Article editing time: February 1, 2026, 20:50. All opinions do not constitute any investment advice! For learning and communication purposes only.

Discipline hides infinite possibilities in life, and its depth also measures the height of life. Every step of deep cultivation has its own echoes; the more disciplined one is, the farther they go. I am Fuzhu, deeply engaged in analyzing mainstream coin trends, breaking down market logic with professional accumulation, and providing pragmatic trading ideas.

Market Overview

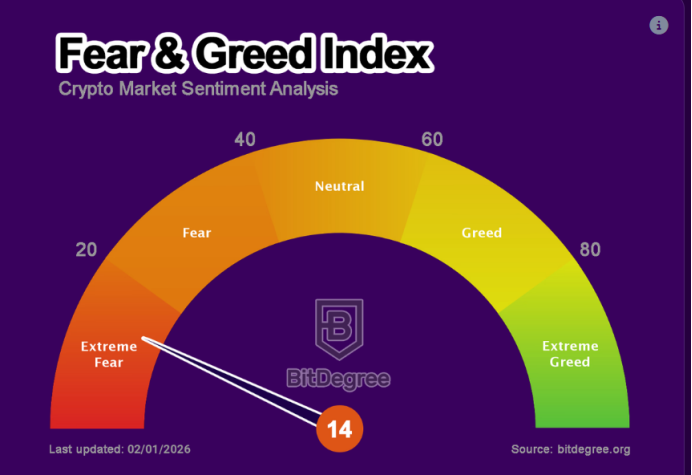

This weekend was anything but peaceful, with the global cryptocurrency market cap shrinking to about $1.57 trillion, a 24-hour drop of about 4-5%, and a trading volume of about $70 billion. Last night, Bitcoin plummeted from $84,000 to $75,500, a drop of nearly $10,000. In 24 hours, 420,000 people were liquidated, with long positions liquidated amounting to $2.575 billion, and the largest single liquidation being $220 million, showing a truly grim situation. The Fear and Greed Index plunged to 14, indicating "extreme fear," as investors sold off like avoiding a plague. Gold and silver also fell sharply, with gold dropping 10% and silver at one point plummeting over 36%.

This liquidation night taught the crypto circle a profound lesson: respecting the market and managing risks are the eternal survival rules. Leverage can amplify profits but can also magnify risks. When the market sheds its bubble, only those participants who adhere to risk control can stand firm in the new cycle of the crypto world.

Fundamentals

Trump nominated Kevin Warsh as the Chairman of the Federal Reserve, which the market views as a hawkish choice, triggering a sell-off in cryptocurrencies and other risk assets. Although Warsh has shown a trend of shifting from hawkish to dovish in recent years, the market remains concerned that he will maintain a relatively hawkish monetary policy, leading to increased funding costs and heightened pressure on those borrowing to trade cryptocurrencies.

Geopolitical tensions are escalating, with the situation between the U.S. and Iran intensifying. Market risk aversion is rising, but funds have not flowed into traditional safe-haven assets; instead, they are being sold off due to concerns over tightening liquidity.

Technical Analysis

BTC is currently consolidating around $78,000. It quickly dipped to a low of $75,500 in the early morning, breaking the level mentioned in the previous article, and then rebounded to a structural trend. It has now dropped to near the weekly support level. In the short term, watch the support at the $76,000 level; if it falls, it could drop to $70,000, while the upper support is at $82,000-$85,000. ETH fell even harder, with a low spike around $2,200. If it breaks below $2,000, it could drop to $1,800-$1,500.

In terms of operations, currently, spot trading is relatively stable. Spot can be entered in batches, and if the fear index breaks 10, then increase positions.

Short-term contracts: If BTC does not break $82,000, take light long positions with a target of $80,000-$76,000. If ETH does not break $2,600, take light long positions with a target of $2,000. Avoid high leverage and keep a close eye on unlocking events and Fed dynamics. (Remember to control contract positions within 10% and set stop-loss orders.)

Disclaimer: The above content is personal opinion, and the strategies are for reference only and should not be used as investment basis. Any risks taken are at your own discretion.

Friendly reminder: The above content is created by the public account: Fuzhu Zhiyuan. The advertisements at the end of the article and in the comments section are unrelated to the author. Please discern carefully. Thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。