Article edited on January 30, 2026, at 17:20. All opinions do not constitute any investment advice! For learning and communication purposes only.

Discipline hides infinite possibilities in life, and its depth also measures the height of life. Every step of deep cultivation has its own echo; the more disciplined one is, the farther they go. I am Fuzhu, deeply engaged in analyzing mainstream coin trends, breaking down market logic with professional accumulation, and providing pragmatic trading ideas.

Market Overview

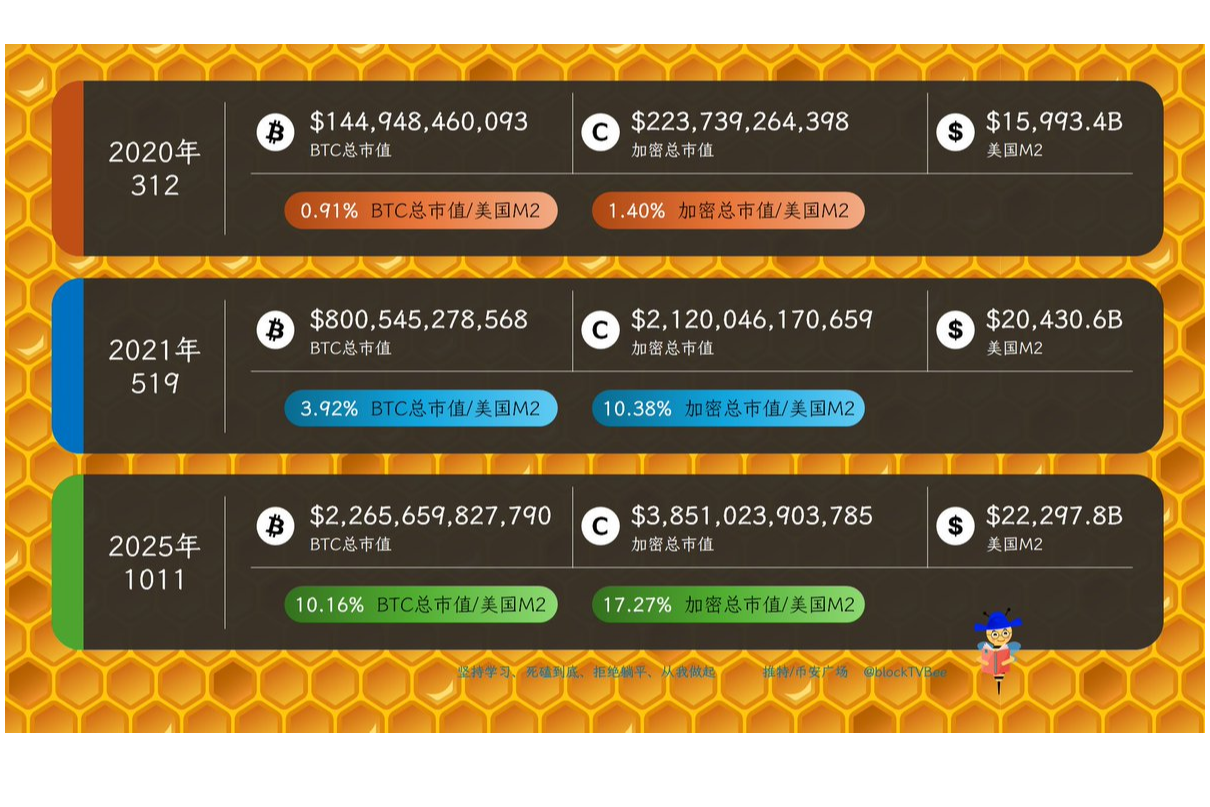

In the early hours of today, the cryptocurrency market plummeted across the board. The global cryptocurrency market cap shrank to about $2.82 trillion, with a 24-hour decline of approximately 5.11% and a trading volume of about $70 billion.

Bitcoin fell over 5%, dropping below the $85,000 mark; mainstream coins like Ethereum and SOL also saw declines exceeding 6%. In the last 24 hours, over 227,000 people globally faced liquidation, with a total liquidation amount of about $1.014 billion. Cryptocurrency-related stocks in the U.S. stock market also generally fell sharply.

The Fear and Greed Index plunged to 16, indicating "extreme fear," as investors sold off like they were fleeing! News highlights include the Federal Reserve maintaining interest rates, China's money laundering network handling $16 billion in illegal funds, Russia blocking cryptocurrency news websites, and leveraged liquidations exceeding $1 billion.

Fundamentals

The fundamentals of BTC face short-term collapse pressure, with economic risks in the U.S. and leveraged liquidations exceeding $500 million leading to a market cap evaporation of about $10 billion. ETFs recorded a weekly net outflow of $1.137 billion. Institutional demand is slowing, but the increase in supply from long-term holders provides a buffer, while miners are shifting towards AI applications to strengthen growth points.

The fundamentals of ETH are weak, with active addresses soaring but DeFi and RWA adoption slowing. Staking exit queues have cleared, with institutional staking reaching $170 million. Weekly net outflows from ETFs have slowed, but whale transfers of $145 million in ETH have intensified selling pressure.

Policy Environment

Policy uncertainty has intensified. The Federal Reserve announced on January 28 that it would maintain interest rates, as expected. However, Fed Chairman Powell's term will end in May, shifting focus to the new chairman and the 2026 policy outlook, while geopolitical risks (such as fears of Trump attacking Iran) have triggered panic.

Risk of a U.S. government shutdown: Federal agency operating funds will expire at midnight on January 30. If Congress fails to pass a new budget, the government may partially shut down, exacerbating market volatility.

Technical Analysis

BTC is currently consolidating around $83,000. It touched a low of around $81,000 in the early session, then rebounded to a high near $83,000 before starting to consolidate, continuously breaking through several important support levels under the influence of policy news.

From a weekly perspective, BTC is still in a downward trend. In the short term, watch the support at the $80,000 mark; if it falls, it could drop to $76,000, which is also a previous strong support level. If ETH drops below $2,600, it could fall to the $2,000 mark.

In terms of operations, the focus should be on defense and observation, waiting for the market's panic sentiment to release and clearer stabilization signals to appear. For short-term operations, BTC can be traded between $81,000 and $86,000, and ETH can be traded directly between $2,600 and $2,800 (remember to control contract positions within 10% and set stop-loss orders).

Disclaimer: The above content is personal opinion, and the strategies are for reference only and should not be used as investment basis. Any risks taken are at your own discretion.

Friendly Reminder: The above content is created by the public account: Fuzhu Zhiyuan. The advertisements at the end of the article and in the comments section are unrelated to the author. Please discern carefully. Thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。