Good evening everyone, I am Xinya. It has been a few days since the last update, and the financial market has been extremely intense; you should be more aware of this than I am. Global wealth has shrunk, with gold dropping from around 5600 at the end of January to around 4500, a decline of over a thousand points, while silver has fallen from around 120 to 70, nearly halving. Part of the reason for this round of market movement is the change in the Federal Reserve chair, with a hawkish leader taking charge, and the core reason is debt reduction.

We issued a risk warning at the end of January, not only advising against gold and silver but also shorting the crypto market, which provided us with considerable space. After exiting, we did not attempt to catch the bottom.

We are concerned that the panic in the financial market will spread to the crypto circle when the market opens on Monday, so we have been lying low. You should have seen various bloggers across the internet starting to apologize profusely, but we are not among them. Just from this point, the difference is clear. The real reason is that before this round of market movement, we had already profited significantly, and we are not very interested in the subsequent market consolidation; instead, we avoided the black swan. Those who attempted to catch the bottom during the first drop had logical reasoning, but they did not consider the possibility of pressure from other markets and technical structural corrections. Their thinking was not wrong; they were just deprived of chips by the market. Some KOLs have already started to mortgage their cars and houses because they have lost other liquid assets and have experienced the peaks and golden ages of the crypto circle.

From the early hours of January 31 to February 1, Bitcoin and Ethereum saw a technical kill; Bitcoin dropped from 85000 to 75800, losing ten thousand points, while Ethereum fell from around 2700 to around 2200, losing five thousand points. This was enough to wipe out a large number of long positions. The rebound after the spike was decent, with Bitcoin bouncing back four thousand points and Ethereum bouncing back two hundred points. The strength of the rebound led some to attempt to catch the bottom. On the afternoon of February 1, Bitcoin's dual indicators showed a potential golden cross on the four-hour chart, but it began to face technical pressure and started to decline. On Monday morning, following the drop in gold and silver, Bitcoin tested a new low around 74500, while Ethereum was around 2150. This was not far from the first spike, but it was enough to clear out all the speculators who had attempted to catch the bottom during the process.

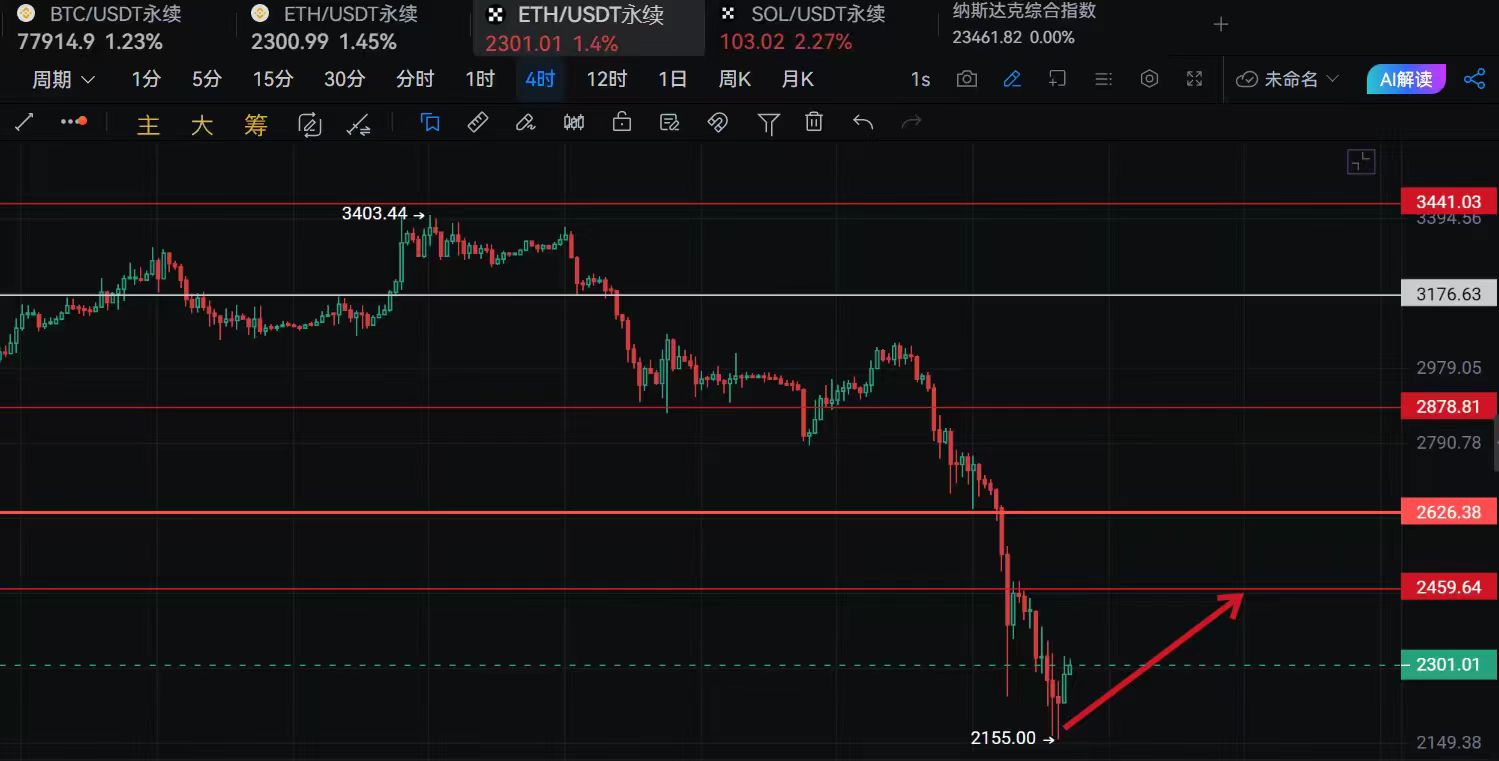

Only when the market is sufficiently panicked will the main players be interested in intervening. I believe this position is very good and can easily become a turning point in the cycle. Currently, there are signs of slight divergence at the bottom, which is more evident on the one-hour chart. To put it simply.

Currently, the one-hour EMA144 and EMA120 for Bitcoin are around 81500. This is also the four-hour EMA30. We need to pay close attention to this. We take half of the range from the previous rebound platform of 85000 to the recent low of 75000, looking for a rebound towards 80000. The pressure is temporarily seen at around 81500, where multiple moving averages converge.

Currently, the overall focus is on handling the rebound. The short-term trend is slightly volatile, while the first segment of the medium-term trend looks towards the rebound range. If the rebound stabilizes and market sentiment turns positive, we can continue to hold and look to test the pressure. Due to the large amount of trapped positions above, whether the new entries become a springboard for the second upward attack or a hindrance will depend on the strength and duration of the rebound process.

In these recent market movements, we should recall the black swan of October 2025. If there is no waterfall currently, the crypto circle will definitely absorb the gains from this round of gold and silver; this black swan will occur in the crypto circle, and gold and silver will not be so miserable. But now, when one rises, all rise; when one falls, all fall. This has already led many to have increased expectations for the crypto circle. If the rebound goes well, more people will spontaneously flock to the crypto circle. As mentioned around eight o'clock tonight, the lowest spike in this round of market movement is very likely to become a turning point in the cycle. Driven by the rebound, there will definitely be a trend before the Spring Festival to attract more funds to enter the market, but the process will not be easy for everyone. Let's watch and see.

Supporting a bountiful year, WeChat Official Account: Xinya Talks About Chan

WeChat Official Account: Xinya Talks About Chan

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。