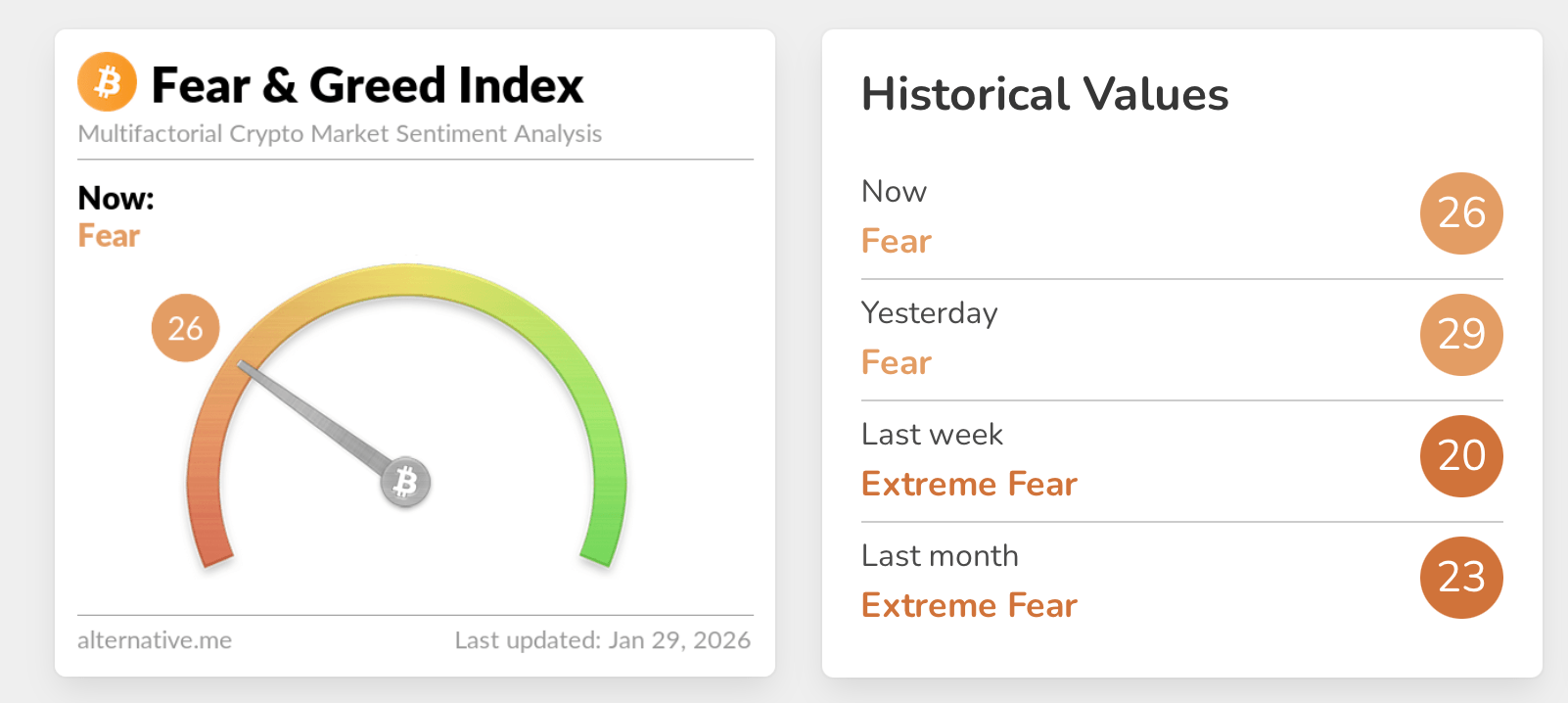

The Crypto Fear and Greed Index (CFGI) hosted on alternative.me printed 26 (Fear) on Thursday, Jan. 29, 2026, barely changed from recent readings and underscoring a market that has failed to rebuild confidence.

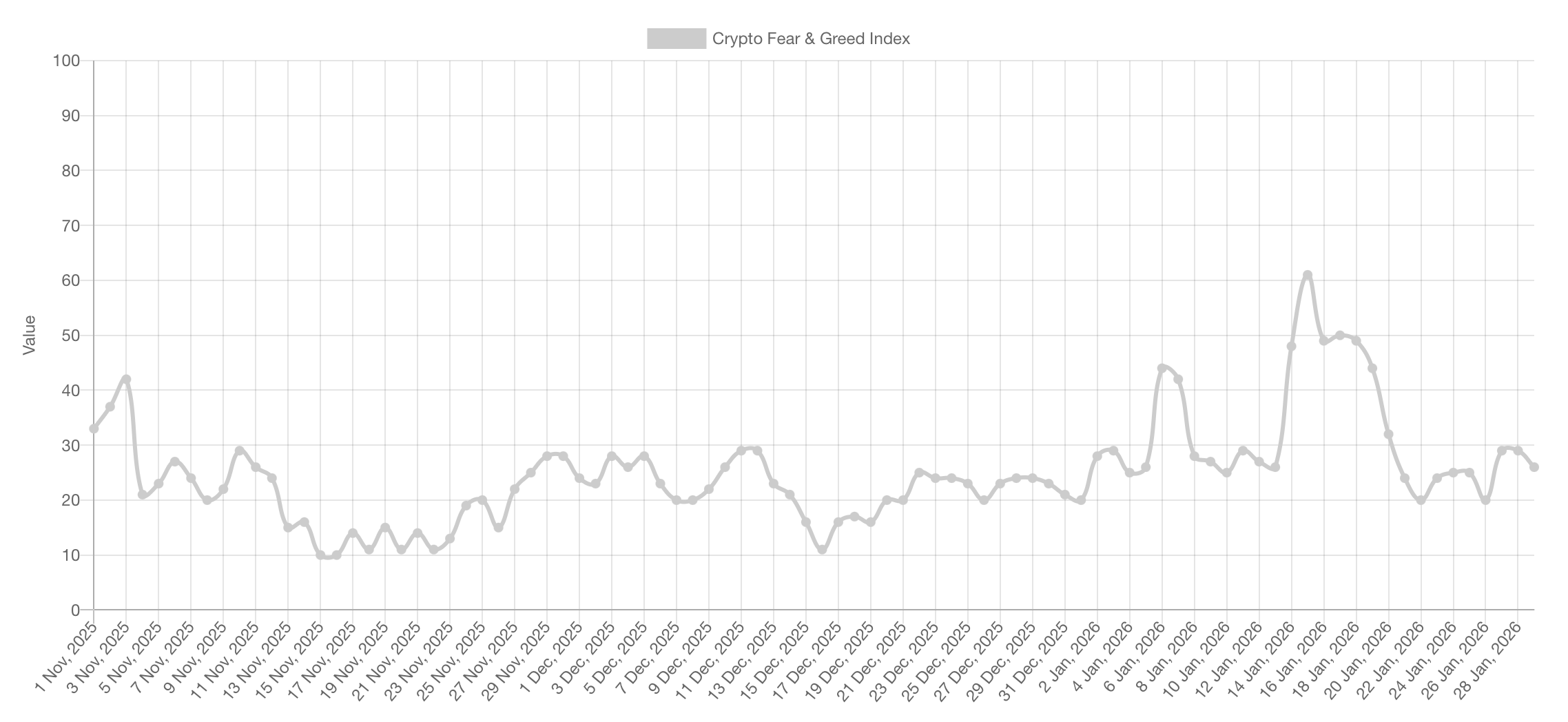

The index stood at 29 (Fear) on Wednesday, 20 (Extreme Fear) last week, and 23 (Extreme Fear) last month, showing how sentiment has remained compressed for weeks rather than snapping back. The longer-term CFGI chart highlights this stagnation. In early November, the index hovered in the low-to-mid 30s, already signaling caution.

CFGI on Jan. 29, 2026, via alternative.me.

By mid-November, sentiment deteriorated sharply, with readings dropping into the low teens as selling pressure intensified. That period marked one of the deepest fear phases of the past quarter. December offered only partial relief. The index oscillated between the high teens and upper 20s, suggesting traders were willing to probe risk but unwilling to commit.

CFGI stats on Jan. 29, 2026, via alternative.me.

Each rebound stalled near the same zone, creating a pattern of lower conviction highs and reinforcing the idea that fear was structural, not fleeting. January followed a similar script. Early-month optimism briefly lifted the CFGI toward the upper 20s, but the move quickly faded.

By mid-to-late January 2026, the index slid back toward extreme fear territory, aligning with renewed volatility and tighter correlations between crypto and U.S. equities. That sentiment backdrop mattered Thursday as bitcoin fell 6% between roughly $84,000-$85,000, and an intraday low of $83,242 per coin.

The CFGI’s inability to lift meaningfully above the mid-30s this year suggests traders have treated rallies as opportunities to reduce exposure rather than signals of a durable turn. Equity markets supplied the immediate catalyst.

Microsoft shares fell more than 12% after earnings as heavy artificial intelligence (AI) spending revived concerns about delayed returns, dragging the Nasdaq down roughly 1.5%. Software and megacap weakness reinforced risk aversion across markets.

Also read: Senate Committee Advances Digital Asset Oversight Framework

Crypto mirrored the move. Bitcoin tracked stocks lower, liquidations increased, and the CFGI reflected the shift as volatility and negative momentum weighed heavily in its calculation.

Geopolitics added pressure. President Trump’s warnings of potential strikes on Iran, coupled with visible military buildup, pushed investors toward safe havens like gold and silver and away from risk assets.

Taken together, the CFGI tells a clear story: fear has become entrenched. Until sentiment can sustain a move out of the 20s and 30s, crypto markets remain vulnerable to macro shocks and equity-driven selloffs.

- What is the Crypto Fear and Greed Index?

It measures crypto sentiment using volatility, momentum, volume, and market behavior. - What does a reading near 26 indicate?

It signals fear, meaning traders are cautious and risk appetite is limited. - Why has sentiment stayed weak for months?

Repeated equity-driven selloffs and macro uncertainty have capped confidence. - Does prolonged fear matter for prices?

Extended fear often coincides with higher volatility and fragile market structure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。