In a post on X, the former Coinbase CTO says that the global fiat system, especially dollar-based economies, is entering a sovereign debt crisis that will eventually force governments to seek new sources of wealth through taxation, capital controls, or outright asset seizure.

Srinivasan says that the end of the dollar and “Keynesianism” in the West will likely conclude in a similar manner to the rise of communism in Eastern Europe and Asia during the 20th century – governments and revolutionaries simply stealing things in the name of equality.

As the process unfolds, “pauperization” will hit the majority of the population, Srinivasan predicts.

Srinivasan warns:

“If you live in a jurisdiction that heavily depends on the dollar (which includes the entire G7), you want to get out. Because the total pauperization that follows the end of the dollar may mean that angry mobs (or government agents, or both) may come to your home, steal your assets, and perhaps rip you limb-from-limb in the process.”

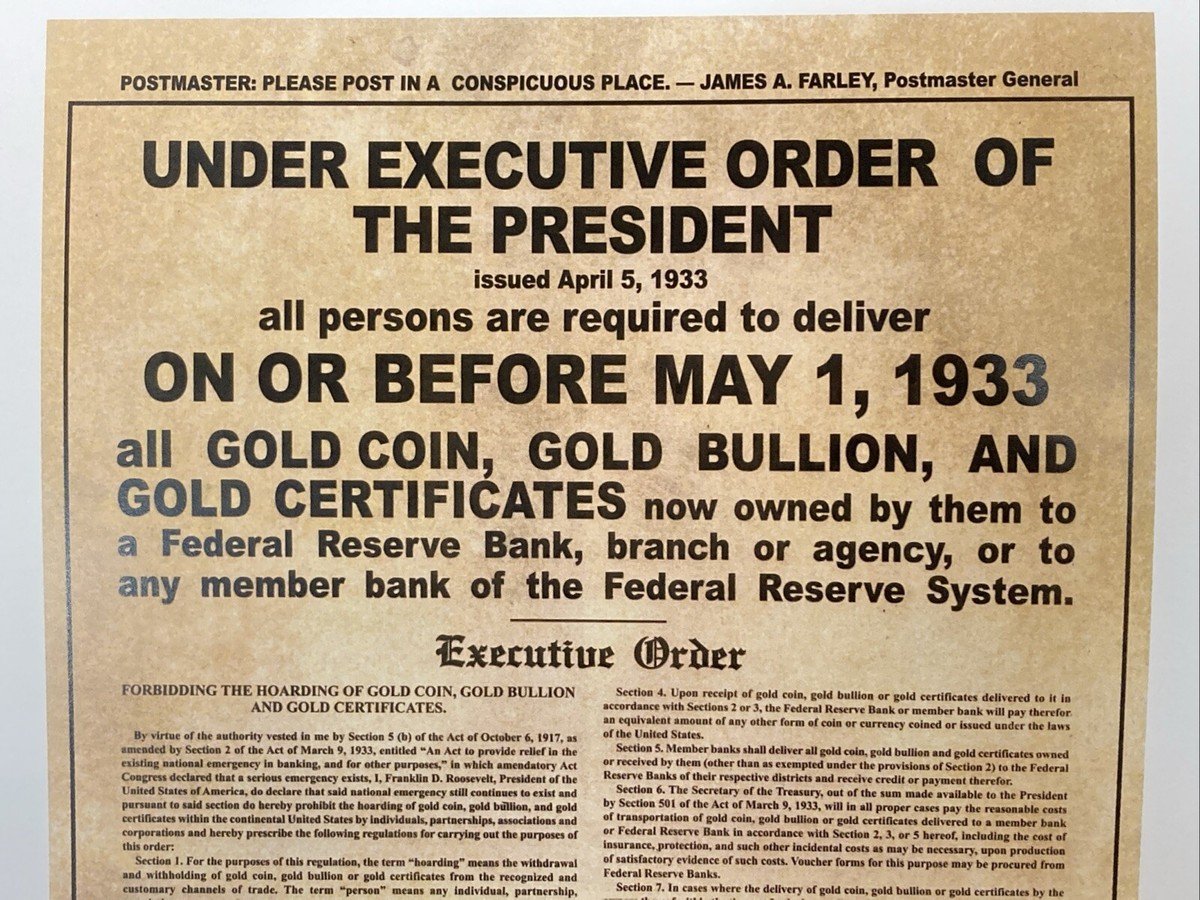

While both gold and bitcoin are good hedges against such a scenario, the ex-Andreessen Horowitz general partner says that digital gold may provide certain advantages, especially to those within North America and Western Europe.

Read more: Resistance Everywhere, Relief Nowhere: Bitcoin’s Rollercoaster Ride Continues

Source: Balaji Srinivasan

He says people in both regions will be out “hunting for whatever they can steal,” giving an advantage to those who hold non-tangible assets like BTC and crypto assets.

Says Srinivasan:

“So: feel free to hedge as you see fit between the physical past and the digital future, with just one caveat: namely, you may not want to buy physical precious metals unless you’re in a financially and physically secure region of the world. That probably means being outside North America and Western Europe. Because those countries are in the midst of sovereign debt crisis. And as that crisis deepens, both their failing states and their angry mobs are going to be hunting for whatever they can steal.”

While Eastern Europe and Asia will most likely be fine during the end of the dollar, Srinivasan says Western Europe and North America are “toast, with extreme levels of debt and social ruin.” He also predicts that “all the value on fiat ledgers in the West” will be seized.

In the latest episode of Token Narratives, Abra CEO Bill Barhydt also mentioned that gold was a useful tool when the “old world order is falling.”

- What does Balaji Srinivasan warn about a new sovereign debt crisis? He predicts Western governments will resort to higher taxes, capital controls, and large-scale asset seizures as fiat systems collapse.

- Why does Balaji say Bitcoin is important during a debt crisis? He argues Bitcoin’s key advantage is seizure resistance when governments and mobs seek to confiscate wealth.

- Which regions are most at risk according to Srinivasan? He says North America and Western Europe face extreme debt, social unrest, and widespread asset confiscation.

- Is Bitcoin better than gold as a hedge, according to Balaji? He suggests Bitcoin may outperform gold in the West because digital assets are harder to seize than physical wealth.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。