Original Author: Raoul Pal, CEO of Real Vision and GMI

Translation by: CryptoLeo (@LeoAndCrypto_)

This morning, Raoul Pal, CEO of Real Vision and GMI (Raoul Pal's investment bible), published an article titled "False Narratives….and Other Thoughts", explaining the recent downturn and crises facing the crypto industry through data comparisons and macro analysis. He stated that the industry's winter will soon pass, and everyone needs to remain patient and not lose faith in the industry. Odaily Planet Daily translates it as follows:

These insights were originally written for GMI over the weekend, and I hope they provide you with some confidence. In the past, I would save this content for discussions in GMI and Pro Macro, but I know you all need this to ease your tense nerves.

Mainstream Narrative: Is Crypto Over?

The mainstream view is that Bitcoin and cryptocurrencies have collapsed, this cycle is over, and everything is finished; it can't go back to how it was before. Cryptocurrencies have decoupled from other assets, and this is CZ's fault, BlackRock's fault, etc. This is undoubtedly a very appealing narrative trap, especially when mainstream coin prices are plummeting daily.

However, yesterday a GMI hedge fund client sent me a message asking whether they should buy SaaS stocks on the dip, or if, as everyone is saying, Claude Code has already killed the SaaS industry.

So I started researching SaaS, and in the process, I found conclusions that not only overturned the mainstream narrative about Bitcoin but also the narrative about the SaaS industry. The charts for SaaS and BTC look identical?

UBS SaaS Index vs. Bitcoin Trends

This indicates that there is a factor that everyone has overlooked affecting the trend.

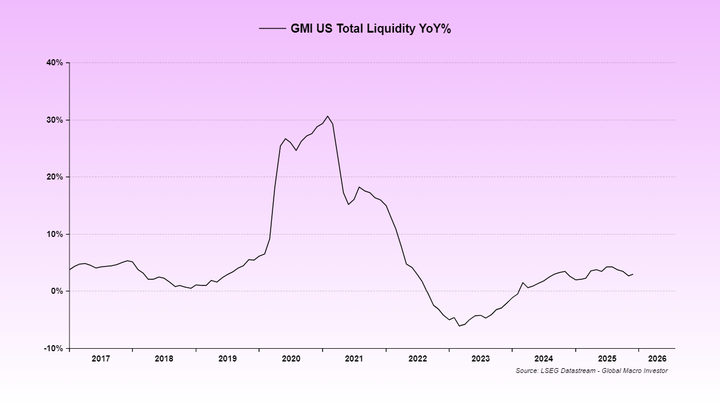

This factor is: Due to two government shutdowns and issues with the underlying U.S. financial system (the liquidity from the reverse repo mechanism will not be fully replenished until 2024), U.S. liquidity has been suppressed. Therefore, the TGA (Treasury General Account) rebuild in July and August did not have corresponding monetary offset measures, leading to a reduction in liquidity.

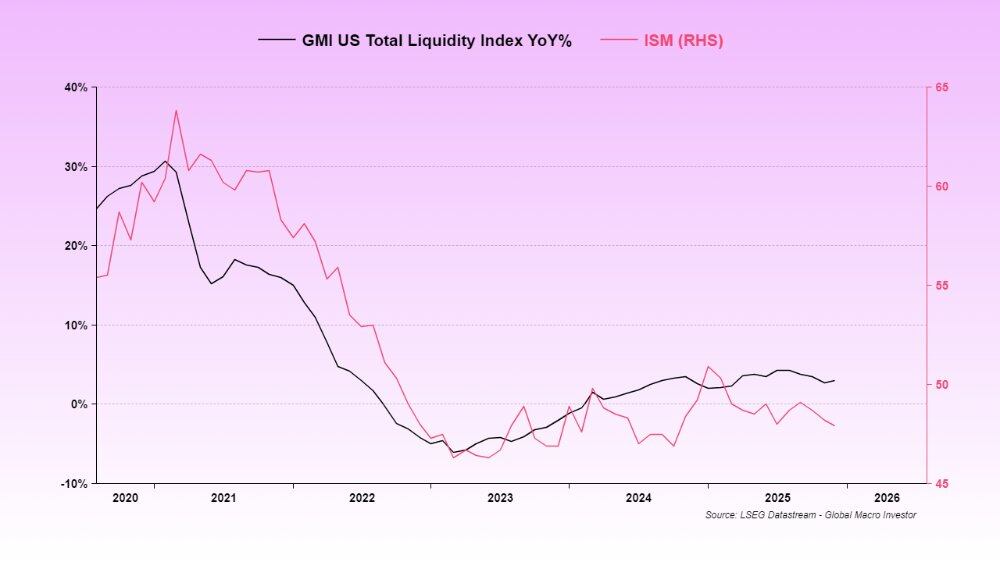

So far, the liquidity slump is the reason the ISM Manufacturing Index has remained low.

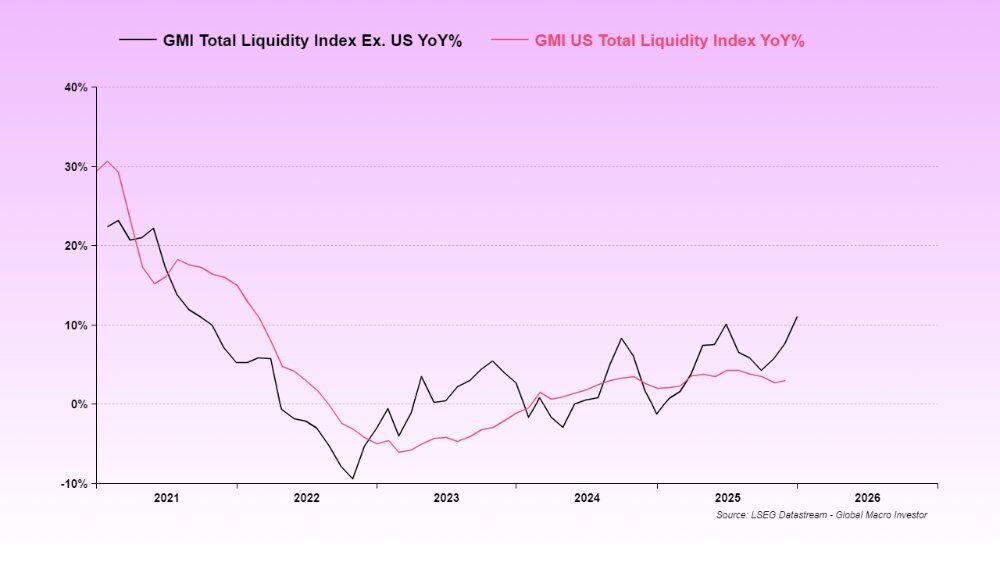

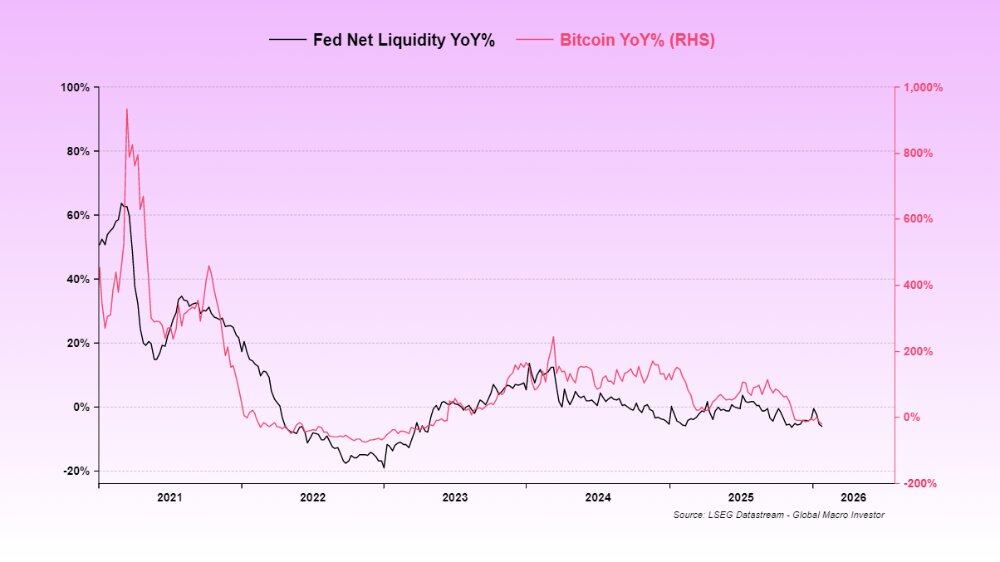

We usually use the global total liquidity indicator because it has the highest long-term correlation with BTC and the Nasdaq, but at this stage, U.S. total liquidity seems more important, as the U.S. is the main provider of global liquidity.

In this cycle, the GMI Global Total Liquidity Index has led the U.S. Total Liquidity Index and is about to rebound (which will also drive the ISM index).

This is precisely the factor affecting SaaS and BTC. Both assets are among the longest-existing assets and have fallen due to a temporary withdrawal of liquidity.

The rise in gold has essentially siphoned off the marginal liquidity that could have flowed into the Bitcoin and SaaS markets, and there isn't enough liquidity to support these assets, so high-risk assets are impacted and fall; there's really nothing we can do.

Now, with the U.S. government facing another shutdown, the Treasury has taken precautionary measures: after the last government shutdown, no TGA funds were utilized, and the asset scale actually increased (i.e., liquidity further drained). This is the crisis we currently face, leading to severe price volatility, and our beloved cryptocurrencies still lack liquidity.

However, various signs indicate that this government shutdown will be resolved this week, clearing the last liquidity obstacle.

Odaily Note: U.S. House Speaker Johnson stated in an interview on NBC's "Meet the Press" that he believes he has secured Republican support to ensure the partial government shutdown ends before Tuesday.

I have mentioned the risks of this government shutdown multiple times, but it will soon pass, and we can continue to address the upcoming liquidity injection, which includes some return from eSLR, TGA, fiscal stimulus, interest rate cuts, etc., all related to the midterm elections.

Odaily Note: U.S. regulators are easing leverage requirements to alleviate capital pressure on major banks like Bank of America (BAC.US).

In a complete trading cycle, time is often more important than price. Prices may be severely impacted, but as time passes and the cycle evolves, everything will be resolved, and eventually, the dust will settle.

This is why I have always emphasized the need for everyone to be "patient." Events need to progress, and focusing solely on the risk-reward ratio will only affect your mental health, not your portfolio.

The Fed's False Narrative

Regarding interest rate cuts, there is another misconception that Kevin Warsh is hawkish. This is complete nonsense; these statements are mainly from 18 years ago.

Warsh's job and task are to execute the strategies from the Greenspan era. Trump and Bessent have both stated (not detailed here, but the main direction is towards rate cuts) to keep the economy hot and assume that productivity gains from artificial intelligence will suppress core CPI increases (just like during the 1995 to 2000 era).

Odaily Note: Greenspan is one of the longest-serving chairs in Federal Reserve history, advocating for a highly flexible monetary policy (controlling inflation + promoting maximum employment), but in practice, it prioritizes anti-inflation while actively injecting liquidity during crises.

He does not favor balance sheet expansion, but the system is constrained by reserves, so he is unlikely to change his current approach, or it would destroy the credit market.

Warsh will cut rates and do nothing else. He will not intervene in Trump and Bessent's actions to manage liquidity through banks. Fed Governor Milan will likely push for a comprehensive reduction in eSLR to accelerate this process.

If you don't believe me, then believe Druck ↓

The image above shows "investment guru" Stanley Druckenmiller's views on Warsh's monetary policy ideas and the agreement reached with Bessent after he became Fed Chair.

I know how difficult it is to hear optimistic narratives when the crypto market looks so bleak. My holdings in SUI are terrible, and we don't know what or who to believe anymore. First, we have been through many situations like this before. When BTC drops 30%, altcoins can even drop 70%. But if they are high-quality altcoins, their rebounds will be faster.

Mea Culpa (My Fault)

GMI's mistake was not viewing U.S. liquidity as the current driving factor, which usually plays a dominant role throughout the cycle, is global total liquidity. But now the situation is clear; anything is possible.

The two are not unrelated. It's just that we couldn't predict the combination of a series of events (reverse repo draining liquidity > TGA rebuild > government shutdown > gold rising > shutdown again) or we failed to anticipate their impact.

It's almost over, and soon we can return to normal work.

We cannot ensure that every link will be error-free (now we have a deeper understanding), and we remain very optimistic about the prospects for 2026 because we understand the strategies of Trump/Bessent/Warsh. These three have repeatedly told us: we just need to listen and be patient, in full-cycle investing, time is more important than price.

If you are not a cycle investor and do not have a strong risk tolerance, that's perfectly fine. Everyone has their own style, but Julien (GMI's macro research director) and I are not good at swing trading (we do not care about the ups and downs within the cycle), but we have a proven track record in full-cycle investing and have been industry leaders for the past 21 years. (Warning: we also make mistakes, like in 2009), now is not the time to give up. Good luck, and let's achieve greater results in 2026.

Liquidity reinforcements are on the way!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。