- Popular CEX Cryptocurrencies

Top 10 CEX Trading Volumes and 24-Hour Price Changes:

- BTC: +1.24%

- ETH: +1.39%

- SOL: +1.35%

- BNB: +0.67%

- WLFI: -1.37%

- DOGE: +2.21%

- Binance Life: -2.31%

- MDT: +2.34%

- SENT: -3.85%

- UTK: -2.63%

24-Hour Price Increase Rankings (Data Source: OKX):

- ZAMA: +8.97%

- KAIA: +7.96%

- MERL: +7.64%

- ASP: +6.58%

- STX: +5.83%

- SOPH: +4.51%

- SSV: +4.49%

- XAUT: +4.29%

- RESOLV: +4.13%

- PAXG: +4.09%

24-Hour Cryptocurrency Stock Price Increase Rankings (Data Source: msx.com):

- SNDK: +18.27%

- WDC: +8.61%

- GME: +8.46%

- SOXL: +8.16%

- PLTR: +7.79%

- STX: +7.46%

- MU: +6.41%

- INTC: +6.04%

- AMD: +5.92%

- COHR: +5.37%

- On-Chain Popular Memes (Data Source: GMGN):

- ELON

- BARRON

- ELON MUSK

- CCT

- stars

Headlines

Federal Reserve's Bostic: Perhaps One or Two Rate Cuts Could Reach Neutral Level

Federal Reserve's Bostic: Current policy is not highly restrictive, perhaps one or two rate cuts could reach a neutral level. I previously expected no rate cuts in 2026.

Trump's Dispute with Powell Becomes a "Stumbling Block" for Warsh's Appointment

Institutions point out that before the new Federal Reserve Chairman takes steps to promote rate cuts, Trump may have to abandon punitive actions against Powell. Trump's criminal lawsuit against Powell has angered some of Trump's allies in Congress and led a key Republican senator, Tillis, to vow to block all Federal Reserve nominations until the investigation results are released. As of now, Tillis remains firm in his stance. Meanwhile, Trump has not backed down, stating he is willing to wait until Tillis retires in January 2027 for Warsh to gain Senate approval.

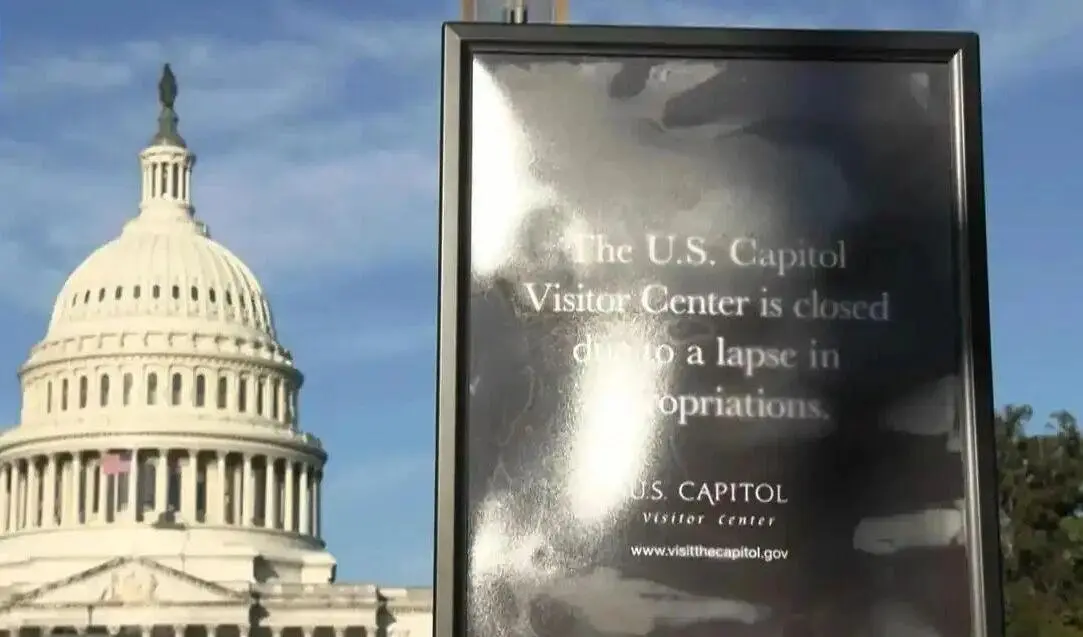

Trump: Working with House Speaker Johnson to Push Funding Bill

Trump stated, I am working with U.S. House Speaker Johnson to ensure the funding agreement passed in the Senate last week goes smoothly through the House and reaches my desk, where I will immediately sign it into law! We must get the government back up and running, and I hope all Republicans and Democrats can support this bill and get it to my desk as soon as possible without delay. There can be no changes at this time. We will work together in good faith to address the issues raised, but we cannot have another long, meaningless, and highly destructive shutdown, which would severely harm our country—such a shutdown would not benefit Republicans or Democrats. I hope everyone will vote in support.

Multiple ETH Treasury Companies Report Losses, BitMine Holds ETH with a Book Loss of $6.95 Billion

Due to the decline in the crypto market, enterprise-level Bitcoin and Ethereum treasuries are facing severe book losses. BitMine, as the company holding the most ETH, currently has a floating loss of $6.95 billion, with an average holding price of $3,883, while the current price of ETH has dropped to $2,240. Additionally, SharpLink Gaming is facing a book loss of $1.09 billion.

Due to market pressure, some institutions have begun to reduce their positions. Trend Research (0x4a2…b82) sold a total of 53,589 ETH today to repay debts, worth approximately $123 million. Although the institution still holds 618,000 ETH, it has incurred over $534 million in floating losses. Trend Research founder Jack Yi stated that it was a wrong decision to think ETH was undervalued and to be bullish too early when it was at $3,000. Meanwhile, Nansen data shows that Smart Money addresses bought $38.3 million in ETH against the market trend in the past week.

UBS Group Increases Its Stake in Strategy to $805 Million

UBS Group disclosed that it has increased its holdings in Bitcoin treasury company Strategy (MSTR) by 3.23 million shares, now totaling 5.76 million shares, valued at $805 million.

Sun Yuchen: Plans to Increase Bitcoin Holdings Worth $50 Million to $100 Million

Tron founder Sun Yuchen revealed to the media that he plans to add Bitcoin worth $50 million to $100 million to the blockchain's held assets. This purchase plan comes as Bitcoin's price once dropped to $74,674, having fallen 21% since January 15.

Industry News

GameStop May Exit Bitcoin, Plans to Advance "Super Mergers in the Consumer Sector"

GameStop CEO Ryan Cohen stated that the company is planning a high-risk, high-impact merger transaction targeting a "very, very large" publicly traded consumer company, which may mean GameStop will gradually exit its Bitcoin allocation.

Ryan Cohen told CNBC that this acquisition is "transformative," potentially raising GameStop's valuation to hundreds of billions of dollars and having a profound impact on the capital markets. He stated that the potential target should have an undervalued stock price, solid fundamentals, and "lack of ambition in management," and plans to enhance its efficiency through GameStop's capital, governance, and operational capabilities.

Reports indicate that last week on-chain data showed GameStop transferred all of its 4,710 Bitcoin to Coinbase Prime, sparking market speculation that it might sell Bitcoin to fund the merger. In response, Ryan Cohen did not directly address whether they would liquidate their Bitcoin, only stating that the new strategy is "more attractive than Bitcoin." The news drove GME's stock price up over 8% on Monday, with a year-to-date increase of about 25%.

Shen Yu: When Bitcoin Drops to $75,000, 23.3W/T Miners Will Reach Shutdown Price

Cobo & F2pool co-founder Shen Yu (DiscusFish) posted on X platform that Bitcoin has dropped nearly 15% this week. When Bitcoin reaches $75,000, a miner with a power of 23.3W/T will reach the breakeven point (shutdown price).

WSJ: Chicago Options Exchange Plans to Relaunch Binary Options to Enter Prediction Market

The Chicago Options Exchange (Cboe) is in early discussions with retail brokers and market makers to plan the relaunch of binary options contracts, aiming to compete in the rapidly growing prediction market. Kalshi and Polymarket saw trading volumes reach $17 billion in January, setting a monthly historical high. Cboe previously launched this product in 2008 but later delisted it, and is now seeking to reposition it as a starting point for retail investors to enter the options market through compliant design. The plan will be regulated by the SEC or CFTC.

U.S. President nominated Kevin Warsh as the new Federal Reserve Chair. Kraken's global economist Thomas Perfumo stated that this nomination suggests overall market liquidity is expected to stabilize rather than significantly expand, maintaining a complex macro backdrop for Bitcoin and cryptocurrencies. Coin Bureau co-founder Nic Puckrin believes that since Kevin Warsh advocates for reducing the Federal Reserve's balance sheet, market concerns about a future low liquidity environment have led to declines in cryptocurrency, stock, and precious metal markets. Currently, CMEGroup data shows that 85% of market participants expect the March 18 meeting to maintain interest rates.

Project News

Sky: Repurchased 130 Million SKY in January, Total Repurchase Amount Exceeds $106 Million

Sky announced on the X platform that Sky Protocol (MakerDao) repurchased 130 million SKY using 8.5 million USDS in January. Since the planned launch in February 2025, the total amount used for repurchase has exceeded 106 million USDS.

Optimism to Transfer 6,400 ETH Today for Liquid Staking

Optimism Governance announced that it will transfer 6,400 ETH between wallets later today to achieve liquid staking of the Optimism Collective treasury assets.

According to the previously released Liquid Staking RFP, Optimism plans to allocate 40% (approximately 6,400 ETH) of its approximately 21,500 ETH treasury assets to the liquid staking protocol on the OP mainnet, while the remaining 60% of the assets will be used for native staking on the Ethereum mainnet.

CrossCurve: EYWA Token Vulnerability Attack Has Been Contained, Hackers Cannot Sell Stolen Tokens

CrossCurve stated on the X platform that the vulnerability attack on its EYWA token has been contained. Hackers extracted EYWA from the cross-chain bridge on the Ethereum network, but since the recharge channel for the token on Ethereum is only XT.com Exchange and has been frozen, hackers cannot use these tokens. Users' EYWA and all tokens on the Arbitrum network are safe. To further ensure security, the project team is in contact with KuCoin, Gate.io, MEXC, BingX, and BitMart Exchange to ensure that hackers cannot sell or use the stolen tokens. The stolen EYWA tokens will not enter circulation. The team is conducting a comprehensive investigation into the matter.

Market News: Hyperliquid is Testing Native Prediction Markets on Testnet

Hyperliquid is testing native prediction markets on its testnet.

Despite the Market Crash Last Weekend, Weekly Trading Volume in Prediction Markets Hits New High

According to Dune data, although the crypto market crashed last weekend, trading in prediction markets remained active, with weekly trading volume hitting a new historical high of 26.39 million transactions, of which Polymarket accounted for 13.34 million transactions, ranking first; Kalshi had 11.88 million transactions, ranking second; and Opinion had 379,300 transactions, ranking third.

In addition, the weekly trading volume in prediction markets is also at a high level, with Polymarket's trading volume last week at $2 billion, an 18.4% increase, ranking first; Kalshi's trading volume was $1.4 billion, an 8.5% increase, ranking second.

Regulatory Trends

New York Attorney General Criticizes GENIUS Stablecoin Bill: Insufficient Consumer Protection

New York Attorney General Letitia James, along with four local prosecutors, recently sent a letter to several Democratic lawmakers criticizing the GENIUS Stablecoin Bill, which was signed into law by Trump last year, for significant flaws in consumer protection, particularly for not requiring stablecoin issuers to return stolen funds in the event of theft.

The letter specifically names Tether (USDT) and Circle (USDC), arguing that the two major stablecoin issuers can still earn interest on related assets after funds are stolen, while victims lack effective recourse. New York prosecutors pointed out that while the bill grants stablecoins higher "legitimacy," it does not simultaneously strengthen key regulatory requirements such as anti-terrorism financing, anti-money laundering, and crypto fraud prevention.

The GENIUS bill is currently entering the implementation phase, requiring stablecoins to be fully backed by U.S. dollars or highly liquid assets and imposing annual audits on issuers with a market cap exceeding $50 billion. However, New York prosecutors believe these measures are still insufficient to address the widespread use of stablecoins in illegal fund transfers.

According to Chainalysis data, approximately 84% of illegal crypto transaction volume in 2025 will involve stablecoins, prompting New York to call for a further strengthening of the regulatory framework to better protect consumer rights.

South Korean Regulators Introduce AI Algorithms to Monitor Crypto Market Manipulation

The Financial Supervisory Service of South Korea has upgraded its virtual asset trading analysis intelligence system, VISTA, and introduced automated detection algorithms to combat improper crypto trading. The algorithm uses sliding window grid search technology to automatically identify potential price manipulation ranges, reducing reliance on manual investigations. Performance tests have shown that the system has successfully detected all known manipulation periods and previously hard-to-detect abnormal ranges. The Financial Supervisory Service has allocated a budget of 170 million Korean won (approximately $116,000) for AI performance upgrades in 2026. Future plans include automatically identifying networks of colluding trading accounts, analyzing abnormal trading texts of thousands of crypto assets, and tracking the sources of manipulated funds.

Hong Kong Monetary Authority: Plans to Issue First Stablecoin Issuer Licenses in March

Eddie Yue, the president of the Hong Kong Monetary Authority, stated at a Legislative Council meeting on Monday that the authority plans to issue the first batch of stablecoin issuer licenses in March, with the initial number of approvals being very limited. The authority has received 36 applications, and the approval process is nearing completion. The review focuses on risk management, anti-money laundering controls, reserve asset quality, and application scenarios. Licensed issuers must comply with local cross-border activity regulations and may explore mutual recognition arrangements with other jurisdictions in the future.

Voices from the Industry

Galaxy Digital: Bitcoin May Test 200-Week Moving Average of $58,000 in Coming Months

Alex Thorn, head of research at Galaxy Digital, analyzed that Bitcoin's recent performance has significantly weakened. From January 28 to January 31, Bitcoin fell approximately 15%, with a single-day drop of 10% on January 31, triggering over $2 billion in long contract liquidations. During this period, the price dipped to about $75,600, falling below the average cost of U.S. Bitcoin ETFs at around $84,000 and approaching the annual low of about $74,400 formed in April 2025. Currently, about 46% of Bitcoin supply is in a state of floating loss.

Analysis suggests that Bitcoin may further retreat to the supply gap bottom near $70,000, and could even test the 200-week moving average of about $58,000 and the realized price of about $56,000 in the coming weeks to months. This range historically corresponds to cyclical bottoms and has provided important reference points for long-term investors.

Additionally, the report notes that while profit-taking behavior among long-term holders has slowed, the market has not observed large-scale accumulation by whales or long-term holders. Furthermore, Bitcoin's recent failure to rise in tandem with traditional safe-haven assets like gold and silver has weakened its narrative as a "hedge against currency devaluation." Analysts believe that the market may still face downward pressure in the short term, but long-term funds can focus on changes in key support levels.

CZ Responds to Multiple FUD: Polymarket Incident is Fabricated, Binance Has Not Sold Bitcoin

CZ recently posted a response to several market rumors circulating, stating that many of them belong to "overly imaginative FUD."

Regarding the claim of a "$7 million betting incident on Polymarket," CZ stated that this incident does not exist on Polymarket or any prediction market, and the related trading volume is also false information.

On the rumors of "CZ canceling the super cycle," CZ clarified that he only expressed that he has "less confidence than before" and did not make a definitive judgment on the market cycle.

Regarding the claim that "Binance sold $1 billion in Bitcoin," CZ pointed out that the actual situation is that Binance users are selling Bitcoin, not Binance itself; the changes in Binance's wallet balance only occur when users withdraw funds.

Additionally, in response to the skepticism about the SAFU fund's conversion to BTC not showing significant on-chain movements, CZ stated that Binance had previously explained that it would gradually complete the related operations within 30 days, and that the scale is limited in impact relative to Bitcoin's market cap of about $1.7 trillion, serving more as a confidence-building measure.

CZ concluded by stating that he will continue to focus on building and advancing related work.

Opinion: BTC Whales are Accumulating, While Retail Investors Continue to Exit

According to Glassnode monitoring, the group of whales holding over 10,000 BTC is currently the only group in an accumulation phase. Since Bitcoin fell to $80,000 at the end of November, this group has maintained a neutral to positive balance growth trend.

Meanwhile, the number of entities holding over 1,000 BTC has increased from 1,207 in October to 1,303. In contrast, all smaller holder groups, especially retail investors holding less than 10 BTC, have continued to sell over the past month. The current trading price of Bitcoin is approximately $78,000.

Analysts at Bernstein expect that the crypto market is currently in a short-term bear market cycle but anticipate a reversal in the first half of 2026. Bitcoin is expected to bottom in the $60,000 range, which corresponds to the previous cycle's peak, and then establish a higher price bottom. Bernstein points out that the past two years have been an institutional cycle for Bitcoin, with the assets under management of spot Bitcoin ETFs growing to approximately $165 billion. Despite recent market adjustments, institutional participation remains resilient, and there has been no collapse of miner leverage similar to previous cycles. Additionally, the establishment of U.S. strategic Bitcoin reserves and potential changes in Federal Reserve leadership may lead Bitcoin to be viewed as a sovereign or reserve asset. Bernstein believes that the current weakness is a late-cycle correction rather than a long-term winter, and the reversal in 2026 will lay the foundation for Bitcoin's most influential cycle.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。