Introduction: The "Export Industry" of Power Outage Countries: How Electricity Turns into Bitcoin

On a summer night in Tehran, the heat wave feels like an airtight net, making it hard to breathe.

In the recurring electricity crisis of recent years, the summer of 2025 became the most difficult moment for this capital city of Iran; that year, the city experienced one of the most extreme heatwaves in nearly half a century, with temperatures repeatedly exceeding 40 degrees Celsius, and 27 provinces were forced to implement power rationing, leading to the shutdown of multiple government offices and schools. In several local hospitals, doctors had to rely on diesel generators to maintain power—if the power outage lasted too long, the ventilators in the intensive care units could stop working.

But on the outskirts of the city, behind the walls, another sound is sharper: industrial fans roar deafeningly as rows of Bitcoin mining machines operate at full capacity; the LED indicator lights flicker in the night like a sea of stars, and here, the electricity has almost never been interrupted.

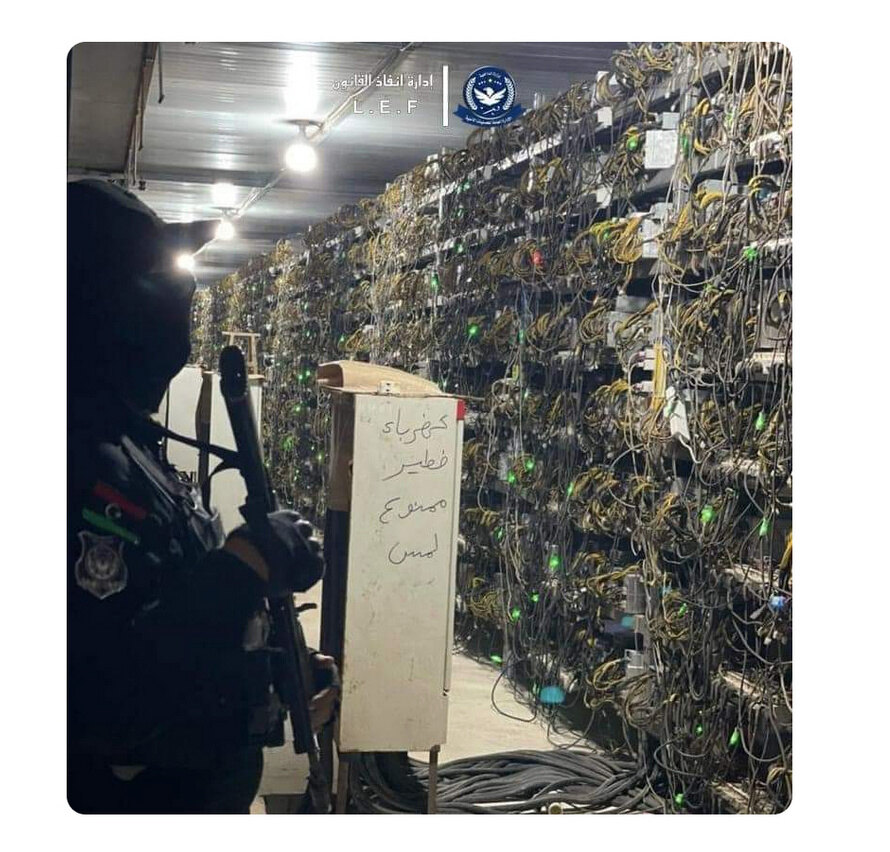

In Libya, a North African country on the other side of the Mediterranean, the same scene plays out every day. Residents in the eastern region have long been accustomed to daily power outages lasting 6 to 8 hours; food in refrigerators often spoils, and children need to do their homework by candlelight. But in an abandoned steel mill outside the city, old mining machines smuggled in operate day and night, converting the country's nearly free electricity into Bitcoin, which is then exchanged for dollars through cryptocurrency exchanges.

This is one of the most absurd energy stories of the 21st century: in two countries ravaged by sanctions and civil war, electricity is no longer just a public service but is treated as a hard currency that can be "exported."

Image description: Two Iranian men sit outside their mobile phone shop, illuminated only by emergency lights, as the street is plunged into darkness due to a power outage.

Chapter 1: Power Run on the Edge: When Energy Becomes a Financial Tool

The essence of Bitcoin mining is an energy arbitrage game. Anywhere in the world, as long as the electricity price is low enough, mining machines can be profitable. In Texas or Iceland, miners meticulously calculate the cost of each kilowatt-hour, and only the latest generation of efficient mining machines can survive in the competition. But in Iran and Libya, the rules of the game are completely different.

In Iran, industrial electricity prices are as low as $0.01 per kilowatt-hour, while Libya's prices are even more outrageous—around $0.004 per kilowatt-hour, one of the lowest electricity prices in the world. Such low prices are made possible by the government’s massive subsidies for fuel and artificially suppressed electricity prices. In a normal market, such prices wouldn't even cover the cost of electricity generation.

But for miners, this is paradise. Even outdated mining machines that have been phased out in China or Kazakhstan—those that have long been considered electronic waste in developed countries—can still easily turn a profit here. According to official data, in 2021, Libya's Bitcoin hash rate accounted for about 0.6% of the global total, surpassing all other Arab and African countries, and even some European economies.

This number may seem small, but in the context of Libya, it is extremely absurd. This is a country with a population of only 7 million, a grid loss rate of up to 40%, and daily power outages. At peak times, Bitcoin mining consumed about 2% of the country's total electricity generation, equivalent to 0.855 terawatt-hours (TWh) annually.

In Iran, the situation is even more extreme. This country has the fourth-largest oil reserves and the second-largest natural gas reserves in the world, and theoretically should not be short of electricity. However, due to U.S. sanctions cutting off its access to advanced power generation equipment and technology, combined with an aging grid and chaotic management, Iran's electricity supply has long been under strain. The explosive growth of Bitcoin mining is completely stretching this thin line.

This is not ordinary industrial expansion. This is a run on public resources—when electricity is treated as a "hard currency" that can bypass the financial system, it is no longer prioritized for hospitals, schools, and residents, but flows to those who can convert it into dollars through mining machines.

Chapter 2: Two Countries, Dual Mining Stories

Iran: From "Exporting Energy" to "Exporting Hash Power"

Under extreme sanctions pressure, Iran chose to legalize Bitcoin mining, converting its cheap domestic electricity into globally tradable digital assets.

In 2018, the Trump administration withdrew from the Iran nuclear deal and reimposed "maximum pressure" sanctions on Iran. Iran was kicked out of the SWIFT international settlement system, unable to use dollars for international trade, oil exports plummeted, and foreign exchange reserves dried up. In this context, Bitcoin mining provided a "side door" for "monetizing energy": no need for SWIFT, no need for corresponding banks, just electricity, mining machines, and a way to sell the coins.

In 2019, the Iranian government officially recognized cryptocurrency mining as a legitimate industry and established a licensing system. The policy design seemed very "modern": miners could apply for licenses to operate their mining farms at preferential electricity prices, but they had to sell the mined Bitcoin to the Central Bank of Iran.

In theory, this was a win-win-win solution— the state exchanged cheap electricity for Bitcoin, then used Bitcoin to obtain foreign exchange or import goods; miners gained stable profits; and the grid load could be planned and regulated.

However, reality quickly deviated from the plan: licenses existed, but the gray area was broader.

By 2021, then-President Rouhani publicly acknowledged that about 85% of mining activities in Iran were unlicensed; underground mining farms sprang up like mushrooms after rain, from abandoned factories to mosque basements, from government office buildings to ordinary homes, mining machines were everywhere. The deeper the electricity price subsidies, the stronger the arbitrage motivation; the looser the regulation, the more stealing electricity seemed like a "default benefit."

Faced with the worsening electricity crisis and the reality that illegal mining consumed over 2 gigawatts, the Iranian government announced a temporary ban on all cryptocurrency mining activities from May to September of that year, lasting four months. This was also the most severe nationwide ban since legalization in 2019.

During this period, the government organized large-scale raids: the Ministry of Energy, police, and local authorities raided thousands of illegal mining farms, seizing tens of thousands of mining machines in just the second half of 2021.

However, after the ban ended, mining activities quickly rebounded. Many confiscated mining machines were put back into use, and the scale of underground mining farms increased rather than decreased. This "rectification" was seen by the public as a brief performance: on the surface, it appeared to crack down on illegal activities, but in reality, it failed to address the deeper issues, instead allowing some well-connected mining farms to expand.

More critically, multiple investigations and reports indicated that some entities closely linked to power institutions had massively intervened in this industry, forming "privileged mining farms" that enjoyed independent electricity supply and law enforcement exemptions.

When mining farms are backed by the "untouchable hand," so-called rectification becomes a political performance; and the public narrative is sharper: “We endure the darkness just to keep the Bitcoin machines running.”

Source: Financial Times

Libya: Cheap Electricity, Shadow Mining

Slogans on the walls of Libyan streets condemn "the buying and selling of relief supplies as illegal," reflecting the moral outrage of the public over unfair resource distribution—similar sentiments have quietly fermented against the backdrop of electricity subsidies being diverted for mining.

The mining script in Libya resembles "barbaric growth in the absence of institutions."

Libya, a North African country (with a population of about 7.3 to 7.5 million and an area of nearly 1.76 million square kilometers, making it the fourth largest country in Africa), is located on the southern shore of the Mediterranean and borders Egypt, Tunisia, and Algeria. Since the fall of the Gaddafi regime in 2011, the country has been mired in long-term turmoil: repeated civil wars, armed factions abound, and national institutions are severely fragmented, creating a state of "managerial fragmentation" (where violence levels are relatively controllable, but unified governance is lacking).

What truly drives Libya to become a hotspot for mining is its absurd electricity pricing structure. As one of Africa's largest oil producers, the Libyan government has long provided massive subsidies for electricity, keeping prices at around $0.0040 per kilowatt-hour—this price is even lower than the fuel cost of electricity generation. In a normal country, such subsidies are meant to ensure people's livelihoods. But in Libya, it has become a huge arbitrage opportunity.

Thus, a classic arbitrage model emerged:

- Old mining machines that have been phased out in Europe and the U.S. can still be profitable in Libya;

- Industrial areas, abandoned factories, and warehouses are naturally suited to hide high electricity-consuming loads;

- Equipment imports are restricted, but gray channels and smuggling allow machines to continue entering;

Although in 2018 the Central Bank of Libya (CBL) declared virtual currency trading illegal and in 2022 the Ministry of Economy banned the import of mining equipment, mining itself has not been explicitly prohibited by national law, and enforcement often relies on peripheral charges like "illegal electricity use" and "smuggling," which are poorly executed in the reality of fragmented power, leading to the continued expansion of gray areas.

This state of "prohibition without cessation" is a typical manifestation of power fragmentation—the bans from the Central Bank and the Ministry of Economy are often difficult to enforce in eastern Benghazi or southern regions, where local armed groups or militias sometimes even tacitly allow or protect mining farms, leading to mining's barbaric growth in gray areas.

Source: @emadbadi_

More absurdly, a significant portion of these mining farms is operated by foreigners. In November 2025, Libyan prosecutors sentenced nine individuals operating mining farms within the Zliten steel mill to three years in prison, confiscated their equipment, and seized their illegal gains. In previous raids, law enforcement agencies had arrested dozens of Asian nationals who were operating industrial-scale mining farms using old machines that had been phased out in China or Kazakhstan.

These old devices have long been unprofitable in developed countries, but in Libya, they are still money printers. Because the electricity price is so low, even the least efficient mining machines can turn a profit. This is why Libya has become a revival ground for the global "graveyard of mining machines"—those electronic wastes that were discarded in Texas or Iceland have found a second life here.

Chapter 3: The Collapsing Grid and Energy Privatization

Iran and Libya have taken two different paths: one attempts to incorporate Bitcoin mining into the national machinery, while the other has long allowed it to wander in the shadows of the system. But the endpoint is the same—the expansion of the electricity grid deficit and the political consequences of resource allocation are beginning to emerge.

This is not merely a technical failure but a result of political economy. Subsidized electricity prices create the illusion that "electricity is worthless"; mining offers the temptation that "electricity can be monetized"; and the power structure determines who can cash in on this temptation.

When mining machines share the same grid with hospitals, factories, and residents, the conflict is no longer abstract. Power outages damage not only refrigerators and air conditioners but also surgical lights, blood bank refrigeration, and industrial production lines. Each instance of darkness is a silent examination of the way public resources are allocated.

The problem is that the profits from mining are highly "portable." Electricity is local, and the costs are borne by society; Bitcoin is global, and its value can be quickly transferred. The result is a highly asymmetric structure: society bears the costs of electricity consumption and outages, while a few individuals reap the cross-border profits.

In countries with sound institutions and abundant energy, Bitcoin mining is usually discussed as an industrial activity; but in countries like Iran and Libya, the issue itself has changed.

Emerging Industry or Resource Plunder?

Globally, Bitcoin mining is seen as an emerging industry, even a symbol of the "digital economy." But in the cases of Iran and Libya, it resembles a privatization experiment of public resources.

If it is to be called an industry, it should at least create jobs, pay taxes, be regulated, and bring net benefits to society. However, in these two countries, mining is highly automated, creating almost no jobs; many mining farms operate in illegal or semi-legal states, contributing limited tax revenue, and even licensed farms lack transparency in their profit flows.

Cheap electricity was originally intended to ensure people's livelihoods. In Iran, energy subsidies are part of the "social contract" since the Islamic Revolution—the government subsidizes electricity prices with oil revenues, while the public accepts authoritarian rule. In Libya, electricity subsidies are also central to the welfare system left over from the Gaddafi era.

But when these subsidies are used for Bitcoin mining, their nature fundamentally changes. Electricity is no longer a public service but is used by a few to create private wealth. Ordinary people not only do not benefit from this but also pay the price—more frequent power outages, higher costs for diesel generators, and weaker medical and educational services.

More importantly, mining has not brought real foreign exchange income to these countries. Theoretically, the Iranian government requires miners to sell Bitcoin to the central bank, but the actual enforcement is questionable. In Libya, there is no such mechanism at all. Most Bitcoin is exchanged for dollars or other currencies through overseas exchanges and then flows out through underground money houses or cryptocurrency channels. These funds neither enter the national treasury nor flow back into the real economy but become private wealth for a few.

In this sense, Bitcoin mining resembles a new type of "resource curse." It does not create wealth through production and innovation but rather seizes public resources through price distortions and institutional loopholes. The costs are often borne by the most vulnerable groups.

Conclusion: The True Cost of One Bitcoin

In a world where resources are increasingly strained, electricity is no longer just a tool to illuminate the darkness but has become a commodity that can be transformed, traded, or even plundered. When a state treats electricity as "hard currency" for export, it is essentially consuming what should be used for people's livelihoods and development in the future.

The issue is not Bitcoin itself but who holds the power to allocate public resources. When this power lacks constraints, the so-called "industry" becomes merely another form of plunder.

And those sitting in the dark are still waiting for the lights to come back on.

“Not everything that is faced can be changed, but nothing can be changed until it is faced.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。