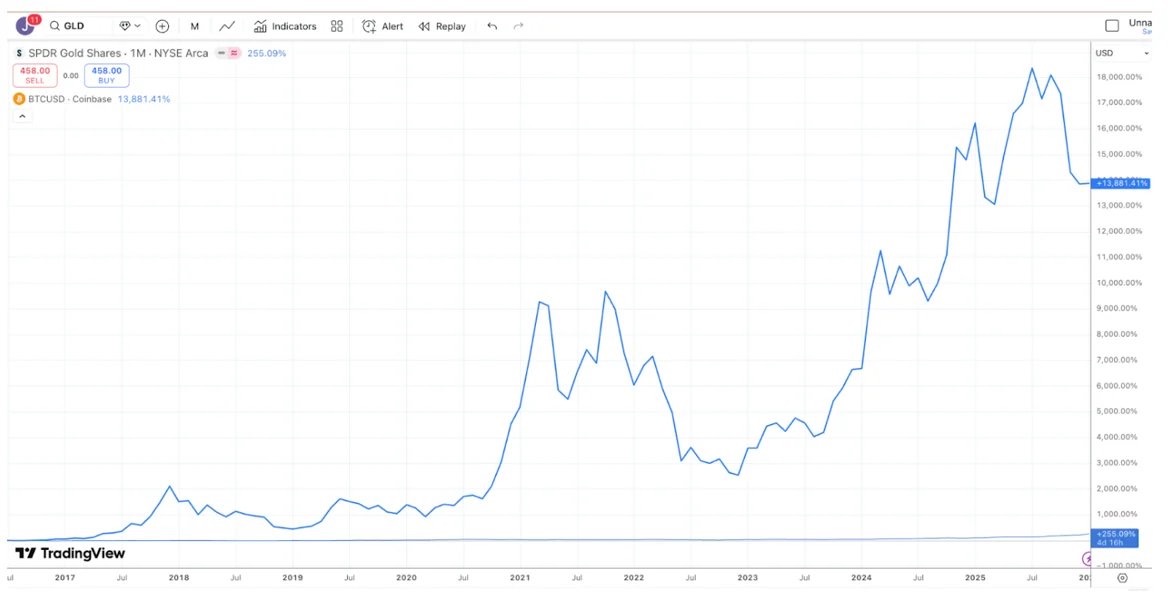

Source: TradingView, comparison of Bitcoin (BTC) and gold (GLD) returns over the past 10 years

Gold investors, on the other hand, tend to believe that gold is the best investment and have recently been mocking Bitcoin's downturn, as gold has clearly outperformed Bitcoin over the past year (the same goes for silver and copper).

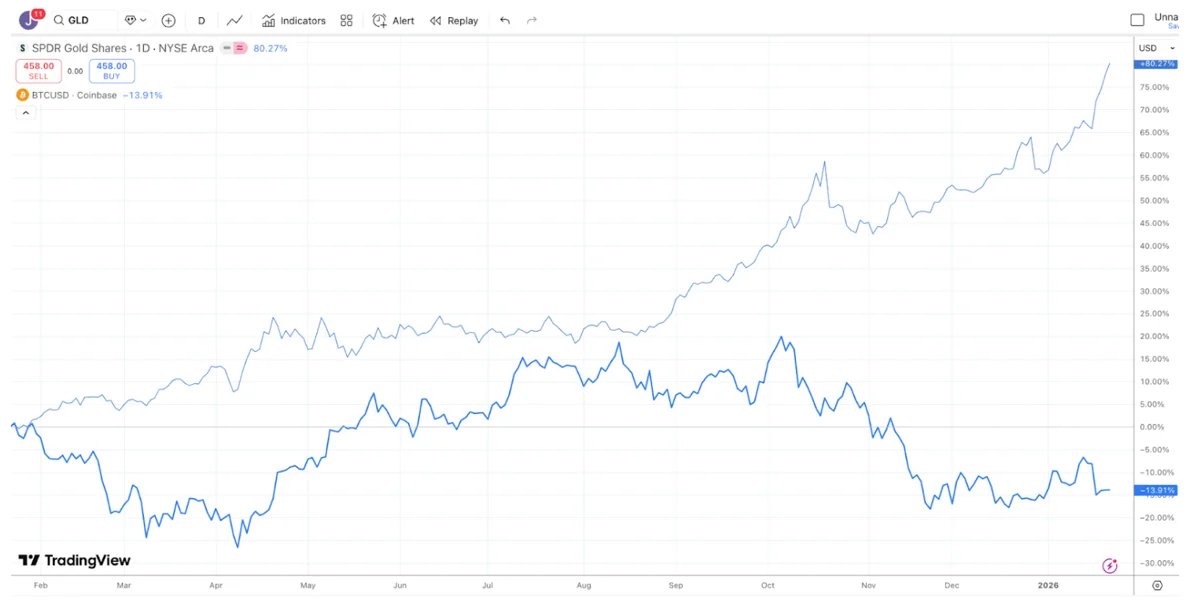

Source: TradingView, comparison of Bitcoin (BTC) and gold (GLD) returns over the past year

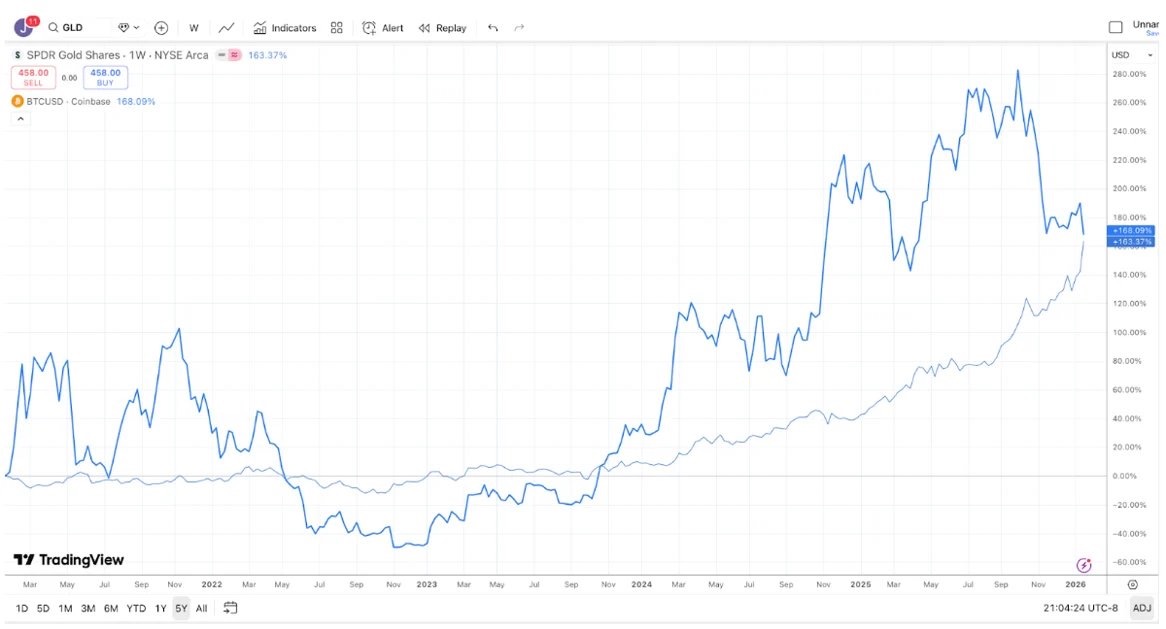

Meanwhile, over the past five years, the returns of gold and Bitcoin have been almost identical. Gold often remains stagnant for long periods, then skyrockets when central banks and trend followers buy in; Bitcoin tends to have sharp surges followed by significant crashes, but ultimately still trends upward.

Source: TradingView, comparison of Bitcoin (BTC) and gold (GLD) returns over the past five years

Thus, depending on your investment horizon, you can almost win or lose any debate about Bitcoin versus gold.

Even so, it is undeniable that recently gold (and silver) has shown strength relative to Bitcoin. To some extent, this is somewhat comical (or sad). The largest companies in the crypto industry have spent the last decade catering to macro investors rather than true fundamental investors, only for these macro investors to say, "Forget it, let's just buy gold, silver, and copper." We have long called for a shift in thinking within the industry. There are currently over 600 trillion dollars in entrusted assets, and the buyer group for these assets is much stickier. Many digital assets look more like bonds and stocks, issued by companies that generate income and conduct token buybacks, yet for some reason, market leaders have chosen to ignore this token sub-industry.

Perhaps Bitcoin's recent poor performance relative to precious metals is enough to make large brokers, exchanges, asset management firms, and other crypto leaders realize that their attempts to turn cryptocurrencies into all-encompassing macro trading tools have failed. Instead, they may turn their attention to educating that $600 trillion market of investors who prefer to buy cash-generating assets. For the industry, it is not too late to start focusing on quasi-equity tokens that carry cash-generating tech businesses (such as various DePIN, CeFi, DeFi, and token issuance platform companies).

That said, if you simply change the "finish line" position, Bitcoin remains king. So, the more likely scenario is that nothing will change.

The Differentiation of Assets

The "good days" of crypto investing seem like a distant memory. Back in 2020 and 2021, it seemed like new narratives, tracks, or use cases, along with new tokens, emerged every month, bringing positive returns from all corners of the market. While the growth engine of blockchain has never been stronger (thanks to legislative progress in Washington, the growth of stablecoins, DeFi, and the tokenization of real-world assets), the investment environment has never been worse.

One sign of market health is dispersion and lower cross-market correlation. You certainly want the performance of healthcare and defense stocks to differ from that of tech and AI stocks; you also want emerging market stocks to move independently of developed markets. Dispersion is generally seen as a good thing.

2020 and 2021 are largely remembered as a "rising tide" market, but that was not entirely the case. It was rare to see the entire market move in sync. More commonly, when one sector was up, another was down. When the gaming sector surged, DeFi might be declining; when DeFi surged, "dino-L1" tokens might be down; when Layer-1 surged, the Web3 track might be down. A diversified crypto asset portfolio actually smoothed returns and often reduced the overall portfolio's beta and correlation. Liquidity came and went with interest and demand, but return performance was varied. This was very encouraging. It made sense that a lot of money flowed into crypto hedge funds in 2020 and 2021 because the investable space was expanding, and returns were differentiated.

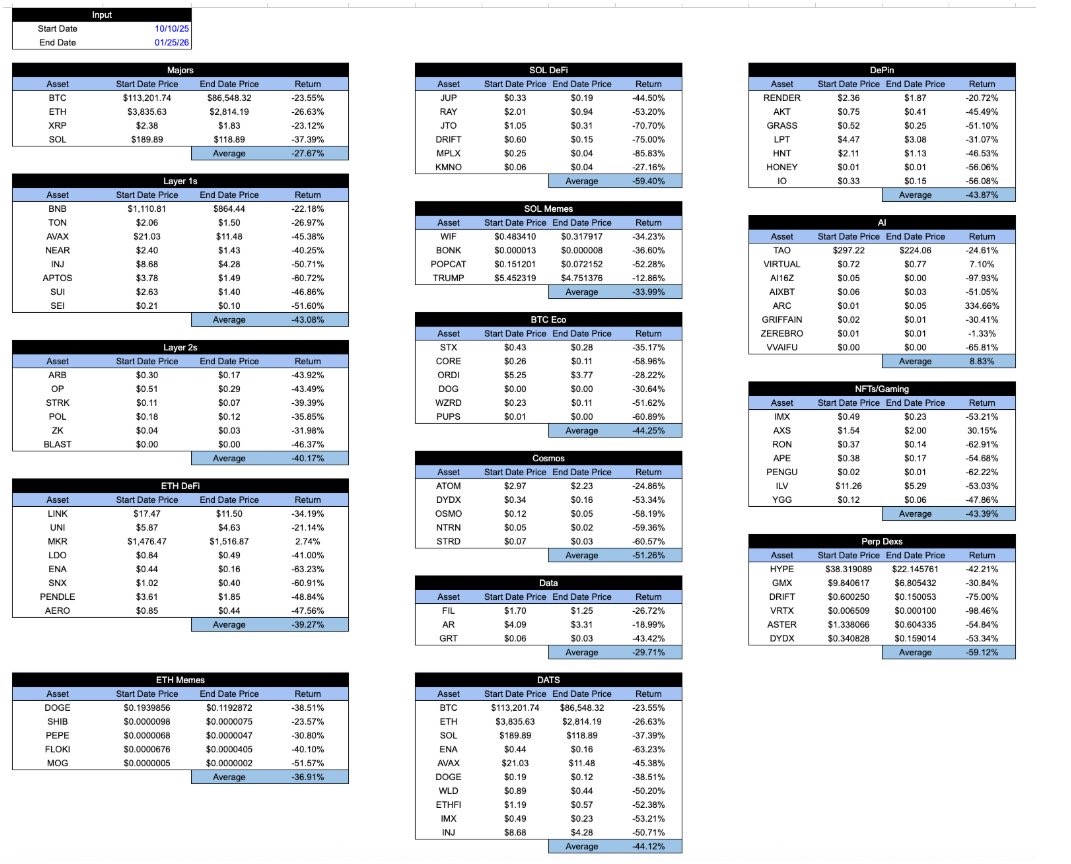

Fast forward to today, all assets "wrapped in crypto" seem to yield the same results. Since the flash crash on October 10, the declines across sectors have been nearly indistinguishable. No matter what you hold, how the token captures economic value, or how the project's development trajectory looks… the returns are generally the same. This is very frustrating.

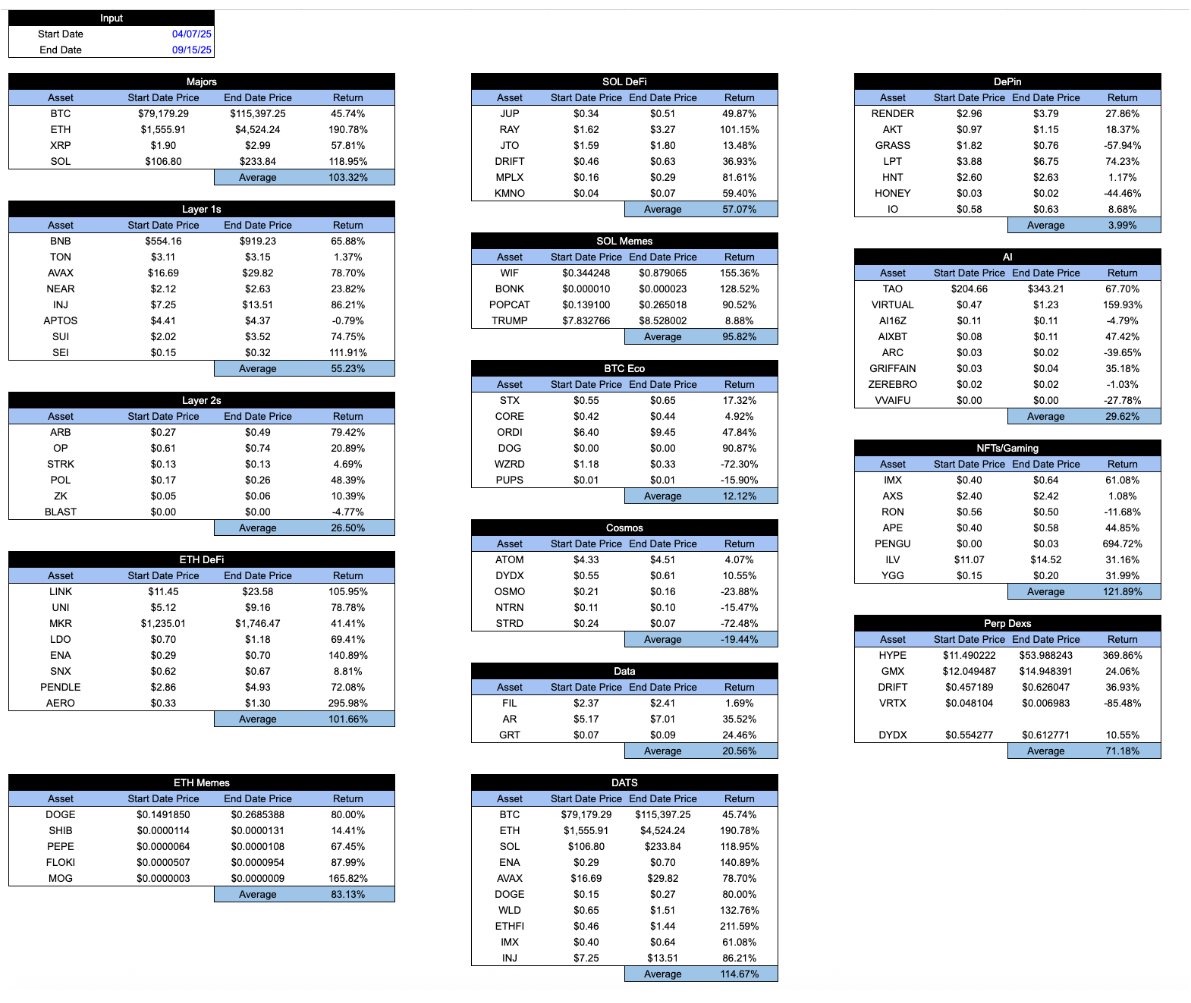

Arca internal calculations and representative crypto asset sample from CoinGecko API data

In a booming market, this table would look somewhat more encouraging. "Good" tokens often outperform "bad" tokens. But a healthy system should actually be the opposite: you want good tokens to perform better even in bad times, not just when the market is good. Here is the same table from the low on April 7 to the high on September 15.

Arca internal calculations and representative crypto asset sample from CoinGecko API data

Interestingly, when the crypto industry was still in its infancy, market participants worked very hard to differentiate between different types of crypto assets. For example, I published an article in 2018 where I categorized crypto assets into four types:

- Cryptocurrencies/money

- Decentralized protocols/platforms

- Asset-backed tokens

- Pass-through securities

At that time, this classification method was quite unique and attracted many investors. Importantly, crypto assets were evolving from just Bitcoin to smart contract protocols, asset-backed stablecoins, and quasi-equity pass-through securities. Researching different growth areas was a major source of alpha, as investors sought to understand the various valuation techniques needed to assess different types of assets. Most crypto investors at that time didn't even know when unemployment claims data was released or when FOMC meetings were held, and rarely looked for signals from macro data.

After the crash in 2022, these different types of assets still exist. Essentially, nothing has changed. But there has been a huge shift in the way the industry markets itself. Those "gatekeepers" have deemed Bitcoin and stablecoins as the only important things; the media has decided they don't want to write about anything other than TRUMP tokens and other memecoins. Over the past few years, not only has Bitcoin outperformed most other crypto assets, but many investors have even forgotten the existence of these other asset types (and tracks). The underlying companies and protocols' business models have not become more relevant, but due to investor flight and market makers dominating price movements, the correlation of the assets themselves has indeed increased.

This is why Matt Levine's recent article about tokens was so surprising and popular. In just four short paragraphs, Levine accurately described the differences and nuances between various tokens. This gives me some hope that such analysis is still viable.

Leading crypto exchanges, asset management firms, market makers, OTC platforms, and pricing service providers still refer to everything outside of Bitcoin as "altcoins" and seem to only write macro research reports, bundling all "cryptocurrencies" together as a massive asset. For instance, take Coinbase as an example; they appear to have only a small research team led by a primary analyst (David Duong), whose focus is mainly on macro research. I have no issues with Mr. Duong—his analysis is excellent. But who would specifically go to Coinbase just to see macro analysis?

Imagine if leading ETF providers and exchanges only vaguely wrote articles about ETFs, saying things like "ETFs are down today!" or "ETFs react negatively to inflation data." They would be laughed out of business. Not all ETFs are the same; just because they use the same "wrapper" doesn't mean they are identical, and those who sell and promote ETFs understand this. What is inside the ETF is what matters most, and investors seem to be able to wisely differentiate between different ETFs, primarily because industry leaders help their clients understand these distinctions.

Similarly, tokens are just a "wrapper." As Matt Levine eloquently describes, what matters is what is inside the token. The type of token is important, the track is important, and its attributes (inflation or amortization) are also important.

Perhaps Levine is not the only one who understands this. But he does a better job of explaining the industry than those who are truly profiting from it.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。