Cryptocurrency trading platform Bybit announced yesterday that it will initiate a strategic transformation towards a "New Financial Platform" in 2026, aiming to build a comprehensive financial ecosystem for the global population underserved by financial services, providing more modern banking, investment, and payment infrastructure. Ben Zhou, co-founder and CEO of Bybit, presented this vision during a keynote speech in the first half of the year, stating that the plan aims to promote the deep integration of crypto assets with traditional finance and the real economy, marking Bybit's transition from a platform focused on digital asset trading to a new phase of connecting the global financial system. In 2025, Bybit's average monthly trading volume ranked second.

In his first live broadcast of 2026, Ben stated that the core of this strategy is a long-term mission: to break down the barriers of modern finance, allowing the 1.4 billion people globally who lack adequate financial services to benefit and empowering them to integrate into the new generation of financial systems.

Currently, millions of people around the world are unable to access reliable banking services due to geographical, infrastructural, or financial system limitations. Bybit's platform architecture utilizes blockchain technology to provide round-the-clock, location-independent financial services, seamlessly integrating into regulated fiat currency infrastructure.

"Finance should not be limited by geographical boundaries," said Ben Zhou, co-founder and CEO of Bybit. "We are building a financial infrastructure that connects digital assets with real economic activities, aiming to eliminate the inconveniences of modern finance and create a financial system that is always available, efficient, and global."

MyBank: A New Retail Banking Experience, Breaking Geographical Boundaries

One of the key focuses of the new plan is MyBank, Bybit's brand new retail banking service, expected to launch in February 2026. MyBank offers dedicated accounts that allow users to conveniently and securely deposit and withdraw large sums of money and conduct cross-border transfers, fully compliant with relevant regulations.

This service is designed to address real challenges faced by users in emerging markets, including slow transfers, limited financial services, high fees, and limited product choices. MyBank combines cryptocurrency liquidity with banking channels, enabling individuals and businesses to utilize funds more quickly and efficiently with a bank-grade experience.

ByCustody: Institutional-Level Asset Protection, the Cornerstone of Financial Inclusion

The foundation of inclusive finance is trust. Bybit's institutional custody framework, ByCustody, currently manages over $50 billion in assets for more than 30 asset managers on the platform. ByCustody supports the separate storage of client assets, ensuring asset security, allowing institutions and high-net-worth clients to access the digital asset market while enjoying the protections of traditional finance.

Currently, over 2,000 institutions have adopted Bybit's infrastructure, with an annual growth rate of 100%, reflecting the increasing market demand for hybrid financial platforms that connect traditional and digital assets.

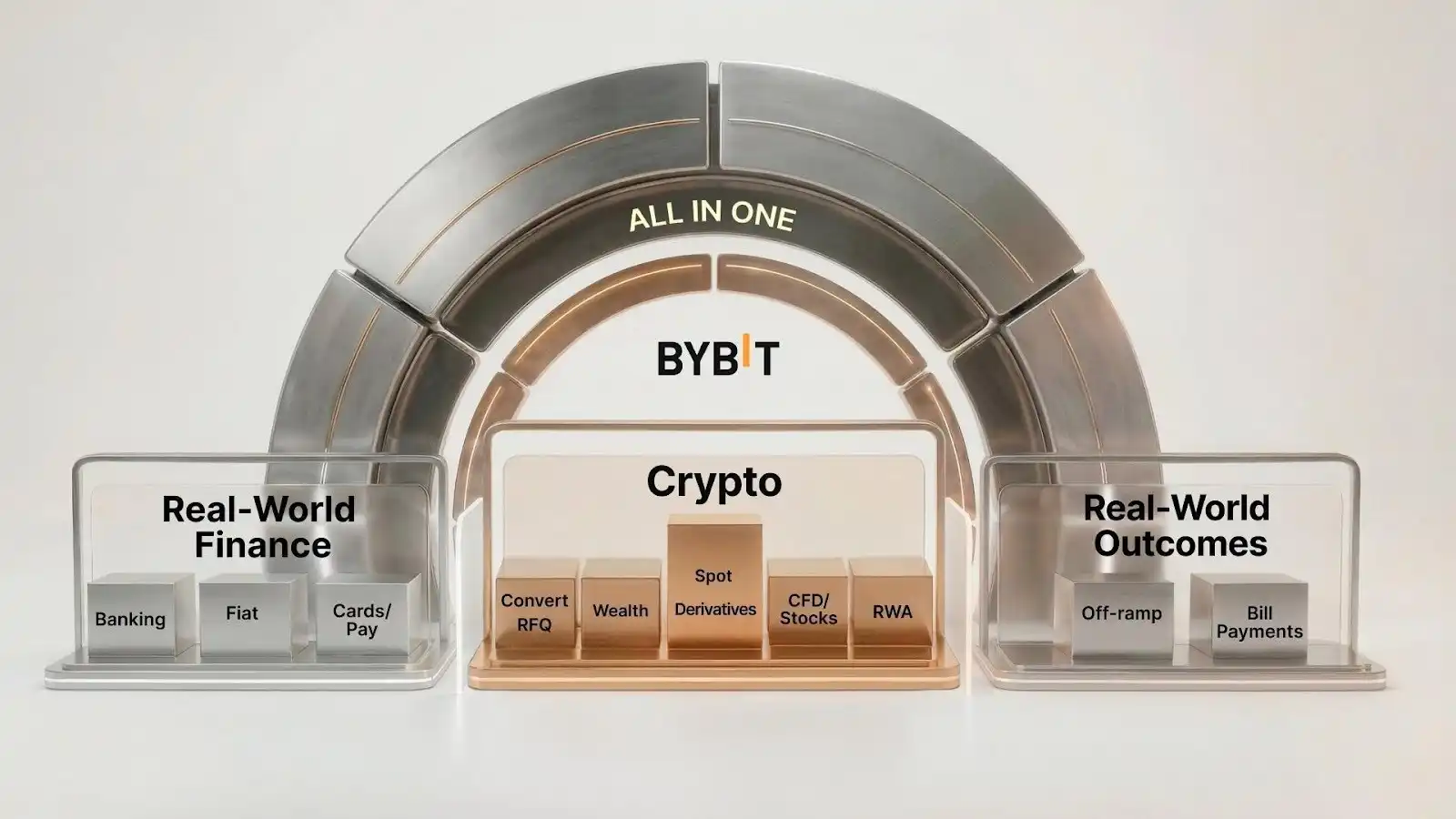

One-Stop Financial Infrastructure

Bybit now serves over 82 million users across 181 countries and regions, with platform advantages including:

· Connecting nearly 2,000 local banks and over 58 fiat currency channels

· Over 200,000 P2P merchants globally

· Issued over 2.7 million Bybit cards

· Bybit Pay supports local fiat payments in over 10 countries

· Bybit Earn manages assets totaling $71 billion, generating $110 million in user earnings in 2025

· As of January 29, 2026, Bybit holds a 16% market share in the global XAUT (Tether Gold) spot trading market, ranking first worldwide

Since launching its traditional financial product line, Bybit TradFi, in 2022, it has integrated over 200 traditional financial instruments. Plans are in place to launch 500 trading combinations in the first quarter, covering stock CFDs, forex, commodities, and indices, running parallel to the crypto market, allowing users to manage diversified financial activities on the same platform.

Compliance-Based Global Expansion

Bybit's platform innovations closely follow the development of global regulatory frameworks and collaborate with licensed banks and custodians to continuously optimize institutional access mechanisms, custody frameworks, and trading monitoring systems, ensuring compliance with the needs of regulators and traditional financial users.

Currently, Bybit works closely with over 10 international banks and custodians to achieve a unified collateral system, allowing fiat currencies, traditional assets, and cryptocurrency holdings to coexist and be managed securely.

Artificial Intelligence as Financial Infrastructure

Bybit incorporates artificial intelligence into the core infrastructure of its overall operations, viewing it as an efficiency engine that runs throughout the entire system.

According to existing data, the application of artificial intelligence has improved engineering efficiency by 30%. Looking ahead to 2026, Bybit will launch:

· AI4SE: Aiming to enhance efficiency by 50% in the software development lifecycle

· A company-wide AI network: Supporting risk control, compliance monitoring, customer service, and analysis

· Upgraded TradeGPT: A personalized AI assistant for convenient connectivity to financial markets

Bybit's AI framework aims to reduce operational costs, strengthen risk management, and extend financial services to previously hard-to-reach groups.

Ben Zhou added, "This innovation is to embrace the future of traditional finance. We are not just providing crypto asset services; we are building a brand new financial ecosystem—making crypto assets an indispensable part of real financial activities, helping users utilize funds more efficiently in both traditional and crypto markets."

About Bybit

Bybit was established in 2018 and is the second-largest cryptocurrency trading platform by trading volume, serving over 80 million users worldwide. Bybit is committed to creating a simpler, more open, and equitable ecosystem for everyone, redefining openness in a decentralized world. Bybit is deeply engaged in the Web3 space, forming strategic partnerships with leading blockchain protocols to provide robust infrastructure and drive on-chain innovation. Bybit is known for its secure custody services, diverse markets, intuitive user experience, and advanced blockchain tools, bridging traditional finance (TradFi) and decentralized finance (DeFi), empowering builders, creators, and enthusiasts to fully explore the potential of Web3.

This article is contributed and does not represent the views of BlockBeats.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。