Written by: Andjela Radmilac

Abstract

- Coinbase's latest survey shows that institutional investors currently exhibit a seemingly contradictory attitude: they claim "the bear market is here," yet continue to hold or even increase their positions in Bitcoin.

In this global investor survey jointly released by Coinbase Institutional (Coinbase's institutional business unit) and on-chain data analytics firm Glassnode, one-quarter (25%) of institutions believe that the crypto market has entered a bear market.

However, at the same time, most institutions indicate that Bitcoin is still undervalued, and since October 2025, they have either maintained their existing positions or increased their exposure to Bitcoin.

This apparent contradiction is significant because it reveals the true strategy of institutions at present:

They remain cautious about the market phase but are still willing to stay in the market, preferring to concentrate risk on Bitcoin rather than on smaller market cap tokens that are more volatile and prone to rapid collapse during deleveraging.

"Bear Market" Label + "Value Buy": How to Explain the Contradiction?

The report points out that it is the market structure itself that explains this paradox.

The deleveraging process in October 2025 indeed severely impacted the price performance of altcoins, but Bitcoin's market share (Bitcoin Dominance) has hardly changed—rising slightly from 58% at the beginning of the fourth quarter to 59%.

This stability is crucial, indicating that the sell-off is not evenly distributed across the market but is mainly concentrated on long-tail assets (i.e., smaller tokens). In other words, this is a "cleansing of marginal assets," rather than a wholesale rejection of the entire crypto space.

When investors need to reduce risk but do not want to exit the crypto market entirely, Bitcoin is the asset they choose to retain.

David Duong, Global Research Director at Coinbase Institutional, clearly explained in an interview with CryptoSlate why "bear market" and "undervalued" can coexist:

“When institutions assess the value of Bitcoin, they are not looking at short-term price movements but rather at longer-term factors such as adoption rates, scarcity, improvements in market structure, and the gradual clarity of regulatory frameworks. Historically, bear markets often mean tightening liquidity and low sentiment, but these phases lay the groundwork for future rounds of institutional participation and growth.”

In other words, when an investor says "this is a bear market" (note: this is not Coinbase's own view), they are describing the current phase of the cycle and overall risk appetite—the market may trend downward or be weakly volatile, positions may lean defensive, and liquidity may become selective.

But when they say "undervalued," they refer to what they believe Bitcoin's long-term value position should be, rather than a judgment on the current market situation.

The data in the report also supports this interpretation: the market no longer rewards indiscriminate risk-taking, but there is still buying support for leading assets (especially Bitcoin).

From High Leverage to Risk Protection: Institutions Change Their Playbook

The most common mistake is to assume that "undervalued" means everyone is using the same valuation model. In reality, both the report and Duong's statements show that institutions' judgments are more based on changes in market structure rather than a precise "fair value" number.

First, let's look at the changes in the derivatives market:

The report shows that perpetual futures have been hit the hardest, with their systemic leverage ratio dropping to just 3% of the total market capitalization of the crypto market (excluding stablecoins). Meanwhile, open interest in options has risen significantly—traders are increasingly using options to hedge against further declines.

If you are an institutional investor, what would you do when you judge "this is a bear market"?

You would: buy insurance (like put options), reduce liquidation risk, and continue to hold the exposure you want through tools that won't force you to liquidate at the worst moments.

When asked what actions institutions took after the October liquidation wave, Duong said:

“After the October liquidation reset, institutions' interest in on-chain activity remains, but they have become more cautious and are diversifying operations through multiple channels. More importantly, they are increasingly expressing views through options and basis trades—these methods can provide convexity returns or funding rate returns without the forced liquidation risk that came from excessive leverage in October.”

This statement is key: institutions have changed the way they take on risk.

Options and basis trading, while not flashy, are core methods for professional funds to continue participating in the market under adverse conditions.

On-Chain Data Confirms This Logic

On-chain indicators are telling the same story.

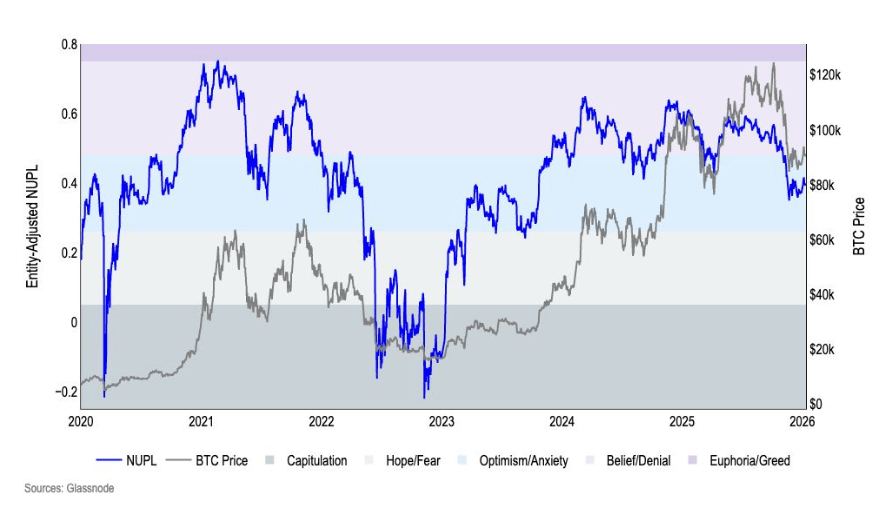

The report shows that market sentiment, measured by "entity-adjusted NUPL" (Net Unrealized Profit/Loss), slid from the "belief" phase to the "anxiety" phase in October and has remained at this level throughout the fourth quarter.

This is certainly not euphoria, but it is far from "desperate selling."

The chart shows the ratio of entity-adjusted unrealized profits to losses for Bitcoin from January 2020 to January 2026 (Source: Coinbase Institutional)

The decline in NUPL indicates that the market no longer rewards blind optimism, but participants are still holding firm. This state aligns perfectly with a scenario where investors are concerned about the current phase but still believe asset prices are below their long-term equilibrium levels.

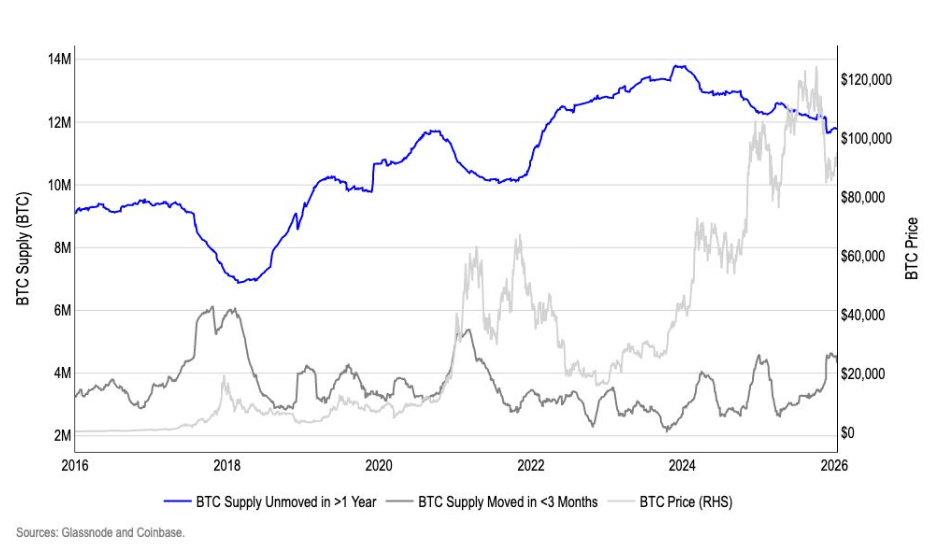

The report also notes that in the fourth quarter of 2025, the supply of Bitcoin that changed hands in the past three months increased by 37%, while the Bitcoin held for over a year decreased by 2%. The authors interpret this as entering a "distribution phase" at the end of 2025.

A comparison of Bitcoin's dormant and active supply from 2016 to 2026 (Source: Coinbase Institutional)

If we take institutions' views seriously, this distribution may not be a bad thing—it could mean that large holders have moderately reduced their positions at high levels, and the market is looking for the next wave of new buyers who can hold long-term without continuously relying on liquidity injections.

In this context, the statement that "Bitcoin is undervalued" is no longer an isolated valuation judgment but a belief: Bitcoin has become the only asset in the crypto space capable of absorbing capital on a large scale without relying on retail enthusiasm to maintain structural stability.

Duong clearly distinguishes Bitcoin from other crypto assets:

“Unlike retail investors—who often focus on short-term price fluctuations and market cycles—institutions are less concerned with timing and more focused on Bitcoin's long-term value proposition. In this context, Bitcoin is increasingly viewed as a strategic store of value and macro hedge tool, rather than a speculative token in the broader crypto world.”

This aligns with the report's views on large-cap vs. small-cap assets:

They are more optimistic about large-cap tokens for the first quarter of 2026, while small-cap tokens are still digesting the aftermath of the October shock.

Therefore, believing that Bitcoin is "undervalued" may be less about it being absolutely cheap and more about: in the current adverse market environment, it is the only crypto asset that institutions are willing to treat as a long-term allocation.

Liquidity is the True Cycle Driver

The second pillar of this paradox is the different time dimensions.

Calling the current situation a "bear market" is usually a judgment on short-term conditions;

Whereas calling an asset "undervalued" is often based on a longer-term perspective.

The bridge between the two is whether institutions still believe that the "four-year cycle" dominates the market or have shifted to an analytical framework centered on macro liquidity, interest rates, and policy.

Duong states that the four-year cycle remains a behavioral reference point for institutions, but not a rigid model:

“In discussions with these institutions, the four-year cycle is still mentioned, but more as a behavioral template rather than a strict predictive tool. They will reference where we are in the historical cycle, the halving time point, typical retracement and rebound patterns—because these levels affect market positioning and sentiment. However, to say that halving 'causes' every cycle is actually weak evidence: we only have four observations, and each is highly confounded with significant macro and policy changes (such as quantitative easing, COVID-19 stimulus, etc.). In our '2026 Outlook,' we clearly state: once we control for variables like liquidity, interest rates, and the dollar's trajectory, the economic significance of halving itself is quite tenuous.”

The report mentions that in December 2025, the U.S. CPI year-on-year remained at 2.7%, and the Atlanta Fed's GDPNow model predicts a real GDP growth of 5.3% in the fourth quarter of 2025.

The baseline scenario assumes that the Federal Reserve will cut rates twice (a total of 50 basis points) as the market expects, which is seen as favorable for risk assets.

Additionally, the job market is cooling—there were 584,000 new jobs in 2025, far below the 2 million in 2024, and the widespread application of AI is considered one of the reasons for the slowdown in job growth.

You don't have to agree with all macro inferences, but you can see that the institutions' judgment that Bitcoin is "undervalued" is built on a macro and liquidity framework, rather than purely on crypto cycle logic.

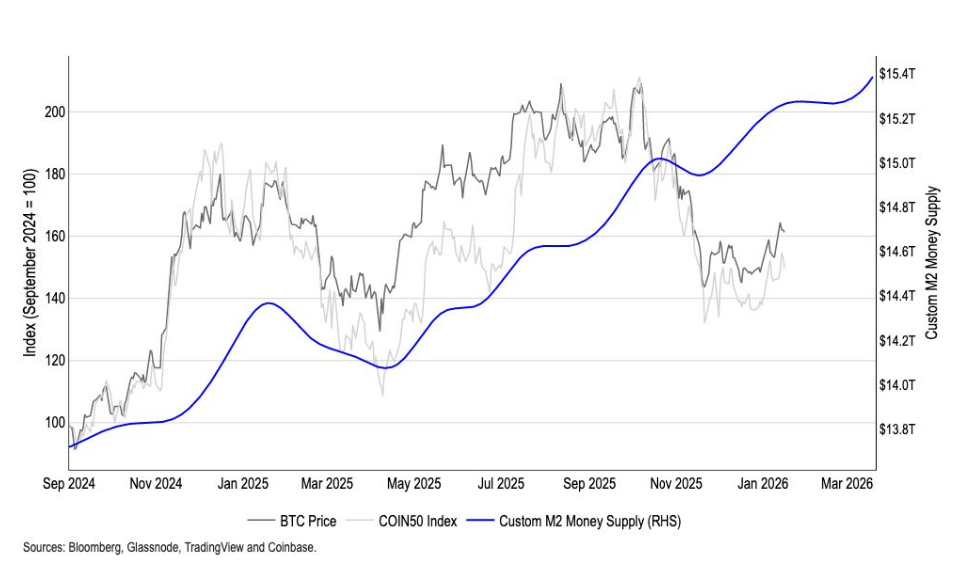

The liquidity section of the report even constructs a self-developed "Global M2 Money Supply Index," which Coinbase claims leads Bitcoin prices by about 110 days, and has a correlation coefficient of up to 0.9 with Bitcoin's movements across multiple backtesting windows.

A comparison of Bitcoin with Coinbase's custom M2 money supply chart, covering the period from September 2024 to January 2026 (Source: Coinbase Institutional)

If we accept this framework, then the aforementioned "contradiction" becomes easier to understand:

You can see the current market's scars, the demand for downside protection, while still believing—as long as macro policies and liquidity develop as expected, Bitcoin will be revalued over a longer time dimension.

Thus, "bear market" becomes a description of current market behavior, while "undervalued" is an expectation of future price revaluation.

What Could Break This Logic?

Duong denies that a typical correction would be enough to shake institutional beliefs. He points out that what truly constitutes a challenge must be a set of macro and on-chain signals deteriorating simultaneously:

_“Institutions are not anchored to the price itself, but to macro liquidity conditions and on-chain market structure. The clearest reverse signal would not be a typical correction, but rather a collective failure of the fundamental drivers supporting this view.

In other words, it won't be a single signal, but a set of signals that must appear simultaneously—

For example: a clear shift towards tightening macro liquidity, a reversal in on-chain accumulation indicators, long-term holders continuing to distribute in weakness, and a sustained weakening of institutional demand indicators.

Only this combination could substantively challenge the view that 'Bitcoin is undervalued' or 'currently has structural support'.”

Survey data shows that institutions have differing views on the current stage of the market, but there is a high degree of consensus on Bitcoin's relative attractiveness.

The report's charts also show that this belief has translated into actual actions:

Reducing reliance on fragile leverage, using more options for risk limitation, market sentiment cooling but not collapsing.

Duong's response provides a connecting point for this logic:

"Undervalued" is not an emotional market sentiment but an analysis framework anchored in liquidity, market structure, and time dimensions.

Whether institutions are ultimately correct does not depend on their debates over short-term cycle labels, but on whether this framework can withstand the next macro test.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。