Original|Odaily Planet Daily (@OdailyChina)

The scale and trading volume of prediction markets are still rapidly growing. The pre-IPO market of leading platforms like Kalshi and Polymarket has also attracted a certain level of market attention and liquidity. According to data from the PreStocks platform, the pre-IPO price of Kalshi stock has increased by 21.7% in the past 30 days, far exceeding the growth of mainstream cryptocurrencies like BTC and ETH over the past month.

Before the IPO cake is served, the Pre-IPO sector may be a battleground for more people to participate in advance. In this article, Odaily Planet Daily will analyze whether the prediction market stock pre-IPO market is worth a heavy bet from the perspectives of industry track, platform data, and capital valuation.

“Prediction markets still have 100 times growth potential” judgment behind: Total trading volume exceeds $50 billion in 2025

Last August, Nick Tomaino, founder of 1confirmation, boldly claimed “the trading volume of prediction markets will grow 100 times.”

At that time, the “duopoly” of prediction markets, Polymarket and Kalshi, had not yet secured over $1 billion in financing, and their valuations were far from the $10 billion mark. The overall trading volume of prediction markets in July was still less than $2 billion, nearly halving compared to the historical peak of over $4 billion in October 2024, making the judgment of 100 times growth seem absurd.

However, soon after, in October 2025, Polymarket announced it received a $2 billion investment from ICE Group, the parent company of the New York Stock Exchange, with its valuation skyrocketing to $9 billion, and it subsequently sought a new round of financing at a valuation of $12 billion to $15 billion. Kalshi, on the other hand, completed two rounds of financing between October and December, with the latest round reaching $1 billion, boosting its valuation to $11 billion, led by Paradigm, with participation from Sequoia, a16z, Meritech Capital, IVP, ARK Invest, Anthos Capital, CapitalG, and Y Combinator.

Behind the capital's fervent interest is the rapid development of prediction markets.

According to the data from our previous article, “2025 Prediction Market Review: Total Trading Volume Exceeds $50 Billion, Duopoly Market Share Exceeds 97.5%”:

- In September 2025, the combined trading volume of Kalshi and Polymarket reached $1.44 billion;

- In October 2025, the trading volume of prediction markets reached $8.7 billion, with Kalshi leading and Polymarket following;

- In November 2025, the combined trading volume of Kalshi and Polymarket approached $10 billion, with Kalshi's trading volume reaching $5.8 billion, a month-on-month increase of 32%; Polymarket's trading volume reached $3.74 billion, a month-on-month increase of 23.8%.

- In December 2025, analyst Patrick Scott stated that in November 2025, the trading volume of prediction markets exceeded $13 billion, more than three times the trading volume during the peak of the 2024 election.

In just a few months, the overall monthly trading volume of prediction markets has increased by about six times, suggesting that a 100 times growth is not out of reach.

After all, 100 times of $2 billion is only $200 billion, and compared to the overall trading volume of over $50 billion in prediction markets in 2025, it only requires a fourfold increase. Behind such rapid growth is the meteoric rise of Kalshi, a compliant prediction market platform in the U.S.

Kalshi is expected to become the “leading stock in prediction markets”: trading volume close to $24 billion in 2025, with January trading volume expected to reach $9 billion

The emphasis on Kalshi's “compliant status in the U.S. market” is because, based on its various licenses and compliance preparations, the door to an IPO is easier to open for Kalshi. Additionally, as a pioneer in the prediction market platform established in 2018 (Note from Odaily Planet Daily: the platform officially launched in July 2021, slightly later than Polymarket), Kalshi's business growth in recent years has also been remarkable.

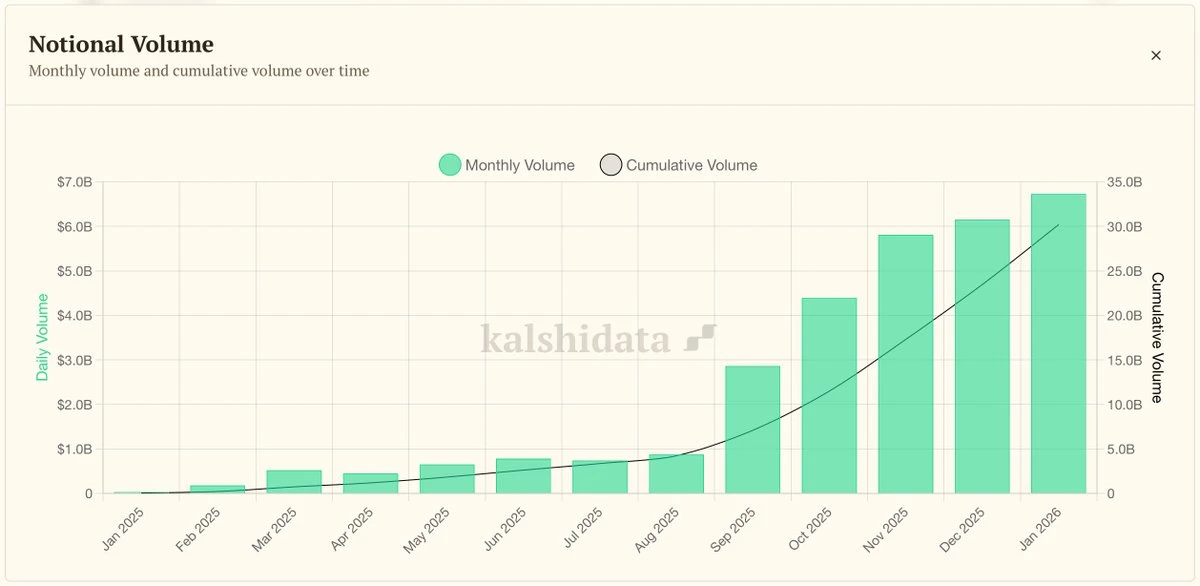

Kalshi's 2025 Report Card: Annual Trading Volume of $23.8 Billion, Number of Trades Reaching 97 Million

KalshiData previously reported that in 2025, all indicators of Kalshi achieved record growth.

- In terms of nominal trading volume, the total for the year reached $23.8 billion, a year-on-year increase of 1108%, approximately 12.1 times. December alone set a monthly historical high of $6.38 billion, with the fourth week of December setting a weekly historical high of $1.7 billion, and December 21 setting a daily historical high of $381.7 million.

- In terms of the number of trades, the total for the year reached 97 million, a year-on-year increase of 1680%, approximately 17.8 times. In December, the number of trades was 27.67 million, with the fourth week of December at 7.6 million, and December 21 at 1.5 million, all setting historical highs.

As we enter 2026, Kalshi's business data growth is astonishing.

Kalshi's Business Surge: January 2026 Nominal Trading Volume Expected to Exceed $9 Billion

On December 16, 2025, Kalshi CEO Tarek Mansour stated that with the launch of the Combo feature, the platform's single-day trading volume reached a historical high of $340 million;

On January 12, 2026, the single-day trading volume of prediction markets grew to approximately $702 million, setting a historical high; of which, Kalshi accounted for about $465 million, approximately two-thirds of the total, while Polymarket and Opinion contributed about $100 million in trading volume.

On January 26, KalshiData reported that as of January 23, Kalshi's monthly nominal trading volume was approximately $6.7 billion, with a daily average trading volume of approximately $293 million. If the current pace continues, Kalshi's nominal trading volume in January is expected to reach approximately $9.1 billion.

It is worth noting that last October, the overall trading volume of prediction markets was $8.7 billion, with Kalshi's market share around 45%-55%; now, the monthly trading volume of Kalshi alone exceeds the overall market size at that time. This not only reflects that the prediction market is in a period of windfall but also highlights the terrifying growth rate of Kalshi's business.

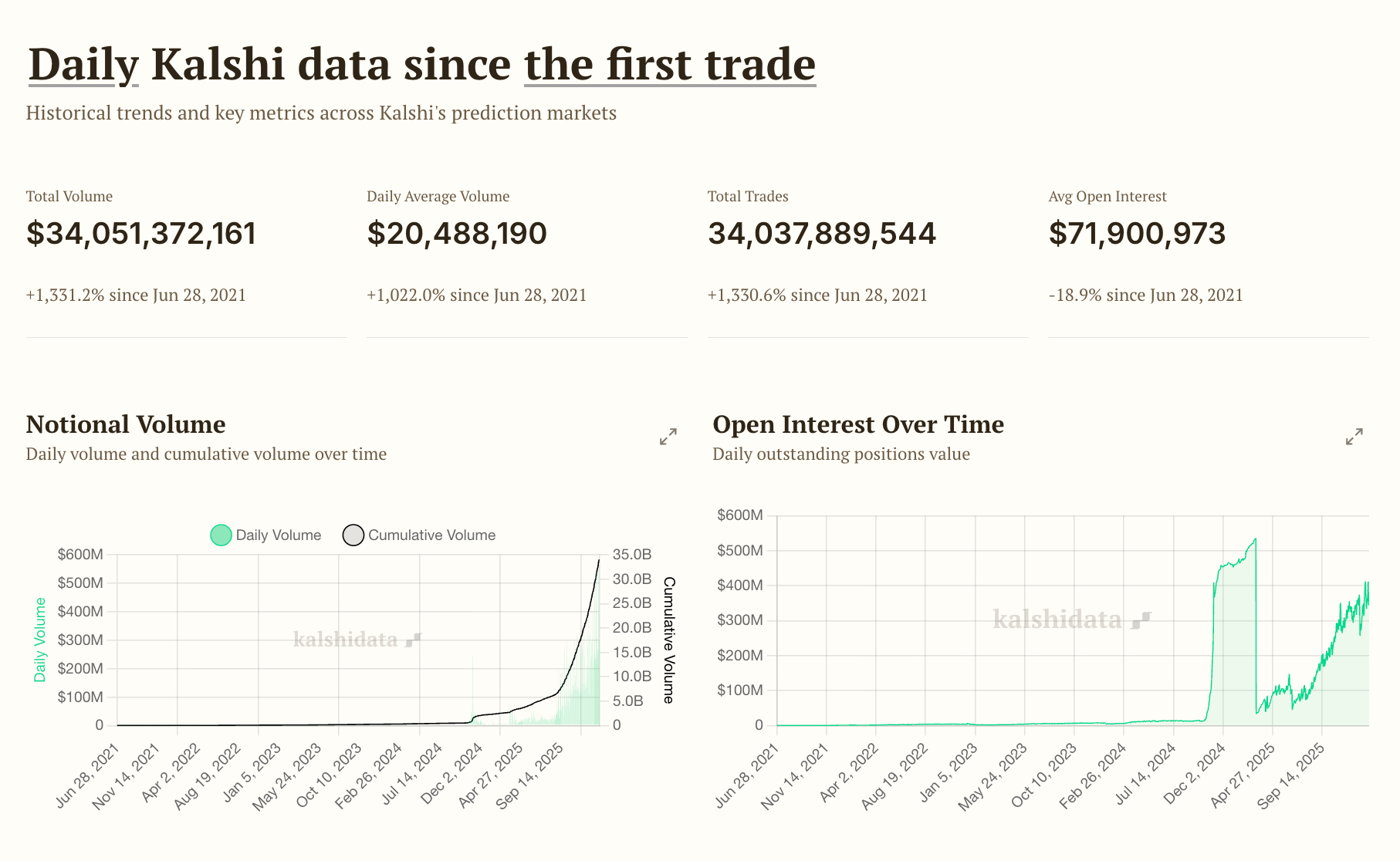

According to data from the KalshiData website, as of January 29, Kalshi's total historical trading volume has surpassed $34.05 billion, with a daily average trading volume exceeding $20.48 million; looking at its nominal trading volume K-line chart, since September 2025, it has almost shown exponential growth.

Capital market pricing range: Kalshi stock price is $300-$450

Finally, as the current largest prediction market platform, although the specific time and number of shares for Kalshi's IPO have not been determined, based on its previous financing news and external statements, an IPO is a certainty. Currently, there are significant discrepancies in the pre-IPO market pricing of its stock between traditional financial markets and cryptocurrency markets:

The pre-market pricing of Kalshi's stock in traditional financial markets is relatively low—

- On the Nasdaq Private Market, Kalshi's stock price is around $307;

- On Hiive, Kalshi's stock price is around $357.

The pre-market pricing of Kalshi's stock in cryptocurrency markets is relatively high—

- On PreStocks, Kalshi's implied market value is about $14 billion, with a stock price of about $407;

- On Jarsy, Kalshi's market valuation is $11 billion, with a separate price of $450.

In the next article, Odaily Planet Daily will analyze in detail the price range at which Kalshi's stock in the pre-IPO market is worth buying, breaking down the investment opportunities of prediction market stocks from the perspective of the pre-market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。