The final week of January delivered a sobering reality check for crypto ETF investors. What began with tentative stabilization quickly unraveled into a broad-based selloff, leaving no major asset class unscathed by Friday’s close.

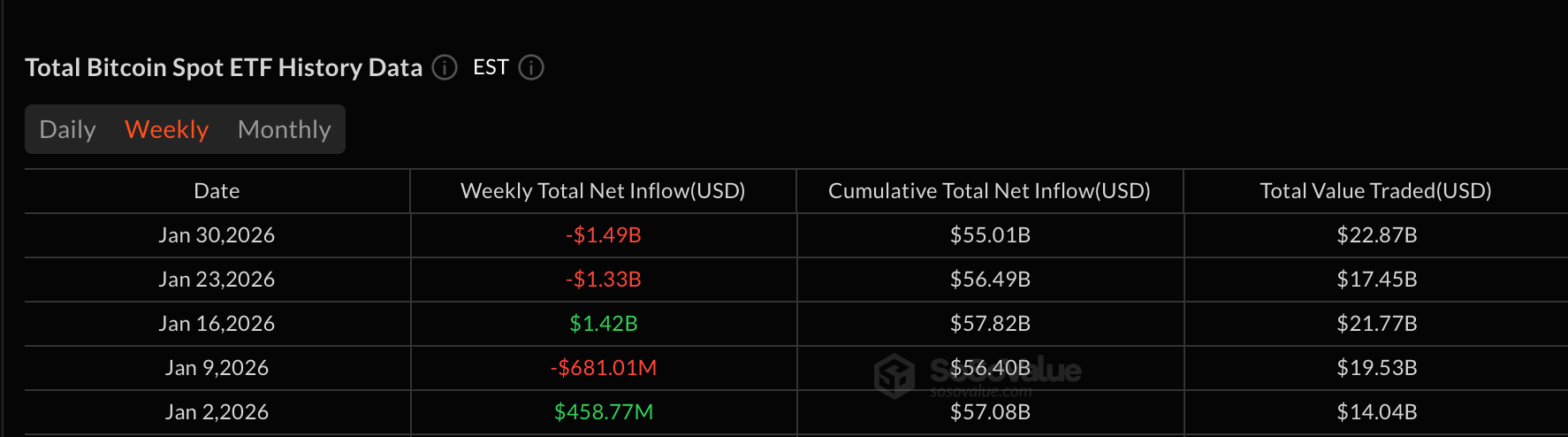

Bitcoin spot ETFs recorded a staggering $1.49 billion net outflow, marking the second-largest weekly outflow on record. Blackrock’s IBIT carried the heaviest burden, posting consistent daily redemptions that culminated in $947.17 million in net weekly outflows.

Fidelity’s FBTC followed with $191.59 million in net weekly outflows, weighed down by sustained selling pressure despite brief midweek relief. Grayscale’s GBTC shed approximately $119 million, while Bitwise’s BITB lost $112 million. Ark & 21shares’ ARKB also saw notable weakness, ending the week down $78.45 million.

Smaller but persistent outflows were recorded across Vaneck’s HODL, Grayscale’s Bitcoin Mini Trust, and Invesco’s BTCO. Weekly trading volume across Bitcoin ETFs exceeded $22 billion, while total net assets fell sharply toward $107 billion.

Successive billion-dollar exit weeks for Bitcoin ETFs.

Ether spot ETFs posted $327 million in net weekly outflows, extending January’s volatility. Blackrock’s ETHA led the declines with roughly $264 million in net redemptions, including two outsized exit days late in the week. Fidelity’s FETH lost approximately $16.92 million, while Grayscale’s ETHE and Ether Mini Trust together saw combined outflows near $45 million. Bitwise’s ETHW added further downside with modest but steady exits. Weekly trading volume across ether ETFs reached nearly $7.78 billion, while net assets slipped below $16 billion.

XRP spot ETFs recorded their largest weekly setback since launch, with $52.26 million in net outflows. Grayscale’s GXRP accounted for the majority of the damage, posting a weekly net exit of $95.79 million, partially offset by steady inflows into Bitwise’s XRP ($18.71 million), Franklin’s XRPZ ($9.11 million), 21Shares’ TOXR ($8.19 million), and Canary’s XRPC ($7.53 million). Despite late-week inflows, total net assets declined to around $1.19 billion.

Read more: ETF Recap: Redemptions Surge as Bitcoin, Ether See Historic Weekly Exits

Solana spot ETFs closed the week with $2.45 million in net outflows, snapping their recent inflow streak. Bitwise’s BSOL and Grayscale’s GSOL absorbed most of the pressure, while Fidelity’s FSOL provided intermittent support. Net assets dipped just below $1 billion, reflecting cautious positioning rather than outright capitulation.

Overall, the week was defined by aggressive de-risking. Bitcoin and ether bore the brunt of institutional selling, while XRP and solana lost their defensive footing. As January closed, crypto ETFs entered February facing damaged sentiment and a market clearly searching for firmer ground.

• Why did crypto ETFs suffer heavy losses in late January?

A sustained risk-off shift triggered aggressive institutional de-risking across digital assets.

• How large were Bitcoin and Ether ETF weekly outflows?

Bitcoin ETFs lost $1.49 billion, while Ether ETFs saw roughly $327 million in net exits.

• Did any crypto ETFs show resilience during the selloff?

XRP and Solana saw partial inflows, but both still ended the week in net outflows.

• What does this mean for crypto ETFs heading into February?

Sentiment is damaged, with investors cautious and waiting for clearer macro signals.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。