Author: Tiezhu Ge in CRYPTO

The most fundamental and also the most hidden organizational coordination mechanism in modern society is not money itself, but the continuous extension of debt-credit relationships.

Whether it is a country, community, organization, or individual, the essence is performing a repetitive action: exchanging the future for the present.

The economic growth and consumption prosperity we take for granted do not stem from wealth appearing out of thin air, but from a highly institutionalized consensus that the future can be distributed in advance. Debt is the technical realization of this consensus.

From this perspective, a more essential core lies in: who has the greater ability to discount the future to the present, and who has the power to define the future.

In this sense, the creation and contraction of money are merely expressions of the world of debt. The magic of finance actually boils down to one thing: the intertemporal exchange of resources.

1. Understanding Gold and the Dollar from the Perspective of Debt

If you place debt at the center of the world's operation, the roles of gold and the dollar become immediately clear. The dollar is not money; it is a tool for coordinating and pricing debt.

U.S. debt is not merely a liability of the United States itself. In the global balance sheet, the dollar system is: the U.S. exports future commitments, and the world provides the current debt-bearing production capacity. Both parties, under the contract of the dollar, have achieved the largest intertemporal transaction in human history.

The uniqueness of gold lies in the fact that it is the only financial asset that does not correspond to any liability. It does not require anyone's endorsement or commitment; it is the ultimate payment itself. On the balance sheet, gold is the only asset without a counterparty.

Because of this, gold often appears inefficient, unprofitable, and lacking in imaginative space when the debt system is functioning well; however, when people begin to doubt whether the future can still be smoothly fulfilled, the value of gold will be reinterpreted.

Some say gold hedges against geopolitical risks. But if you continue to analyze this with a balance sheet, this statement itself is incomplete; geopolitics does not directly destroy wealth; it truly undermines the stability of debt relationships.

2. Hedging is About Finding a Healthy Balance Sheet

Understanding the logic above naturally leads to the realization that if you view the world as an ever-expanding balance sheet, then so-called hedging is not about finding a type of asset that is always safe, but about seeking a still healthy and sustainable asset-liability structure at different stages. The fundamental risk is not volatility, but the imbalance of the debt structure.

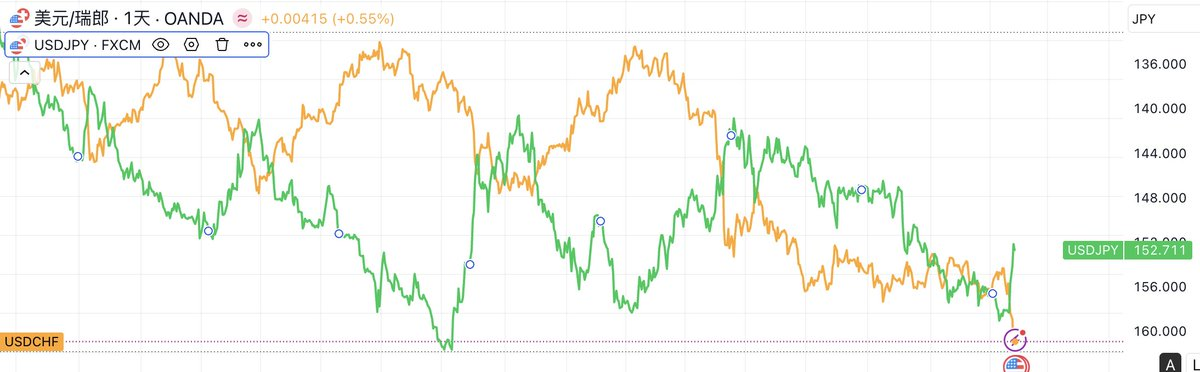

Therefore, if you observe recent market trends, what accompanies the depreciation of the dollar and the huge fluctuations of the yen is the rapid appreciation of the fiat currency of relatively healthy countries like Switzerland.

If you extend this further to examine why silver is rising and why more commodities are increasing, from a broader macro perspective, the only fundamental variable currently affecting debt-credit relationships is AI.

AI is not merely an industry; in my view, its essence lies in its ability to reshape balance sheets. On one end, it exponentially reduces human efficiency costs; software becomes cheaper, labor is replaced, and information processing approaches zero cost; on the other end, it creates unprecedented rigid capital demands in the real world, with computing power, electricity, land, energy, and minerals becoming the strongest real constraints.

These two forces are simultaneously acting on the global balance sheet: the efficiency side is becoming lighter, while the capital side is becoming heavier. This is fundamentally reshaping the current debt system.

In other words, any work that can be digitized, logicalized, and automated sees its costs approaching zero. Software, copywriting, design, and basic coding—these once expensive intellectual assets are becoming as cheap as tap water. Everything has a cost, corresponding to the generation of each Token, which is backed by the burning of computing chips, the consumption of electricity, and the transmission of copper cables. The smarter AI becomes, the greedier it is in demanding from the physical world.

In the past few decades, global growth has relied more on financial engineering, credit expansion, leverage rolling, and expectation management. The future can be continuously discounted, making debt appear light and controllable. But when growth is re-bound to variables like computing power, electricity, resources, and production capacity—variables that cannot be fabricated—debt is no longer just a numerical game. From this perspective, when you look at silver and commodities, the market is pricing what is essentially the advance pricing of constraints on future production capacity.

Thus, when growth is locked by physical constraints, the magic of debt becomes ineffective. Because no matter how much currency you inject, if there is not enough copper to build the power grid, or enough silver to make panels, AI's computing power cannot run.

3. Is the End of the Dollar's Era Approaching?

Nothing is eternal, including gold. Understanding the operational logic of the debt world also requires accepting an unappealing conclusion: gold is not an eternal answer. The current rise is merely due to the scarcity of being a no-counterparty asset. However, gold cannot create cash flow, cannot enhance production efficiency, and cannot replace real capital formation. From the perspective of the balance sheet, it is roughly equivalent to temporarily freezing risk.

Returning to the dollar, why, despite the market continuously singing the dollar's decline, is it still used for pricing? It is because you need the deepest global asset pool for collateral, settlement, and hedging; you hold U.S. debt not just because you believe in America, but because you need an asset that is recognized by the global financial system and can be collateralized for financing at any time.

The strength of the dollar lies not in its financial correctness, but in its irreplaceable network effect. It is currently the only container in human civilization capable of carrying tens of trillions of dollars in debt extension.

In the past few decades, the core capability of the dollar system has been: discounting the future to the present; the U.S. issues debt, and the world pays; the U.S. consumes, and the world supplies—essentially a global redistribution of time value.

However, as the U.S. fiscal path increasingly relies on continuous balance sheet expansion and debt rolling, the credit of the dollar will undergo a subtle change: it remains the best choice, but it is no longer a free choice, and the opportunity cost rises significantly.

But the fatal issue is not these; it is that as growth increasingly relies on electricity, computing power, resources, and production capacity, the financial system's expertise in using expectations, leverage, and discount rates to pull the future into today will face hard constraints from the physical world.

The so-called Greenland Island, tariffs, and the return of manufacturing are essentially all games surrounding this hard constraint. In other words, the U.S. must first complete the reshaping of AI infrastructure, turning the dollar into the only certificate for purchasing the world's strongest computing power and most efficient productivity. This is the necessary condition for the dollar's return to dominance.

Otherwise, against the backdrop of physical constraints and AI redefining global division of labor, the dollar system will gradually lose its ability to discount the future, moving towards an end-of-era scenario. A slow but irreversible relative decline will occur until a currency that better represents real productivity and technological dominance takes its place.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。