Original author: angelilu, Foresight News

Looking back at 2025, Arthur Hayes remains the love-hate big winner.

As the founder of BitMEX and one of the most articulate KOLs in the crypto space, every "call" he made in 2025 could ignite retail traders' enthusiasm. However, upon reviewing 2025, you will suddenly realize that if you had jumped in every time he made a call, the result would be that he profited while you lost.

He loudly proclaimed on Twitter, "Bitcoin to one million dollars," and "ETH to ten thousand dollars," but on-chain, Arthur Hayes would always casually sell off the assets he once favored. If we lay out all his operations from last year, you will find a top trader's extremely calm, even ruthless trading record.

We can break down his operations into three categories.

"Openly Calling, Secretly Selling" VC Coins

Hayes' most controversial operations usually occur with projects where he holds early-stage tokens. This is essentially a completely unequal game: perhaps he made ten times his money when he sold at $50, while your losses only began when you bought in at $60.

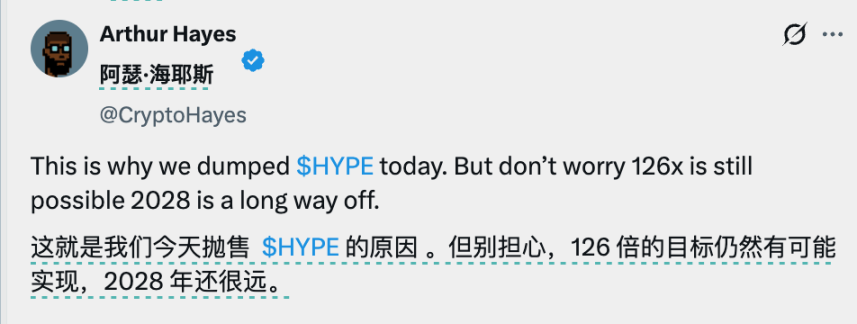

The most typical scenario occurred with Hyperliquid (HYPE). As an early investor who acquired tokens at a very low cost, his operational logic is very simple and brutal:

Step one, use his influence to call out at high prices, constructing a grand narrative (for example, "HYPE will grow a hundredfold in three years");

Step two, decisively liquidate when the tokens unlock or liquidity is abundant.

For instance, last August, Hayes predicted at a conference in Tokyo that HYPE would see a hundredfold increase and made a high-profile purchase. Just one month later, before HYPE's decline, he liquidated his position and made millions, citing "to avoid unlocking risks" as his reason for doing so.

However, HYPE was not completely abandoned by him; in mid-January 2026, Hayes purchased approximately $499,000 worth of HYPE again after a three-month hiatus.

The same story repeated itself with other tokens like ETHFI and ATH, which experienced similar scripts.

But imagine if you were Arthur Hayes, what would you do? To achieve significant profits, this seems to be the most standard playbook: first, throw out a market analysis that is plausible enough to be self-justifying, using logic to win over the audience; when the followers flock in, the market will naturally validate his predictions.

For whales, the only window to quietly exit is when the crowd is roaring and liquidity is most abundant.

The "Old Narrative" That Can't Be Shouted

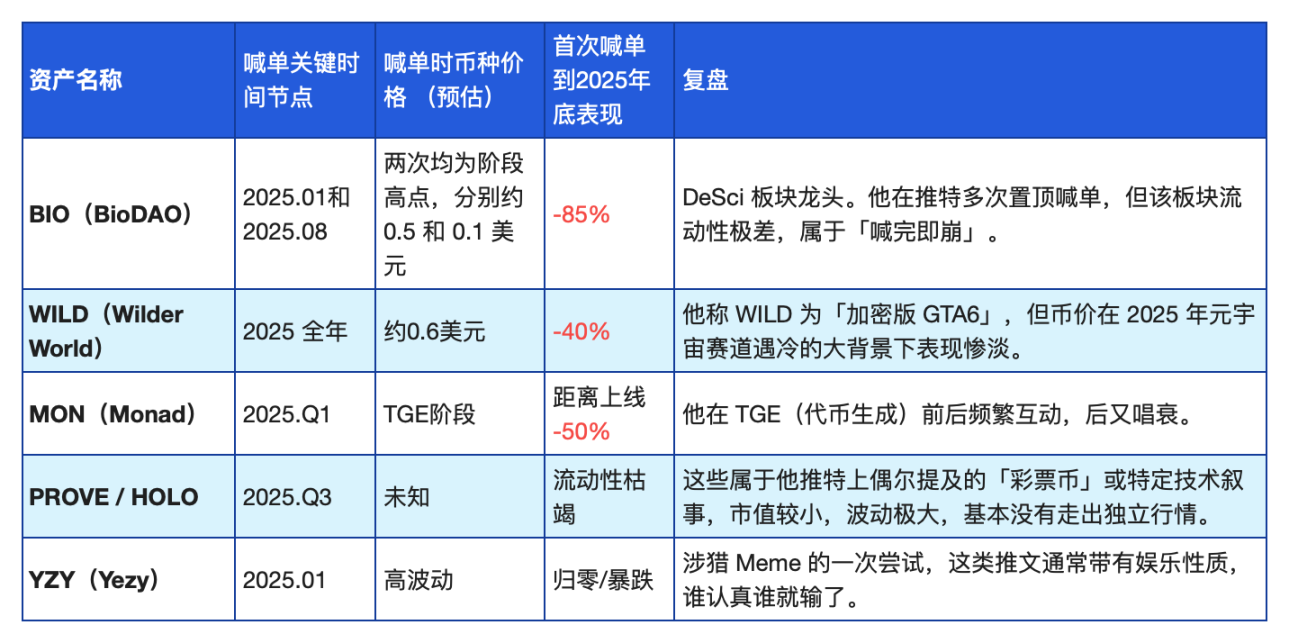

After watching Hayes' successful calls, we find that he also has his misses, especially when he attempts to "revive" some old or niche sectors.

At the beginning of 2025, his family fund Maelstrom published a long and profound article titled "Degen DeSci," strongly optimistic about the DeSci (decentralized science) sector. He listed a series of projects, including BIO and GROW…

As everyone saw, the DeSci sector nearly collapsed, with many tokens dropping over 85% from their highs. In August, Hayes again built a position worth $1.1 million in BIO, and by late November, he ultimately deposited 7.66 million BIO into Binance, incurring a loss of up to $640,000 (-58%).

Then there was Wilder World (WILD), which he referred to as the "crypto version of GTA6," that he shouted about for an entire year, only to see its price sink along with the metaverse concept.

Most of the tokens Hayes called out were those that had a certain level of heat at specific stages, summarized as shown in the image:

ZEC's "Smoke Screen"

This might be Hayes' most spectacular and thought-provoking operation of 2025.

On the surface, Hayes was frantically calling out Zcash (ZEC), claiming he initially bought millions of dollars worth after hearing advice from Silicon Valley mogul Naval at a private dinner during Token 2049. He shouted a "target of $10,000" slogan last November.

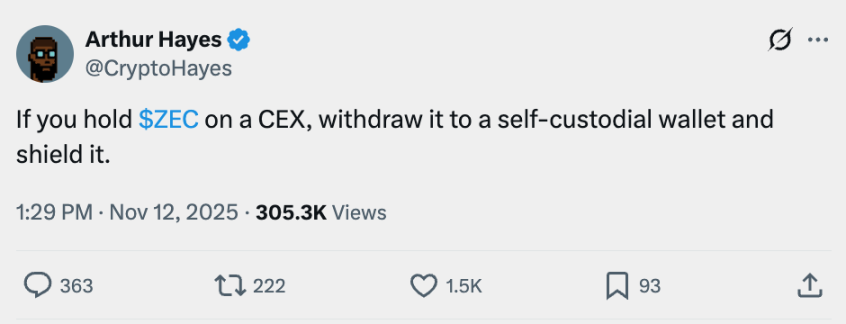

Hayes even initiated a withdrawal movement, calling on everyone to withdraw their coins to lock in liquidity on-chain.

Many people were watching his wallet to see if he secretly sold ZEC. The result was that he didn't sell, and even increased his position.

Perhaps Hayes created this ZEC frenzy with the real purpose of selling ETH and exchanging it for anything that was rising quickly at the time.

Before this, Hayes had already made several "cuts" on ETH. Although he shouted that ETH would rise to $10,000 in 2025, he experienced several "back-and-forths" in between. He sold about $13.34 million worth of ETH and other tokens on August 2, but on August 9, he expressed regret for taking profits and had to buy back.

By November 15, 2025, just as he was loudly calling out ZEC, Lookonchain monitored that on the same day he transferred millions of dollars worth of ETH and ENA to Binance, Hayes publicly declared on Twitter that he "aped more" into ZEC. On-chain analyst EmberCN also pointed out that this selling fund was most likely providing "ammunition" for increasing his ZEC position.

Due to ZEC's privacy attributes, his transparent ETH was sold off and exchanged for opaque assets. On-chain, we could only see him "exiting" (selling ETH), but we couldn't quantify the scale of his "entry" (buying ZEC).

However, in the last two weeks of 2025, Hayes sold another 1,871 ETH (about $5.53 million) and went back to buy the DeFi assets he had abandoned a month earlier.

This is a very cold signal: in his logic, Ethereum is the "capital reserve" in his portfolio. When he needs money to buy new narratives (ZEC), he sells it; when he needs money to bottom out old sectors (DeFi), he still sells it.

In the end, you will find that he attracted the entire market's attention with ZEC's price increase, and then quietly completed a position rotation while everyone was discussing the "privacy revival." It wasn't until early 2026, when ZEC plummeted due to internal team conflicts, that everyone realized that although Hayes' holdings had shrunk, he successfully escaped the peak of this phase, which performed worse than ETH.

How to Understand Arthur Hayes?

After reviewing this year, you will find that Hayes is just as he wrote in his X background image; he is not a "faithful" HODLer but an extremely shrewd businessman.

He uses words to build dreams, which is to attract liquidity; he uses on-chain operations to harvest profits, which is to avoid risks; he dares to quickly admit mistakes when he misjudges (like giving up on ETH), which is to protect his principal.

Therefore, his articles are still worth reading because his macro judgments have been validated. But before you prepare to hit the "buy" button, please take one more step: don't just listen to what he says, go see what his on-chain wallet is doing.

After all, in this brutal market, his loyalty to "volatility" far exceeds any faith in a project. And volatility is precisely the portion of money that shifts from retail pockets to traders' pockets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。