Introduction

One of the recent hot topics in the cryptocurrency market is the news that the chain abstraction stablecoin protocol River has received strategic investment from TRON. On January 21, 2026, TRON founder Justin Sun announced an investment of $8 million in River to support its deployment of cross-chain stablecoin abstraction technology within the TRON ecosystem. Following the announcement, the price of River's native token RIVER skyrocketed, increasing by as much as 1900% over the past 30 days, from about $5 at the beginning of January to a recent high of $86, with a market capitalization exceeding $1.6 billion, placing it among the top 70 cryptocurrencies by market value. Industry leaders like Arthur Hayes have publicly supported the project, and exchanges have rushed to list RIVER, sparking a wave of discussions around the concept of "abstraction."

In this article, we will focus on the two main concepts of "abstraction" and "intent," providing a comprehensive overview of the development history and current status of this emerging sector, representative projects, and the risks and opportunities behind them, as well as prospects for future trends. The first part will explain what "abstraction" and "intent" are and what pain points they aim to address in the blockchain space; the second part will review the development context and current state of related technological concepts, from the inception of Ethereum account abstraction to the demand for chain abstraction driven by the prosperity of multi-chain ecosystems and the evolution of the intent concept; the third part will focus on representative projects in the abstraction and intent space, analyzing their models and performance; the fourth part will discuss the potential risks and challenges in this field, and the fifth part will explore opportunities and future prospects. Through a comprehensive analysis, we hope to provide valuable insights for investors and practitioners on how to seize opportunities and be wary of risks in the wave of abstraction and intent, and whether these innovative sectors can become the engine for the next round of industry growth.

1. Analysis of the Concepts and Background of Abstraction and Intent

To understand "abstraction" and "intent," it is essential to recognize the pain points in the current blockchain user experience. For ordinary users, the barriers to using on-chain applications are quite high: they must first hold cryptocurrency, prepare the corresponding assets on the target chain, and have the mainnet coin ready to pay network gas fees, all while facing complex operations such as transaction signing, cross-chain bridge conversions, and slippage in fees. This series of steps acts like layers of obstacles, keeping most potential users outside the door of Web3. Therefore, improving blockchain usability and lowering user barriers have become common goals in the industry. The new ideas of "abstraction" and "intent" have emerged in this context, with hopes of significantly enhancing user experience.

Abstraction

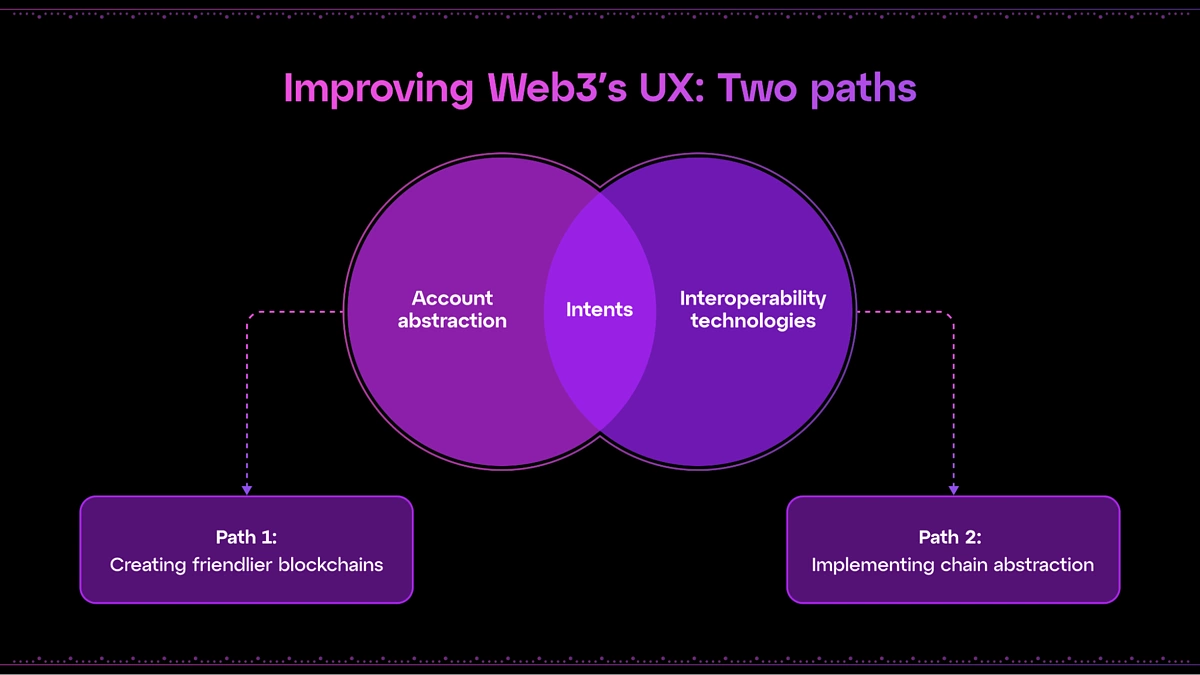

In the blockchain field, "abstraction" typically refers to a series of technical solutions that hide underlying complexities and simplify user interactions with multiple chains. Depending on the application layer, it can be subdivided into categories such as "account abstraction" and "chain abstraction." The current abstraction track mainly covers two directions:

Account abstraction is essentially a proactive technical improvement that allows accounts to be programmable, enabling features such as social recovery, payment delegation, and batch transactions, thus making operations more flexible;

Chain abstraction is more of a user experience transformation, a product of the Web3 ecosystem's spontaneous response to the challenges of multi-chain fragmentation, aiming to eliminate the cumbersome operations involved in cross-chain interactions.

Intent

Complementing the goal of hiding complexity in "abstraction," the intent track aims to redefine interaction logic. In traditional models, users must gradually formulate and execute transaction processes. For example, if a user wants to buy SOL on Solana using USDC from the Ethereum mainnet, they need to research bridging, exchange paths, and perform each operation individually.

Under the "intent-driven" architecture, users only need to declare the final desired outcome—such as "I want to exchange 1000 USDC from the ETH mainnet for SOL on the Solana chain"—and the solver in the system will automatically find the best route, coordinating cross-chain bridges and DEXs to complete the series of steps.

Users no longer submit specific transactions but rather submit an "intent," with the system executing operations based on the user's intent. This "declare result—automatically achieve" paradigm is believed to significantly reduce the difficulty of use, making blockchain interactions more intuitive.

Although "abstraction" and "intent" focus on different aspects, they share a common mission: to lower the barriers for users to engage with blockchain. Account abstraction transforms the account system to make wallets smarter and safer; chain abstraction integrates cross-chain liquidity to make multi-chain operations as smooth as single-chain ones; and intent-driven approaches revolutionize the transaction paradigm, allowing users to focus solely on what they want without having to design "how to do it." The development of Web3 has entered an era of coexistence of multiple chains and increasing application complexity, and these concepts address many pain points for ordinary users. As a result, projects centered around abstraction and intent have frequently attracted capital and community attention over the past two years, becoming a new trend. Some even refer to this phase as the "Age of Abstraction," marking a new era of infrastructure focused on user experience.

2. Development History and Current Status of the Abstraction and Intent Tracks

1. The Inception and Implementation of Account Abstraction

As early as 2016-2017, the Ethereum community began discussing ideas to make user accounts more flexible. Vitalik proposed the initial concept of Account Abstraction (AA), hoping to make ordinary accounts programmable like contracts.

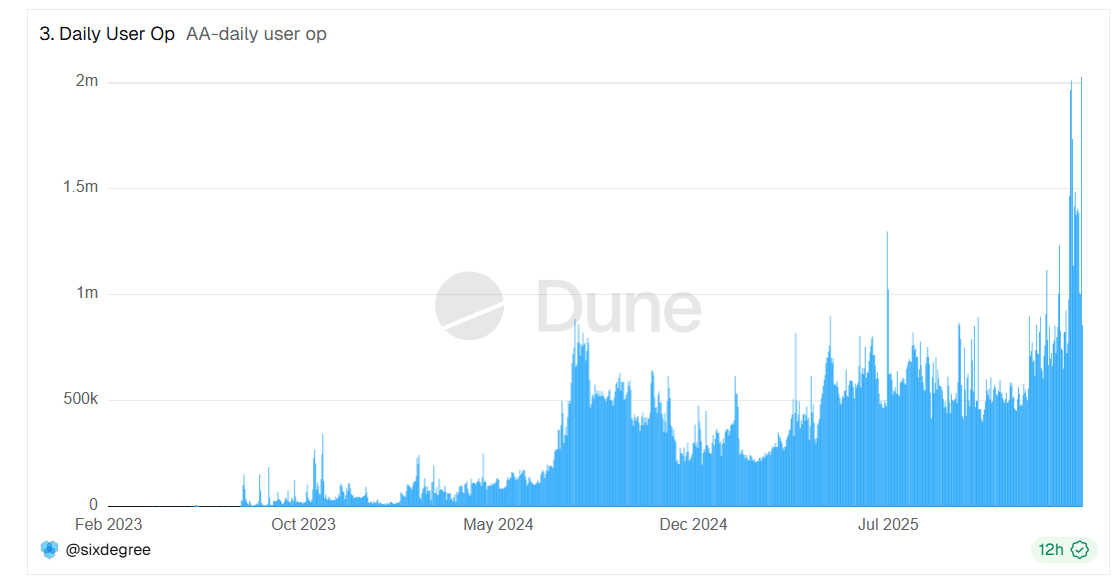

In March 2023, Ethereum achieved account abstraction without changing the underlying protocol: the EIP-4337 standard was officially released, constructing a smart account system outside the consensus layer, allowing users to create "contract accounts" to replace traditional EOA wallets. This marked the true implementation of account abstraction. With ERC-4337, users can utilize social recovery wallets, have third parties pay gas fees, and even pre-set automatic transactions or batch execute complex operations. Major wallet projects began upgrading to support AA functionality, and some on-chain applications (such as games, social DApps, etc.) introduced gas sponsor mechanisms to simplify operations for newcomers. Giants like Coinbase also launched wallets based on account abstraction, and institutions like Visa developed automatic payment demos based on AA. By the end of January 2026, the number of AA account users had exceeded 40 million, with daily operations surpassing 2 million.

Source: https://dune.com/sixdegree/account-abstraction-overview

- Ethereum clients are also discussing improvement proposals like EIP-7702, which would allow external accounts to directly invoke certain smart account functions, aiming to further lower the barriers to using AA.

2. The Rise of Multi-Chain Ecosystems and Chain Abstraction

Starting in 2020-2021, high Ethereum fees spurred the emergence of numerous new public chains and Layer 2 solutions, leading to the dispersion of users and assets across different chains. However, the prosperity of multi-chain ecosystems has brought about liquidity fragmentation and increased user barriers: assets struggle to flow freely between chains, and users must learn to use various cross-chain bridges and wallets, which is very inconvenient. To address this issue, the industry gradually explored methods of "chain abstraction," which hides the complexity of multi-chain interactions through innovations at the protocol layer. For example, some projects have launched smart contracts that can be called across chains or issued tokens that anchor multiple chain assets simultaneously, allowing users to freely use assets across chains without worrying about where they are actually located.

In the stablecoin sector, this idea has given rise to "chain abstraction stablecoins": users can deposit mainstream stablecoins on any chain to mint a globally usable stablecoin at a 1:1 ratio, which can be freely transferred and used across different chains, and redeemed for the original chain assets when needed. River is one of the pioneers of this model: it supports using USDT (on Ethereum, TRON, etc.), USDD (the stablecoin issued by TRON), or even compliant USD stablecoins like USD1 as collateral to mint the satUSD universal stablecoin with one click, which can circulate across multiple networks, thus eliminating the need for cross-chain stablecoin bridging. As long as users hold satUSD, they effectively hold dollar liquidity across all chains without needing to frequently bridge and exchange.

Additionally, many well-known projects have entered the chain abstraction/cross-chain space: for instance, cross-chain communication protocols LayerZero and Axelar focus on message bridge technology, allowing contracts to be called directly across chains. It is foreseeable that as Ethereum scales and multi-chain coexistence becomes the norm, abstraction layer infrastructure will play an increasingly important role.

3. The Proposal and Development of the Intent Concept

2023-2024: Projects like Anoma explicitly proposed an Intent architecture for cross-chain asynchronous transaction execution, emphasizing that users only need to declare "the goals they want to achieve" without worrying about the execution path. Account abstraction has become one of the infrastructures for entering the intent track, enhancing the flexibility of wallets and transaction processes.

2024-2025: More DeFi protocols, DEXs, and aggregators will introduce intent mechanisms into product design, aiming to improve user experience. For example, solvers will bid to execute intents to obtain optimal routing, reducing operational complexity in scenarios such as trading, cross-chain bridges, and asset management.

Currently, the intent mechanism is still in its early stages, but application growth is evident: it mainly includes transaction aggregation, automatic investment execution tools, etc. The intent mechanism is expected to significantly lower the on-chain user barrier, allowing ordinary users to focus solely on "goals," thereby promoting broader user adoption.

Source: https://blog.particle.network/chain-abstraction-vs-intents/

3. Overview of Representative Projects in the Abstraction and Intent Tracks

3.1 Account Abstraction: Smart Wallets and Seamless Payments

Safe ($SAFE): Safe is one of the pioneers of account programmability. It offered multi-signature smart contract wallets long before ERC-4337, supporting advanced features such as social recovery and transaction pre-configuration, and has become the largest smart account ecosystem in Web3. The Safe team actively participates in the formulation of account abstraction standards and plans to integrate new proposals like EIP-7702 into its ecosystem. Currently, almost all top DAOs have their funds stored in Safe wallets, and DeFi protocols are exploring direct support for users to log in and interact using Safe wallets. Given Safe's first-mover advantage in the AA field, SAFE is also seen as a potential core asset in the account abstraction sector.

Biconomy ($BICO): Biconomy started by providing gas payment and cross-chain relay services and gradually developed a complete account abstraction + chain abstraction solution for developers. Its SDK allows DApps to integrate "one-click transactions," enabling users to complete multi-step operations like "exchanging and staking assets" with just one signature, while gas fees can be paid by the DApp or a third party, achieving a near-Web2 smooth experience. Biconomy also launched a module called "Smart Account Nexus," which helps projects create ERC-4337 accounts on a large scale. As its Modular Execution Layer expands to more chains and supports more complex "super transactions" (such as cross-chain combination operations), Biconomy is expected to further enhance user retention and token value.

Particle Network ($PARTI): Particle approaches from the perspective of Web2 user experience, providing an integrated solution of passwordless login + smart wallets. Users can log in using their phone numbers or emails, with Particle creating ERC-4337 smart accounts in the background and managing private key shards, allowing users to use blockchain seamlessly. Particle's biggest feature is the promotion of the "Universal Account" concept: under its architecture, users appear to have a single unified account, which actually corresponds to instances of smart contract wallets on multiple chains, coordinated and managed by a proprietary underlying chain from Particle. This simultaneously achieves both account abstraction and chain abstraction: users see one account and one balance, allowing them to freely use DApps across all supported chains without worrying about where the assets are or how gas is paid. Particle incentivizes network nodes through B-end service fees and ecosystem tokens. However, its custody solution also faces skepticism regarding decentralization and security, requiring technical improvements and open-source efforts to gain user trust.

3.2 Chain Abstraction: Cross-Chain Liquidity and Unified Assets

River ($RIVER): River allows users to deposit stablecoins from different chains and issues a unified satUSD, enabling seamless fund transfers across chains. The core product, satUSD, is an over-collateralized stablecoin, with the protocol's TVL around $159 million, down from its peak of $605 million in October 2025. The recent surge in RIVER's price was certainly stimulated by the investment news from Justin Sun, but it is also related to its small circulating supply and market speculation, necessitating caution regarding short-term volatility risks. In the long run, the success of the River model depends on:

Security, as cross-chain minting must guard against contract vulnerabilities and risks associated with pegged assets;

Network Effects, requiring more chains and application scenarios to support satUSD;

Regulation, as a unified stablecoin touches on multi-chain regulations, facing regulatory uncertainties.

Currently, the integration with the TRON ecosystem provides River with an opportunity for rapid expansion. If it can attract more ecosystems like Ethereum and BSC beyond TRON, its positioning may upgrade to that of a "hub" for cross-chain stablecoins, expanding the value potential of the RIVER token. Conversely, if growth encounters obstacles or risk events arise, the high valuation may quickly decline, and investors need to closely monitor project developments.

ZetaChain ($ZETA): ZetaChain is a public chain designed for full-chain interoperability, referred to as "the first universal blockchain." Its features include built-in cross-chain messaging and asset capabilities, allowing smart contracts to directly control external assets like Bitcoin, Ethereum, and Solana on ZetaChain. Developers can thus build Omnichain dApps: contracts deployed on ZetaChain can read and write the states of various mainstream chains, achieving truly native cross-chain applications. For example, a user initiating an operation on a DeFi application on ZetaChain can automatically call a DEX on Ethereum and a lending service on BSC, with the results fed back to the user, all completed through ZetaChain's native support without user intervention or the need for third-party bridges. To avoid centralization risks, ZetaChain employs DPoS multi-node verification for external chain assets, with a mechanism similar to a cross-chain version of Ethereum. ZETA, as its native token, is used to pay gas fees and maintain cross-chain consensus. ZetaChain represents another path for chain abstraction: using a new public chain as a carrier to fundamentally provide cross-chain abstraction capabilities through underlying multi-chain integration.

LayerZero/Axelar: These two projects represent cross-chain communication infrastructure and are also an important part of achieving chain abstraction. LayerZero provides a unified cross-chain messaging protocol, allowing developers to easily build cross-chain dApps. Axelar (AXL) is another star cross-chain network that achieves asset and message cross-chain through decentralized gateways and has launched a cross-chain stablecoin similar to satUSD (axlUSD). The AXL token is used to pay cross-chain fees and for node staking. LayerZero and Axelar can be seen as paving the way for chain abstraction from different angles: the former focuses on the messaging layer, while the latter balances the asset layer. As more applications require cross-chain interoperability, the importance of such protocols continues to rise. It should be noted that cross-chain bridge security has always been a high-risk area, and LayerZero and Axelar have repeatedly emphasized security measures. However, investors should still be cautious, as any security incidents in cross-chain infrastructure can have significant impacts, with token values being the first to suffer. Therefore, while enjoying the benefits of chain abstraction brought by LayerZero and Axelar, attention must also be paid to their technical reliability and audit status.

3.3 Intent: User Needs and Automatic Fulfillment

Anoma ($XAN): Anoma is a Layer 1 blockchain project designed around the concept of "intent." Anoma aims to build a "decentralized operating system" where users can publish any on-chain needs, and the network automatically matches and executes them without requiring users to specify detailed steps. In simple terms, on Anoma, users no longer send transactions but instead publish "intents"—for example, "I want to exchange 50 tokens A for token B at an exchange rate of at least 1:100"—and the Anoma network will be responsible for finding matchmakers or pathways to complete this exchange. Architecturally, Anoma consists of three parts: an intent pool (to collect user intents), solvers (to compete in matching intents and generating transaction plans), and a settlement layer (to execute the plans on-chain). Anoma's parallel project, Namada, provides zero-knowledge privacy features, allowing user intent content to be encrypted, with only the results being recorded on-chain once achieved. The risks include: Anoma's technical challenges are extremely high, and achieving universal intent matching requires solving many open problems (such as solver games, complex intent composability, etc.), with uncertainties regarding implementation timelines and outcomes.

CowSwap ($COW): CowSwap cleverly applies the concept of intent to existing Ethereum DEX trading, becoming a successful case. CowSwap is a decentralized trading platform based on the Gnosis protocol, allowing users to submit not traditional swap transactions but rather "request for quote" (RFQ) intent orders. For example, if a user states, "I want to exchange 100 DAI for at least 0.05 WBTC," this order is broadcast to a group of professional market makers and algorithmic solvers. Solvers will attempt to find the optimal path in various DEX pools or order books or match other users' counter orders, then provide an execution plan. If a plan meets the user's intent (at least receiving 0.05 WBTC), CowSwap will facilitate the transaction; otherwise, the order will not be executed, and the user will not incur gas fees. This model has several notable advantages: ① Batch Matching: CowSwap processes orders received over a period collectively, identifying the optimal batch trading plan, often reducing slippage and gas costs; ② Avoiding Front-Running: Since user intents are matched off-chain and not in the public memory pool, MEV bots cannot know in advance and thus cannot insert themselves, helping to achieve fair pricing; ③ Simplified User Experience: Throughout the process, users only need to sign authorization, and gas payments are only executed if a match is successful; if no transaction is completed, users do not lose gas fees.

4. Risks and Challenges Facing the Abstraction and Intent Tracks

As emerging hot sectors, abstraction and intent hold promising prospects, but the performance of related projects since their launch has mostly been unsatisfactory. The journey from the proposal of new paradigms to their maturity has always been accompanied by twists and pains, necessitating a rational view of the risks and challenges.

High Difficulty of Technical Implementation: Although the standards for account abstraction have been established, integrating them into various DApps still faces significant obstacles—many applications have yet to support smart account logins, and the development work to integrate ERC-4337 is complex and cumbersome. In terms of chain abstraction, achieving seamless connections between different chains poses great challenges in terms of security and complexity. Therefore, security and reliability are the lifelines of abstraction/intention solutions. For example, River must ensure that satUSD is fully backed 1:1 and guard against contract risks; otherwise, if the stablecoin becomes unpegged, it will severely undermine confidence. The intent network must also guard against collusion among solvers for profit, misuse of user intents, and how to balance decentralization and efficiency. These technical challenges do not have ready-made answers and require continuous iteration and improvement.

Challenges of Ecological Collaboration and Standardization: Currently, the fields of abstraction and intent are flourishing, with various projects advancing their own solutions. In the short term, innovation is active, but in the long term, there may be issues of non-uniform standards and fragmentation. For example, besides ERC-4337, account abstraction has various models adopted by non-EVM chains like Aptos; cross-chain abstraction has some leaning towards cross-chain bridges and others towards new contract chains, and whether a common standard can be formed remains uncertain. In terms of intent, different projects may design different intent expression formats and protocols, and if they are incompatible, it will reduce network effects. To avoid "each going their own way," the community needs to promote more open-source collaboration and standard-setting, such as a common Intent format or cross-chain abstraction API interfaces. Research institutions like Paradigm have already called for the construction of an open intent pool and a permissionless solving network. In the future, we may see organizations similar to W3C emerge in the blockchain field to coordinate industry unity in abstraction and intent technologies.

Economic and Governance Risks: Abstraction and intent projects often introduce new incentive mechanisms and token economic models. If the project token distribution is not reasonable and the governance mechanism is not well-developed, it may give rise to issues such as price manipulation and governance attacks. For instance, in the intent network, solvers may choose plans that are most beneficial to themselves rather than optimal for users (such as secretly capturing MEV profits without returning them to users). Designing incentive mechanisms that align interests with user goals is a challenge on the economic level. Additionally, the degree of decentralization of these new networks or protocols needs to be monitored—many account abstraction wallets are currently partially hosted by project parties, many chain abstraction bridges are controlled by multi-signatures, and the intent solving may initially involve only a few nodes. These points of centralization are potential risk points; if compromised or abused, they could jeopardize user assets.

Regulatory Compliance Risks: Unified cross-chain stablecoins and intent networks that hide transaction details may attract the attention of regulatory agencies. The stablecoin sector, in particular, has always been a high-pressure area for regulation; for example, projects like River operating satUSD in various countries need to comply with anti-money laundering and payment regulations in the jurisdictions of each chain. Some chain abstraction projects attempt to bypass traditional financial and cross-border restrictions to achieve free capital flow, which may trigger policy risks. Intent networks involving privacy transaction matching also need to guard against being exploited by criminals for money laundering or evading scrutiny. All of this requires projects to establish compliance mechanisms beyond technology, such as KYT monitoring and preventing black market addresses, and to actively communicate with regulators.

5. Opportunities and Outlook: Opening a New Paradigm for Web3

Despite the challenges, the direction represented by abstraction and intent is still widely regarded as containing the key momentum for driving the large-scale adoption of blockchain. With technological iteration and ecological evolution, we have reason to remain cautiously optimistic about the broad prospects in this field:

From the perspective of user experience, abstraction and intent are expected to work together to elevate the usability of Web3 to unprecedented heights. Account abstraction addresses wallet usability and security, preventing ordinary people from experiencing a "zero balance overnight" due to lost private keys, and eliminating the need to constantly calculate gas fees; chain abstraction breaks down ecological barriers, allowing users to not worry about "which chain my coins are on or which L2 this DApp belongs to," making assets and applications easily accessible; the intent-driven approach further realizes a paradigm shift in user interaction with blockchain, where users only need to express their goals to automatically receive services. It is conceivable that if these technologies mature and integrate, the future user experience of blockchain applications will approach or even surpass that of traditional internet products—registering and logging into an account, selecting desired services, and being able to navigate seamlessly across various underlying blockchains. This will truly eliminate the barriers to mass adoption of Web3, making it possible for the next hundred million users to enter the crypto world.

From the perspective of innovative applications, abstraction and intent will open up new horizons. When cross-chain and complex interactions become simple and efficient, developers can unleash their creativity to build application scenarios that were previously difficult to achieve. For example, through chain abstraction, a DeFi application can aggregate liquidity across all chains to provide users with the best rates, while users remain completely unaware of where the assets come from; combined with intent, a wealth management protocol can allow users to publish intents such as "help me automatically rotate funds among the three pools with the highest returns," with smart agents optimizing execution. These complex strategies, which previously required advanced users to operate manually or were simply impossible, will become accessible due to abstraction/intent infrastructure. Additionally, in areas like NFTs, gaming, and social interactions, intent-driven approaches also hold enormous potential. For instance, NFT markets could allow users to publish purchase intents, with the platform automatically seeking quotes for them; blockchain game players could propose complex operational intents (such as "defeat a certain boss and redeem rewards"), with game contracts automatically coordinating multiple parties to complete the task. It is foreseeable that abstraction and intent will give rise to entirely new DApp paradigms, containing a wealth of new opportunities.

From the perspective of industry trends, abstraction and intent align with the current multi-chain landscape and the trend of prioritizing user experience, and are likely to become one of the important main lines in the next cycle. The Ethereum Foundation and many L2 teams have prioritized enhancing user experience in their R&D efforts, with account abstraction accelerating the optimization of standards, and Layer 2 projects exploring combinations with AA and Intent. New non-EVM public chains like Sui and Aptos are also exploring abstraction and intent functionalities, allowing developers to customize account authentication logic using the Move language. Meanwhile, Web2 tech and traditional financial giants are also paying attention to developments in this field; payment companies like Visa and Mastercard are researching AA for automatic payments; decentralized social applications are also raising expectations for breakthroughs in account abstraction in the social finance sector. It can be said that abstraction and intent are on the eve of a significant breakthrough: once the accumulated technologies and concepts mature and integrate, they may trigger a "sudden satisfaction" in user growth and application prosperity at some point.

Conclusion

In today's blockchain world, technological innovation has never ceased. The rise of the abstraction and intent track reflects the industry's urgent demand for user experience and application connectivity. From River's chain abstraction stablecoin to Anoma's intent public chain, these projects are boldly reshaping underlying logic and interaction paradigms. In this article, we have analyzed their exciting innovations while calmly examining the inherent risks. Looking ahead, it is foreseeable that the concepts of abstraction and intent will continue to gain traction and gradually permeate mainstream blockchain applications. When the vision of seamless cross-chain interactions and effortless transactions is truly realized, the value of blockchain will be accessible to a much broader audience.

About Us

Hotcoin Research, as the core research institution of Hotcoin Exchange, is dedicated to transforming professional analysis into your practical tools. Through our "Weekly Insights" and "In-Depth Reports," we analyze market trends for you; leveraging our exclusive column "Hotcoin Selection" (AI + expert dual screening), we help you identify potential assets and reduce trial-and-error costs. Every week, our researchers also engage with you face-to-face through live broadcasts, interpreting hot topics and predicting trends. We believe that warm companionship and professional guidance can help more investors navigate cycles and seize value opportunities in Web3.

Risk Warning

The cryptocurrency market is highly volatile, and investment carries risks. We strongly recommend that investors conduct investments based on a full understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。