Recently, against the backdrop of a generally lackluster or even declining performance in the mainstream cryptocurrency market, the unusual movements in two niche sectors have attracted widespread attention: the native token HYPE of the decentralized derivatives platform Hyperliquid has been rising against the trend, and the sports fan token sector represented by CHZ (Chiliz) is gaining momentum due to expectations for the 2026 World Cup. This market structure of "the overall market going down while certain sectors go up" has sparked in-depth discussions about capital flows, sector rotations, and the sustainability of niche assets.

1. Three Major Drivers Behind HYPE's Rise Against the Trend

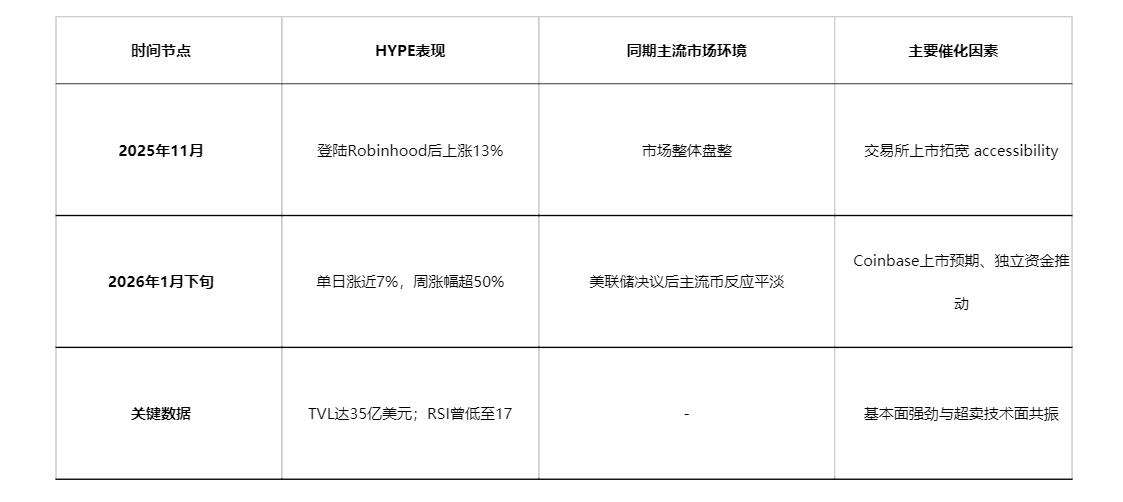

While mainstream assets like Bitcoin and Ethereum have reacted mildly to macro news (such as the Federal Reserve's interest rate decisions), HYPE has shown an independent market trend, rising nearly 7% in a single day and accumulating over 50% in a week by late January 2026. Its strong performance is not coincidental; it is supported by multiple factors including fundamentals, capital flows, and news.

Solid Fundamental Support: TVL Growth and Product Upgrades

● Hyperliquid, as a decentralized perpetual contract trading platform, has seen improvements in its core fundamentals, which are the cornerstone of HYPE's price increase.

● As of June 2025, the platform's total locked value (TVL) reached $3.5 billion, growing over 70% since the beginning of the year. The growth is primarily driven by its support for EVM-compatible dual-layer architecture upgrades and the HIP-3 upgrade, which significantly reduced new market order fees by 90% to 0.0045%, attracting over $50 million in daily capital inflows.

Significant Capital Push: Whale Purchases and Exchange Listings

● The behavior of large investors has had a direct impact on HYPE's price. Blockchain data shows that a single whale address purchased HYPE tokens worth over $4.88 million in one go.

● Additionally, HYPE was listed on the Robinhood exchange in November 2025, with its price rising 13% on the first day of trading, significantly broadening the participation channels for retail investors. At the beginning of 2026, Coinbase included it in its asset listing roadmap, further catalyzing the price.

Resonance of Technical and News Factors

● From a market sentiment perspective, HYPE's rise occurred against a backdrop of technical indicators showing oversold conditions. During a round of corrections at the end of 2025, its relative strength index (RSI) fell to 17, indicating severe oversold territory, which created conditions for subsequent rebounds.

● At the same time, rumors about the well-known asset management company VanEck potentially submitting a spot ETF application for HYPE also boosted market optimism.

The table below summarizes the key points of HYPE's performance against the trend compared to the mainstream market:

2. The World Cup Narrative Logic of the Fan Token Sector

Unlike HYPE's technically driven narrative, the fan token sector centered around CHZ has its rise logic closely tied to the event expectations of the 2026 World Cup in the US, Canada, and Mexico. This represents a typical event-driven investment logic.

2.1 Core Narrative and Historical Patterns

● The essence of fan tokens is to connect sports fans with clubs (or sports organizations) through utility tokens, where holders typically enjoy rights such as voting and exclusive experiences. Chiliz (CHZ) serves as the core fuel and payment method for this ecosystem.

● Historical experience shows that global top sports events like the World Cup and the European Championship often act as strong catalysts for related concept tokens, with market attention typically beginning to heat up and price in advance 6 to 12 months before the event. As the 2026 World Cup approaches, this narrative is re-entering investors' sights.

2.2 Current Market Situation and Early Layouts

● As of January 22, 2026, CHZ's price was approximately $0.05, having rebounded from earlier lows, with trading volume and market discussion noticeably increasing. Sharp investors have already begun to position themselves. In addition to the leading ecological token CHZ, some specific football club fan tokens (such as SANTOS and LAZIO) have shown resilience far exceeding the broader market amidst market fluctuations, being viewed as relatively certain opportunities by market participants.

● Furthermore, as early as the second half of 2025, various themed meme coins related to World Cup participating countries (such as $ARG, $BRAZIL) and official mascots (such as $CLUTCH, $MAPLE) began to emerge in the market. Although their market caps are small (mostly in the tens of thousands to hundreds of thousands of dollars), they have already shown active characteristics in the pre-event phase.

2.3 The "Double-Edged Sword" Nature of Investment Logic

● The World Cup narrative provides fan tokens with a clear time window and explosive potential, but this event-driven logic also poses risks. The market consensus is that most of the positive impacts brought by the event are often priced in before the event starts, i.e., "buy the expectation, sell the fact."

● This means that if the entry timing is too late, one may face price corrections after the expectations are realized. Additionally, the prices of such assets are highly influenced by sentiment, with volatility typically exceeding that of mainstream crypto assets, and their ultimate performance remains tied to the overall macro liquidity environment of the crypto market.

3. Signals and Controversies of Sector Rotation

The independent market trends of HYPE and fan tokens raise the question of whether a rotation from "mainstream" to "niche narratives" is occurring within the crypto market. Opinions in the market are divided.

3.1 Signs of Rotation Occurring

Those supporting the view that rotation is happening point to three clear signals in the current market:

● Capital Flight and Selection: In a context of high macroeconomic uncertainty and a lack of clear direction for mainstream coins, some active capital tends to flow out of large-cap assets with reduced volatility, instead chasing niche sectors with clear short-term narratives and higher volatility to seek excess returns.

● Increased Narrative Independence: Whether it is the fundamental progress of the DeFi platform that HYPE relies on or the countdown to the World Cup that fan tokens depend on, the driving factors have become less correlated with Bitcoin's macro narrative, leading to independent market trends.

● Shift in Market Attention: Community discussions have shifted from purely "Bitcoin ETF capital flows" to "the next explosive narrative sector." For example, on community platforms like Gate Square, discussions about how to position in sports tokens and which fan tokens are attracting more capital attention are increasing.

3.2 Cautious Views on "Pseudo-Rotation"

Another viewpoint is more cautious, suggesting that the current market trend leans more towards structural opportunities rather than a comprehensive sector rotation. The reasons are:

● Limited Scale and Capacity: Whether it is decentralized derivatives platform tokens or sports fan tokens, their overall market value and capital capacity remain relatively small compared to mainstream public chains and Layer 2 sectors, making it difficult to accommodate large-scale systemic capital transfers.

● Sustainability of the Trend in Doubt: The rise of niche narrative sectors is often rapid and intense but lacks long-term stable capital inflow support, making them more susceptible to significant pullbacks when sentiment wanes. For instance, HYPE experienced a trust crisis and price volatility in November 2025 due to a market manipulation incident.

● Overall Market Direction Unchanged: The cryptocurrency market remains dominated by macro factors such as Federal Reserve policies and inflation data, and the activity of niche sectors has not changed the overall oscillating pattern of the market.

4. The Possibility and Risks of Niche Coins Continuing to Strengthen

Whether niche coins can convert short-term strength into sustained strength depends on their ability to overcome the following challenges and seize key opportunities.

4.1 Potential Factors Supporting Continued Strength

● Substantial Progress in Fundamentals: For HYPE, whether the platform can continue to maintain TVL growth, successfully launch a native stablecoin, and effectively address the upcoming large-scale token unlocks (releasing about 10 million tokens monthly since the end of November 2025) will be key to whether its price can gain long-term support. The Hyperliquid platform has demonstrated its commitment to supporting prices by repurchasing nearly 13 million HYPE tokens.

● Time Span of the Narrative and Diffusion Effects: For fan tokens, the World Cup narrative has a clear time window of nearly a year and a half. As the event approaches, every node such as promotional activities, ticket sales, team dynamics, and sponsor events could become new topics for speculation, with the potential for gradual diffusion and deepening of interest.

● Ecological Expansion and Breaking the Circle: If platforms like Chiliz can leverage the massive traffic during the World Cup to successfully convert more non-cryptocurrency users into ecological participants, achieving "breaking the circle," it could bring long-term value to fan tokens beyond the event itself.

4.2 Major Risks and Challenges Faced

Cooling of the Macro Market: The cryptocurrency market is highly interconnected. If the global macroeconomic situation deteriorates or regulatory pressures increase sharply, leading benchmark assets like Bitcoin into a deep bear market, all niche sectors will struggle to remain unaffected, and their declines could be even more severe.

Narrative Exhaustion and Expectation Realization: This is the biggest risk for event-driven assets. The price of fan tokens may fully exhaust the benefits of the World Cup at some point in the future, and once the event officially begins, there could be a situation where "good news turns into bad news."

Internal Competition and Project Risks: There is competition within each sector. For example, new platforms are continuously emerging to challenge Hyperliquid's position in the decentralized derivatives space; within the fan token ecosystem, the performance of different club tokens will also diverge. Additionally, many low-market-cap meme coins born around the World Cup carry high risks regarding contract security and team credibility.

Liquidity Risks: Niche coins, especially low-market-cap themed meme coins, often lack market depth. Large buy and sell orders can easily trigger significant price fluctuations, and during market sentiment reversals, they may face rapid liquidity depletion.

5. Conclusion and Outlook

HYPE's rise against the trend and the pre-World Cup market for fan tokens together paint a subtle picture of the current cryptocurrency market: in the absence of an overall bull market engine, market funds are more actively and finely digging for structural opportunities with clear short-term narratives.

This can be seen as a limited and selective sector rotation, characterized by funds flowing from directionless broad-based assets to niche targets with clear stories and catalysts. However, the essence of this trend is that "trading opportunities" outweigh "allocation opportunities."

For investors, participating in such trends requires more precise timing and stricter risk management. The key lies in:

● Distinguishing between primary and secondary factors: Understanding the fundamental improvement logic of HYPE versus the event-driven logic of fan tokens.

● Timing the market: Especially for fan tokens, deeply understanding the historical patterns of "pre-event pricing" to avoid chasing highs during narrative peaks.

● Managing risks: Recognizing the high volatility, high liquidity risks of niche coins, and the potential for sudden black swan events (such as market manipulation affecting protocols).

Looking ahead, the price trend of HYPE will be closely related to its platform's ability to continuously attract institutional and retail users, as well as to manage token unlocks smoothly; while the sustainability of the fan token sector's excitement will depend on whether the World Cup narrative can continuously bring new catalysts during the fermentation process over the next year and ultimately achieve a substantial expansion of its ecological user base. Regardless of the outcome, the recent performance of these two sectors has proven that even in the calm seas of cryptocurrency, there are always undercurrents stirring in specific waters.

Join our community to discuss and become stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。