🚨 According to a report by Standard Chartered Bank, it is estimated that by 2028, approximately $500 billion will be transferred from bank deposits to stablecoins—

This is equivalent to 1% of the total deposits in high-risk countries such as Egypt, Pakistan, Bangladesh, Sri Lanka, Turkey, India, and Kenya.

This should be a significant impact on banks in the coming years!

The stability of bank deposits in the past was due to their simultaneous roles as a parking point for funds, a payment hub, and a credit intermediary.

However, stablecoins have already begun to dismantle the first two roles, with an increasing number of cross-border settlements, on-chain transactions, and over-the-counter clearings occurring directly outside the banking account system.

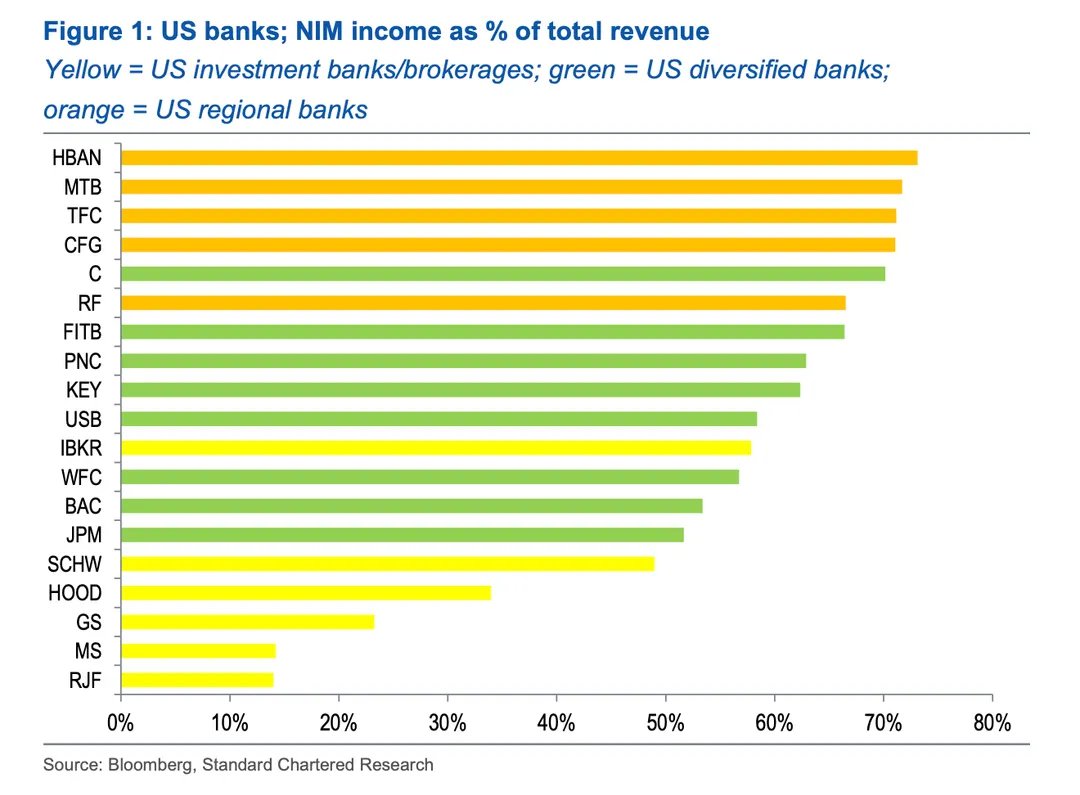

Regional banks like Huntington Bancshares and M&T Bank cannot compare to diversified banks like JPMorgan and Citigroup, as over 60% of their business income comes from net interest margins, relying on low-cost deposits to leverage asset returns.

If deposits start to flow out, it could directly lead to an increase in the bank's risk exposure, making available liabilities more expensive and unstable.

This may not be obvious during a high-interest rate cycle, but once we enter a narrowing interest margin cycle, a bank run could happen in an instant!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。