Are American institutions out of money? Is this the reason for the decline?

Today's sudden continuous decline is not just in stocks and cryptocurrencies; gold and silver are also down, and the dollar is falling. My first thought was whether institutions are exiting the market, and if so, what the reason is. Then I considered that institutions might not have much cash left.

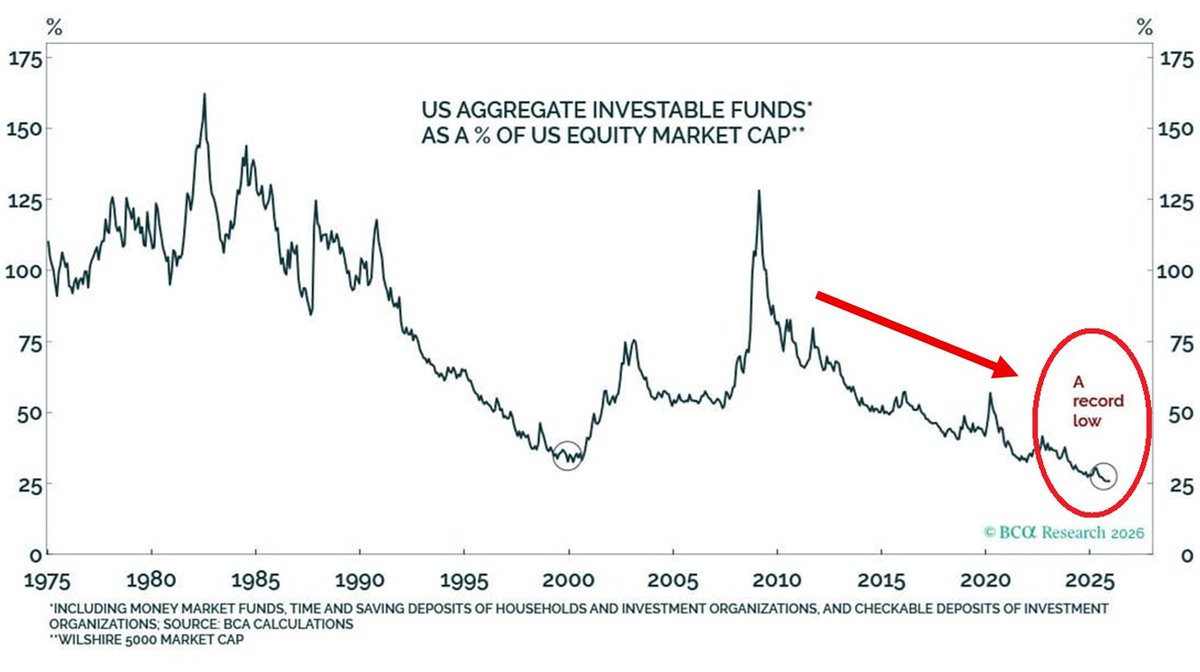

Last week, we looked at the global fund managers' allocations and saw that cash allocation had hit a historical low of 3.2%. This indicates that fund managers do not have enough cash to continue driving the market up. We also observed a lot of data showing that the main buyers of ETFs are retail investors, making them the "bag holders" for institutions, which logically makes sense.

Then I saw the chart of US aggregate investable funds as a percentage of US equity market cap, which shows that the proportion of cash available for investment relative to the total market cap of US stocks has dropped to a historically low level. This indicates that the market is in a state of having very little cash, being fully invested, and being more sensitive to new liquidity.

In simple terms, everyone is almost fully invested and has no cash left to buy the dip.

Of course, having little cash does not mean institutions are going bankrupt; it means the marginal capacity for incremental buying is decreasing. As soon as the market experiences even a minor negative event, it will switch from an upward trend driven by sentiment and inflows to a downward trend driven by redemptions. When positions are full, any fluctuation will trigger risk budgets, margin requirements, and stop-loss levels, leading to passive reductions in positions rather than voluntary exits.

More critically, today's decline exhibits this characteristic: the information from earnings season has become the last straw that broke the camel's back. It's not that the earnings reports are particularly bad, but rather that the market has no room for error. Earnings season essentially revolves around two things: expectations and volatility. When expectations have reached an extremely optimistic level, earnings do not need to be very poor; they just need to be not good enough to be perceived as negative by the market. When positions are already full, earnings do not need to be disastrous; as long as volatility increases, risk control models will prompt institutions to sell first and ask questions later.

Therefore, I am more inclined to believe that today's decline is a result of institutions' passive exits, and that earnings and profits have already provided many institutions with sufficient gains. The upcoming market may experience increased volatility due to earnings, especially since the rise in gold and silver has been significant, triggering risk controls. Consequently, the first assets to be sold are often not the worst-performing ones but rather the easiest to sell and the most liquid assets, including stocks, ETFs, gold, and even some mainstream cryptocurrencies.

For this reason, I believe this wave of decline resembles a shift in liquidity from "increasing positions" to "preserving capital." In "preserving capital" mode, institutions are not "shorting and exiting" but rather "reducing risk exposure first," with "position structure + risk control mechanisms" at play.

So, returning to the initial question, "Are American institutions out of money, is this the reason for the decline?" A more accurate statement would be that it is not the lack of money that causes the decline, but rather that the low cash ratio among institutions and the overall full positions in the market make it extremely sensitive to any fluctuations. Once a high-volatility event like earnings season occurs, the market will switch from rising due to incremental funds to falling due to passive selling.

What to watch next is quite simple: if ETF fund flows start to turn negative, redemptions continue, and volatility rises, then this decline will not be a matter of just one or two days. Conversely, if fund flows continue to increase (with retail investors continuing to buy) and only short-term deleveraging occurs, the depth of the sell-off may actually present a buying opportunity.

PS: I am just reflecting on this after the fact. Last week, I did mention that fund managers might take profits and exit, but I did not know the specific timing or method; I could only speculate on possible reasons by looking at more data.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。