Written by: Glendon, Techub News

In the early hours of today, Bitcoin fell below $73,000, marking its lowest point since November 4, 2024, erasing all gains since U.S. President Trump's re-election. Although Bitcoin quickly rebounded above $76,000, the trend of further declines severely impacted market confidence, leading to a widespread drop across the entire cryptocurrency market. According to CoinAnk data, as of the time of writing, the total liquidation amount across the network in the past 12 hours reached approximately $400 million, with over $300 million in long positions liquidated. Meanwhile, data from Alternative.me shows that the cryptocurrency fear and greed index has dropped to 14 today, indicating a state of "extreme fear" in the market.

Just in mid-January, Bitcoin had several rallies and was expected to challenge the $100,000 mark. However, in just two weeks, under the multiple impacts of macroeconomic and policy factors, as well as a lack of internal liquidity, Bitcoin's price entered a sustained downward mode once again.

The Market is Deep in a "Bear Market"

To be precise, this round of the cryptocurrency market's bear market is not triggered by internal factors within the crypto industry, but rather a result dominated by multiple macro risks. First, the uncertainty in the macro economy and political deadlock has heightened market tension. On January 31, parts of the U.S. federal government entered a "technical, partial shutdown," with non-essential federal employees temporarily furloughed and some government services forced to halt. This situation became a key factor suppressing risk assets, and risk-averse sentiment quickly spread throughout the cryptocurrency asset market, with large amounts of capital withdrawing from high-volatility assets. Bitcoin, as a high-beta risk asset, was hit hardest, experiencing its largest drop since 2026, with a decline of over 10% on that day.

At the same time, traditional safe-haven assets like gold and silver reached new historical highs amid geopolitical tensions and concerns over currency devaluation, while Bitcoin, dubbed "digital gold," failed to rise in tandem, undermining its narrative as an "inflation hedge." This divergence further eroded market confidence.

Secondly, the repeated delays in the legislative review of the U.S. cryptocurrency market structure bill, the "CLARITY Act," have led to unmet market expectations, and many have begun to question the likelihood of the bill passing in the first quarter of 2026. Bitwise previously pointed out that the probability of the "CLARITY Act" passing has dropped significantly from 80% at the beginning of January to about 50%. If the bill ultimately fails to pass, the industry will enter a difficult "performance realization period."

Just yesterday, the White House convened representatives from the cryptocurrency industry and Wall Street banks to discuss whether stablecoins in the "CLARITY Act" should be linked to yields and rewards. Although representatives from the cryptocurrency industry expressed optimism about the meeting's progress, no consensus was reached on the yield-related terms for stablecoins, and bank representatives did not propose specific compromise solutions.

As a result, the continuous delays of the "CLARITY Act" have had a clear negative impact on Bitcoin and the cryptocurrency market in the short term, primarily manifested in significant capital outflows. In terms of capital flow, the U.S. Bitcoin spot ETF saw a net outflow of up to $1.49 billion last week, a new high since February 2025 (which saw a single-week net outflow of $2.61 billion).

At the same time, Bitcoin's price fell below the average cost basis of Bitcoin ETFs (approximately $84,000). The loss of this key price point has dampened the willingness of new capital to enter, further exacerbating the panic among holders. In terms of market trading, there have not yet been any positive signals of long-term holders accumulating positions on a large scale, and buying power remains weak, lacking strong support. This has made it difficult for Bitcoin to gain rebound momentum after losing key support levels, leading to a continued downward trend.

However, some positive changes have emerged in the market. On February 3, local U.S. time, Trump signed a funding bill negotiated with Senate Democrats. This bill provides funding for several federal government departments until September 30 (the end of the current fiscal year), alleviating part of the federal government's "shutdown" deadlock. This positive political development may be one of the important factors that allowed Bitcoin to rebound quickly this morning.

Additionally, cryptocurrency journalist Eleanor Terrett cited sources indicating that Senate Democrats plan to hold another closed-door meeting tomorrow to specifically discuss the "CLARITY Act." This news suggests that the legislative process for cryptocurrency market structure is still progressing steadily, bringing a glimmer of hope to the market.

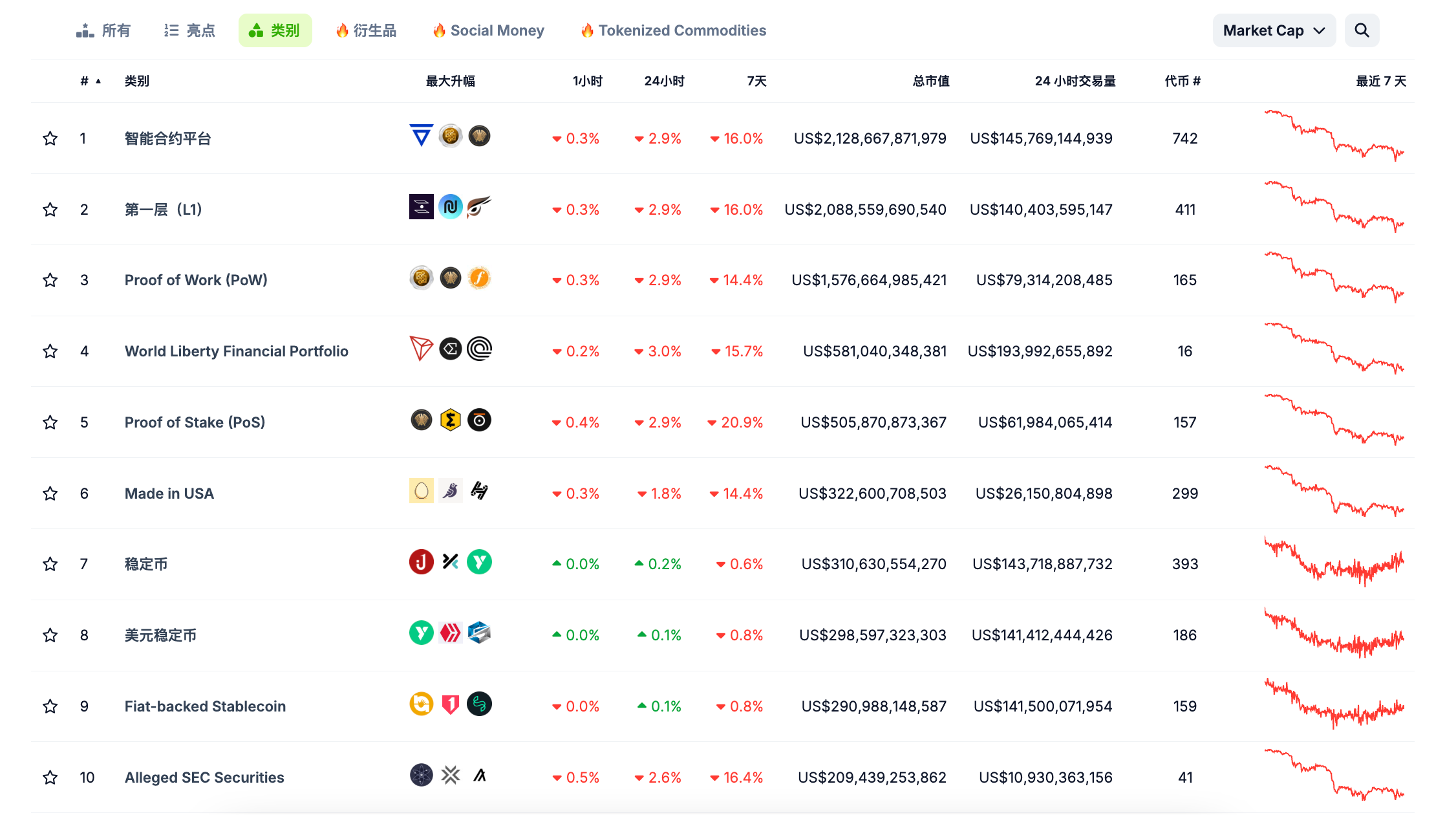

Nevertheless, even so, the cryptocurrency market has inevitably entered a phase of "full bear market." Coingecko data shows that in the past seven days, among the top ten asset categories in the cryptocurrency industry, all except stablecoin assets have seen declines of nearly 15% or more, with the DeFi asset category experiencing a drop of nearly 50%. The total market capitalization of global cryptocurrencies has also fallen to $2.66 trillion, approaching the market cap level of April 2025.

Regarding Bitcoin's recent performance, Michael Burry, the real-life figure behind "The Big Short" and who successfully predicted the 2008 financial crisis, stated that Bitcoin's drop below the $73,000 key price point fully exposes its underlying fragility. This fragility not only threatens many companies holding Bitcoin, but if the price further drops to $50,000, it could very likely push some mining companies into bankruptcy. Burry also bluntly stated that Bitcoin's attempt to serve as a digital safe-haven asset or gold substitute has already failed. The rise of Bitcoin driven by ETFs is merely speculative behavior, not evidence of lasting, real-world adoption.

Prior to this, Alex Thorn, head of research at Galaxy Digital, also expressed that he believes Bitcoin could further decline to around the 200-week moving average (approximately $60,000) in the coming weeks or months. These views and analyses undoubtedly add to the already sluggish cryptocurrency market, indicating that the downward trend will continue.

"Vitality" in the Crypto Winter

The current macroeconomic situation remains severe, with no significant signs of improvement, and the market lacks key factors and important catalysts to drive a recovery. So, is there really no good news for the cryptocurrency market? The answer may not be so simple.

Despite the overall poor market conditions, the prediction market, tokenized assets, and stablecoin sectors are still developing steadily. In particular, the prediction market has become a hot track for traditional giants and crypto-native companies to compete for positioning. For example, the cryptocurrency exchange Crypto.com announced yesterday that it will launch an independent prediction market platform "OG" before the Super Bowl; on the same day, the AI-driven prediction market BLUFF completed a $21 million strategic investment led by 1kx; the professional trading terminal for prediction markets, Kairos, also announced the completion of a $2.5 million financing led by a16z crypto. These developments indicate that the prediction market continues to attract significant capital and attention, with enormous growth potential.

In the area of tokenized assets, the tokenized real asset platform Ondo Finance launched Global Listing, supporting U.S. stock IPOs to be almost real-time on-chain at the moment of listing. Additionally, the platform has partnered with the cryptocurrency wallet MetaMask, allowing eligible non-U.S. mobile users to trade over 200 tokenized U.S. stocks, ETFs, and commodities through Ondo Global Markets within the MetaMask wallet.

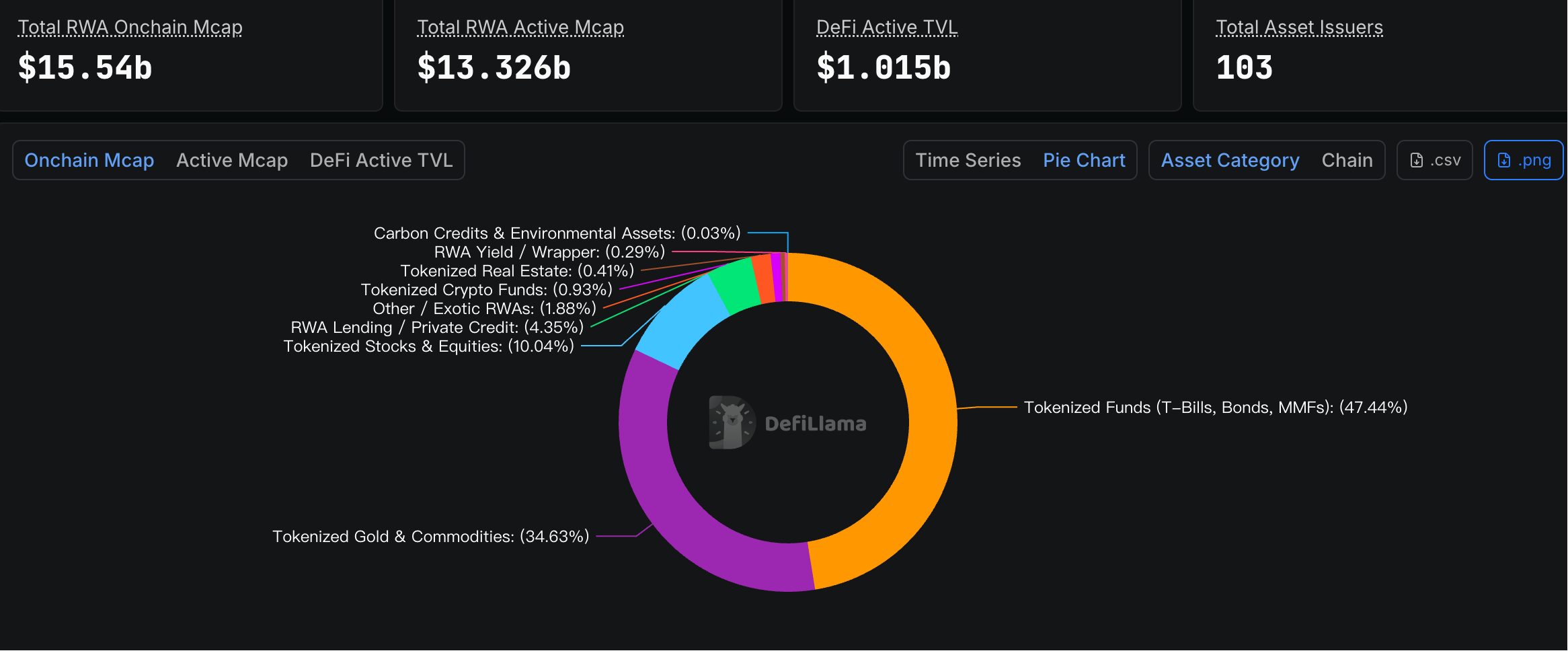

WisdomTree's CEO Jonathan Steinberg also disclosed this Tuesday that the company's cryptocurrency business has transitioned from an experimental phase to a core strategic focus and is about to become profitable. Its tokenized asset scale has grown from approximately $30 million to about $750 million and has expanded to new blockchains like Solana. According to DeFiLama data, the total market capitalization of on-chain RWAs is currently about $15.54 billion.

As for the stablecoin market, although it has been impacted by market conditions, the effect has been relatively small. In the past seven days, the total market capitalization of stablecoins has only decreased by about 0.78%, now standing at $30.5823 billion. Notably, according to incomplete statistics, in the past month, the amount of investment and financing related to the stablecoin sector has exceeded $500 million, with the stablecoin company Rain completing a $250 million financing at a valuation of $1.95 billion; the stablecoin trading and payment platform OSL Group secured $200 million in equity financing to expand its payment and stablecoin businesses. These investment and financing activities further confirm the market's recognition of innovations at the infrastructure level. Although the overall cryptocurrency market is under pressure, the stablecoin sector is still viewed as a quality asset that can "resist bear market cycles," with some institutional funds hedging risks through investments in stablecoin infrastructure projects.

In summary, these markets have not been severely harmed by the market crash, and their development continues. However, these areas have yet to produce truly market-exploding new phenomenon-level products, making it difficult to reverse the downward trend in the cryptocurrency market.

On the other hand, many analysts have noted a significant reduction in profit-taking by long-term holders, which may indicate that the market bottom of this cycle is forming. Glassnode analyst Chris Beamish pointed out that the BTC MVRV Z-Score indicator has compressed to its lowest level since October 2022. This adjustment of the indicator means that the market's unrealized profitability has undergone a solid correction, and Bitcoin's price has returned to fair value after the previous expansion.

The MVRV Z-Score is a key on-chain valuation indicator used to assess the degree of deviation of Bitcoin's current price from its "fair value." When this indicator is at an extremely low level, it indicates that the market is overall in a state of "deep loss" or "extremely undervalued." Historically, such situations often correspond to bear market bottom areas. This means that the speculative bubble in the cryptocurrency market has cleared, and the costs for long-term holders have gradually solidified, potentially laying the foundation for the next round of price increases.

In addition, cryptocurrency market maker Wintermute believes that this bear market has actually been ongoing for some time, but it differs from previous bear markets caused by structural collapses (such as FTX, Luna, Three Arrows Capital, etc.). This bear market is primarily driven by macro and volatility trends leading to natural deleveraging of positions, risk appetite, and narrative-driven factors. This distinction is crucial. Without forced bankruptcies or chain reactions, this bear market may end more quickly than previous cycles.

"Compared to previous cycles, the current infrastructure of the cryptocurrency industry is more solid, the adoption of stablecoins continues to grow, and institutional interest, although temporarily shelved, has not disappeared," Wintermute believes. Once market conditions improve, attention is likely to rebound quickly, and it is expected that in the second half of 2026, when macro uncertainty dissipates and the Federal Reserve's policy path becomes clearer, the cryptocurrency market may welcome new development opportunities.

Thus, it can be seen that the majority of opinions within the industry believe that the cryptocurrency ecosystem has not suffered structural damage, so this bear market may not be as long and deep as in the past.

Conclusion

It is undeniable that a true bear market has fully arrived, and the cryptocurrency industry must face significant challenges and risks once again. However, historical experience shows that every deep adjustment is a key step toward the industry's maturity. Currently, cryptocurrency assets are in an undervalued range, which may be a golden window for long-term capital allocation. When market sentiment rebounds from the bottom, those projects and institutions that have improved their infrastructure during the winter will welcome their spring.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。