Original Author: Alexander Campbell

Original Compilation: Shenchao TechFlow

Introduction: After experiencing a historic washout in precious metals last Friday, former Bridgewater researcher Alexander Campbell wrote this deeply reflective piece.

The article not only dissects the mechanical principles that led to a 6-Sigma level drop in silver from a financial engineering perspective—including short gamma effects, leveraged ETF rebalancing, and the pricing game between the Shanghai and New York markets—but also rarely reveals the emotional struggles of a professional investor when faced with the conflict between fan responsibility and rational decision-making.

The full text is as follows:

Last Friday was a painful day.

This is my reflection.

In the latter part of this article, we will follow the standard process to sort through the historic event of last Friday's precious metals washout: What do we think actually happened? Why? What impact did it have on portfolios? And where do we go from here?

But first, here are my reflections. If the content becomes a bit… philosophical, please bear with me.

The quote at the beginning of this article (Note: referring to "Pain + Reflection = Progress") is not just a motto for me; it is a way of life. It is one of the most profound lessons I learned during my time at Bridgewater, and a way to contextualize all the pain in life.

On the road to your goals, you will face challenges. On the road to financial goals, there will inevitably be drawdowns.

In terms of drawdowns, I have experienced worse. Perhaps not in a single day, but certainly throughout my life. Of course, things could get worse; perhaps the volatility in silver and gold is a "canary in the coal mine," signaling a series of cascading "liquidity competitions" that could push down asset prices and increase demand for safe-haven assets like the dollar, bonds, and Swiss francs. That is indeed a possibility.

In the coming days, you will undoubtedly see a plethora of experts emerge from the woods saying, "I told you so!" Peddling this or that viewpoint, throwing screenshots in your face. To some extent, I have done similar things when the trade direction was the opposite (up), so I am no different.

But the reality is, no one knows the future. There are always some unknowns; the world is chaotic and dynamic. While this makes gaining an edge possible, even the top investors have a win rate of only 55-60%. Gödel's machine will never truly be complete. That is why diversification is important, why hedging is necessary, and why you see the best investors maintaining a sense of humility almost all the time, even though the accompanying compliance language can make it hard to read their true intentions.

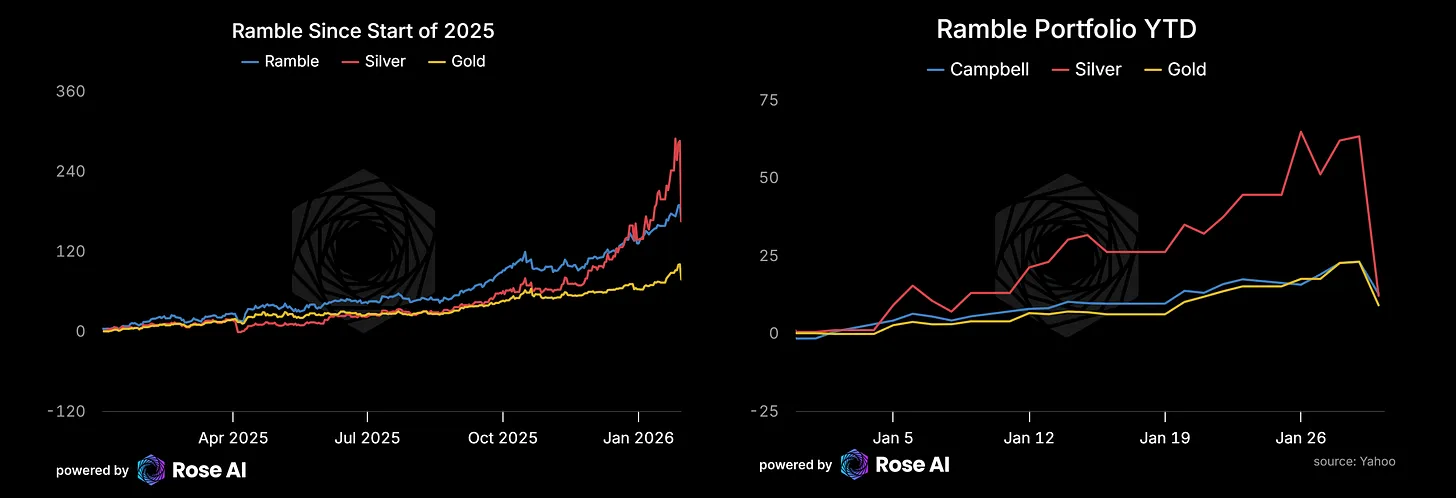

Nevertheless, I believe it is crucial to focus on the moments when you make mistakes, diagnose what happened, and try to learn—about the world and about yourself. When your annual returns grow by 130%, it is hard to reflect. But when you have a portfolio with an expected annual volatility of 40% that loses 10% in a single day, reflection becomes a necessary requirement.

From Thursday night to Friday afternoon, many thoughts flashed through my mind. Later, we will discuss the rational process of trying to track the evolution of the world, piecing together the truth of the story, analyzing the causes, and considering responses. But before that, I want to talk about the emotional side.

All professional investors, or at least those who take substantial risks in the public markets, will understand what I mean when I say "investing is often emotional." You have two demons in your head: greed, telling you to keep pushing and further leverage your alpha; and fear, battling against the realization of "I might be wrong, and there is so much I don't know."

What particularly interests me is a new feeling that emerged from Thursday night to Friday: a sense of responsibility.

You see, many of the people reading this blog are newcomers. The allure of returns always attracts attention, and the price fluctuations from $60 to $120 brought a lot of traffic to these pages, filling my inbox with messages. Some thanked me, while others sought my opinions. In my comments section, it seemed like an endless stream of people were asking for minute-by-minute updates, support levels, and so on. This process may be familiar to well-known public figures, but it is relatively new for me.

If you follow my Twitter/X, you will know I try to adopt an irreverent tone. This is a style I learned during my time debating at the Oxford Union—walking the line between insouciance and incisiveness. It is not entirely an act, but a worldview: I usually strongly believe I am right, while also knowing I am often completely full of shit, and that these views can rapidly evolve in the face of new information. I think this perspective resonates with many professional "shitposters."

When you become "micro-viral," what changes is that even if you strive to maintain that irreverent tone to convey information, the actual audience listening becomes increasingly larger. You transition from friends, colleagues, and internet personalities to countless strangers reading your articles, interpreting you, and interacting with you. Besides knowing that as the reach widens, the context of your message may be diluted (like the internet telephone game), there is also a lag issue.

I first started writing about the relationship between silver and solar energy in 2023. About 18 months ago, I began "beating the drum" to recommend it. At that time, my portfolio was 100% long. As prices rose from $25 to $40, then to $60 and $80, I gradually reduced my risk exposure from "irresponsibly long" to "dangerously long," and then to "still long." I sold a little or rolled options, trying to lock in profits while maintaining exposure. The problem was, as silver climbed, its volatility also increased. So I was still performing well. Critics would say this was a red flag, and indeed it was (we will discuss this later in the section on "signals"), but the point is, you ultimately find yourself in an awkward position: even though many people were on board at $25 or $40, you realize that due to the lag in people writing articles and reading information, the average weighted buy-in price could be as high as $90.

This puts you in a very interesting position. You feel that if you "cut and run" just because of a chill down your spine, you would feel guilty, just as I felt at certain moments over the past week. You feel you owe it to those who appreciate your work to stick with the trade and put yourself in their shoes.

From a risk management perspective, this is completely foolish. You can tell yourself that if you were managing other people's money, you would have cut all positions on Friday morning when the Chinese market opened and instead of a rescue, there was a massive sell-off of gold. You can rationalize that if you were managing other people's money, you wouldn't hold so many positions in copper. You would have exited the risk when it rose 10% on Friday morning. But ultimately, a portfolio is a portfolio.

Before we get into the parts you care about most, let me say one more thing.

Some of you subscribe because you like my views on silver and the market. Some do so because you enjoy my rambles.

Looking ahead, I am considering separating them. The rambles—about philosophy, worldview, and reflections on the process—will remain free. If I start publishing specific, actionable trading ideas and providing real-time updates, that may turn into a paid project. This would create real accountability on my end and generate real value on yours.

Now, just know that not every post will be about "the rock." Some of you may not like that. That's okay.

Given all this, what exactly happened?

How historic was this?

Before diving into a detailed analysis, let’s put last Friday's situation into context. Because I don't think people realize how rare such magnitude of volatility is.

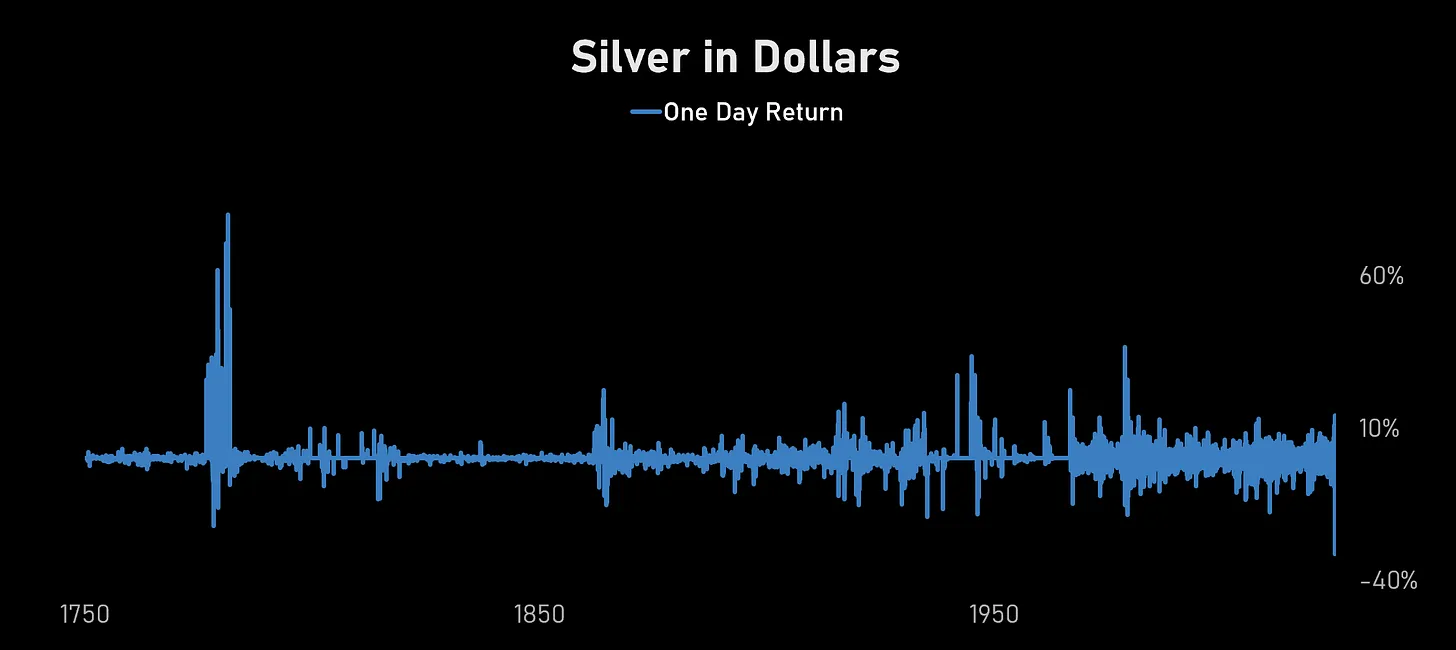

That is the daily return data for silver over 275 years. The volatility last Friday was one of the largest single-day drops in the entire history of the metal. We are talking about events comparable to the end of the gold-silver bimetallic standard, the collapse of the Hunt brothers, and the volatility of March 2020—only this time it happened on an unremarkable Friday in January.

The volatility surface pricing before Friday indicated that a 3-Sigma move was considered a tail event. What we got was about 6-Sigma. Such occurrences should not happen according to historical distributions, but they do happen when everyone's positions are aligned and liquidity disappears.

Specific Details

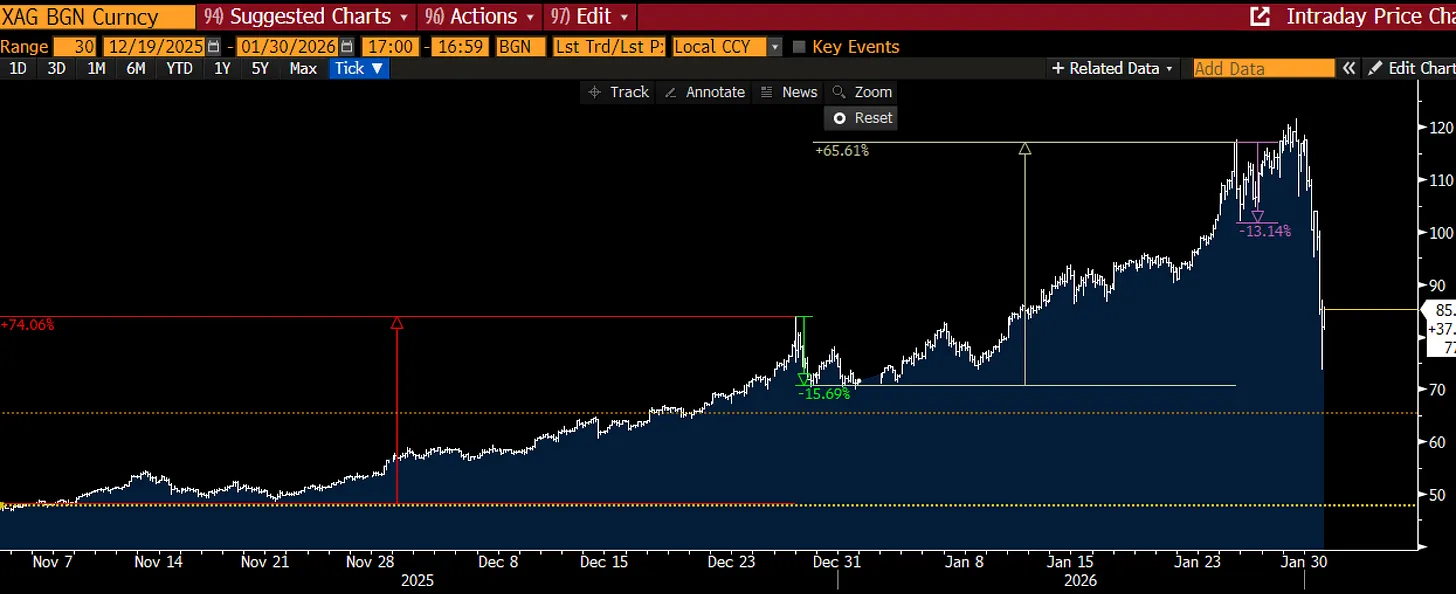

If you track this story from a narrative perspective, even before Friday, the past few months have been a wild journey. Silver opened in November at over $40, rebounded 74% to about $85 by the end of the year, and then pulled back 15% before year-end. As we mentioned in the previous article, the bulls then defended the trend, initiating another monster-level 65% rebound, peaking at about $117 on Monday (note, this was in the New York market), after which Western sellers entered and the price dropped again by 15%.

Gold largely mirrored these movements, with the trend of "New York selling, Shanghai buying, metals flowing east" appearing intact.

Even until Thursday morning, the news was dominated by copper prices rising 10% overnight. (This was another warning signal indicating that things were becoming a bit out of control, which we will discuss in a subsequent article about the red metal).

Feeling this intense chop, I reduced some positions and posted this tweet. It was more of a message to myself. The number 30% had been lingering in my mind, just pushed aside as a voice born out of fear rather than rationality.

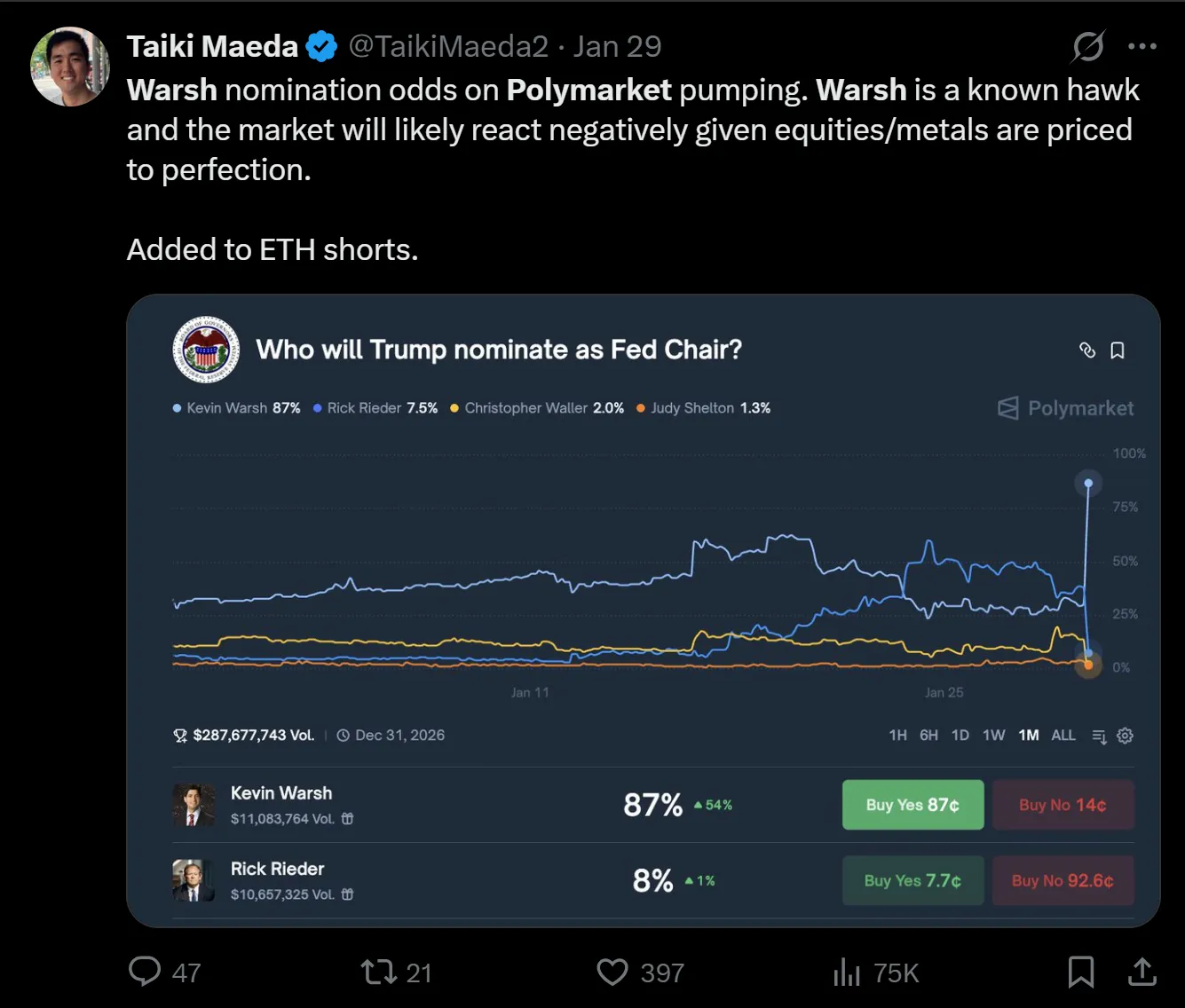

Later on Thursday, Kevin Warsh appeared, confirmed/leaked to be nominated as the Federal Reserve Chair on Polymarket.

Warsh is seen as a sort of advocate for "hard money," and I take that in stride. You see, I briefly met him at Stanford University about ten years ago. At that time (around 2011-2015), he was known for calling for the normalization of the Federal Reserve's massive quantitative easing (QE) policies after the financial crisis. Back then, he seemed more like a politician than an economist, and I always felt that his hawkish stance was a way for him to stand out in a sea of advocates for loose monetary policy. After all, it’s easy to call for interest rate hikes and balance sheet reductions when you’re not in the driver’s seat.

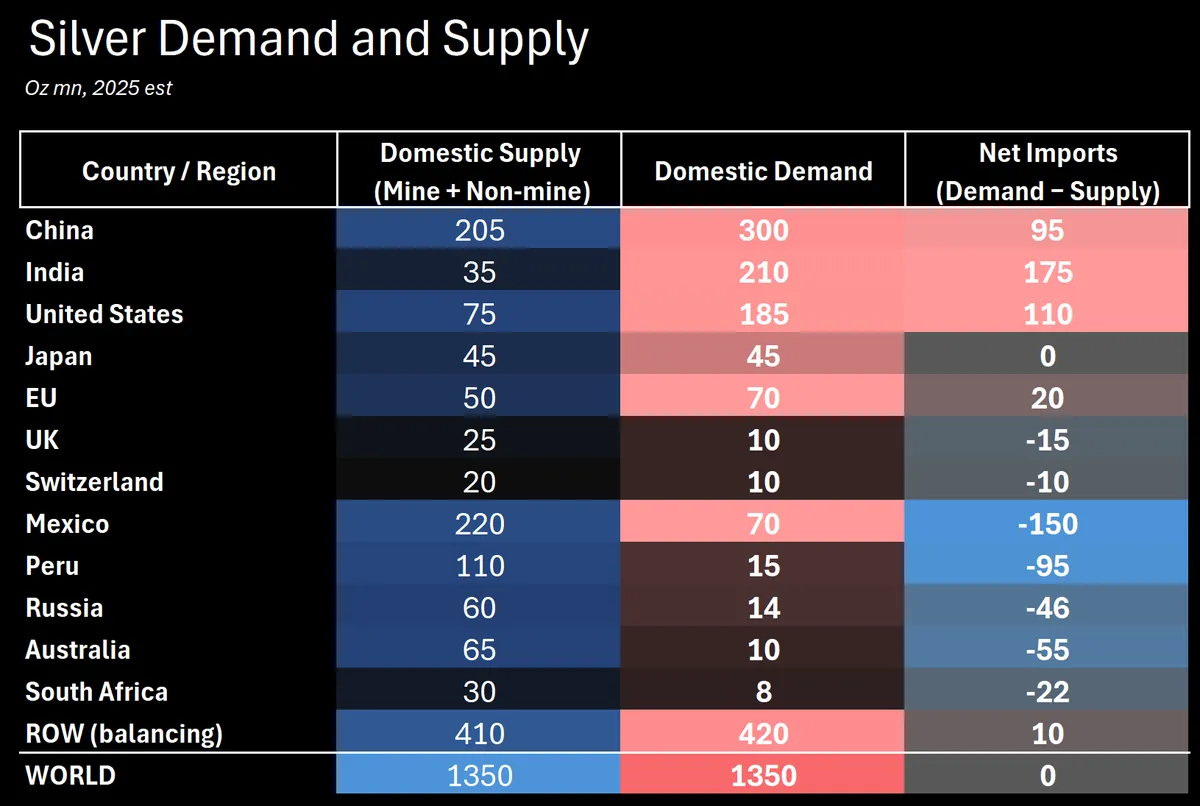

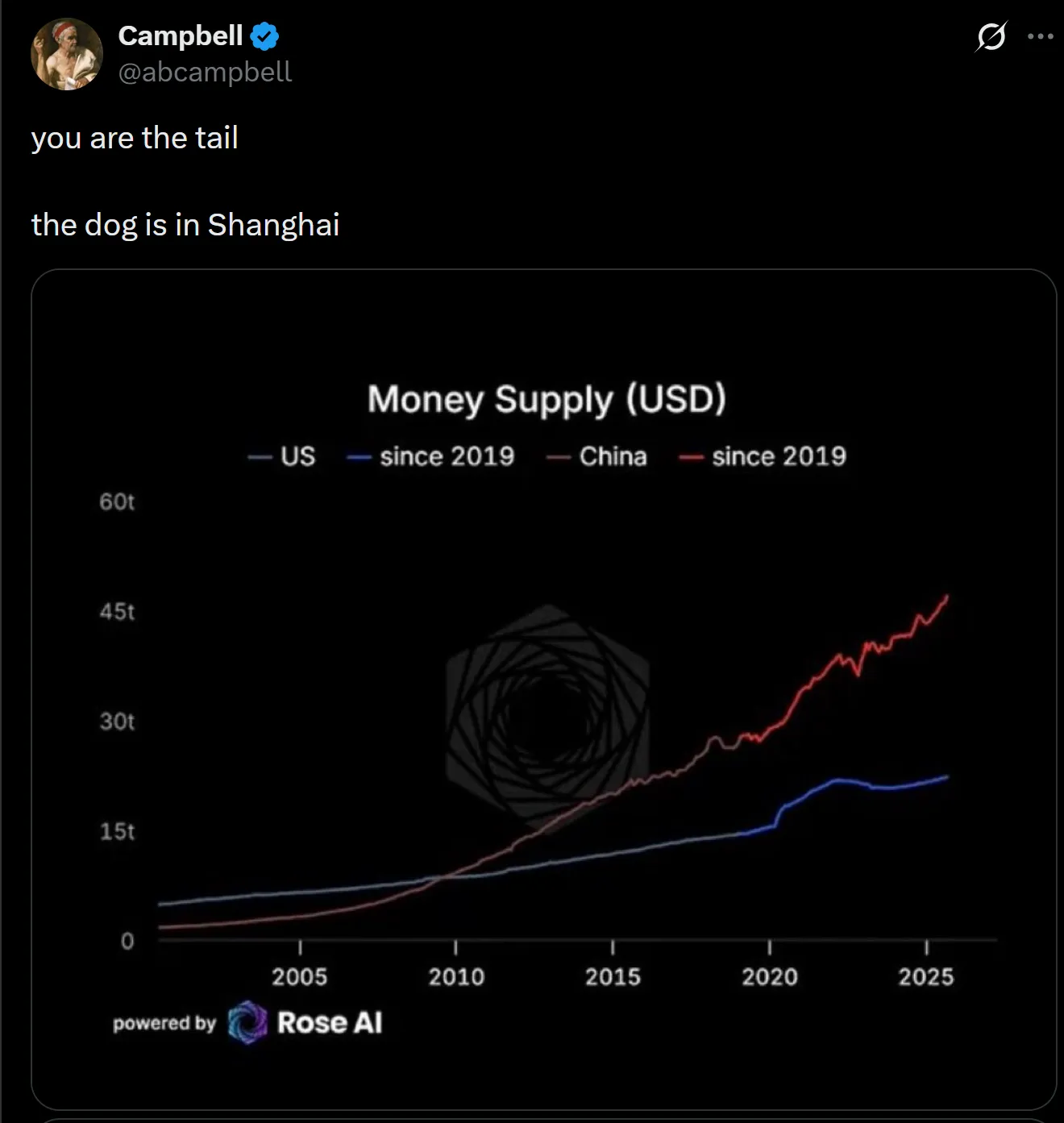

So, even though I had significant risk exposure in commodities (in fact, more in copper and gold than in silver), I thought I would only suffer minor injuries and then wait for the Chinese market to open. Just a reminder, as I have been posting for months, it seems that Western metal investors do not realize that "you are the tail, and the dog is in Shanghai." They underestimate:

a) How concentrated the actual demand for these metals is in the East:

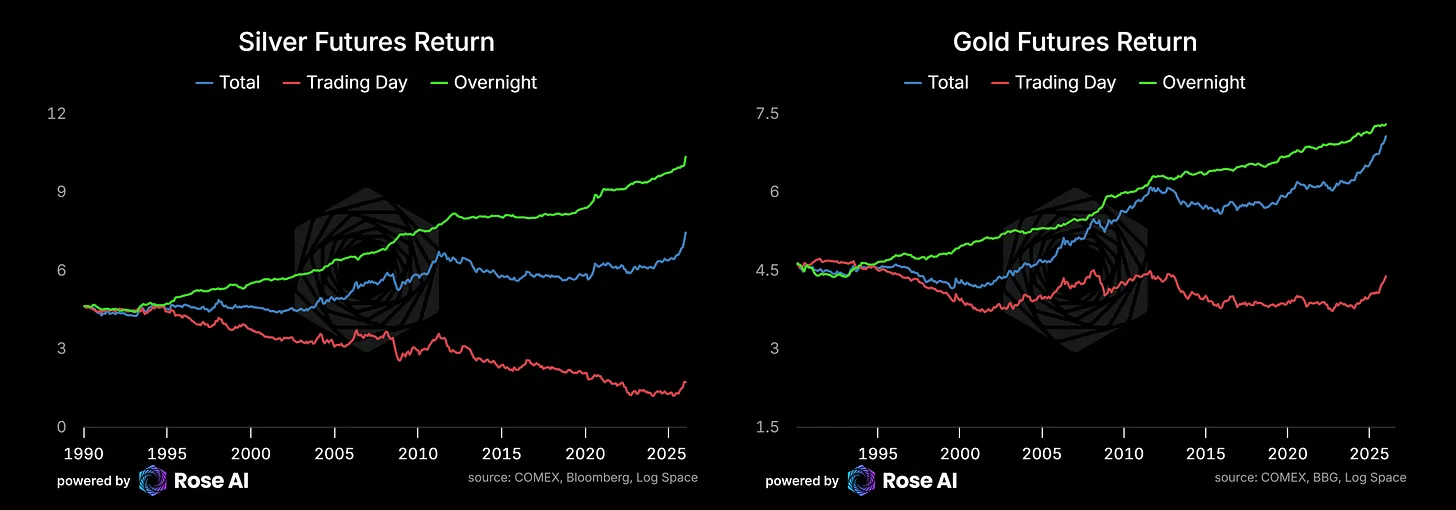

b) How much of the total returns from these metals comes from the "overnight" market (measured by the returns from yesterday's close to today's open):

c) How much actual capital China has compared to the West:

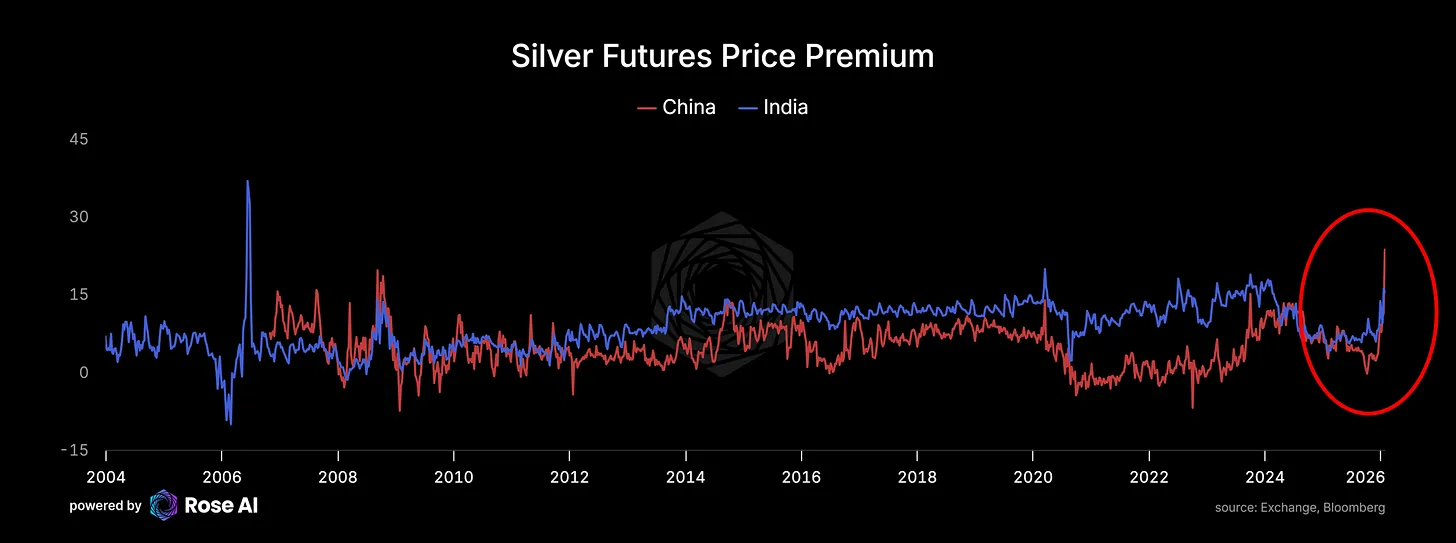

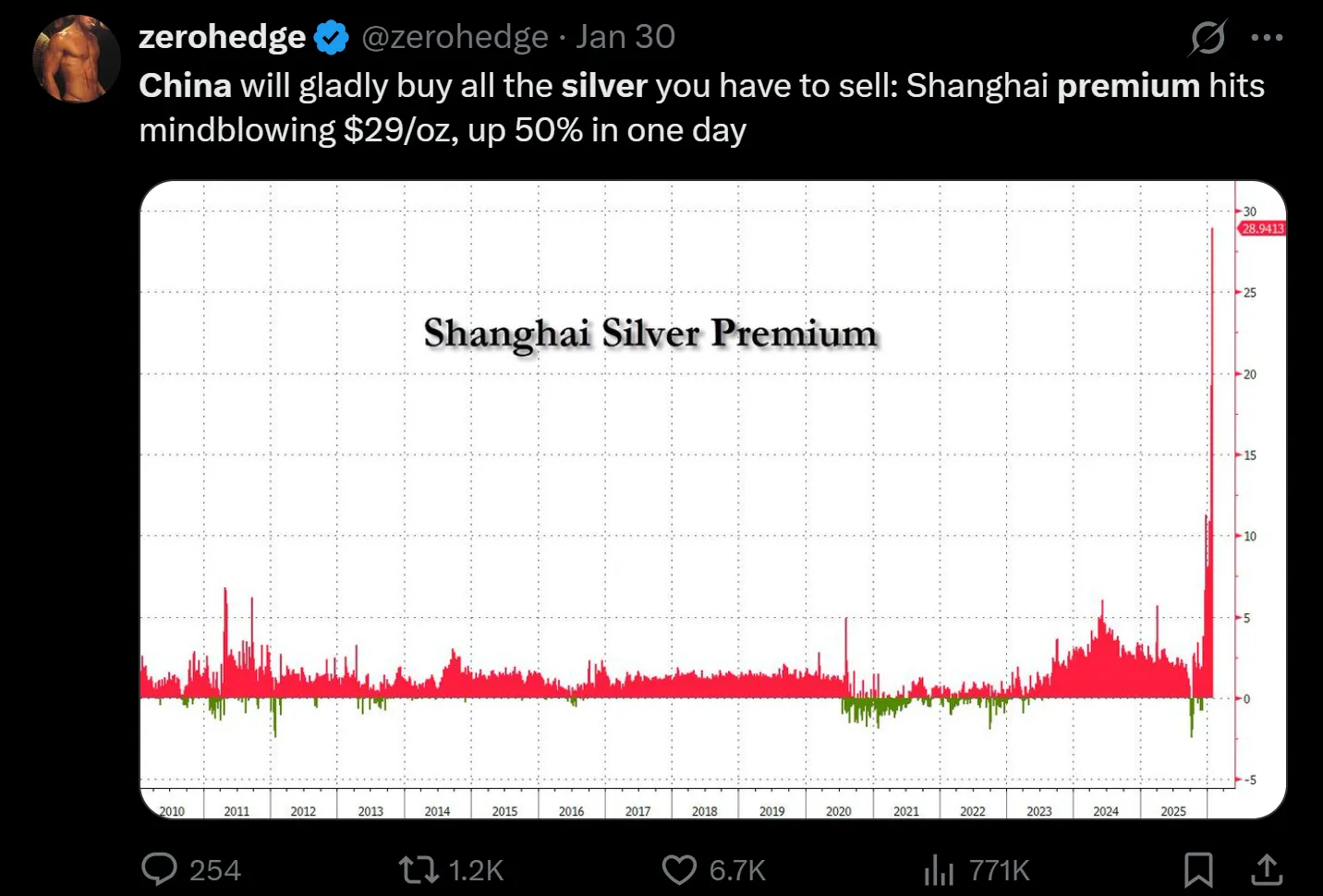

Yes, there is a lot of confusion online about how much of the "China premium" is due to the value-added tax (VAT) imposed on retail physical delivery. There are many things in the macro realm that are both difficult and confusing, so instead of calculating, people online just throw charts at each other, with bulls ignoring this point and bears using it as a weapon to sow doubt in the narrative that "China is driving up prices." To me, this is a classic case of "looking at changes rather than levels," because it is clear: a) This premium (or discount) has increased recently, b) This situation has also appeared in India.

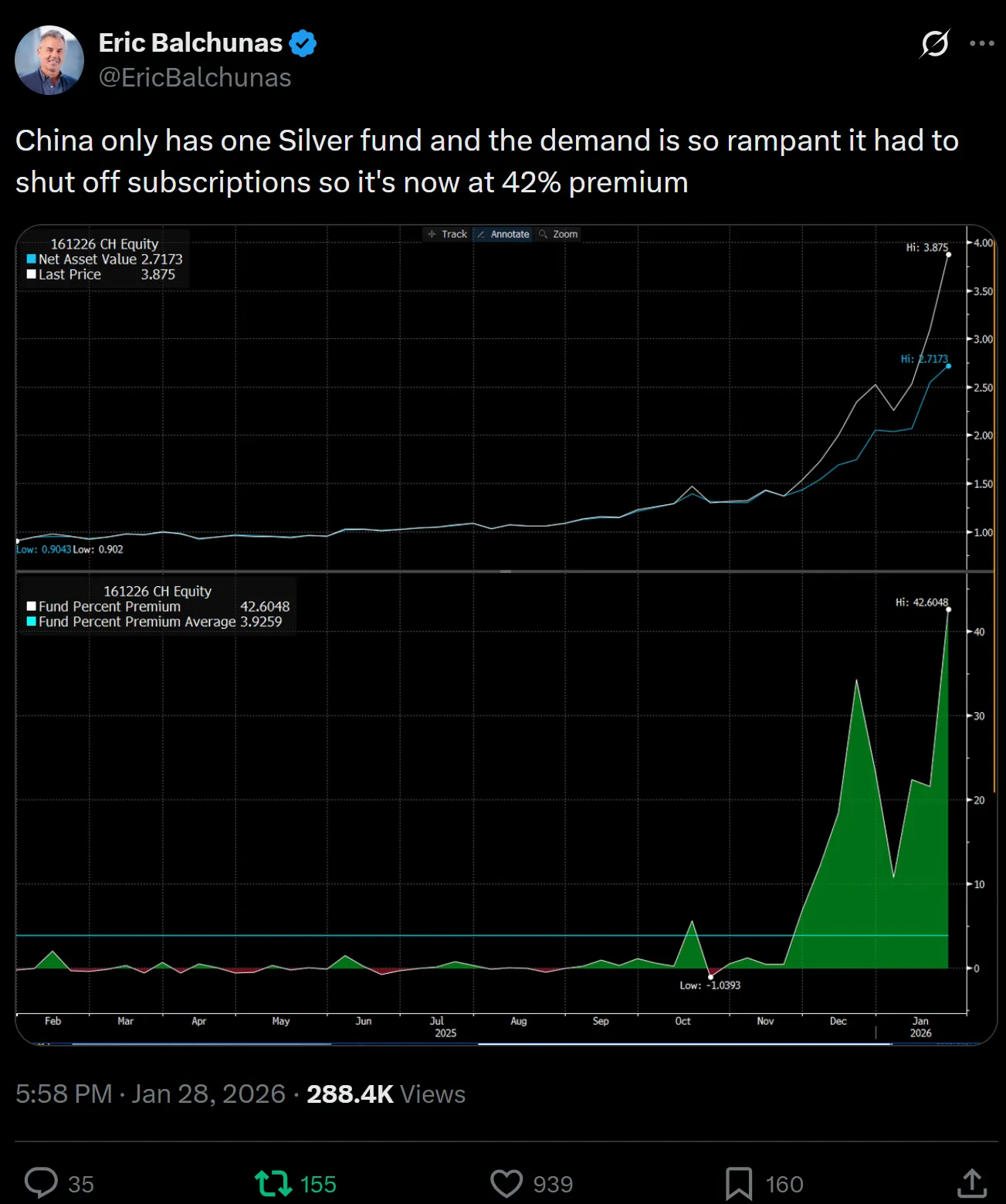

But I could feel the bearish narrative gaining momentum. Even with demand backing it up, such as the absurd premium on the only pure onshore silver fund.

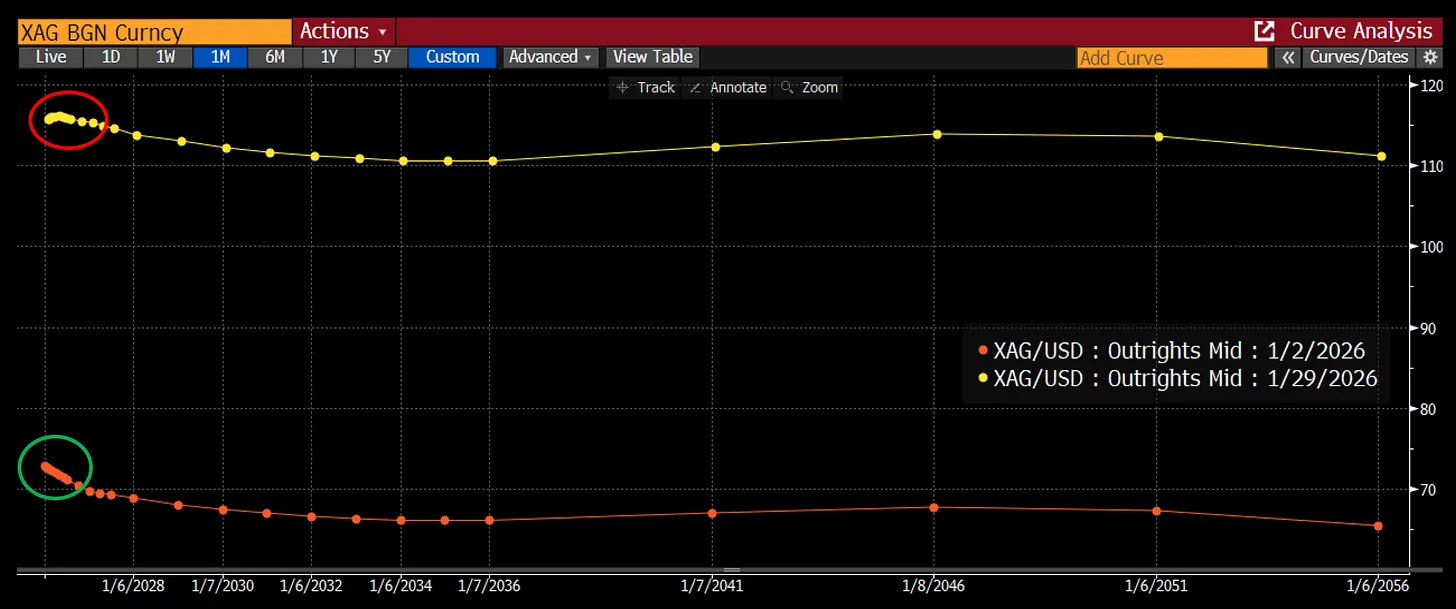

Moreover, there is indeed some evidence that the pressure for physical purchases has eased, most directly reflected in the "front end" of the London silver curve. Over the past month, its "spot premium" (Backwardation) has significantly decreased.

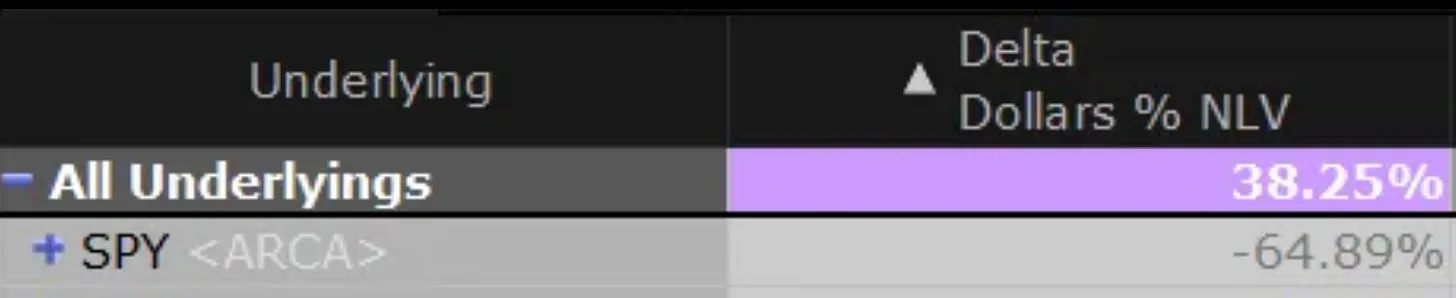

Before nightfall, I reduced my Delta (hedge value) to nearly flat, but I thought, "let's wait and see how China opens." This may have been my biggest mistake.

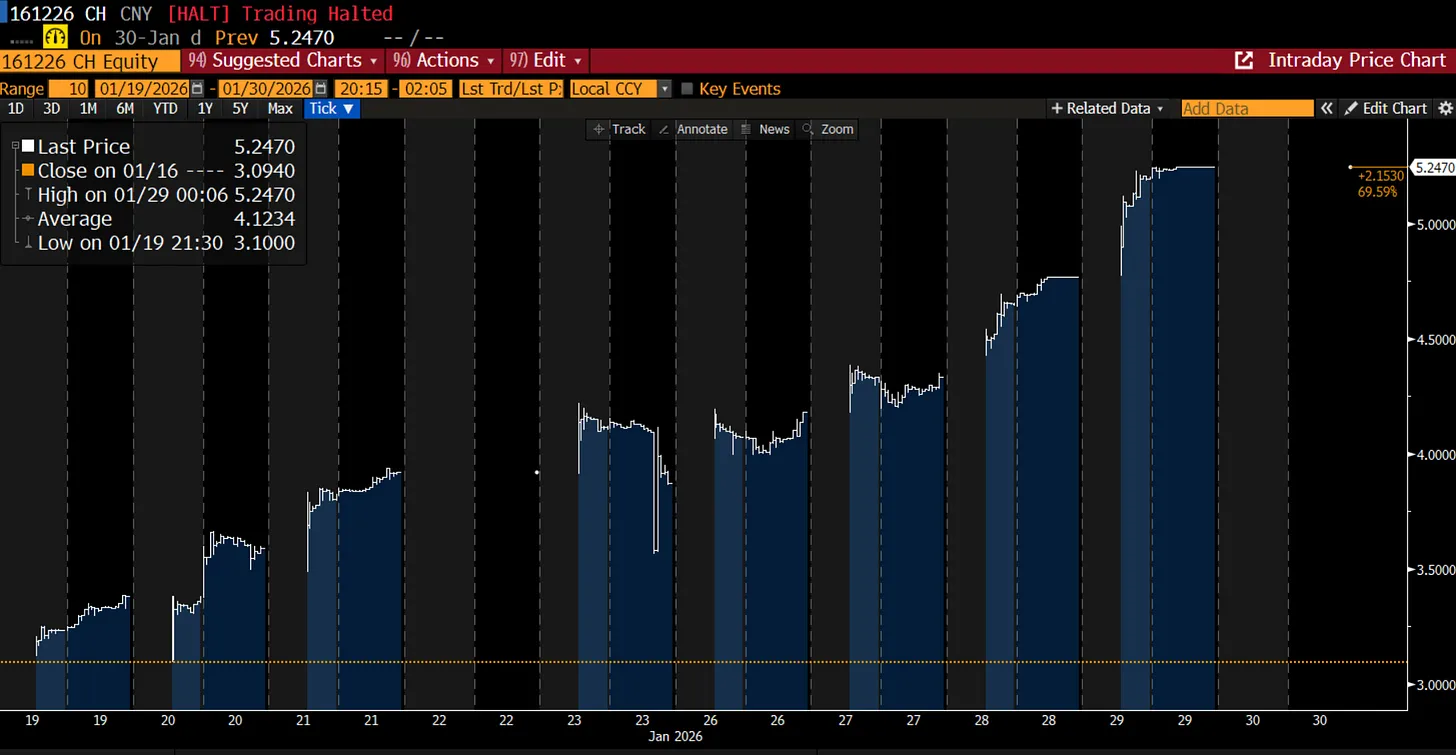

China opened, and not only did it not rebound, but it also faced a sell-off. Not just silver, gold also dropped 8%. This was the first strike (Strike one). At that time, I didn’t know, but the local Chinese silver ETFs had actually suspended trading.

This meant that retail investors in China were not coming to the rescue.

This was a signal to retreat. I checked my portfolio, drafted a position list, and felt satisfied because most of my long exposure was in the form of options, so if there was a complete washout, I would feel pain but not face a margin call. This was the second strike. Not just because I should have sold directly in the futures market (at that time, GLD and SLV had not yet opened, and I had a distaste for futures due to painful lessons from forgetting to roll over positions during the years I wasn’t trading full-time), but because I should have committed to immediately reducing my positions when the market opened. Yes, I had a full day of meetings that made it impractical to flatten a portfolio consisting of 20 options positions, but I didn’t want to sneak away like a dog running away in the night, because there were still so many people long on the trade. This was the third strike, perhaps my worst decision.

You probably know the rest of the story. The U.S. market opened with a sharp drop and then plummeted further. The sell-off was relentless, and by the time I realized what was happening, it was too late. Because as the day progressed, my fourth strike immediately became apparent.

We were in a "short gamma" market.

This is what it feels like to short volatility

"Short volatility" is not just a mysterious state; it actually represents a mechanical process where market movements are exacerbated by machine-like market behavior.

The most obvious example is 1987, when portfolio protection put the market in a short volatility state (or "short gamma" in options terminology), as insurance plans were forced to sell more and more futures as "spot" prices deteriorated.

In hindsight, it’s crazy that I was actually familiar with this dynamic, because in October, when GLD and SLV fell below the bottom strike price of my options, I had suffered from this pain.

In simple terms, the mechanism works like this: you and I go buy call options. Typically, the person selling you the options needs to hedge. They are not betting on direction but on the premium you paid being higher than their expected losses from "Delta hedging" on the other side. They sell call options and buy stock as a hedge. If the price rises and breaks through the strike price, the Delta of the options increases, and they must buy more stock. Conversely, if the price falls below the strike price, the Delta decreases. Now they have more stock, so they must sell into a declining market.

This behavior operates almost mechanically and can usually be observed in asset price movements that seem to have no bottom. The market is particularly susceptible to short gamma effects as it approaches monthly or quarterly options expiration. If you look at the historical records of these flash crashes, I would bet that most of them occurred near or around these expiration dates.

This happens in the options market and is also realized through leverage. When investors buy assets with leverage, they typically need to provide collateral to facilitate the trade. When prices fall, exchanges or their market makers will require them to 'provide collateral,' which means adding more cash. When there is too much leverage in the market, they often have to sell certain assets to realize that cash. Essentially, this puts them in a state of short volatility.

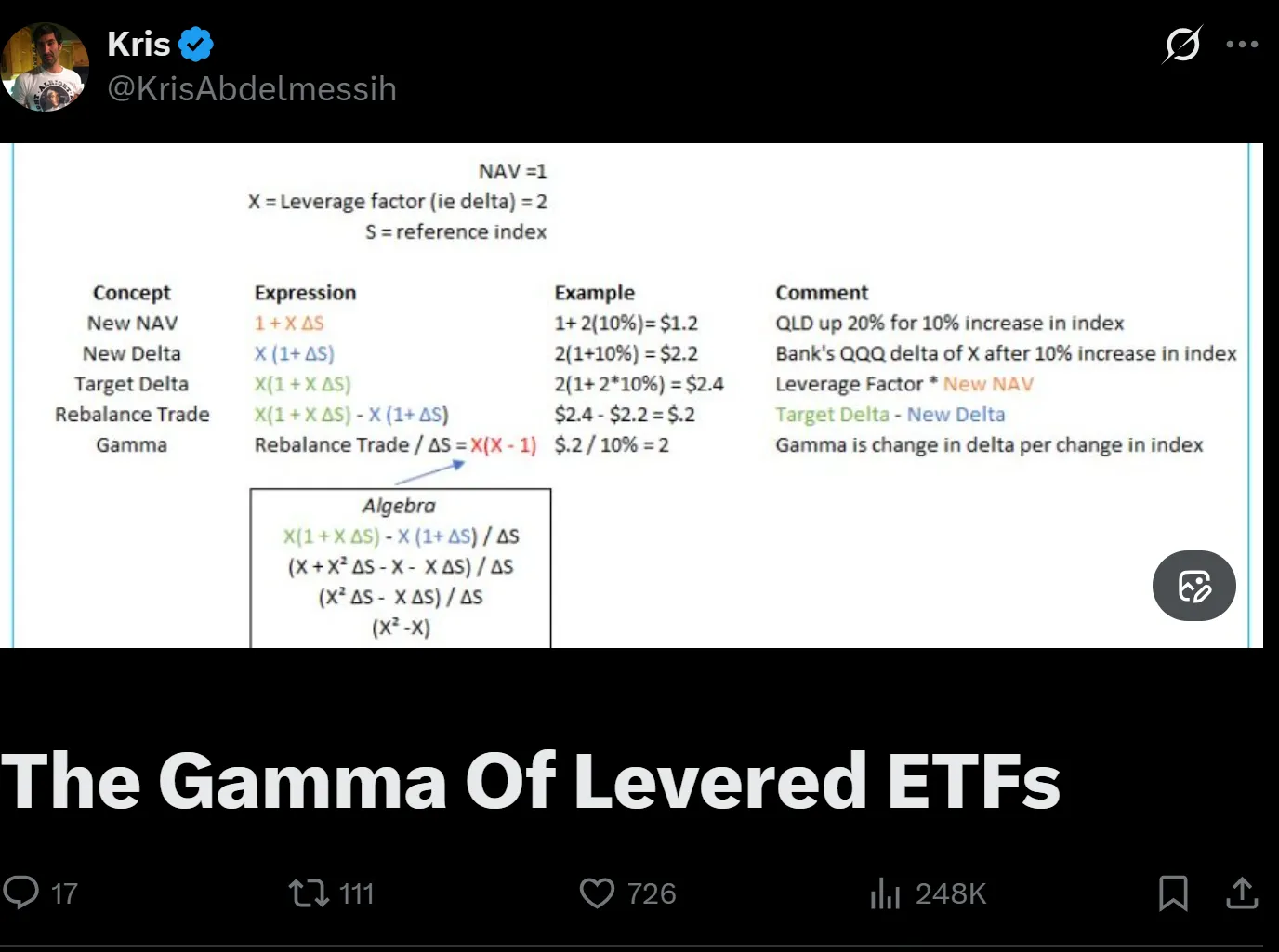

The third way this market is in a "short volatility" state surprised me. I didn’t realize that the "double-leveraged" silver fund AGQ had accumulated $5 billion in assets. This means it holds $10 billion in silver (through futures). The fund "rebalance" every day, so when people woke up to find silver down 15%, the fund effectively lost 20% * $10 billion, or $2 billion. This left the fund's value at $3 billion before redemptions. This means their new Delta is $6 billion, and they must sell $4 billion of silver!

Previously, options expert Kris outlined this dynamic:

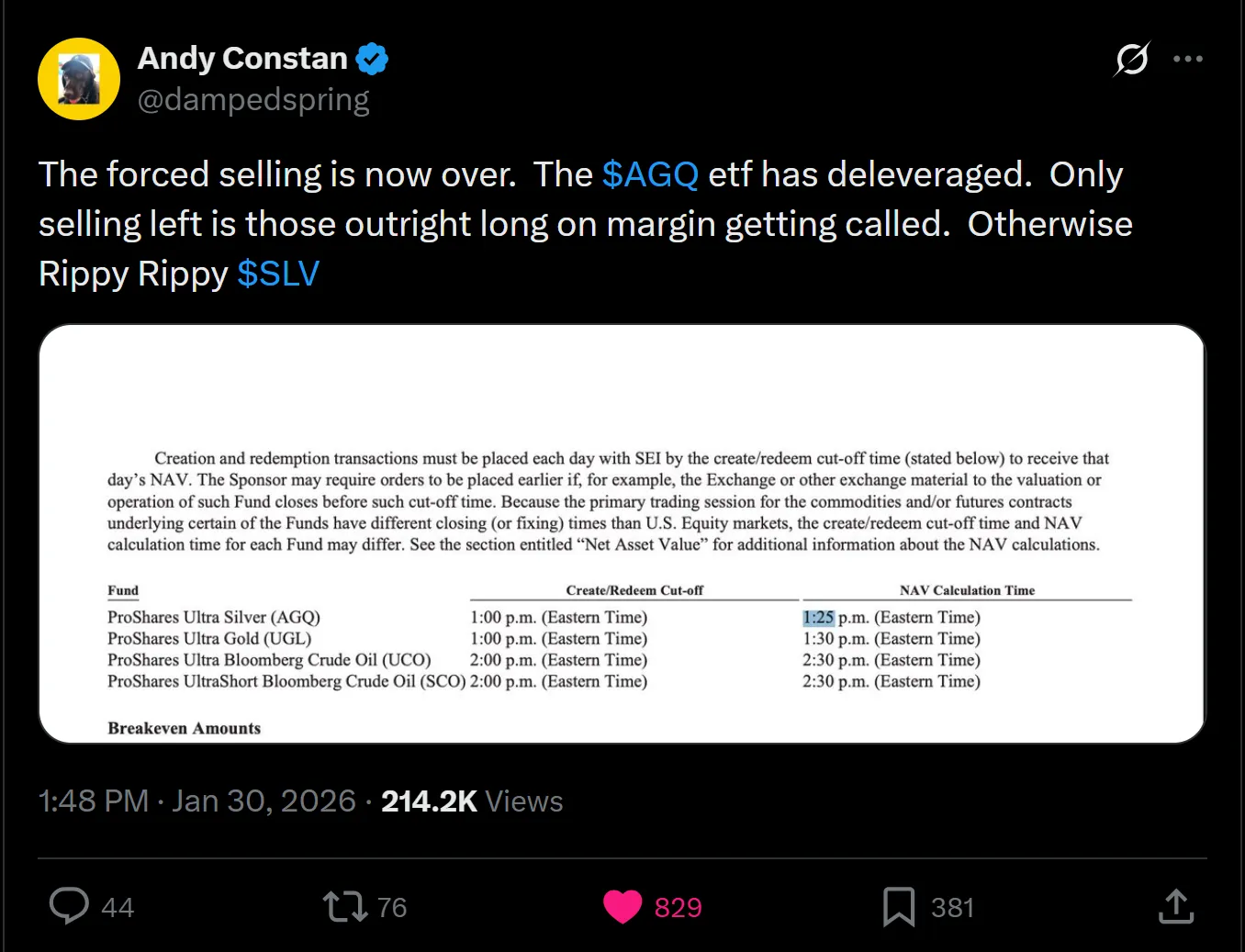

My friend Andy Constan reminded me of this dynamic and also told me that the "rolling" occurred at 1:30 PM.

Just a few minutes after I had been waiting for some tentative bottom signals, I bought SLV at the $71 level and doubled my position by buying stock, buying call options, and selling a put spread below the strike price. Even if I couldn’t outperform my own work, I wanted to profit by leveraging the Alpha from market relationships.

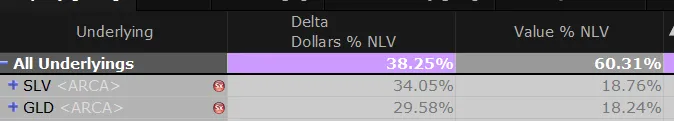

In fact, I have a fourth way of being in a "short volatility" state. Since I tend to buy call spreads and butterfly spreads, I have been "rolling" my options as the strike prices have increased. This gave me a false sense of security. By the end of that day, I had lost 2% on silver and 2% on gold. Including losses on copper and other positions, we were down 8% overall, wounded but not down. This brought our year-to-date (YTD) return to 12.6%, with a cumulative return of 165% since January 25.

Alright, if you’re still reading, we now have an answer to why silver was destroyed; we have a mechanism—short volatility—operating through three channels: excessive leverage, short options gamma, and leveraged ETFs.

But where do we go from here?

Fog of War

First, we need to clear the fog of war. Given that the Chinese market closed before the worst moves in the U.S. occurred, the current simple estimate of the "China premium" is completely disconnected.

The same reasoning applies to the claim that "SLV is trading below its net asset value (NAV)."

This seems more related to SLV using the London clearing price to calculate its NAV (and when the worst situation occurred, London was already closed). From Friday's intraday prices, the ETF appears to be very consistent with the movements of futures prices.

Currently, aside from a possible rebound on Monday, the real question is "How will China open on Sunday night?" If you believe the rumors online, physical prices in the East are still at the level of $136, which means we might see a +5-10% increase on Monday.

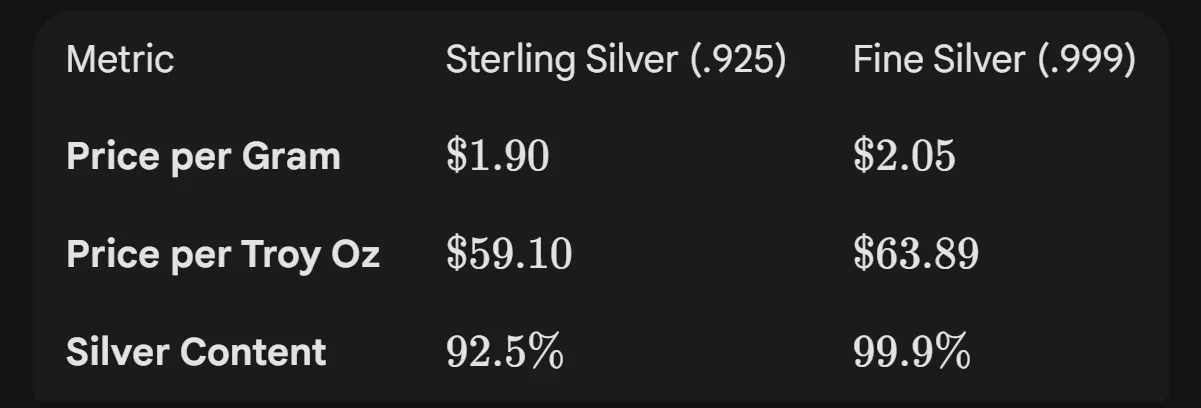

My fiancée is currently hiking, and she reports that jewelers in the West are still selling 925 silver (92% purity) at $1.90 per gram (or about $64 per ounce of pure silver). So the basic situation seems to be that silver is cheap in the West and expensive in China.

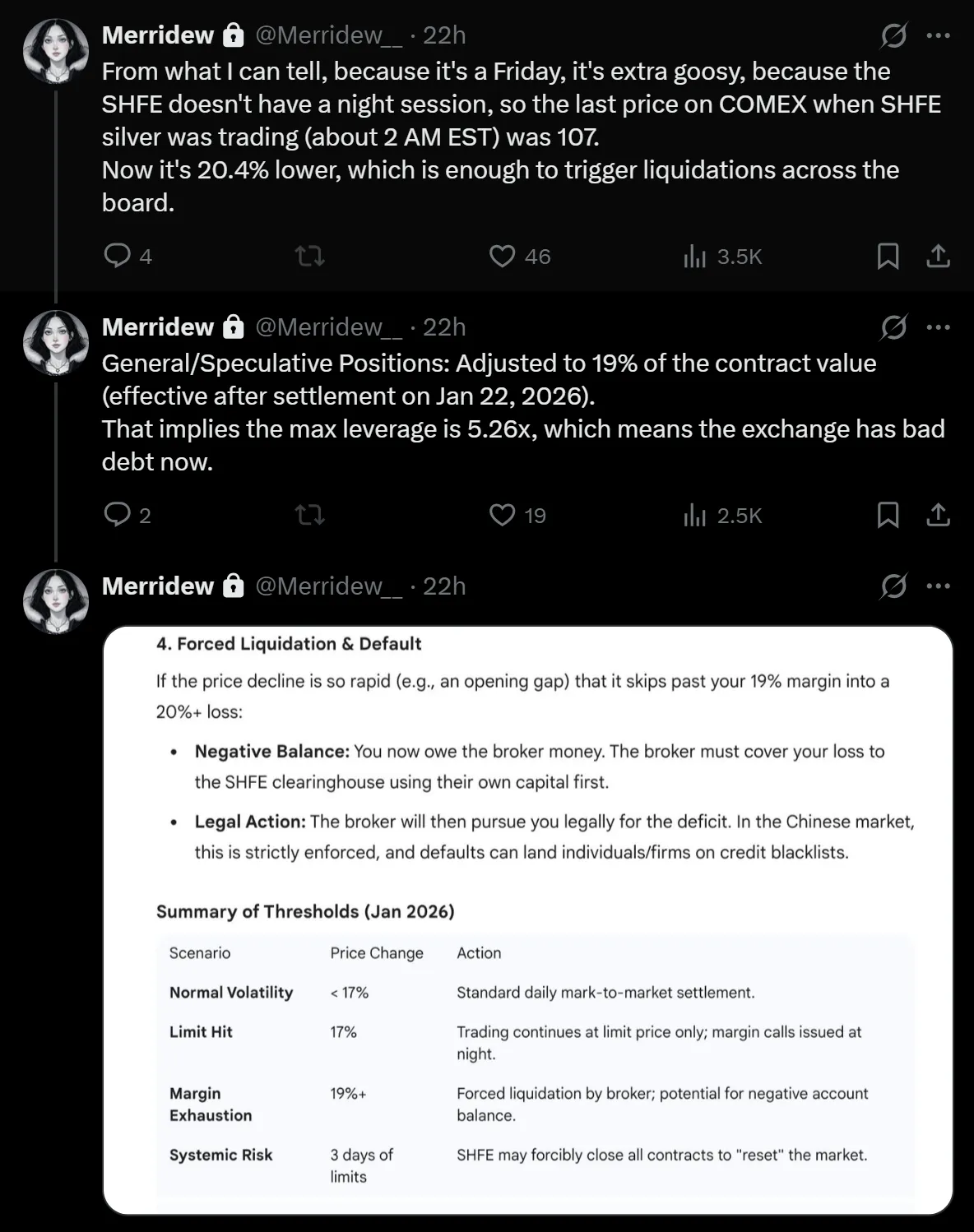

Whether this will lead to a price increase will depend on local conditions. As Merridew pointed out, it is very likely that Chinese leveraged investors will be forced to liquidate at the opening on Sunday night/Monday morning.

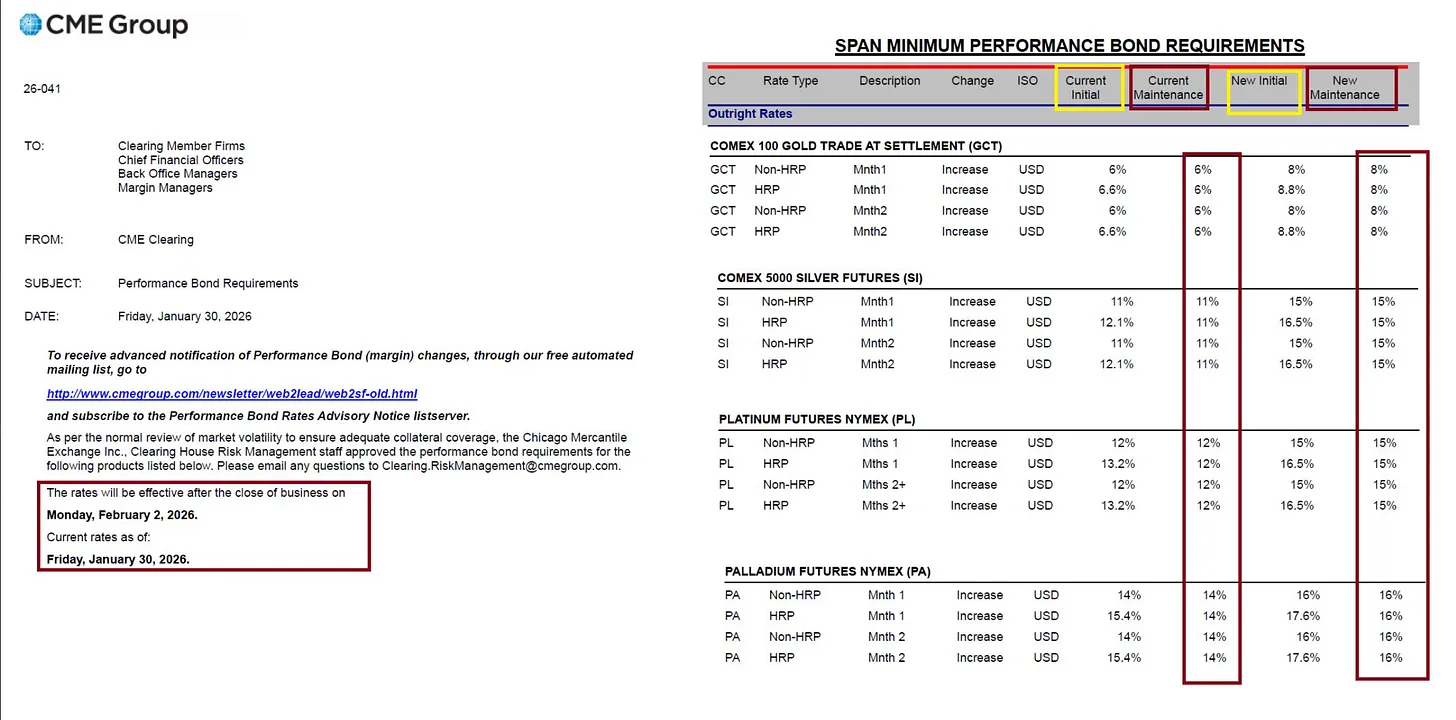

Additionally, the CME raised margins again on Friday, but keep in mind that due to prices dropping by about 30%, even higher margins may mean that net cash extraction for longs could be minimal. The margin per unit of silver has increased significantly, but the total amount of futures margin remains roughly the same.

Source: @profitsplusid

Bitcoin pricing here does not look bullish and seems to be the result of a combination of forced selling, ongoing concerns about quantum computing, and expectations regarding the MSTR issue.

Based on an analysis of its peculiar business model from 14 months ago, we still hold short positions.

What are the Bullish Reasons?

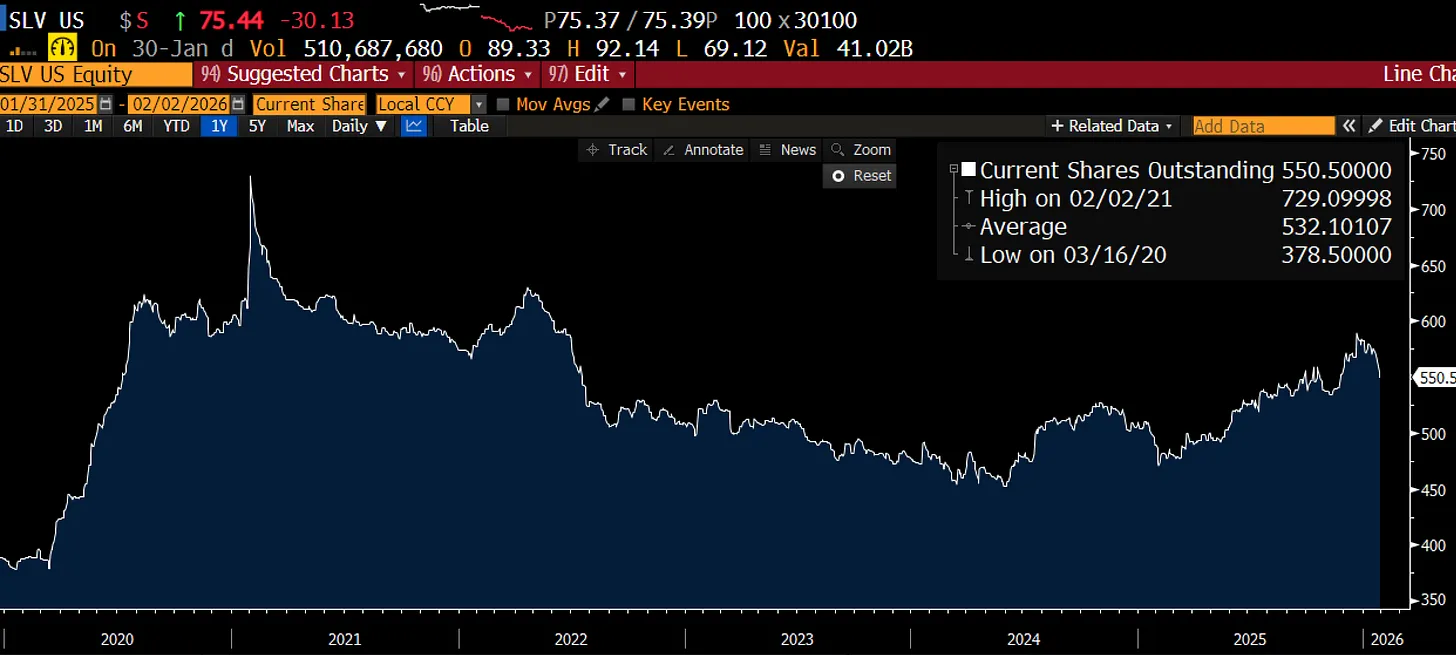

First, the stock price of SLV (the silver ETF) had already started to decline before the big drop on Friday. As prices fell, this means that the nominal risk exposure has significantly decreased.

Unless there is some extreme deleveraging action in the Chinese market on Sunday night, the sell-off of AGQ (the double-leveraged silver ETF) has likely become a thing of the past. Any significant rebound or recovery will have a counteracting effect—just like short call options, forcing those people to buy additional shares when prices rise. As for me, I bet that the Chinese market will not fall all the way to the bottom. And if we really see some forced liquidations, the stock market will likely not be spared either.

One last point worth noting—the geopolitical backdrop has not become more tranquil. If anything has changed, signals from Tehran indicate that we are not further away from some confrontation, but rather closer. Historically, precious metals perform well in such environments, even if the road to success becomes extremely chaotic. Considering all these potential deleveraging forces, you should view current positions as highly tactical. I reserve the right to completely liquidate or go to a negative Delta (short Delta) position across the entire commodity curve as the situation evolves.

Perhaps I have overbet on short positions, but I am increasingly concerned that the stock market will experience a substantial pullback as people begin to price in the "air gap" between the cash flow required to invest in data centers and the actual revenues of these companies. Yes, the era of AI agents is coming, and yes, Moltbook (the name of the AI tool) is indeed interesting (if operated correctly, it will consume a lot of tokens), but deploying AI in enterprises still faces huge logistical, compliance, and operational hurdles. Much of what you see on Twitter/X about the workflow revolution comes from independent hackers, creators, or small companies with flexible and easily renovatable business processes. My estimate remains that agents will primarily start going live on the enterprise side by the end of Q2, followed by revenue. This makes U.S. stocks particularly susceptible to the kind of dynamic that severely impacted Microsoft last week.

Therefore, from a relative value perspective, I still remain bullish on metals. But I am willing to admit that I could be wrong and seek to respond more timely to market conditions.

It all started with that saying about pain and reflection. Friday brought a lot of pain, and this article is my attempt at reflection. The core thesis has not changed—solar demand, capital flight from China, supply constraints. What has changed are the prices and positions, as well as my realization that in a market that feels like it will only go up, there is so much "short gamma" risk hidden.

Pain + Reflection = Progress. Let’s see how this progress presents itself when the Chinese market opens on Sunday night. Wishing everyone successful trading and safety. Until next time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。