Original Title: "Hyperliquid is entering the prediction market, targeting the heart of Polymarket?"

Original Author: Seed.eth, Bitpush News

Hyperliquid, which firmly holds the top position in the crypto derivatives space, is attempting to extend its reach into another burgeoning trillion-dollar market: the prediction market.

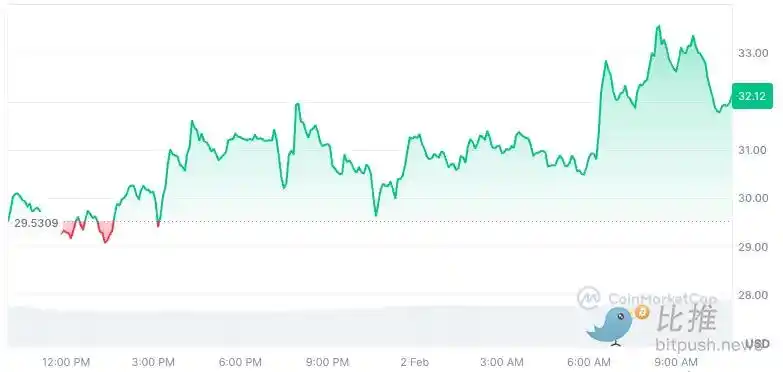

Today, Hyperliquid officially announced the testing of a new feature called "Outcomes." This news has directly ignited enthusiasm in the secondary market, with its native token HYPE recording an increase of over 10% within 24 hours, pushing the price above the $30 mark.

As Polymarket dominates on-chain traffic and Kalshi collaborates with Coinbase to capture the regulated market, Hyperliquid's entry is not merely a "follow the trend" move, but rather a redefinition of the game rules by leveraging its absolute advantages in native underlying performance.

What is Outcomes

According to the official HIP-4 proposal, Outcomes (result contracts) is not a simple betting interface; its design is based on three core logics:

- Full collateral, liquidation risk

Unlike leveraged perpetual contracts, Outcomes follows the principle of "do as much as you have money for." It uses full collateral and settles within a fixed range. This means that regardless of market fluctuations, as long as it is not the settlement date, traders' positions will not face forced liquidation, fundamentally removing the risk of liquidation.

- Non-linear settlement, greater strategic space

Outcomes introduces a non-linear settlement mechanism. For traders, this equates to gaining flexibility similar to options, allowing them to construct more complex hedging tools, no longer limited to simple binary games of "yes" or "no," thus opening up greater space for risk management and strategy combinations.

- Native integration, unlocking liquidity

Outcomes will be deeply integrated into Hyperliquid's underlying chain, HyperCore, and priced in the native stablecoin USDH. More importantly, it can share full-margin collateral with the platform's existing spot and perpetual contracts. This means users can seamlessly connect multiple trading strategies within the same margin account, truly achieving liquidity interoperability and reuse.

Multiple factions: Who will dominate the prediction market?

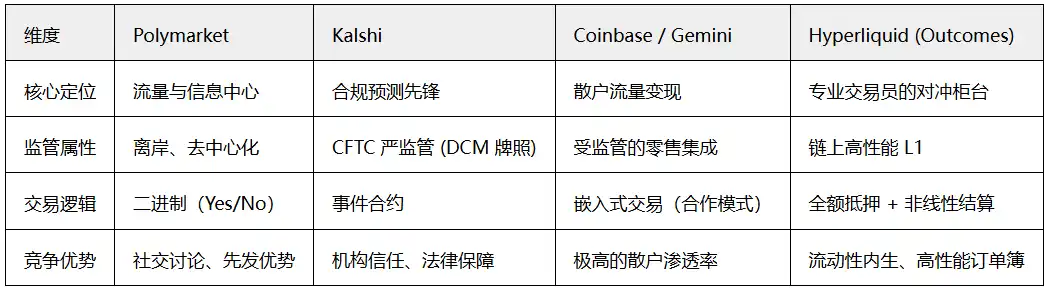

The current prediction market is at a "1995 browser war" moment, forming four distinctly different business paths:

- Polymarket sells "opinions," serving as a barometer for social hot topics;

- Kalshi sells "compliance," attracting domestic U.S. funds looking to avoid legal risks;

- Coinbase employs "dimensionality reduction," turning the prediction market into a consumer product through in-app features;

- Hyperliquid's logic is the most hardcore: it doesn't require you to click Yes or No on a webpage; it wants you to short BTC while simultaneously buying an Outcomes contract for "non-farm data exceeding expectations" to hedge macro risks.

Currently, the community is most focused on the synergistic effects of HIP-3 (permissionless token listing) and HIP-4 (Outcomes).

Under this framework, Hyperliquid's evolutionary path is clear: first, the official deployment of a "regular army" market (Canonical Markets) based on objective data sources, such as interest rates and macroeconomic indicators; followed by the initiation of permissionless deployment.

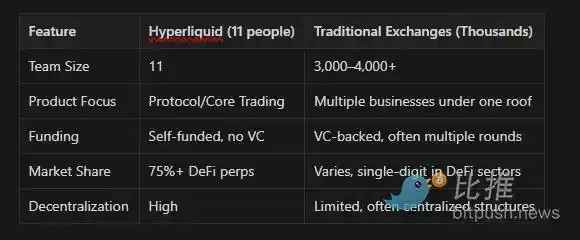

Behind this strategy is Hyperliquid's legendary team advantage. It is hard to imagine that supporting this giant, with an annual revenue exceeding $1.1 billion and trading volume comparable to top-tier CEXs, is a core team of only about 11 people. This "special forces" team, composed of Harvard, MIT scholars, and elite quantitative hedge fund professionals, has created an astonishing efficiency with an average annual contribution income exceeding $100 million per person. It is precisely because the team is extremely streamlined and the decision-making path is short that Hyperliquid can iterate quickly.

A senior DeFi observer stated: "Coinbase's entry validates the business model, but it remains centralized. Hyperliquid's Outcomes challenge a proposition: the ultimate prediction market is not in social media, but in financialization. When prediction results become as smooth as buying and selling stocks and can share margin with futures, the imaginative space of on-chain finance truly opens up."

Is HYPE significantly undervalued?

With the increasing maturity of the crypto options market, Hyperliquid's HIP-3 market open interest (OI) has surged to $1 billion, and the platform's 24-hour trading volume has skyrocketed to $4.8 billion, setting a new historical high.

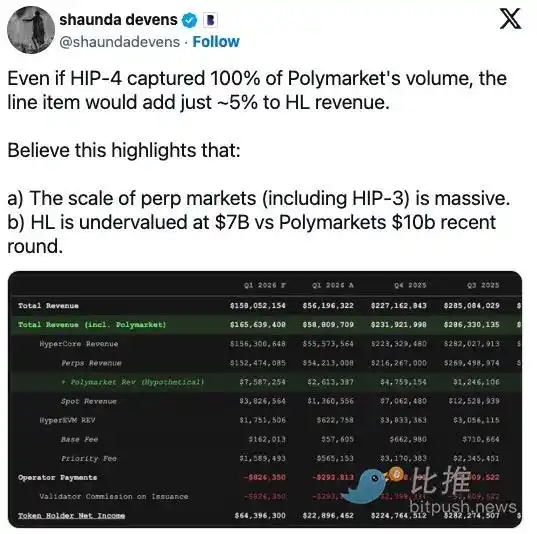

Regarding this layout, Blockworks researcher Shaunda Devens believes this move further supports Hyperliquid's valuation upside potential.

Devens pointed out that even if HIP-4 captures 100% of Polymarket's trading volume, its contribution to Hyperliquid's revenue would only be about 5%.

This figure may seem surprising at first glance, but the underlying logic is that the perpetual contract market (including the long-tail assets brought by HIP-3) is extremely large. Devens believes that Hyperliquid's current valuation of about $7 billion is clearly undervalued compared to Polymarket's latest round of $10 billion valuation (based on 2025 financing data). The launch of Outcomes is primarily to supplement a key part of its comprehensive financial matrix.

Although market sentiment is high, it is important to note that Outcomes is still in the testnet phase, and the exact timeline for the mainnet launch has not yet been announced. However, with the explosion of the HyperEVM ecosystem, mainstream service providers like Kalshi or Crypto.com could theoretically migrate to operate on the Hyperliquid chain using the HIP-4 protocol in the future.

In summary, the prediction market is entering its best era. In the U.S., thanks to the advancement of regulatory transparency, the collaboration between Kalshi and Coinbase has allowed the prediction market to cover all 50 states; similarly, strong growth momentum is also seen in the EU and Asia. For Hyperliquid, Outcomes is not just a simple "betting game," but an indispensable piece of the puzzle in building "on-chain Wall Street."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。