Author: seed.eth, Bitpush

After three consecutive interest rate cuts, the Federal Reserve finally pressed the "pause button" at its first monetary policy meeting of 2026.

In the early hours of Thursday Beijing time, the Federal Reserve announced that it would maintain the benchmark interest rate in the range of 3.5% to 3.75%. This somewhat "mundane" decision aligns with market expectations of over 97%, but it also reveals subtle cracks within the policy: two Federal Reserve governors voted against the decision, supporting a further rate cut of 25 basis points.

The Shoe Has Dropped, But the Direction Remains Unclear

In the policy statement, the Federal Reserve continued its relatively cautious tone: the economy is still "growing steadily," inflation "has eased but remains above target," and there are signs of cooling in the labor market, but it has not yet posed systemic risks. The core message is very clear—monetary policy has transitioned from the "active adjustment" phase to the "observation and verification" phase.

It is worth noting that the Federal Open Market Committee is not entirely united. The two members who voted for a continued rate cut indicate that there are still differences in policy direction between easing inflation and slowing economic growth. Overall, however, the Federal Reserve is clearly reluctant to release new policy commitments in the current environment, choosing instead to hand the decision-making power back to subsequent data.

This stance sets the tone for the market: there is unlikely to be clear directional guidance in the short term, and asset pricing will revolve more around "changes in expectations" rather than "changes in policy."

Current pricing in the federal funds rate market shows that investors generally expect rates to remain unchanged this quarter, with the first rate cut now pointed to June of this year, and the market further anticipates a possible pause in the rate cut cycle until 2027.

However, there are still significant differences among institutions regarding the rate path after this quarter: Morgan Stanley, Citigroup, and Goldman Sachs predict rate cuts in June and September, while Barclays believes cuts may occur in June and December, and JPMorgan maintains its expectation of unchanged rates for the year.

Macro Market: Gold Dominates, Other Assets Remain Calm

If the Federal Reserve's decision itself did not stir up waves, then the divergence in asset performance is the real signal worth noting.

After the interest rate decision was announced, spot gold prices soared, breaking the $5,500 per ounce mark for the first time. In just four trading days, gold prices rose from just below $5,000, breaking through multiple hundred-dollar thresholds, with a cumulative increase of over $500 and a weekly gain of 10%. This speed and magnitude have made gold the undisputed star of the global market.

The strength of gold is not simply a result of interest rate trading logic. Although the Federal Reserve has paused rate cuts, after a series of easing measures, policy is nearing a neutral range, and the marginal constraints of real interest rates have eased; at the same time, resilient inflation, trade frictions, political uncertainties, and global policy games continue to amplify demand for safe-haven assets. Under the accumulation of multiple uncertainties, funds have chosen the most traditional and widely accepted safe-haven asset.

In stark contrast to gold, other assets have performed flatly. U.S. stocks maintained narrow fluctuations after the decision, without any trend breakthroughs; the U.S. dollar index showed limited volatility; U.S. Treasury yields adjusted slightly but did not evolve into a systemic risk-off trend.

Cryptocurrency assets have shown similar behavior. Bitcoin's price initially dipped from $89,600 to $89,000 after the announcement, then quickly rebounded to around $89,300. The fluctuation was less than 1%, while Ethereum (ETH) hovered around the $3,000 mark, and mainstream altcoins like Solana and XRP remained within previous fluctuation ranges.

The market has provided a straightforward answer: when the direction is unclear, gold is pushed back to center stage, while other assets enter a waiting state.

A More Important Question Than Rate Cuts: Who Will Shape the Next Phase of the Federal Reserve?

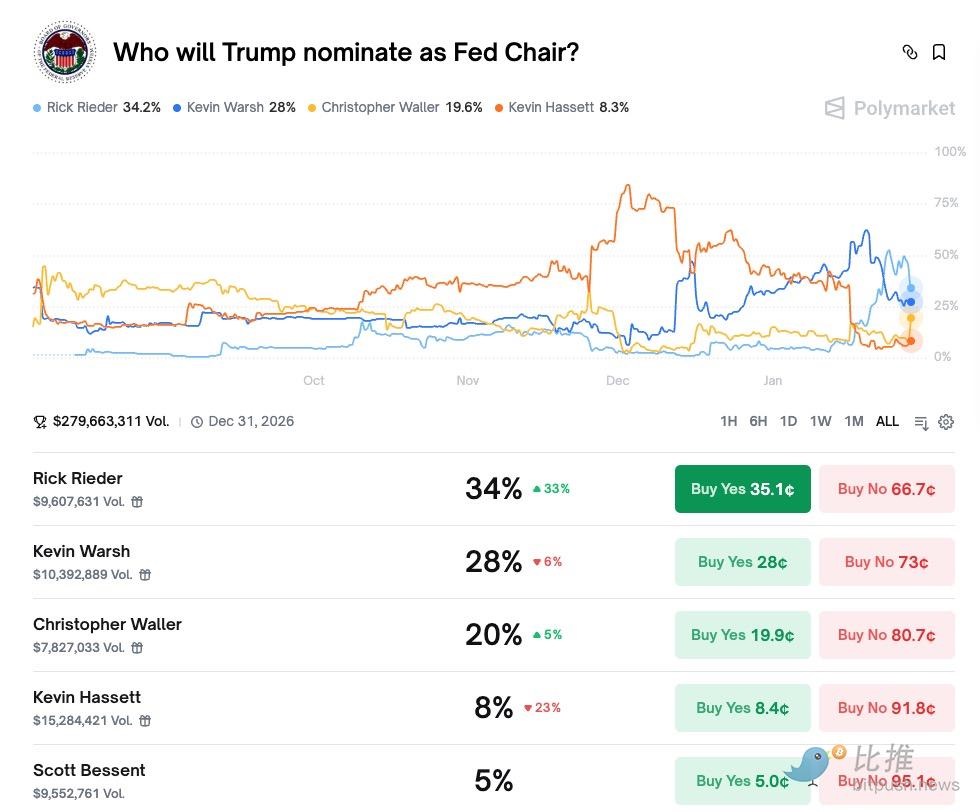

After the interest rate decision was made, the market's focus quickly shifted. Rather than "when will rates be cut," investors began to focus on another question: who will lead the next phase of the Federal Reserve?

According to the latest data from Polymarket, in the betting on "who Trump will nominate as Federal Reserve Chair," several candidates have seen their odds diverge:

Rick Rieder: The Market's Favorite "Pragmatist" (Approx. 34%)

Currently, the candidate with the highest betting probability is Rick Rieder, with support around 34%, and this has clearly risen recently.

Rieder is the Chief Investment Officer of Global Fixed Income at BlackRock and has long been deeply involved in bond markets and macro asset allocation decisions. He is seen as one of the few individuals who truly spans "policy—market—capital structure." His public views often emphasize financial market stability, policy transmission efficiency, and avoiding unnecessary systemic shocks.

From the market's perspective, if Rieder were to become Federal Reserve Chair, it would mean that central bank decisions would place greater emphasis on financial conditions and asset price signals, maintaining policy flexibility within the bounds of allowable inflation. This expectation explains why he has garnered increasing financial support in the prediction market—it's a bet on "predictability" and "market friendliness."

Kevin Warsh: A Representative of Discipline and Credibility (Approx. 28%)

In second place is former Federal Reserve governor Kevin Warsh, with a current betting probability of about 28%.

Warsh is known for his clear stance and tough style, emphasizing central bank credibility and long-term discipline on inflation issues. He has repeatedly expressed concerns about overly accommodative policies and is seen as an important representative of traditional hawks.

If Warsh ultimately wins, the market generally expects the Federal Reserve to be more cautious regarding the pace of rate cuts, asset price tolerance, and policy communication. This style typically helps to suppress inflation expectations but also means that risk assets need to adapt to a stricter financial environment.

Christopher Waller: The Academic Fed Governor (Approx. 20%)

Current Federal Reserve governor Christopher Waller has a betting probability of about 20%, ranking third.

Waller has a strong academic background and clear policy logic, and he has long been viewed as one of the most influential "hawks" (advocating for high rates to suppress inflation) within the Federal Reserve. However, at this FOMC meeting, he voted against the decision, supporting a continued rate cut, which suggests he believes inflation is no longer a major threat or feels significant political/economic pressure.

If Waller were to take over, the Federal Reserve might place more weight on employment and growth targets, with a relatively flexible policy pace, but whether he can maintain the central bank's independence in a highly politicized environment remains a focal point for the market.

Will Bitcoin Continue to Bear?

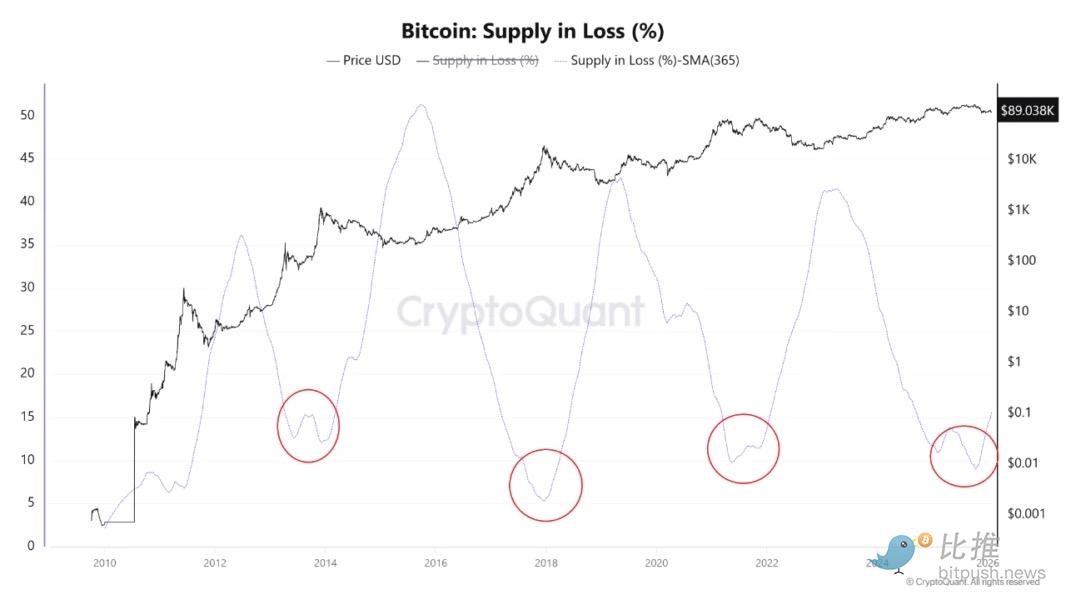

As macro uncertainties increase, on-chain data is beginning to release concerning signals.

The latest analysis from CryptoQuant shows that the 365-day moving average of the "supply in loss" for Bitcoin is rising again. This indicator measures the proportion of Bitcoin whose current price is below its most recent on-chain transfer price and is an important tool for observing changes in market structure.

When Bitcoin surged to its historical high of $126,000 last October, this indicator fell to its lowest point in this cycle, reflecting a highly profitable market. However, as prices have retreated, the Supply in Loss has begun to rise continuously, indicating that losses are gradually spreading from short-term traders to longer-term holders.

Historically, such directional changes often occur in the early stages of a bull-bear transition. However, it is important to emphasize that this indicator has not yet reached the typical "surrender zone," resembling more of a risk signal rather than a trend confirmation.

This means that Bitcoin's current state is closer to high-level digestion and structural reorganization, rather than having entered a clear bear market phase. Whether it will evolve into a deeper adjustment still heavily depends on macro liquidity and subsequent capital flows. Gabe Selby, head of research at CF Benchmarks, stated: "The short-term bullish catalysts for Bitcoin still exist, but they are increasingly leaning towards political factors rather than monetary factors."

Conclusion: Macro Uncertainty, Structural Changes, the Market is Waiting for Answers

Overall, this round of market changes is not driven by a single event but is the result of multiple factors acting together; funds embrace gold amid uncertainty, pushing risk-off sentiment to the forefront; while Bitcoin's next step still requires waiting for further convergence of macro and cyclical signals.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。