Today, let's briefly discuss the trend of gold and its relationship with Bitcoin.

I. Why Gold is Rising

The core reason for the rise in gold is the demand for safe-haven assets, rather than retail investors driving it. In this round of market activity, the main buyers are central banks from various countries.

The global financial environment is unstable, and the market lacks better investment options, forcing funds to choose gold. This indicates that risks are accumulating, but have not yet been fully released; the rise in gold is more about preemptive defense.

II. The Likelihood of a Short-term Drop in Gold is Low

Historically, significant drops in gold usually occur when the Federal Reserve enters a rate hike cycle. However, the likelihood of the Federal Reserve raising rates again in 2026 to 2027 is extremely low.

At the same time, the U.S. dollar index peaked and fell since last October, with the rise in gold occurring simultaneously with the weakening of the dollar. This rhythm is also consistent with Bitcoin's decline after peaking at 126,000.

III. Limited Technical Significance of Gold

Currently, gold is in a one-sided upward trend, and the technical analysis lacks effective reference value; it is impossible to determine when the main upward wave will end.

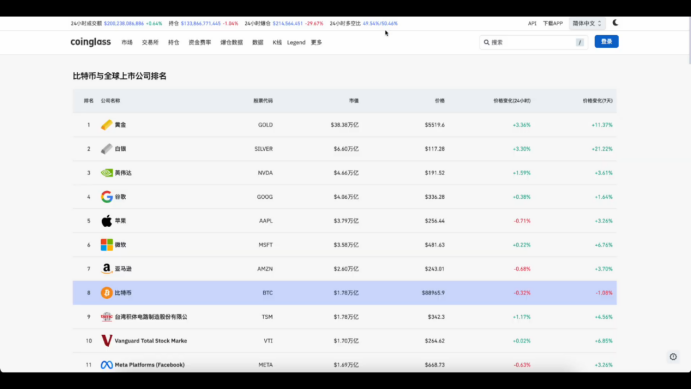

IV. The Market Capitalization Gap Between Gold and Bitcoin

Currently, the total market capitalization of gold is about 38 trillion USD, close to 40 trillion USD, while Bitcoin's market capitalization is only 1.78 trillion USD.

If gold's market capitalization remains at the current level, Bitcoin would only need a total market capitalization of less than 20 trillion USD to reach 1 million USD per coin. From a market capitalization perspective, this is just a matter of time.

V. Bitcoin is Not the Main Character in This Round

The main theme of this market activity is precious metals, not Bitcoin. Bitcoin may become the main theme again in 5, 10 years, or even longer.

If I were to make a relatively neutral judgment, I would lean towards the idea that in about 10 years, Bitcoin has a chance to approach 1 million USD per coin, but now is not the time to start.

VI. Differences Between Long-term and Swing Trading

Buying Bitcoin spot around 90,000, if held long-term, there is no need to worry about short-term fluctuations. Assuming it reaches 1 million USD per coin in the future, there is still nearly 10 times the potential.

However, from a swing trading perspective, buying around 90,000 is somewhat early.

VII. Elasticity Comparison Between Gold and Bitcoin

Gold has a massive volume, with limited room for growth. If gold rises to 10,000 USD per ounce, its corresponding market capitalization would approach 80 trillion USD, which is extremely difficult to achieve in reality.

Bitcoin requires a much lower market capitalization, showing significantly stronger elasticity in the medium to long term.

VIII. Short-term Structure of Bitcoin

Bitcoin began a new round of decline from 126,000, with support levels at 124,000, 94,000, and 90,000 being broken, now turning into resistance above.

Currently, 90,000 remains a core resistance level, having rebounded to 90,500 yesterday but not breaking through. Until it surpasses 91,000-92,000, the overall strategy remains to short on rallies.

IX. Ethereum Trend Judgment

The current core resistance range for Ethereum is 3,050-3,100, which is the central axis of the previous adjustment structure.

The price rebound has not effectively broken through, and this range remains a resistance level. Structurally, it is still a rebound after a decline, and this round of decline is likely to break below 2,000, which has not yet reached the bottom.

In the first half of this year, the overall trend is still primarily downward, and whether there will be a reversal in the second half needs further observation.

Follow me, join the community, and let's progress together.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。