In 2025, a set of combined punches called Sui Stack was practiced, and in 2026, a battle about "experience" is planned.

Written by: Deep Tide TechFlow

During Token2049 in September 2024, Sui announced its partnership as the official blockchain partner of the fighting event ONE Championship.

This collaboration covers broadcasts in over 190 countries, prominently displaying the water droplet-shaped Sui logo on the ring's fencing.

Looking back at this scene today, it feels more like a metaphor.

The public chain track in 2025 is essentially an elimination match. The market has experienced severe fluctuations, with many once-prominent projects falling silent, some halting updates, and others going to zero. There are actually very few competitors still in the arena.

Sui is one of them.

In the two and a half years from planning to launch, its TVL peaked at over $2 billion, daily active wallets peaked at nearly 1.6 million, and monthly transaction volume exceeded 50 million transactions at its highest.

After a rollercoaster year, if you are a holder, you might be confused; if you are observing, you might be wondering—at this point, is Sui still worth paying attention to?

To answer this question, we first need to clarify one thing: what has Sui been doing this year?

What skills has this competitor still in the public chain fighting octagon been practicing this year?

Practicing a set of combined punches called Sui Stack

When Sui launched its mainnet in 2023, it was essentially a high-performance L1 public chain: fast, cheap, capable of running smart contracts, and it had all the necessary features, but that was about it.

What happened in 2025 is that it began to assemble a set of combined punches called "Sui Stack."

This term has been repeatedly mentioned by the official team this year.

It means: Sui doesn't just want to be a single chain; it aims to create a complete developer tool stack, handling everything from execution, storage, permission control, to off-chain computation, all in-house, natively integrated, and ready to use out of the box.

It sounds like a lofty ambition, but several key components have indeed been launched this year.

First, let's talk about storage.

Previously, if you wanted to build a slightly more complex application on Sui, like an NFT marketplace or content platform, where would you store images and videos?

You couldn't afford to store them on-chain, so you had to connect to third-party storage like Arweave or IPFS. It worked, but it was a bit cumbersome. You had to learn another set of tools and worry about compatibility on both sides.

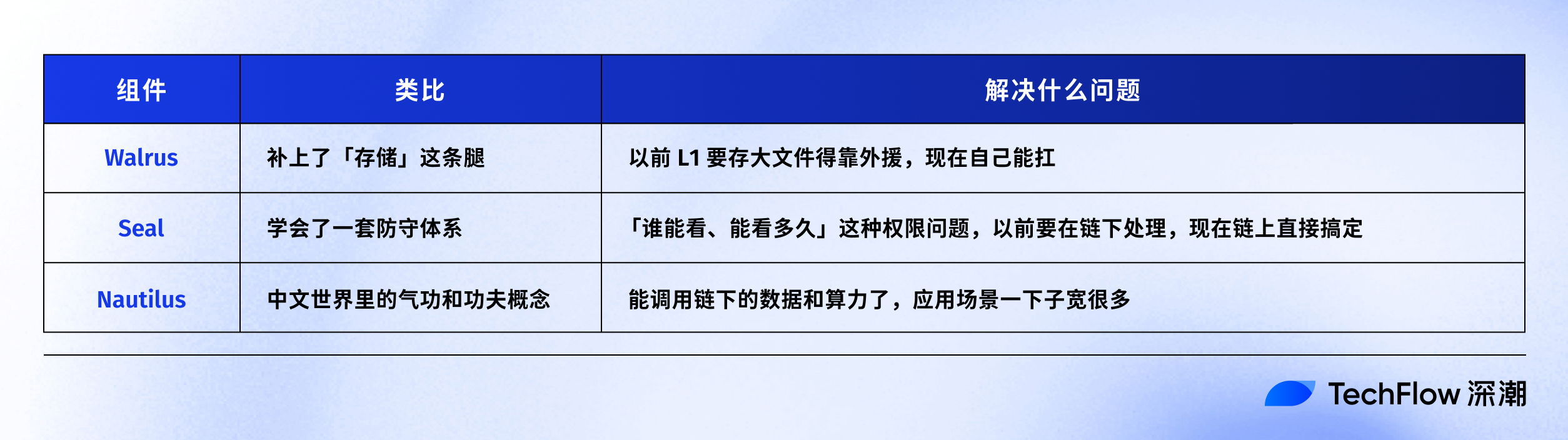

In March 2025, Sui launched Walrus.

Walrus is a decentralized storage layer capable of storing any type of data, including data from different blockchain projects. As a native component of Sui Stack, Walrus provides developers in the ecosystem with ample design choices without needing to connect to external data systems. Just eight months after its launch, Walrus is expected to exceed 300TB of total storage capacity and has numerous well-known brand partners from fields like AI, media, and entertainment.

For a new component that has been online for less than a year, it has certainly gained traction.

Next, let's discuss permission control. This may sound technical, but it actually relates to every user.

If you have a cryptocurrency asset on-chain, who can see it? Who can use it? For how long can they use it?

These questions previously had no standard answers. Most projects either made everything completely public or had to build their own permission systems off-chain, which were complex and prone to vulnerabilities.

Seal, launched by Sui last year, aims to solve this problem. It moves the logic of access control on-chain, allowing developers to directly define "who can access, under what conditions, and for how long" in smart contracts.

I believe this is more like a prerequisite for the privacy emphasized by both a16z and Vitalik recently:

If you want on-chain transfers to be as private as bank transfers, where only the two parties know, you first need a reliable encryption and decryption authorization mechanism.

Finally, there's off-chain computation. Some tasks are not suitable for smart contracts: either they are too expensive, too slow, or require access to off-chain data sources.

But if you do it off-chain, how can you ensure the results are trusted on-chain?

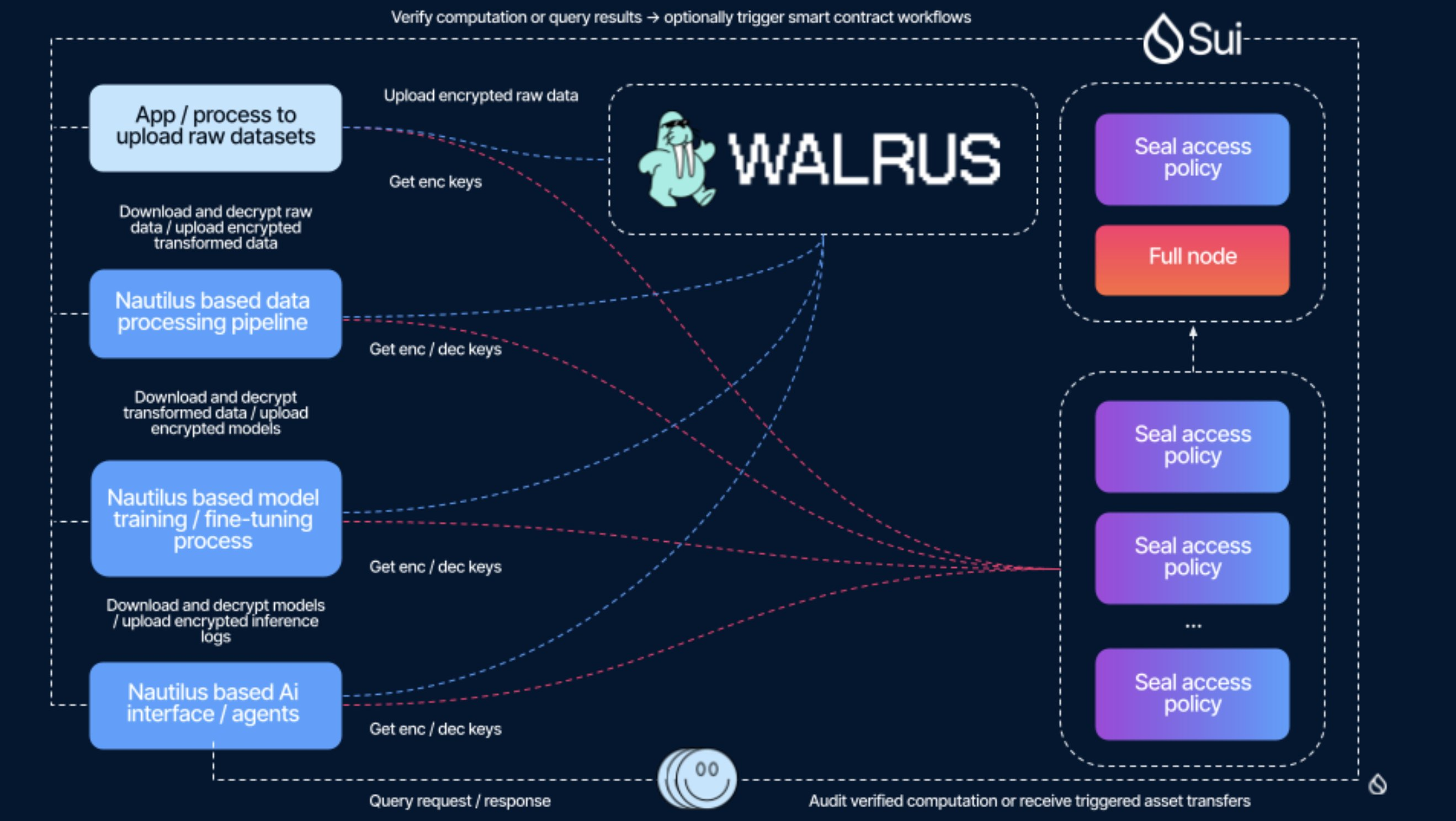

Nautilus is Sui's proposed solution, representing another layer of the entire Sui Stack. It uses a Trusted Execution Environment (TEE) to perform off-chain computations and then submits the results back to the chain for verification. Off-chain computation and on-chain verification do not require mutual trust, relying on cryptography for assurance.

Walrus, Seal, Nautilus, along with the Sui mainnet itself, form the foundational components of the current Sui Stack.

If you still find it too long or difficult to understand, the author has summarized a diagram to quickly clarify Sui's set of combined punches:

In just one year, Sui has quietly transformed from "a chain" into "a platform."

The ambition is clear, but whether it can deliver is another matter. How these solutions perform and whether they can withstand various technical tests remains to be fully answered in 2025. However, the boxing skills have been honed, and the Full Stack strategy for stepping into the ring has taken shape.

What does Full Stack have to do with me?

So what?

What does this Sui Stack mean for me as an ordinary user?

To be honest, the direct relationship is not significant. You won't rush to Sui to trade something just because Walrus has launched. The updates of these underlying components are mostly imperceptible to ordinary users.

But the indirect relationship is quite substantial.

The logic is as follows: as the barriers for developers are lowered, more teams will be willing to build applications on Sui; with more applications, users will have more choices, and competition will drive product experiences to improve; with better experiences, more users will come, creating a positive cycle.

Of course, all of this is predicated on an improvement in the overall environment of the crypto market. However, even in the current market conditions, this is not a pipe dream.

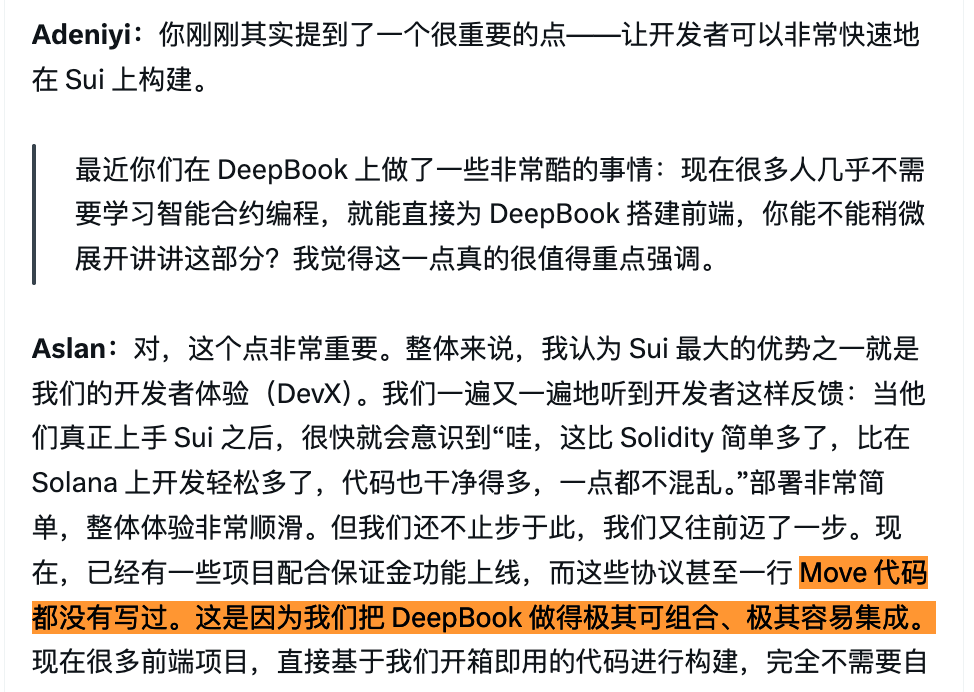

The native on-chain order book project on Sui, DeepBook, has its core developer Aslan Tashtanov mentioning a detail during a live stream:

There are already teams building margin trading front-ends on DeepBook, "without even writing a single line of Move code."

With a robust underlying module, developers only need to focus on the product itself. This means that a small team of three to five people has the opportunity to create what previously required dozens of people.

Does it feel a bit like Vibe Coding? More teams come in, more applications emerge, and ultimately, the users benefit.

Another impact is institutional collaboration, which is often seen as a significant indicator of positive news.

You may have noticed that in 2025, a number of traditional financial institutions began to establish a presence on Sui:

Grayscale has launched a Sui trust product, VanEck has issued an ETN, Franklin Templeton is working on tokenized funds, and 21Shares is also applying for related products.

The choice of a chain by these institutions is heavily influenced by the maturity of the technology. "Full Stack" may sound like a developer concept, but it represents the completeness of the infrastructure, which provides a sense of security for institutions.

Therefore, you don't need to fully understand what Sui Stack is, but it will influence what you can use on this chain, how your experience will be, and how many people will join you in the future in ways you may not perceive.

Infrastructure is often underappreciated; when done well, no one praises it, but when problems arise, people complain. However, it is indeed the foundation of everything.

What is Sui betting on compared to others?

After discussing what Sui is doing, a natural question arises: how does it differ from other public chains?

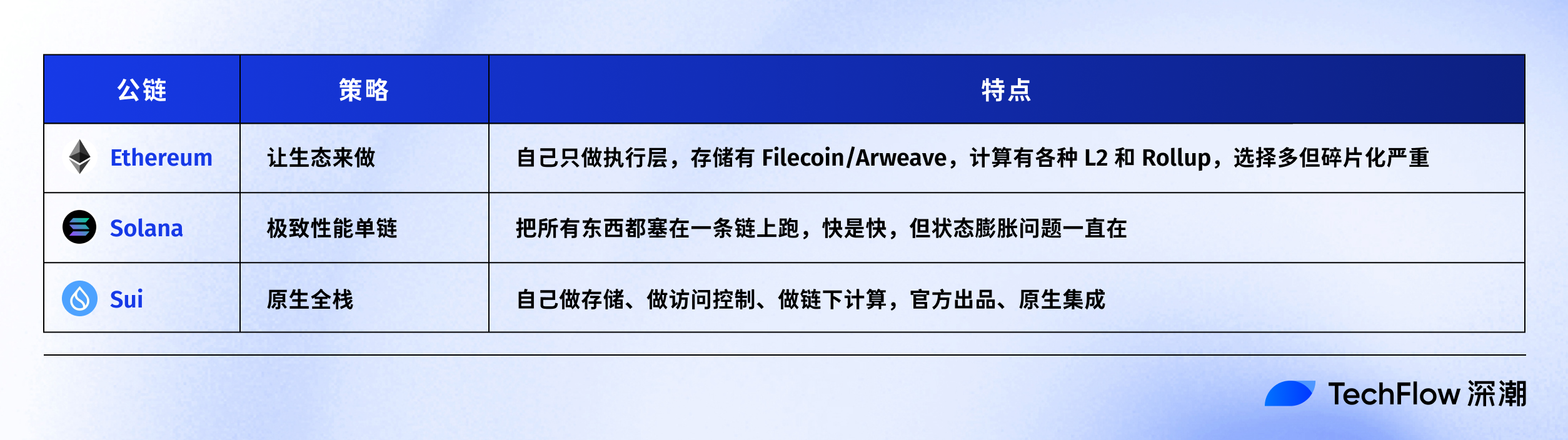

First, let's talk about Ethereum.

Ethereum's strategy can be summarized in four words: let the ecosystem do it.

It only manages the execution layer and consensus layer, leaving everything else to third parties. Storage is handled by Filecoin and Arweave, scaling is managed by L2 solutions like Arbitrum, Optimism, and Base, wallets are provided by MetaMask, and oracles are managed by Chainlink.

The advantage of this model is strong ecological diversity, but the downside is severe fragmentation.

If you want to build a complete application, you may need to interface with seven or eight different projects simultaneously, each with different documentation styles, update rhythms, and it may not be clear who to turn to when issues arise.

Now, let's discuss Solana.

Solana's strategy is the other extreme: it does everything itself. It does not shard or create L2s; it operates as a single chain, pushing performance to the limit.

The advantage is a unified experience; fast is fast, and users can directly perceive it. The downside is that all the pressure is on the mainnet, and state bloat is a long-term issue, with several historical outages. Moreover, because it does everything itself, if any part encounters a problem, there are no alternatives.

Sui has chosen a third path.

It does not throw everything to the ecosystem like Ethereum, nor does it cram everything into a single chain like Solana. Its approach is:

Core components are built in-house but are modular, being both official products and maintaining a degree of independence.

Walrus is an independent storage layer but shares validation nodes with Sui; Seal is an independent permission control protocol but runs on Sui's smart contracts; Nautilus is an independent off-chain computation platform, but its results can be natively verified by Sui. They are a family but not a monolith.

The bet of this approach is "developer experience." It's not about who has the highest TPS, nor about who has the most ecosystem projects, but rather about who can enable developers to create a complete application with the least amount of time and mental burden.

So, this is essentially a trade-off; Sui has chosen "integration" at the cost of "flexibility" and "ecological diversity."

Whether this trade-off will pay off remains to be seen, but it is the direction Sui is firmly betting on.

At least in terms of direction, it differentiates itself from Ethereum and Solana, not clashing head-on in the same dimension.

Three chains, three philosophies, three different experiments. Who is right and who is wrong may take another two to three years to reveal.

Listening to Sui's Annual Outlook, Here's What They Want to Achieve in 2026

The above outlines what Sui has already accomplished. Based on these developments, what exciting things are in store for this year?

On December 23, 2025, Sui held an end-of-year live stream.

Several core founders, including CEO Evan, CPO Adeniyi, Chief Cryptographer Kostas, and DeepBook head Aslan, sat together to discuss nearly an hour, reflecting on 2025 and looking ahead to 2026.

There are typically two perspectives on such live streams: one sees it as the official painting a rosy picture, just something to listen to; the other views it as a rare window of information that reveals what the team is genuinely thinking.

Regardless of how you view it, I’ve taken a look for you and believe that at least a few key signals can be extracted from it.

The first signal is "Year of Experience."

Aslan mentioned in the live stream that the focus in 2026 will shift from institutions to ordinary users.

The gist of his statement was: “I hope to do what I can on Robinhood on Sui DeFi as well. Deposits should be simple, payments should be smooth, and everyday financial life can truly run on-chain.”

This sounds like a slogan that all public chains would shout. However, Sui made a specific commitment: in 2026, transfers of stablecoins on Sui will be completely free.

No gas fees.

This is not a wallet subsidy; it’s a change at the protocol level. If it can be implemented, it means Sui will have a strong selling point in payment scenarios—transfers will cost nothing.

The second signal is still privacy.

Adeniyi revealed in the live stream that in 2026, Sui will support privacy transactions at the protocol level. This is not a private feature of a specific wallet; it is natively supported by the entire chain.

Chief Cryptographer Kostas shared a real example during the live stream: he met a local in Dubai who wanted to donate to a charity but was unwilling to use on-chain transfers because once the transfer was made, everyone could see his real balance.

“Doing this here would cause problems.”

Privacy is not just "better," but a prerequisite for mass adoption. The component Seal mentioned earlier, launched in 2025, is preparing for this step.

The third signal is "product-level protocols."

This is a concept that CEO Evan emphasized repeatedly. He stated that the focus in 2026 is to "package" the complexity of underlying technology so that developers can build products directly at a higher level of abstraction without needing to understand all the primitives.

It sounds a bit abstract; in other words, you don’t need to understand how an engine works to drive a car. What Sui aims to do is completely separate "building the engine" from "driving the car."

At the end of the live stream, Evan summarized with a statement:

“Don’t ask us when we will launch what features. Just watch how we do it.”

This statement itself indicates their attitude. It is clear that the team views 2026 as a critical year, a year to transform the infrastructure investments of the previous three years into actual products.

Later, Adeniyi posted a lengthy article on Twitter titled "2026: Building for What's Inevitable."

In it, he mentioned five trends he believes are "locked in":

Stablecoins becoming the default payment rail, DeFi consuming traditional finance, privacy becoming standard, automation becoming the default mode, and gaming driving the mainstreaming of digital ownership.

He then stated that a single L1 public chain cannot bear the convergence of these trends; a complete technology stack is needed.

This is the underlying logic of Sui Stack. It identifies certain trends as inevitable and then works backward to determine what infrastructure is needed to support them.

Of course, recognizing a trend and that trend actually occurring are two different things. What 2026 will look like is uncertain. But at least from this live stream and the lengthy article, it seems the Sui team knows what they are betting on.

Finally, the five trends that Adeniyi mentioned as locked in are not predictions; they are directions, things that will inevitably happen.

This narrative sounds quite convincing.

However, "inevitability" is a big word. Back in 2021, many believed that the explosion of NFTs was "inevitable," and the metaverse was "inevitable." We all know what happened afterward.

This does not mean Sui's judgment is necessarily wrong, but it does mean that when a team tells you, "We are preparing for inevitability," you have the right to ask:

What makes this thing inevitable?

This question has no answer, and an execution team does not intend to provide an answer through words.

Returning to the metaphor of the octagon, Sui is still in the ring, still throwing punches.

In 2025, it practiced a set of combined punches called Sui Stack, and in 2026, it is preparing to fight a battle about "experience."

Whether it can win is uncertain. But at least, it knows what it is fighting for.

The rest is left to time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。