Rhythm Note: This article was first published on January 17, 2020, and six years have passed. The current situation is that the soon-to-be-appointed hawkish Federal Reserve Chairman Kevin Warsh has become the target of criticism, with the market attributing the epic crash of gold and silver to this Trump-appointed figure, while other markets are pricing in uncertainty. In simple terms, there are currently no appreciating assets on Earth.

While researching Kevin Warsh, I found that he is a disciple of Stanley Druckenmiller, having previously been a partner at Druckenmiller's family office, and they have a very good relationship. Druckenmiller is famously known as one of George Soros's most renowned disciples, having orchestrated the "Black Wednesday" event in 1992 that targeted the British pound.

The recent crash of precious metals and Bitcoin is certainly not Soros's doing, but it reminds us of the article Rhythm wrote in January 2020, titled "If Soros Wanted to Destroy Bitcoin, How Would He Do It?" The background of this article was that Bitcoin had returned above $10,000, and the market was thriving in anticipation of Bitcoin's halving, with hopes of seeing Bitcoin reach a historical high above $20,000 post-halving.

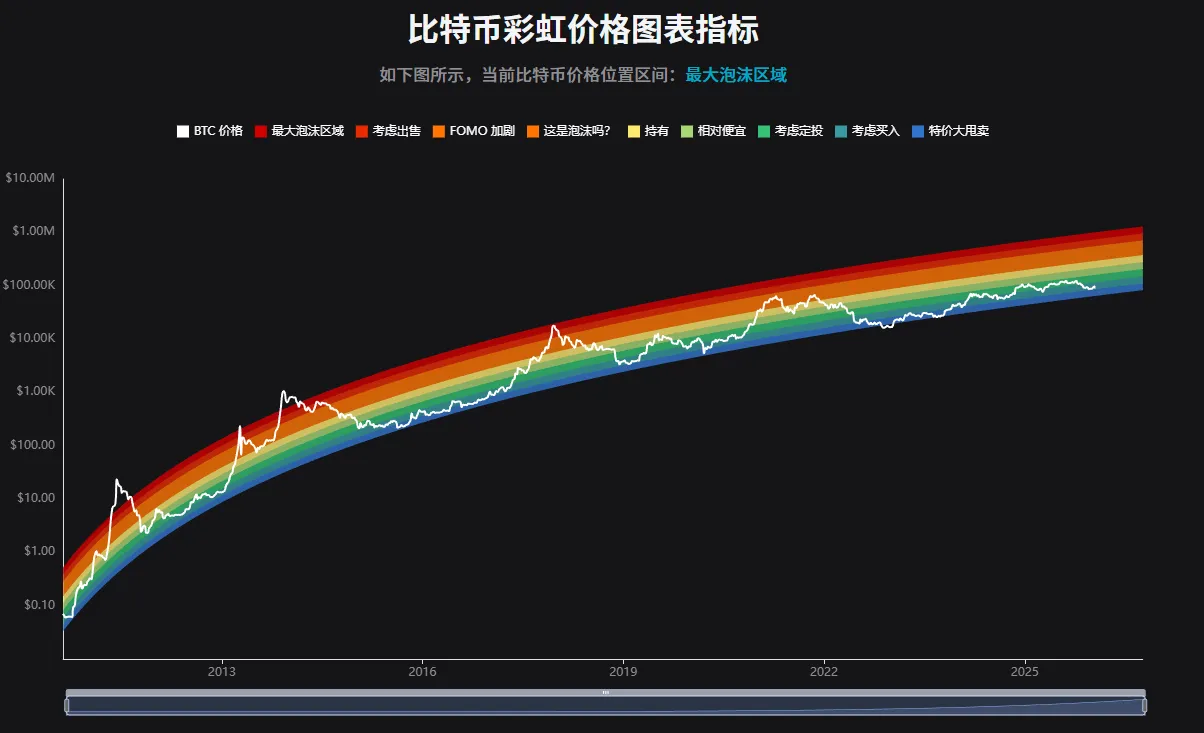

Looking back at this article now, we find that many of the speculations made six years ago have come true: Bitcoin has reached $100,000, interstellar currencies are being mentioned, most Bitcoin mining power has moved to the United States, and crypto banks have basically disappeared, among other things.

The original intention of this article was to caution against excessive optimism. Now we are republishing this piece from six years ago, especially since a disciple of Soros has taken the stage, and Bitcoin has become a multi-trillion dollar commodity. Even a large-cap asset like silver can be halved in two days, making the probability of Bitcoin's decline even greater. We have skin in the game, but we must always respect the market. Below is the original content:

A decade of prosperity.

No one has seriously considered whether Bitcoin will one day face a real crash, and what that might look like. The bulls, who hold high the banner of an eternal bull market, have never thought about it, nor have the bears, who mindlessly sing the praises of decline, given it much detailed thought.

The purpose of this article by BlockBeats is not simply to sing the praises or condemn Bitcoin, but to discuss an interesting and serious topic: What crises will Bitcoin inevitably encounter despite its seemingly bright development prospects? Since many financial forces are not optimistic about Bitcoin, why haven't they shorted it heavily? If one day, Soros and others really enter the market, how would they operate?

Let us imagine a scenario that might occur four years from now.

At this time, Bitcoin's price hovers around $50,000, and its circulating market cap finally reaches the trillion-dollar threshold.

The market's perception of Bitcoin has almost assimilated it as digital gold and a store of value. With some small third-world countries announcing Bitcoin as part of their asset reserves, and Musk's rockets moving to the assembly line, the slogans of Bitcoin supporters have become even more penetrating—Bitcoin is the foreign exchange reserve of the new century, the interstellar currency of the 22nd century.

Those who once sang the praises of Bitcoin's decline—whether rational investors or casual bystanders—are mocked by every holder as "people who don't understand the times."

What times? The era when the Western economy is in decline and needs asset hedging, the era when some countries face hyperinflation and need a store of value, the era when geopolitical tensions require safe havens, and the era when buying means making money.

It seems that everything has been conclusively determined, with no room for maneuver.

In this prosperous age, crises lurk everywhere.

Miners are happy, using advanced machines and financial tools, leisurely calculating their daily and monthly earnings, skillfully employing futures contracts for hedging. Some of them have also hoarded some Bitcoin, hoping for the day when Bitcoin reaches $1 million each.

Investors are also happy; there has never been an asset that can grow so quickly and sustainably. During this time, the financial derivatives market for Bitcoin has also rapidly developed, with many speculators greedily enjoying the thrill brought by volatility through the high leverage of futures and options. No other major asset can provide such great opportunities.

The happiest are those who control money upstream in the industry chain. Some rely on the daily short-term battles of traders to earn millions, while others benefit from the ever-increasing borrowing demand in the industry. At this point, the Bitcoin market has approached maturity, and compared to mining and trading in 2020, an increasing number of composite products have become the first choice for the general public to enter the market.

The allure of money captivates everyone; no one cares that industry data is heading into the abyss. After all, those who are bearish are fools; at least they haven't made money, right?

At that time, borrowing to mine and purchasing mining machines in installments had become the norm; those who paid in full were simply fools who didn't know how to use leverage.

At this point, the global Bitcoin mining industry's comprehensive debt ratio had reached over 70%, meaning that a large number of miners were borrowing money to use leverage for mining. As long as the borrowing rate is lower than the yield from mining, it is a profitable business.

Soros has arrived, the sniper with international capital has come.

Soros first purchased X hundred million dollars' worth of Bitcoin in the spot market. Not only is Soros entering the market, but many more Soroses are also entering; they are Soros's allies in international capital, various investment funds supporting the long position. At that time, it coincided with the Nth hype of Bitcoin's halving, creating the most fervent buying pressure during that speculative market, with blockchain investment institutions and media rallying: The regular army has entered! Let us embrace the Bitcoin era!

After establishing a position in the spot market and further heightening market sentiment, Soros began to increase his long position in Bitcoin's near-month futures.

After a long bullish candle, the bulls in the derivatives market surged like an army, and the number of bears dwindled, with only the bulls' own liquidation operations able to stop them.

With substantial unrealized gains, Soros secretly instructed his assistants to execute a move—buying out-of-the-money put options.

At that time, options trading had become as popular and mature as cryptocurrency trading was in 2020, with liquidity levels significantly increased, making Soros's position-building process seem very easy.

At that time, no one thought Bitcoin would fall below $20,000 again, as Bitcoin had always been on a spiral rise. Moreover, Bitcoin had already risen to nearly $100,000 due to Soros's spot buying, and the sellers of options were happily issuing put options with a $20,000 strike price, calculating how much premium they could earn risk-free in the next year.

They did not know that the counterparties for these out-of-the-money put options were Soros, and the options were the necessary path for Soros's hunt. When you stare into the abyss, the abyss stares back at you.

After Bitcoin officially broke through $100,000, Twitter erupted.

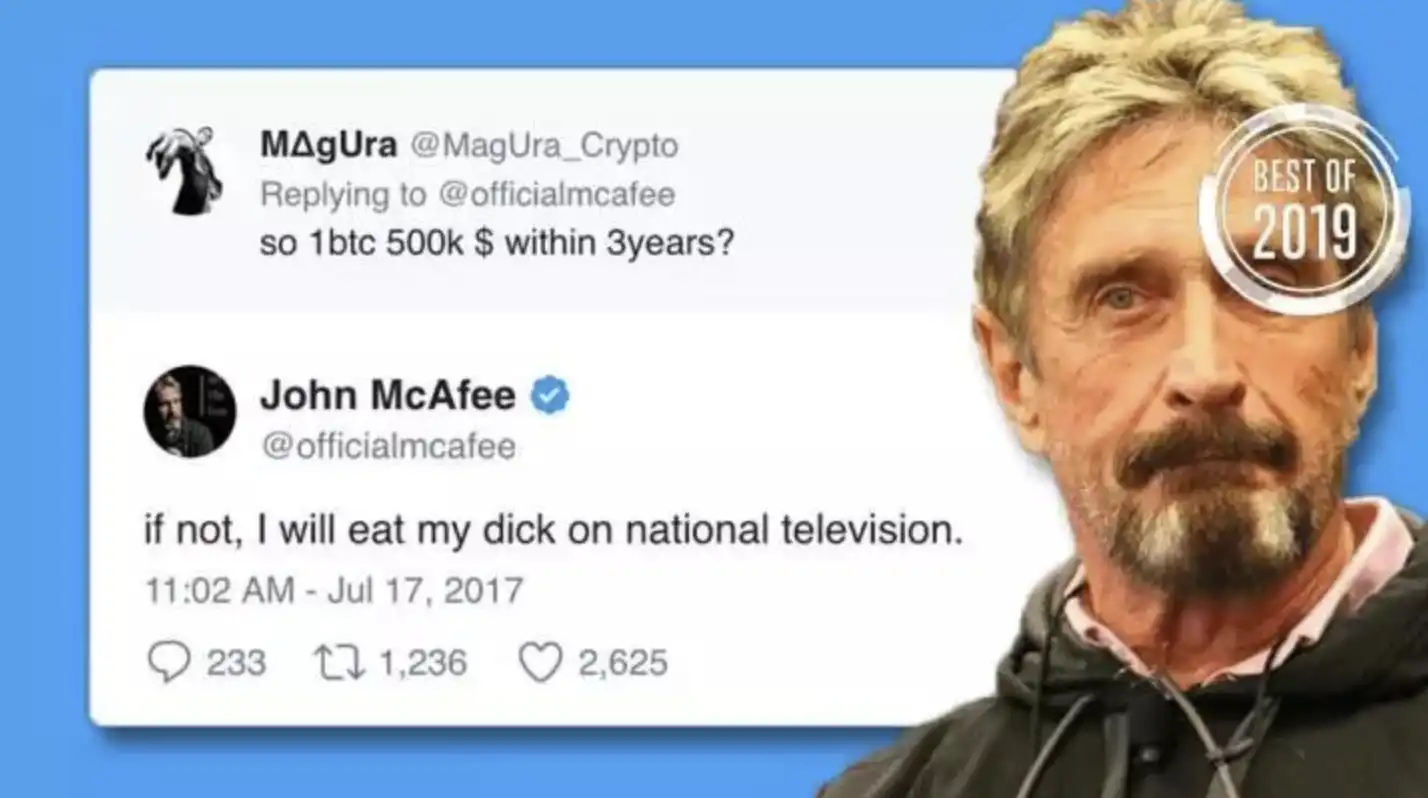

McCafe reiterated that the $500,000 prediction from back then was not a joke, but a genuine thought from within. Musk stated that whether Bitcoin is a safe word is no longer important; what matters is that space travel will only support Bitcoin payments. Well-known trader Xiao K shared his experience of becoming rich overnight by going long on Bitcoin in a trading forum, while miner Xiao B, seeing the rising prices of mining machines, had no choice but to increase his leverage—keep going!

At this point, Soros was ready to act. He secretly arranged for his assistants to start shorting Bitcoin futures for later months. As the market was in a strong bullish trend, the first batch of short positions quickly gathered. Soros did not continue to short but paused to observe the situation's development.

He knew that replicating the successful shorting of the British pound and Thai baht was far from enough.

At that time, 80% of Bitcoin mining machines had already moved to Country M, with most of the computing power concentrated in State N. Soros contacted local officials in State N, explaining his thoughts on Bitcoin's overheated valuation, the distorted leverage in the mining industry, and his intention to short Bitcoin. He mentioned that he had gathered well-known international capital P, and the strategy was nearly foolproof. If they could provide "help on the news front," Soros was willing to share 10% of the profits once the plan succeeded.

To obtain precise data on Bitcoin's circulating supply and proportions in the market, Soros knew he had to take control of the trading platform, the black box. He approached the head of the largest trading platform H in Country M. Soros told him that collecting ten years' worth of trading fees was not as good as collaborating on this deal, especially since well-known capital P and local officials from State N had already joined the short-selling alliance. He stated that knowing the liquidation points of H's large futures long positions and the remaining margin in their accounts would allow for precise strikes with less capital, promising to share all the saved capital costs with the head of H once the plan succeeded.

Soros understood that the market was a precarious high-rise, and he would be the one to ignite it, but he still needed more institutions to add fuel to the fire.

Thus, he began contacting the aforementioned well-known international capital P, explaining his logic for shorting: the mining industry is equivalent to Bitcoin's primary market, and now Bitcoin mining had become quite chaotic, which was a sign of decline. Lending companies were no longer rigorously reviewing clients' creditworthiness as they used to; instead, they were lending carelessly to make money faster. Many miners obtained loans to purchase more mining machines, attempting to secure more loans with these machines. Data showed that the overall debt ratio in the mining industry had far exceeded 70%. Some astute cloud computing companies had already begun selling computing power for the next 100 years.

At the same time, the hedging demand from retail investors in the secondary market gave rise to Bitcoin price insurance products. Crypto asset financial companies no longer paid attention to risk control as they had in the past; instead, they had become accustomed to simply being sellers in the options market, happily collecting one "rent" after another.

Soros smirked slightly, as if he could see the prey about to be caught, and continued: "You should know that the mining cost of Bitcoin is $85,000, while the current price is $110,000. Now happens to be the halving time, and miners' block reward earnings will plummet. As long as we break through $70,000, we can definitely trigger a death spiral for the highly leveraged mining industry. The bulls in the market will become our most brilliant fuel, and their chain liquidations will leave the options sellers at a loss. Moreover, shorting Bitcoin is the politically correct thing to do in this world. Whether in the stock market or commodities, there may be irresistible forces obstructing our plans, but Bitcoin, with its nearly extreme capital game, is the best slaughterhouse."

Seeing that the other party was still somewhat hesitant, Soros added: "To ensure everything goes smoothly, I have already secured the local officials in State N and the head of H. Whether on the news front or data front, we have no chance of failure. I have already laid out these position strategies; I am just waiting for your participation." The head of capital P nodded.

The curtain rises.

On December 24, (2020 + 4N), Soros decided to strike hard on Christmas Eve when everyone was letting their guard down.

That night, Soros suddenly sold short $10 billion worth of Bitcoin futures in multiple transactions, causing Bitcoin to plummet from a high of $120,000. Having obtained the holding data from H, Soros executed each operation with precision, ultimately triggering a chain reaction of liquidations among the bulls, with prices crashing to around $95,000.

The next day, when some brave spot buyers rushed in, Soros began to sell off the previously purchased $X billion worth of spot Bitcoin. The crypto circle was sleepless on Christmas night, as investment institutions and media rushed to write articles about Soros selling Bitcoin and suspected shorting.

On December 26, bearish sentiment began to spread in the market, with well-known international capital P increasing their short positions, and the market fell into panic. Soros immediately contacted local officials in State N, who promptly issued a notice in State N regarding a thorough investigation of illegal electricity use in Bitcoin mining, as well as the "N State Initiative to Resist Bitcoin Speculation," calling on the parliament of Country M to pay attention to the unreasonable speculation and waste of electricity associated with Bitcoin. Bitcoin inevitably dropped to $75,000.

On December 27, the Bitcoin futures long positions that Soros had held entered physical delivery, allowing him to acquire Bitcoin worth $500 million at a unit price of $75.

On December 28, Soros dumped the Bitcoin he received from the delivery, and the market plunged into the abyss, with "Bitcoin Ponzi schemes, blockchain scams" becoming trending keywords on Twitter.

McCafe tweeted again, stating that his $500,000 prediction was clearly a joke and that everyone should not take it seriously. Musk also stated that due to the excessive price volatility, Bitcoin was no longer suitable as a payment currency for interstellar travel. Well-known trader Xiao K left a message on the forum saying "Goodbye!" and never appeared again. As for miner Xiao B? No one knew where he went. Because Bitcoin had already fallen below $40,000, mining machine prices plummeted, and while mining became unprofitable, he was unable to repay his high loans. For the sake of his wife and children, he could only disappear and live in hiding.

On December 29, known in history as Bitcoin's Black Friday, with the continuous defeat of the bulls and the domino effect of the industry's collapse, Bitcoin's price had fallen below the $20,000 mark. The largest "bank" in the crypto world, Q, announced bankruptcy, unable to repay user funds and related policies; while the largest mining machine manufacturer in Country M, S, announced a permanent suspension of its mining business line, shifting to the development of space travel machine chips.

Amidst the market's wailing, the out-of-the-money put options that Soros had bought early began to turn into in-the-money options, and that night he made $50 billion.

This story could never happen because…

Many readers, after reading the above story from BlockBeats, will likely have the first reaction to the above sentence.

Indeed, the story above has exaggerated the numerical descriptions, but it must be admitted that all of this is logically valid on a macro level—or rather, the current objective conditions do not hold, but that does not mean they won't hold in the future.

The reason Soros and others are not operating this way now is that, first, Bitcoin's circulating supply is not large enough to satisfy the appetites of big players; second, the leverage in Bitcoin mining is not high enough, and the liquidity in the options and other derivatives markets is still lacking. The leading companies in the current crypto world still have their bottom lines and original intentions, but if they lose these precious things in the future's rapid development, the consequences will unfold into the story above.

What BlockBeats truly wants to convey in this article is not to sing the praises of decline or bearishness, but to hope to provide some inspiration and warnings to the industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。