Tether has made over $5 billion by buying gold,

CEO Paolo Ardoino stated that the company is currently purchasing 1 to 2 tons of gold each week and will maintain this pace "in the coming months."

So, does Tether hold more gold or more Bitcoin?

Is it politically incorrect for a company that profits from the crypto space to be buying gold like crazy?

This was a question many people messaged me about yesterday.

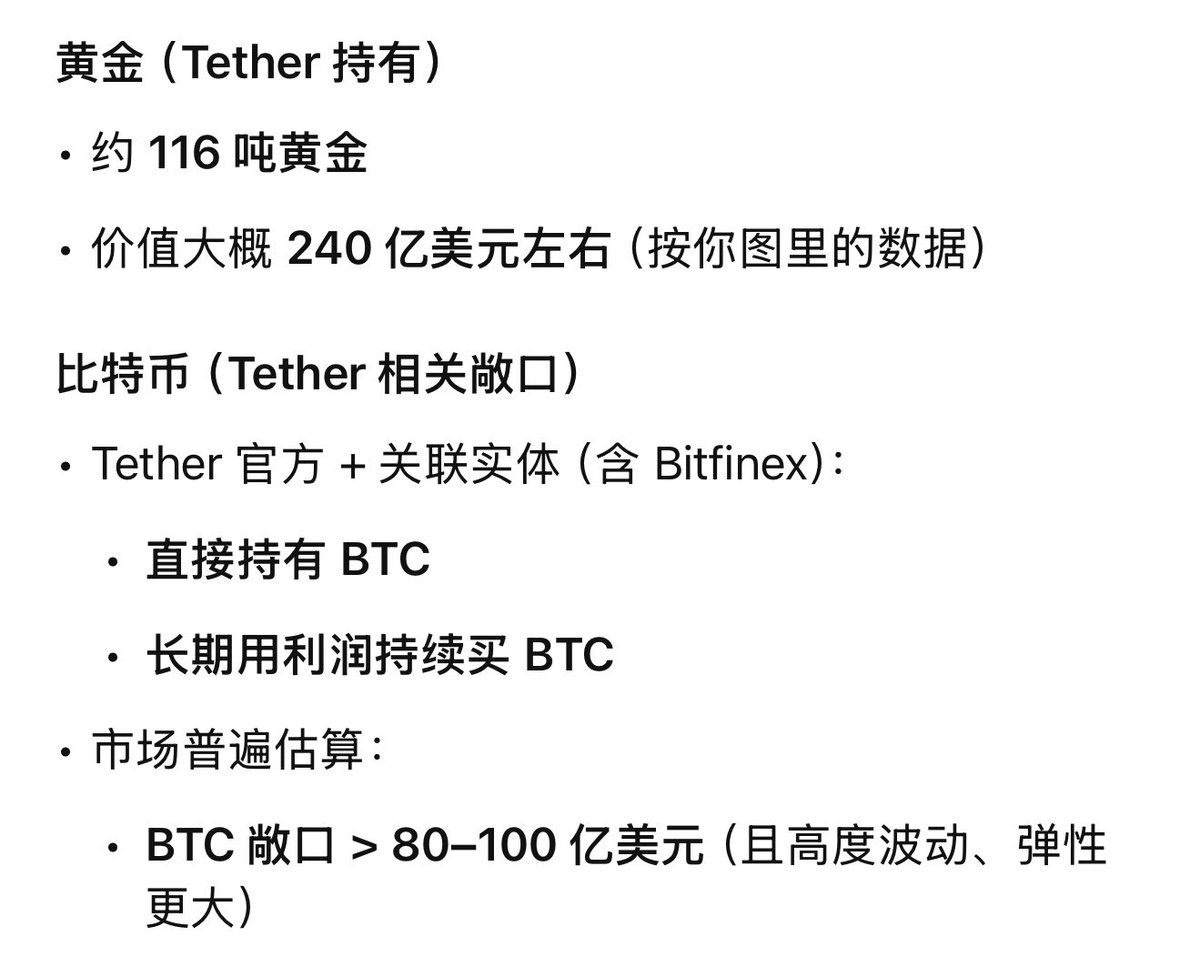

From the data currently available, Tether holds about 116 tons of gold, valued at approximately $24 billion.

Tether's official holdings + associated entities directly hold BTC, and the market generally estimates that the long-term profits used to continuously buy BTC are around $10 billion.

If it weren't for Bitcoin's decline and gold's rise, Tether would likely aim for a 1:1 allocation between the two, with one serving as an offensive asset and the other as a defensive one!

In fact, Bitcoin's role within the Tether system is clearly outlined in their strategy, viewing BTC as the hard currency of the digital age through long-term dollar-cost averaging.

Tether's gold holdings appear substantial on paper, but in terms of "strategic position," Bitcoin remains the primary asset.

I believe:

Gold is insurance, BTC is direction.

If I had money, I would do the same!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。