Original Title: "After a 30x Surge, Then 'Foot Chopping', Do You Dare to Get on the RIVER That Hayes Called?"

Original Author: ChandlerZ, Foresight News

In the first month of 2026, the native token RIVER of the chain abstract stablecoin system River experienced an extreme inverted V-shaped reversal in just four weeks, soaring from around $2 at the end of December 2025 to a historical high above $87, with an increase of over 2700%. It then rapidly fell back within just six days, dropping to around $11, a decline of 87%.

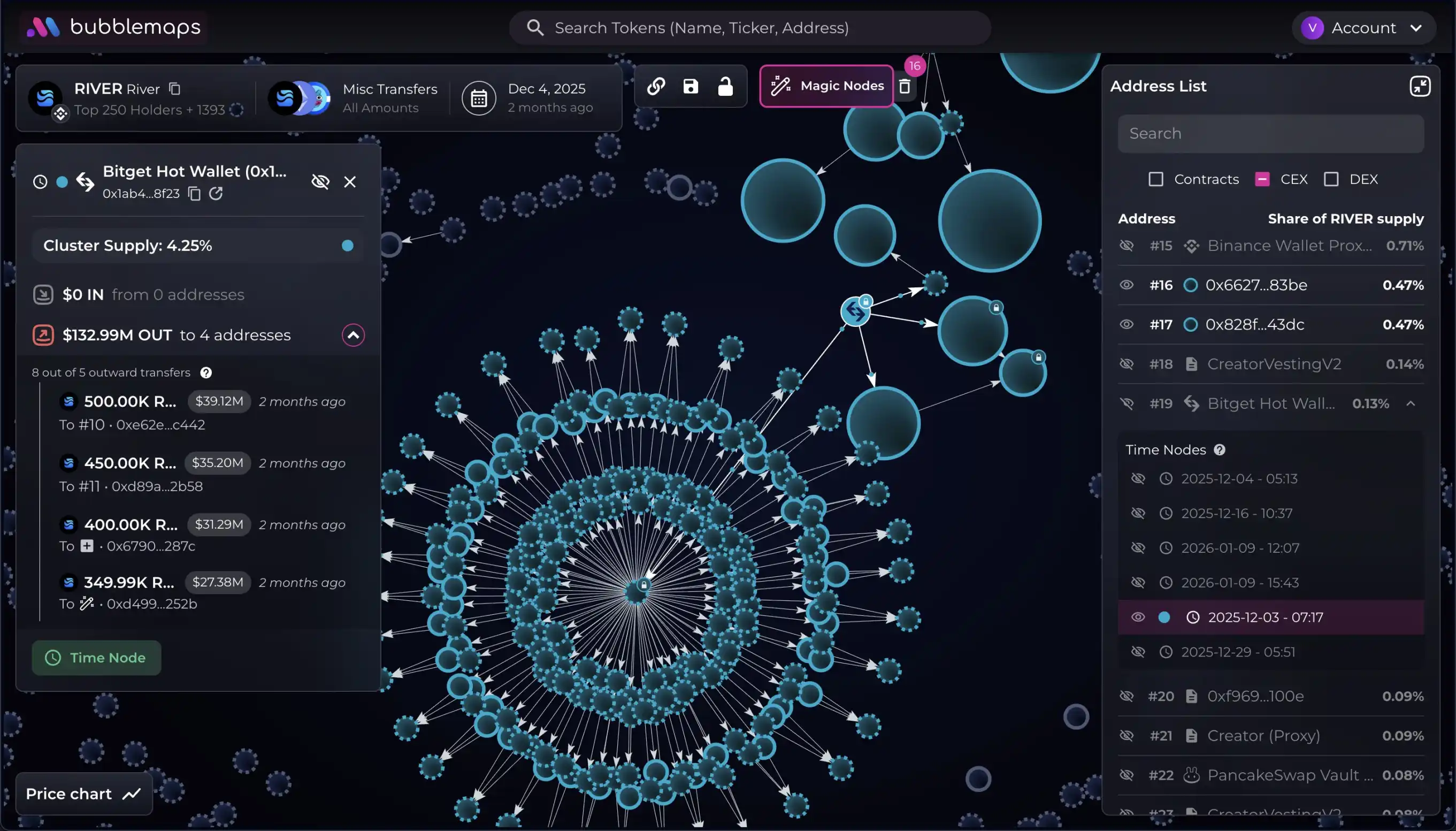

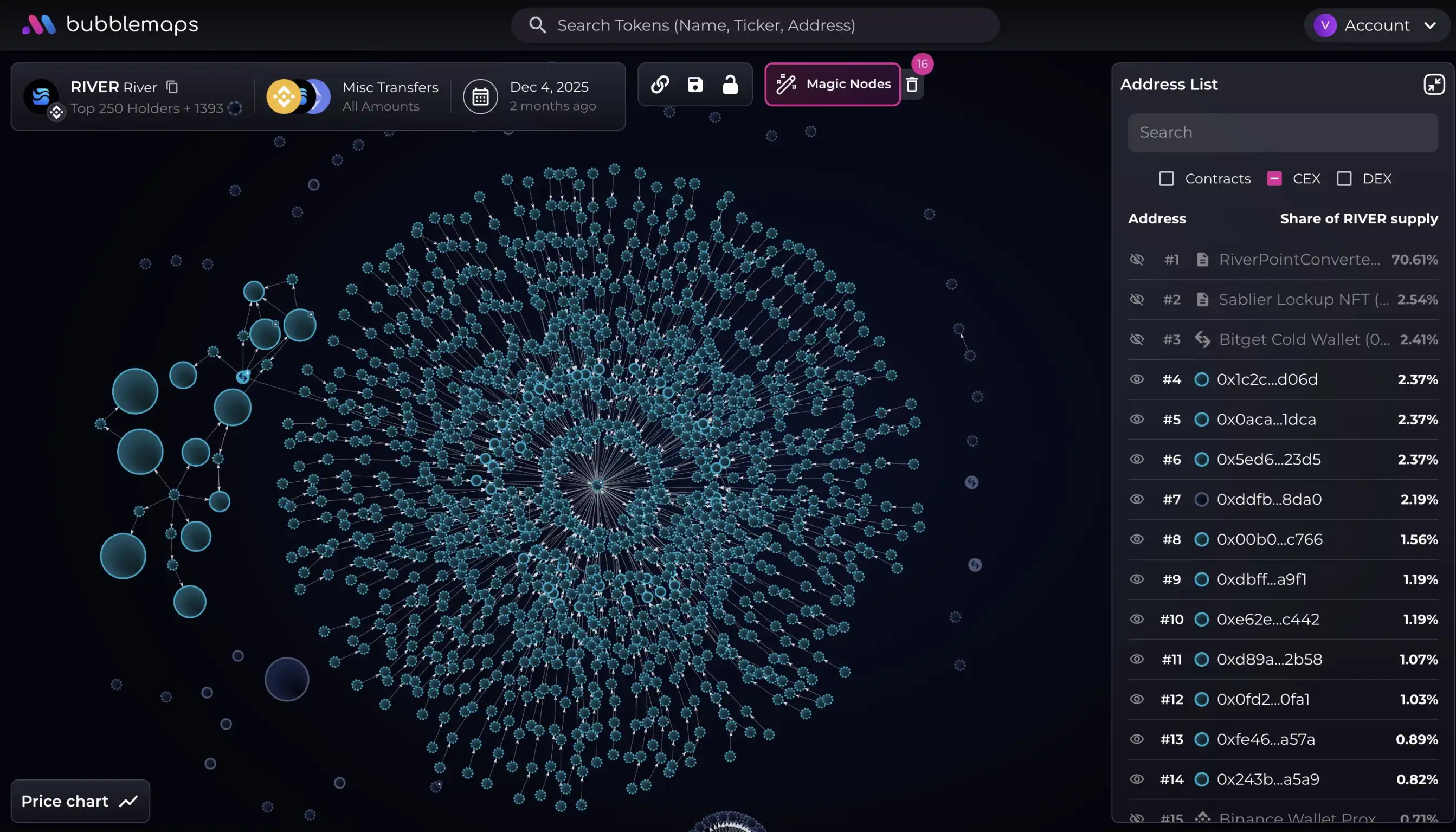

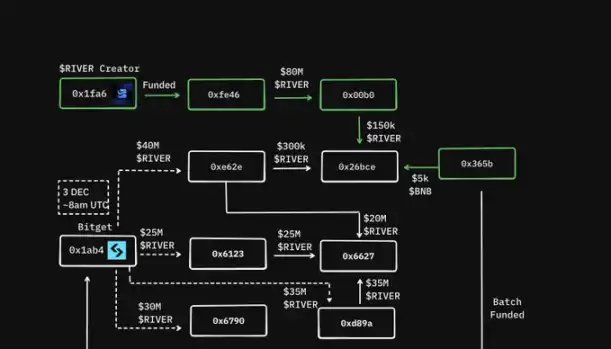

This unusual market volatility has drawn significant attention from industry observers and on-chain data analysis firms. As third-party data institutions like Bubblemaps disclosed key evidence on January 27, questions surrounding the price manipulation of the RIVER token, the high concentration of early chips, and the profits of associated addresses are brewing.

New Financing of $12 Million, Backed by Arthur Hayes

The River project is developed by the RiverdotInc team, which aims to build a chain abstract stablecoin system for a multi-chain ecosystem. This system is designed to connect assets, liquidity, and yields across different blockchains, enabling seamless cross-chain interactions without relying on traditional bridging or wrapping mechanisms.

On January 6, BitMEX founder Arthur Hayes publicly called for the token to be listed on CEX and predicted an explosive growth. Hayes's endorsement injected the first dose of adrenaline into RIVER, which, despite most mainstream crypto assets being in a downward trend at the time, entered a one-sided upward mode, with its market cap more than quadrupling in just a few weeks.

On January 23, River announced the completion of a $12 million strategic round of financing. In addition to previously reported investments from Justin Sun and TRON DAO, this round of investors also includes Maelstrom Fund (founded by Arthur Hayes), The Spartan Group, and Nasdaq-listed companies and institutions from the U.S. and Europe.

The official statement indicated that this financing will support River's expansion in EVM and non-EVM ecosystems (including TRON, Sui, and major EVM networks) and continue to build on-chain liquidity infrastructure. The funds will be used to accelerate ecosystem deployment, deepen stablecoin liquidity, and promote the integration of satUSD in trading, lending, staking, and yield scenarios. Additionally, River will launch yield products Smart Vault and Prime Vault, providing users and institutions with a unified interface for cross-ecosystem yield access through protocol-native and institutional-grade strategies.

Interestingly, just two days after announcing the large financing, RIVER's price reached a peak and entered a decline.

Price Manipulation Driven by Funding Rates

CoinGlass used RIVER as an example to discuss how funding rates can be used in conjunction with leverage structures to drive price fluctuations, emphasizing that this pattern has appeared in multiple tokens over the past two years, with RIVER being just one case. It stressed that many traders misunderstand funding rates. Funding rates do not provide directional prediction signals; they provide information about the imbalance of long and short positions, indicating which side of the market is more crowded.

Step 1: Suppress the price while pushing the funding rate to deep negative values. First, keep the price low or suppressed while pushing the funding rate into a clearly negative range. The result is that short positions become increasingly concentrated, and the market begins to form a consensus expectation that a rebound is imminent due to the negative funding rate.

Step 2: Induce some traders to go long. During the phase of deep negative funding rates, some traders will open long positions, motivated by the expectation of a rebound and the desire to receive funding rate payments. This expectation is referred to as a component of the trap.

Step 3: An upward push may also occur during the negative funding rate phase. CoinGlass's key argument is that when funding rates are at extreme negative values, prices do not need to enter a trend reversal. The market only needs a controllable upward push to trigger a chain reaction among shorts, including liquidations, stop-losses, and passive buybacks.

Why does the surge occur while funding rates are still negative? Many sharp surges start during phases when funding rates are still negative. The drive for price increases comes from the unwinding of leveraged positions, and passive buying in the market amplifies the gains. Once the crowded shorts are cleared, funding rates quickly return to a more neutral level. Some traders view the return of funding rates as a signal of market health.

CoinGlass warns that this is actually just a "reset" process of the trap, where manipulators can repeatedly execute the process of "creating extreme rates, attracting consistent positions, forcing liquidations, and resetting."

Analysis: RIVER Creators Suspected to be Directly Related to a Huge Address Cluster, Profiting $10 Million from RIVER Sales

According to monitoring by Bubblemaps, a massive cluster of over 2,000 wallet addresses is directly related to RIVER.

It pointed out that one month after RIVER's launch, seven addresses withdrew 230 million RIVER tokens from Bitget, and these wallets had no prior activity records, receiving tokens within a tight time window on December 3 and 29.

One of the wallets, 0x6790, distributed 400,000 RIVER among hundreds of wallets. All these receiving wallets showed a similar pattern, having no prior activity, receiving similar amounts of RIVER, and sending tokens to Bitget on January 9, likely for sale, funded by a single source and passing through four hops.

Bubblemaps indicated that the wallet address funding this cluster is 0x365b, which is directly connected to the RIVER creators. Additionally, the wallet 0x6790 that distributed RIVER to the cluster shows a link to the RIVER creators. It predicts that the expected profit for this cluster is $10 million.

What can be confirmed is that RIVER underwent a rapid revaluation from a quick rise to a quick pullback in a very short time, and the market's focus has shifted from narratives and growth expectations to whether there are anomalies in chip distribution and funding paths. The address cluster and associated clues raised by Bubblemaps further amplify the questions regarding early chip concentration, associated address profits, and offloading through trading platforms; the funding rate and position crowding mechanisms mentioned by CoinGlass provide another explanatory framework, suggesting that derivative structures may have amplified the price fluctuations.

For the market, the RIVER incident serves as a reminder that low circulation, high-elasticity tokens are prone to extreme market movements when sentiment and structure resonate, and when negative signals appear in chip and trading structures, price adjustments often come faster and deeper.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。