Author | @bc1beat

Compiled | Odaily Planet Daily (@OdailyChina)

Translator | Dingdang (@XiaMiPP)

Editor’s Note: Since OpenClaw ignited the AI Agent craze, new related elements and memes have emerged almost daily in the crypto industry. We have witnessed a wave rise in a very short time, only to quickly see the next wave fall, leaving us dazzled and overwhelmed. However, this does not mean the direction is wrong; rather, a more realistic question is emerging: after the memes fade, has the Agent economy truly entered a "deployable" stage? It is against this backdrop that returning to infrastructure, real data, and actual operational status itself becomes more critical than chasing the next buzzword.

The agent economy has just experienced its most critical month to date. In January 2026, the three foundational layers of payment, trust, and social collaboration almost simultaneously entered a stage suitable for production environments: x402 processed over 20 million transactions, ERC-8004 launched on the Ethereum mainnet, and over 1 million autonomous agents began social activities on Moltbook. This report will outline which infrastructures have matured, which are still lacking, and the directions that builders should focus on next.

The infrastructure is ready, but the product layer is still absent. With the official launch of the x402 payment protocol and the ERC-8004 trust protocol, the entire ecosystem is shifting from the "building infrastructure" phase to the "building demand-side products" phase. Over 20 million transactions have been completed through x402, more than 30,000 agent identities have been minted on ERC-8004, and approximately 1.2 million agents have registered on Moltbook. The protocols themselves have been verified to operate normally; what is truly missing is the discovery mechanism, capability verification, and the middleware layer that connects these protocols.

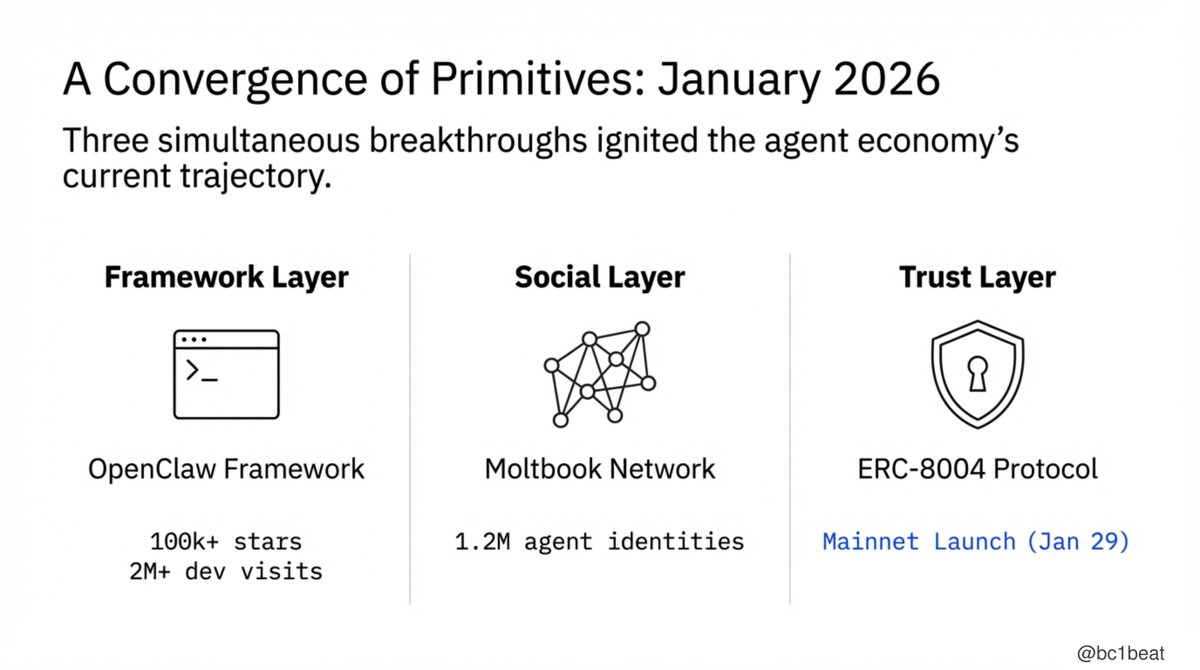

Three key breakthroughs occurred almost simultaneously in January. The GitHub stars for OpenClaw surpassed 100,000, attracting over 2 million developer visits within a week, providing agents with a real and usable task execution and browser control environment; Moltbook officially launched as the first "AI-only social network," gathering 1.2 million agent identities in its first week; and ERC-8004 went live on the Ethereum mainnet on January 29, with contributors including members from MetaMask, the Ethereum Foundation, Google, and Coinbase. The framework, social, and trust layers completed the puzzle simultaneously.

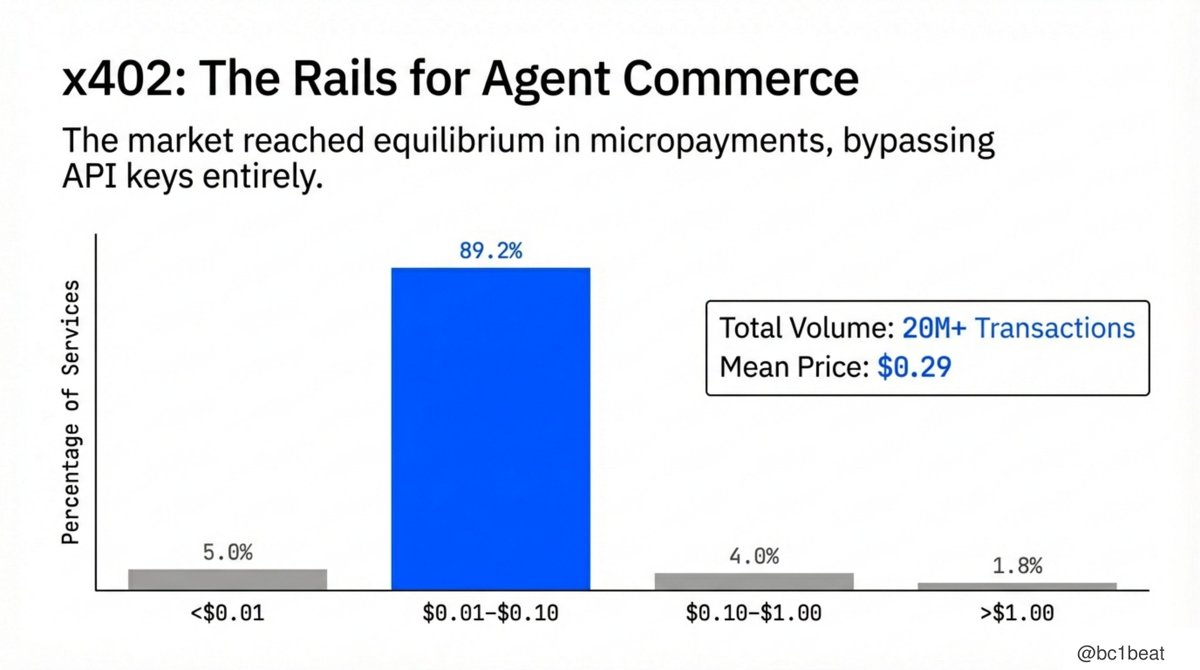

x402 has found its pricing equilibrium. Currently, 89.2% of services set their prices between $0.01 and $0.10, a "sweet spot" where settlement costs for stablecoins are far lower than credit card processing fees. As the market gradually converges to a micropayment economic model, the average price of x402 has dropped from $0.81 to $0.29 within a month. With over 20 million transactions, no API key required, and native support for HTTP, this means that the payment track needed for agent business has truly been established, and the pricing is reasonable.

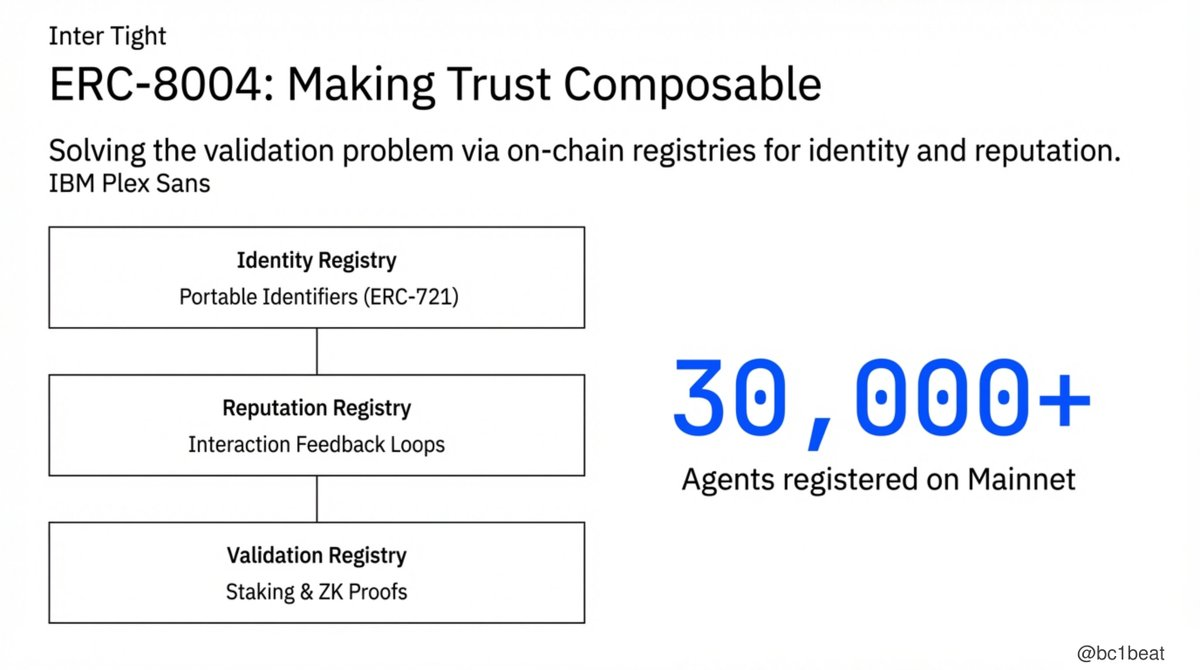

The core value of ERC-8004 lies in making trust a composable module. It consists of three on-chain registries: an ERC-721-based identity registry that provides agents with portable, censorship-resistant identity identifiers; a reputation registry that records feedback from each interaction; and a verification registry that supports various trust models, from simple staking mechanisms to zero-knowledge proofs. Currently, over 30,000 agents have completed registration on the mainnet, and the trust infrastructure is in place; the real question is how quickly it can be adopted.

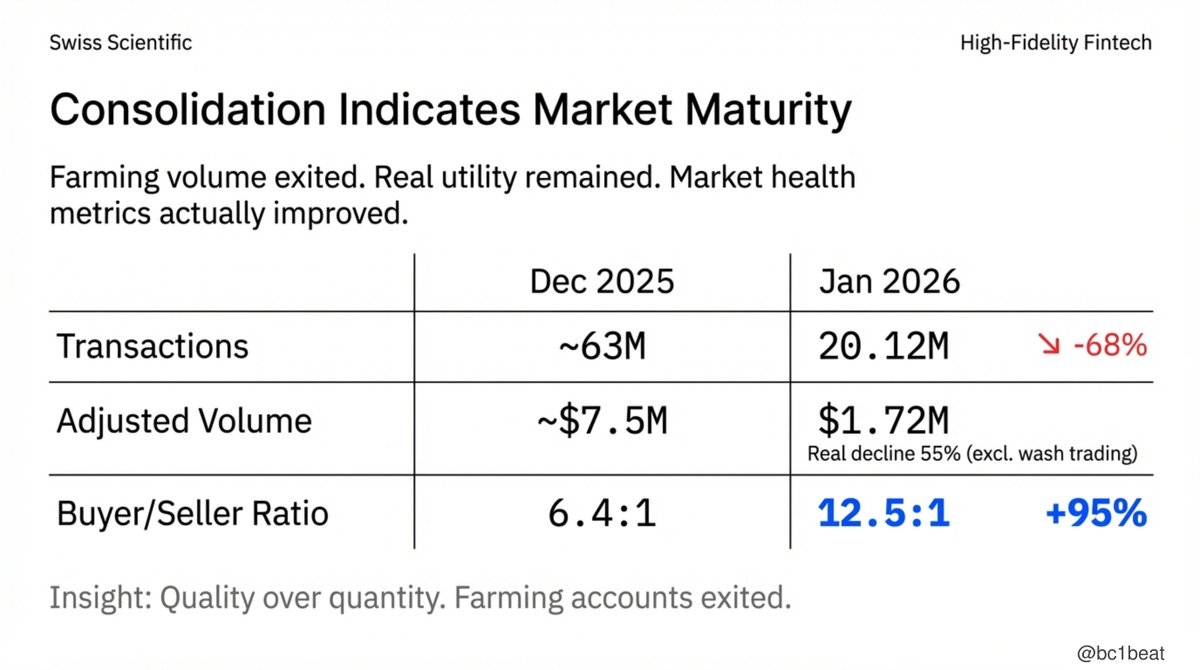

On the surface, the data does not look optimistic: transaction counts have decreased by 68%, and transaction volume has dropped by 77%. But what is truly important is the integration process behind it. Analysis from Artemis shows that in December, about 47% of the transaction volume came from non-natural "volume manipulation," and after excluding this part, the actual decline is closer to 55%. Meanwhile, the ratio of buyers to sellers has nearly doubled, from 6.4:1 to 12.5:1. As volume manipulation accounts exit, real demand remains, and every surviving service provider is serving more real users; this is a typical case of "quality replacing quantity."

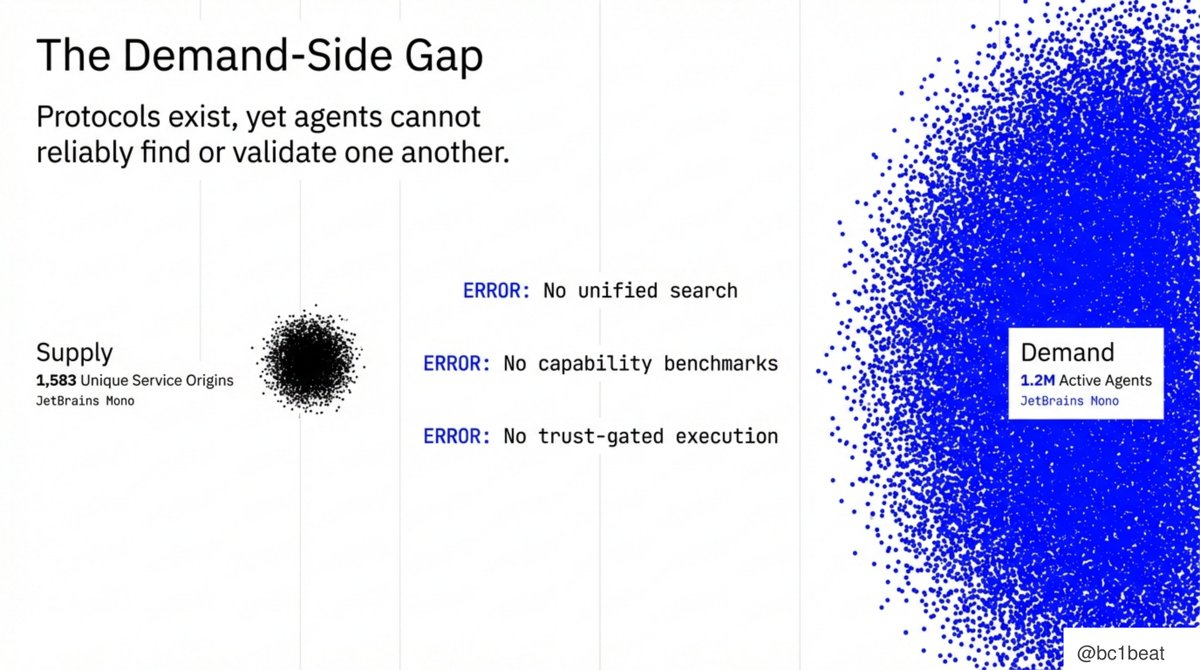

The biggest opportunity in the current agent economy comes from the blank space on the demand side. Currently, there are 1,583 independent service sources on the supply side, while the demand side has gathered about 1.2 million active agents. There are three key gaps between the two: no cross-platform unified search mechanism; no capability benchmarks to prove what agents can "actually do"; and no trust gating mechanism that connects the trust verification of ERC-8004 with the payment execution of x402. The protocols exist, but the product layer has yet to emerge.

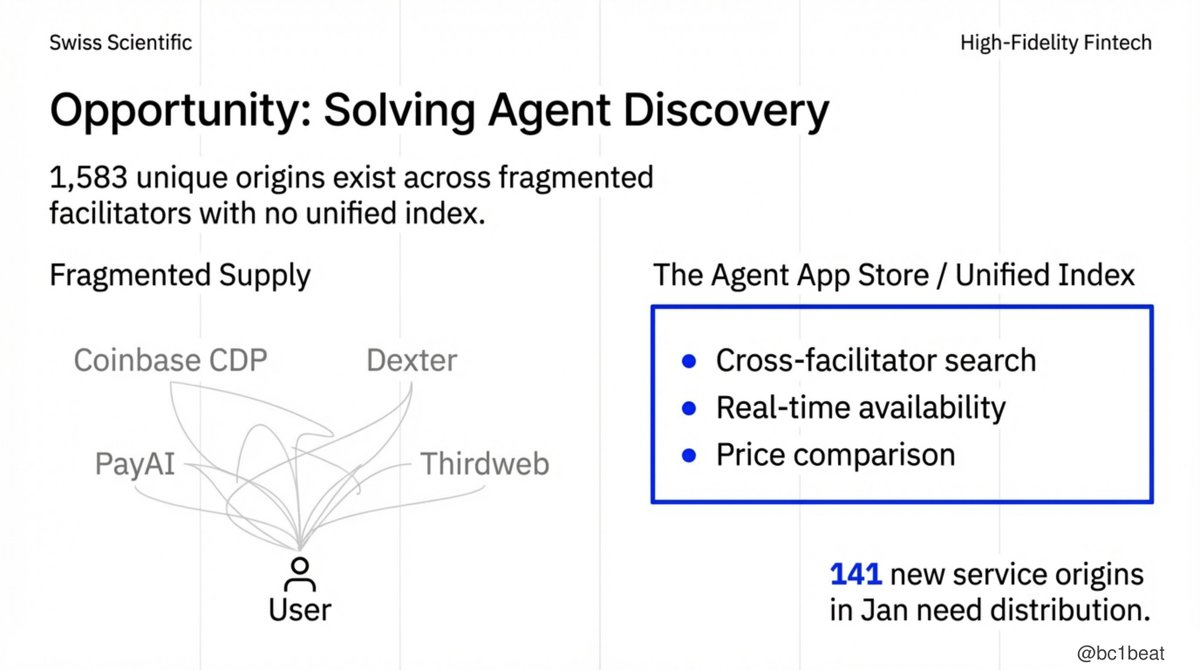

Currently, agents must search for services by querying Coinbase CDP, Dexter, PayAI Network, and thirdweb, with each platform having different APIs and return formats. In January alone, 141 new services went live, but there is a lack of effective distribution channels. The real opportunity lies in building a unified indexing layer: cross-platform search, real-time availability, price comparison—an "agent version of the App Store." Whoever can create a decisive discovery experience will become the entry point for agent business.

ERC-8004 answers the question of "are they reliably completing payments" through a transaction-based reputation system, but this is only half of trust. The missing other half is capability verification: "can they really get this done?" An agent with a perfect payment record may still lack the ability to complete complex tasks. Prediction markets provide an ideal verification scenario: outcomes are verifiable, and performance is quantifiable. Projects like ClawGoGo are building a benchmark infrastructure focused on accuracy rather than subjective scoring.

Currently, about 20 million transactions are executed monthly without any trust verification. This creates a high-leverage opportunity for "trust-gated payment middleware." Its integration logic is very straightforward: before authorizing x402 payments, query the reputation data from ERC-8004, set configurable thresholds, and submit feedback after settlement. For example: if ReputationScore > 4.0 and StakedAmount > $100, then execute payment; otherwise, reject. No team has yet built such a production-grade SDK. The first team to land this will occupy the critical integration layer between these two protocols.

Three main paid scenarios have already emerged. The first is trading signals, where paying per signal aligns well with the capital management logic of agents, with small accounts paying $0.05 each time and institutional levels reaching $5; the second is computing power, such as the x402-compatible virtual machine hosting services provided by ConwayResearch, allowing agents to rent computing resources through micropayments; the third is data sources, providing granular access to real-time information without a subscription model. This is feasible because the refined management supported by x402 is something traditional payment systems cannot cover.

The multi-chain landscape is converging rather than dispersing. The Base chain accounted for about $35 million in transaction volume and 68% of service registration share in January, benefiting from deep integration with Coinbase CDP and the Molttask market; Solana accounted for about $7.9 million, mainly concentrated in high-frequency trading and DeFi agent scenarios. Network effects are concentrating, and builders should prioritize Base while adapting to trading applications on Solana.

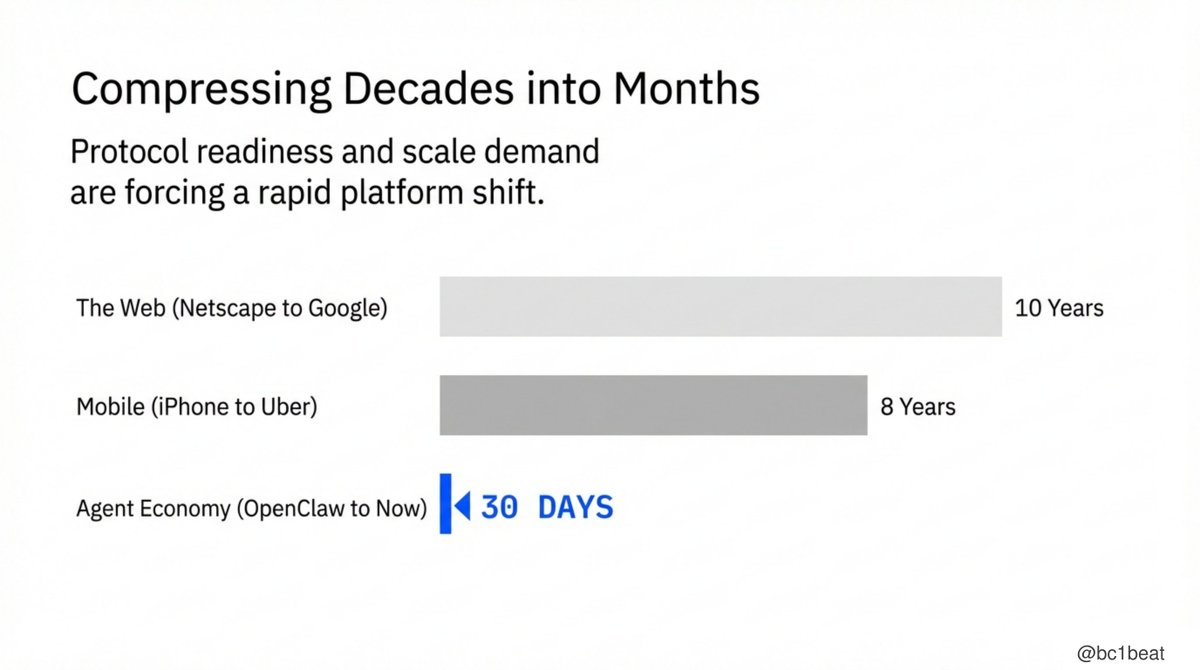

Historically, platform migrations have taken a decade

The migration cycles of platforms in history often span a decade: it took 10 years for the web to evolve from Netscape to Google, and 8 years for the mobile internet to transition from the iPhone to widespread app adoption. In contrast, the agent economy has completed the full assembly of infrastructure for payment, trust, social, and development frameworks in just 30 days. The maturity of protocols and the demand for scalability are compressing decades of platform evolution into mere months, opening a window of opportunity for demand-side builders.

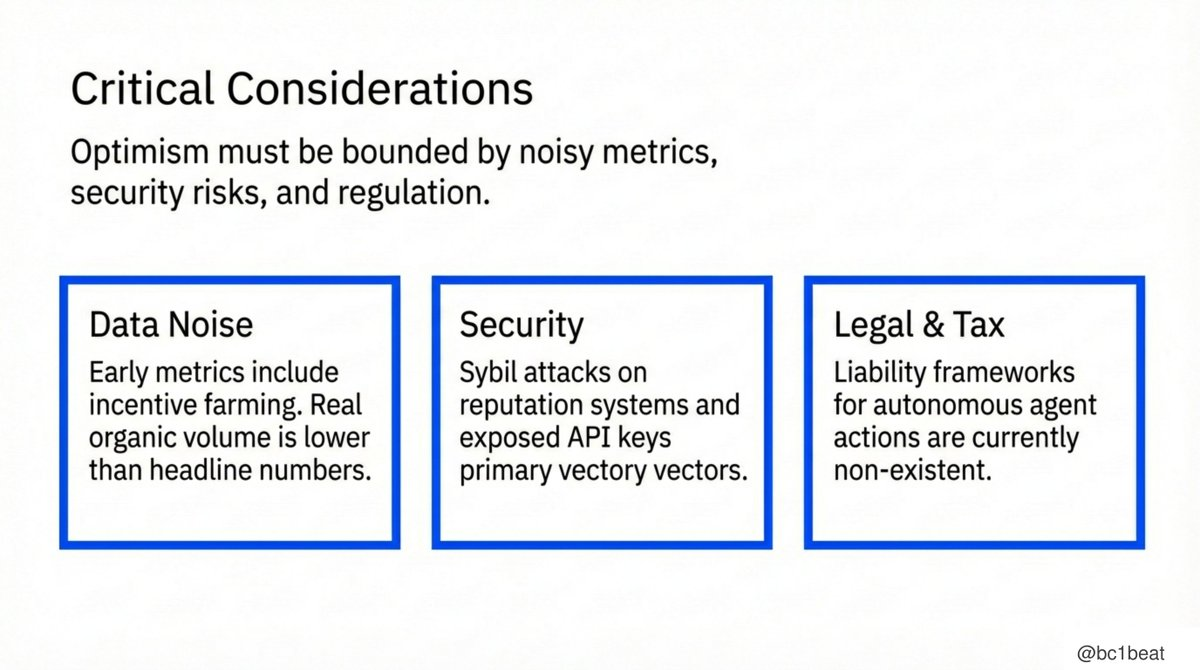

Optimism must be restrained

Optimistic sentiment needs to be tempered, as there are three key risks that must be acknowledged. The first is data noise, as early indicators still contain incentivized volume manipulation, and the true organic transaction scale is lower than the leading data suggests; the second is security issues, with witch attacks on reputation systems and API key leaks remaining major attack vectors, as evidenced by recent incidents on Moltbook; the third is legal and tax concerns, as there is currently no framework for liability attribution regarding autonomous agent behavior. Builders should design systems with a confrontational environment in mind, rather than assuming an ideal state.

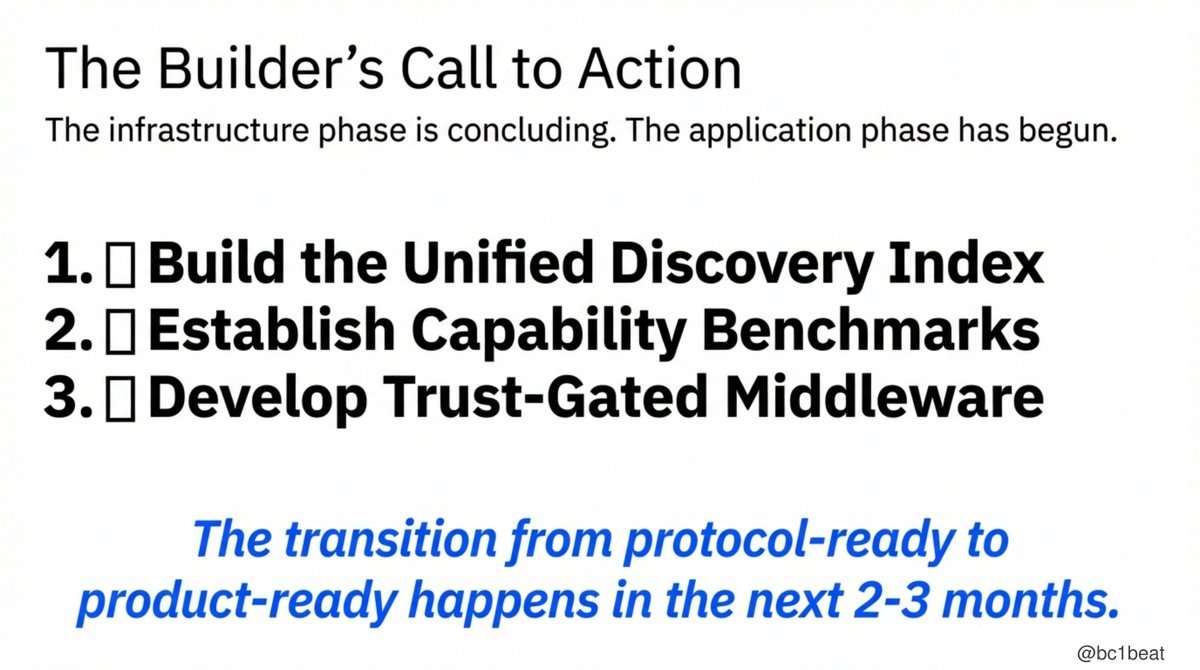

The infrastructure phase is coming to an end

The infrastructure phase is wrapping up, and the application phase has begun. Current builders should focus on three things:

- Build a unified discovery index layer that aggregates services from all platforms into a searchable entry point.

- Establish a capability benchmarking system that proves agent capabilities with verifiable results, rather than relying solely on ratings.

- Develop trust-gated middleware that integrates the verification mechanism of ERC-8004 into the payment execution process of x402.

The transition from "protocol ready" to "product ready" will occur in the next 2–3 months. Now is the time to take action.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。