The past crypto winters were caused by internal issues within the industry, while the current market fluctuations are driven by external factors.

Written by: Ryan Yoon

Translated by: Luffy, Foresight News

As the market enters a downward cycle, skepticism in the crypto market is rising. The core question today is: have we entered a new round of crypto winter?

How did past crypto winters unfold?

The first crypto winter began in 2014. At that time, the Mt. Gox exchange accounted for 70% of global Bitcoin transactions, and approximately 850,000 Bitcoins were stolen in a hacker attack, leading to an immediate collapse of market trust. Subsequently, new exchanges with internal control and auditing functions emerged, gradually restoring industry trust. Ethereum also debuted through an Initial Coin Offering (ICO), opening up new possibilities for industry vision and financing models.

This ICO boom became the catalyst for the next bull market. When anyone could issue tokens for fundraising, the 2017 crypto bull market ignited. Projects that could raise hundreds of millions of dollars with just a white paper flourished, but the vast majority had no real substance.

In 2018, South Korea, China, and the United States introduced regulatory policies in quick succession, leading to the bursting of the market bubble and the arrival of the second crypto winter, which lasted until 2020. After the COVID-19 pandemic, market liquidity was significantly released, and decentralized finance (DeFi) protocols like Uniswap, Compound, and Aave became popular, attracting capital back into the crypto market.

The third winter was the most brutal in history. In 2022, the collapse of the Terra-Luna algorithmic stablecoin was followed by the failures of major institutions like Celsius, Three Arrows Capital, and FTX. This was not merely a price drop; it was a severe shock to the underlying structure of the crypto industry. In January 2024, the U.S. Securities and Exchange Commission (SEC) approved Bitcoin spot exchange-traded funds (ETFs), and subsequent events like the Bitcoin halving and Trump’s crypto-friendly policies led to a renewed influx of capital into the crypto market.

The fixed trajectory of crypto winters: Major events → Trust collapse → Talent outflow

All three crypto winters followed the exact same development trajectory: major events triggered a collapse of industry trust, ultimately leading to a massive outflow of talent.

Each winter was initiated by a major event: the Mt. Gox theft, tightening ICO regulations, and the collapse of Terra-Luna combined with the bankruptcy of FTX. Although the scale and form of each event varied, the outcome was the same: the entire crypto market fell into turmoil.

Market turmoil quickly spread to a complete collapse of industry trust. Practitioners who once discussed the development of next-generation products began to question whether crypto technology had real value. The collaborative atmosphere among developers vanished, replaced by infighting and blame-shifting.

The growing skepticism ultimately led to talent outflow. Developers who once brought new vitality to the blockchain industry became doubtful, moving to fintech and large tech companies in 2014, and then to traditional institutions and the AI sector in 2018, seeking seemingly more certain paths.

Is it currently a crypto winter?

The characteristics of past crypto winters are now evident in the market.

- Major events are occurring in succession: Trump Meme coin issuance saw its market cap soar to $27 billion in a single day, followed by a 90% crash; the "10·10" liquidation event: the U.S. announced a 100% tariff on China, leading to the largest liquidation in Binance's history, involving $19 billion.

- Industry trust is collapsing: skepticism within the industry is spreading, with practitioners shifting their focus from "next-generation product development" to "accountability and blame."

- Talent outflow pressure is emerging: the AI industry is developing rapidly, offering practitioners faster monetization paths and higher wealth returns compared to the crypto sector.

Despite this, defining the current situation as a crypto winter is still somewhat biased. Past winters were triggered by internal industry issues: the security vulnerabilities of Mt. Gox, the majority of ICO projects being proven scams, and the internal management failures of FTX all led to the industry’s self-destruction of market trust.

However, the current situation is entirely different.

The approval of Bitcoin spot ETFs has become the catalyst for a bull market; meanwhile, tariff policies and interest rate adjustments are the core factors driving the market down. It is external factors that have supported the market and also those that have crushed it.

At the same time, developers in the crypto industry have not left the field.

Real-world asset tokenization (RWA), decentralized perpetual contract exchanges (perpDEX), prediction markets, information finance (InfoFi), privacy computing… new narratives are continuously emerging and being created. Although these new narratives have not driven a widespread market rally like DeFi did back in the day, they have never disappeared. The industry has not collapsed; it has merely experienced a change in the external development environment.

We did not create the spring of the industry ourselves, so we will not welcome a true winter.

Main narratives in the crypto industry for 2025

Significant structural changes in the market after regulatory implementation

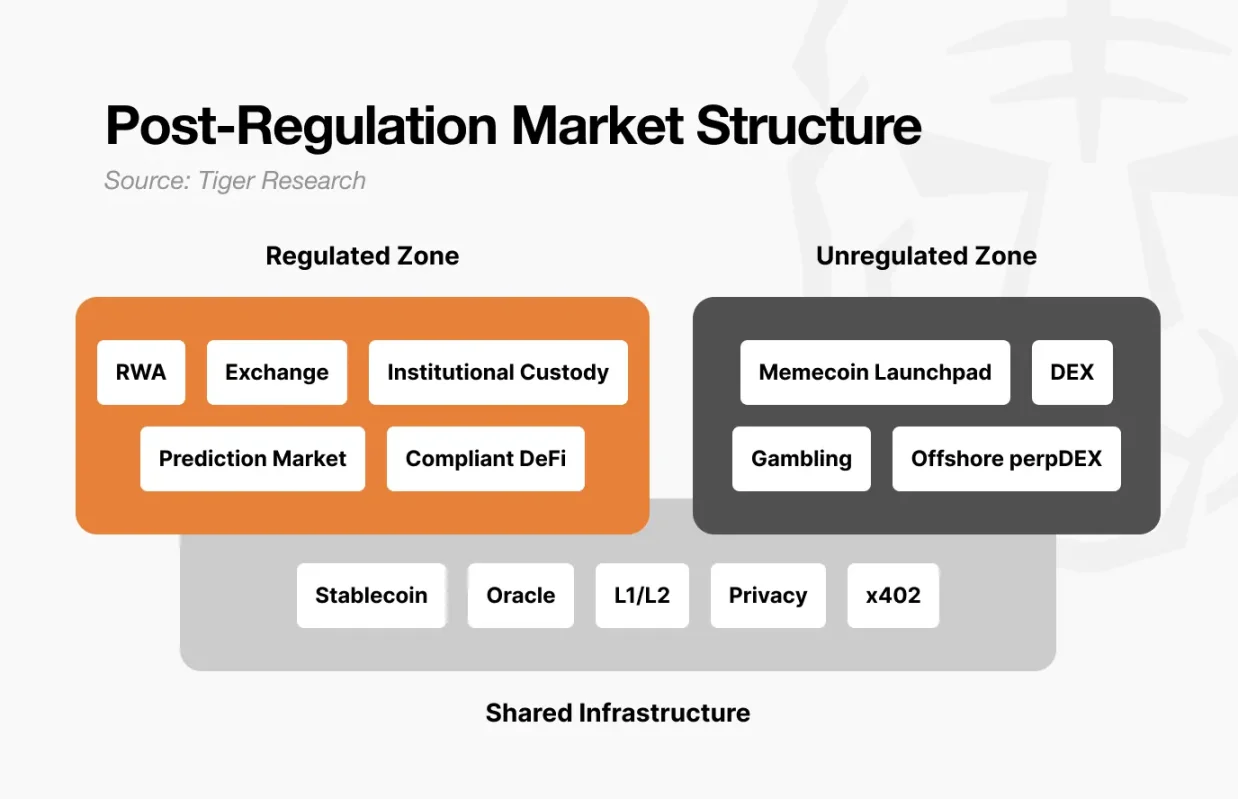

Behind all this is a significant transformation in the structure of the crypto market following regulatory implementation. The current market has clearly differentiated into three major segments: compliant zone, non-compliant zone, and shared infrastructure.

This includes areas such as real-world asset tokenization, compliant exchanges, institutional custody, compliant prediction markets, and decentralized finance based on regulatory frameworks. Projects in this segment must complete audits and information disclosures and are legally protected. Although the pace of development is slower, the capital scale is large and stable.

However, once entering the compliant zone, practitioners will find it difficult to replicate the explosive returns of the past: market volatility decreases, and profit ceilings are locked in, but the risk of loss is also significantly controlled.

In contrast, the speculative nature of the non-compliant zone will further intensify. This segment has low entry barriers and fast trading rhythms, with daily increases of 10 times and subsequent drops of 90% becoming the norm.

But this segment is not without value: innovations born in the non-compliant zone can migrate to the compliant zone after being validated by the market. Just like the DeFi of the past, today’s prediction markets are also on this path; the non-compliant zone is essentially the "innovation testing ground" of the crypto industry. However, the business boundaries between the non-compliant and compliant zones will become increasingly clear.

Shared infrastructure mainly includes stablecoins and oracle services, which are shared foundational facilities between the compliant and non-compliant zones. The same USDC can be used for real-world asset tokenization payments on the institutional side, as well as for speculative trading on platforms like Pump.fun; oracles can provide data verification for the authenticity of treasury bond tokenization and also support data for the clearing processes of anonymous decentralized exchanges.

In other words, with the differentiation of market structure, the logic of capital flow in the crypto market has also fundamentally changed.

In the past, when Bitcoin prices rose, they would drive altcoins to rise through a capital transmission effect; but now, this logic no longer holds. Institutional capital flowing into the crypto market through ETFs is long-term settled in the Bitcoin sector and has not flowed out of the compliant zone. Capital in the compliant zone will not enter the non-compliant zone. Liquidity will only remain in areas that have been validated to have value, and even Bitcoin, compared to traditional risk assets, has yet to prove its value as a safe asset.

What conditions must be met for the next bull market?

Now that the regulatory framework for the crypto industry has gradually clarified, and developers are still holding their ground, two core conditions must be met to welcome the next bull market.

First, the non-compliant zone must give birth to entirely new killer application scenarios. Just like the DeFi wave of 2020, creating value that has never existed before. AI agents, information finance, and on-chain social networking are all potential tracks, but their current scale is still insufficient to drive the entire market. The market needs to re-establish a positive cycle of "non-compliant zone experimental innovation → migration to the compliant zone after validation," just as DeFi did back then, and today’s prediction markets are also practicing this logic.

Second, a favorable macroeconomic environment must emerge. Even if the regulatory framework is complete, developers continue to innovate, and infrastructure accumulates, without the support of a macro environment, the industry's upward potential will be limited. The explosion of DeFi in 2020 stemmed from the release of market liquidity after the pandemic; the market rise after the approval of Bitcoin ETFs in 2024 also closely aligned with expectations of interest rate cuts. Regardless of how the crypto industry develops, it cannot influence interest rate adjustments and market liquidity trends. Only with a warming macroeconomic environment can all the industry’s accumulations and constructions truly gain market recognition.

The past phenomenon of all cryptocurrencies rising and falling together, the "crypto bull season," is unlikely to occur again. The differentiation of market structure determines the pace of industry development. The compliant zone will grow steadily, while the non-compliant zone will continue to experience significant ups and downs.

The next bull market will eventually arrive, but this benefit will not belong to everyone.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。