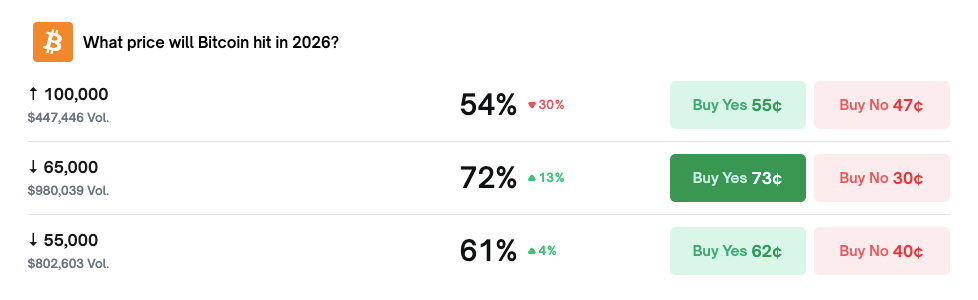

The weekend sell-off briefly pushed Bitcoin's price below the psychological threshold of $75,000, and market sentiment seemed to change overnight. On the prediction platform Polymarket, a striking bet is gaining traction: the probability of Bitcoin falling below $65,000 by 2026 has surged to 72%, attracting nearly a million dollars in wagers. This is not just a numbers game; it reflects the undercurrents swirling deep within the current crypto market—from the euphoria following Trump's victory to the widespread anxiety over a "deep squat," the speed of this transformation is astonishing.

What has raised alarms among some veteran players is that this drop has put MicroStrategy, the publicly traded company with the largest Bitcoin holdings globally, to the test for the first time since the end of 2023, as its average holding cost is being breached. It's like a marathon leader suddenly finding the track beneath them becoming slippery.

Why has market sentiment turned sharply downward?

On the surface, this appears to be a price correction. However, a closer look reveals several forces intertwining to pull the market in different directions.

First, there are technical "breakout" signals. According to observations from some on-chain analysis firms, Bitcoin has actually entered a period they define as a "bear market" since it fell below its 365-day moving average in November 2025. This long-term average is often seen as the "bull-bear dividing line," and once breached, it typically triggers systematic sell-offs by technical traders. I remember during the bear market of 2018, similar long-term averages were breached, leading to months of prolonged declines and bottoming processes; buying in too early was akin to "catching a falling knife."

Second, the "tap" of macro liquidity seems to be tightening. Some macro analysts point out that the current correction is more a result of the overall tightening of liquidity in the U.S. financial environment rather than any fatal issues within cryptocurrencies themselves. Changes in the Federal Reserve's balance sheet and the siphoning effect of Treasury bond issuance—these seemingly distant macro factors are actually being transmitted precisely to Bitcoin's price through the pricing logic of risk assets. When the tide (liquidity) goes out, the assets that are most volatile often show their true colors first.

Finally, an interesting perspective comes from within the industry. Mati Greenspan, CEO of Quantum Economics, reminds us that perhaps we have been focusing on the wrong priorities all along. He wrote on social media that Bitcoin's core design goal is to become a currency independent of the traditional banking system, and price appreciation is merely a "side effect" of its existence, not its purpose. This viewpoint is like a splash of cold water, prompting us to consider: when the market focuses solely on price fluctuations, have we strayed from its original vision?

How accurate is the "crystal ball" of the prediction market?

The high probability bets on Polymarket undoubtedly amplify the market's pessimistic expectations. In addition to the probability of falling below $65,000, the likelihood of Bitcoin dropping to $55,000 has also reached 61%. Meanwhile, there remains a 54% chance that it could return to the $100,000 mark by the end of the year. This standoff between bulls and bears precisely illustrates the significant divide in the market.

But there is a key question: does the "probability" in the prediction market equate to future "facts"? Not necessarily. It more accurately reflects the collective sentiment of current market participants, as expressed through real money. This sentiment is highly contagious; it can become self-fulfilling but may also reverse instantly due to a sudden positive development. Just like in March 2020, when the market crashed, no one could have predicted the ensuing epic bull market. The prediction market is an excellent window for observing sentiment, but it is by no means a navigation chart for investment.

Additionally, Polymarket itself is facing some regulatory challenges, such as restrictions in places like Nevada due to licensing issues. This reminds us that this "sentiment barometer" is also operating in a dynamically changing environment.

Conflicting views among institutions: who should retail investors listen to?

In the face of market confusion, interesting "conflicts" have emerged among large institutions' viewpoints.

On one hand, bearish sentiment is pervasive among prediction markets and some analysts. On the other hand, just a few months ago, several top institutions had released quite optimistic forecasts. For instance, Grayscale Investments predicted that Bitcoin could break its historical high of $126,000 in the first half of 2026, based on ongoing institutional adoption and a gradually clearer regulatory environment. Analysts from Standard Chartered and Bernstein also set a target price of $150,000 for 2026, although they later downgraded their expectations due to a slowdown in ETF inflows.

Such contradictions are not uncommon. The long-term logic of institutions (such as Bitcoin's scarcity and the narrative of digital gold) often speaks a different language from the short-term market fluctuations (liquidity, sentiment, technical factors). For investors, the key is to discern which type of voice you are hearing. Is it a judgment based on years-long trends, or a warning about risks in the coming quarters?

What can investors focus on right now?

There is a lot of market noise, and I believe we can focus on a few more substantive observation points rather than being led by simple probabilities of price increases or decreases.

- MicroStrategy's "cost line" defense: As a "flagship" of the market, the relationship between its stock price and average holding cost is worth monitoring. If Bitcoin continues to stay below its average cost, will it shake its long-term holding strategy or affect the attitudes of other publicly traded companies? This is an important barometer.

- Real data on macro liquidity: Instead of guessing, it is better to pay attention to real data such as the Federal Reserve's balance sheet and the balance of the U.S. Treasury General Account (TGA). These are the "driving forces" behind all risk assets, including cryptocurrencies.

- The "quality" and "quantity" of on-chain activity: When prices fall, are long-term holders panic selling, or are they calmly accumulating? On-chain data can tell us whether the chips are being dispersed or concentrated. For example, examining changes in the supply of long-term holders and the inflow and outflow of exchanges often provides more forward-looking insights than looking at price charts.

- Is your own investment logic still intact? This is the most important point. What was your reason for investing in Bitcoin initially? Was it because you believed in its long-term potential as a store of value, or merely for short-term speculation? If the long-term logic remains unchanged (such as global currency overproduction, sovereign credit risks, etc.), then market volatility may actually be a moment to test your beliefs and provide better entry opportunities. If you are just following the hype, then any slight movement can leave you restless.

The market always oscillates between excessive optimism and excessive pessimism. When 72% of people on Polymarket are betting on a downturn, it may be precisely the time for us to maintain a bit of calm and think contrarily. After all, in the crypto world, consensus is often very expensive, and real opportunities frequently arise where consensus breaks down. Of course, any judgment must be combined with one's own situation; the market always carries uncertainty, and effective position management and risk control are essential lessons for navigating any cycle.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。