Article editing time: February 4, 2026, 17:20. All opinions do not constitute any investment advice! For learning and communication purposes only.

Self-discipline hides infinite possibilities in life, and its depth also measures the height of life. Every step of deep cultivation has its own echo; the more disciplined one is, the further they go. I am Fuzhu, deeply analyzing mainstream coin trends, breaking down market logic based on professional accumulation, and providing pragmatic trading ideas.

Market Overview

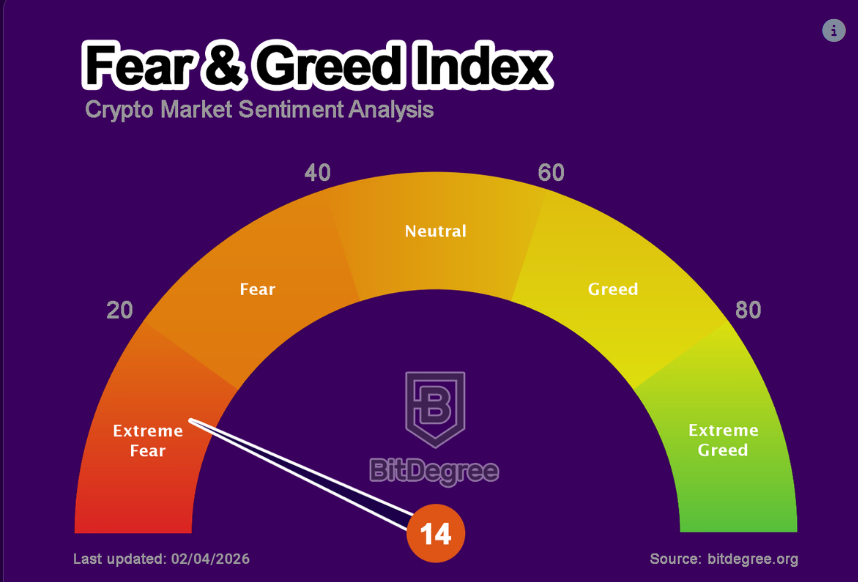

Currently, the cryptocurrency market continues to face downward pressure, extending the selling trend from earlier this week. Bitcoin's price briefly fell below $73,000, marking a nearly 15-month low, and then slightly rebounded to around $76,000, but still dropped over 4% within 24 hours. The overall market capitalization is approximately $2.3 trillion, evaporating about 15% compared to last week. Although trading volume remains high, leveraged liquidations and institutional sell-offs have intensified volatility. The Federal Reserve's hawkish stance, geopolitical tensions, and ETF fund outflows are the main driving factors, leading to Bitcoin's dominance rising to about 58%. The Fear and Greed Index remains at 14, indicating extreme fear. In the short term, the retreat of risk assets continues to dominate the market.

Trend Analysis

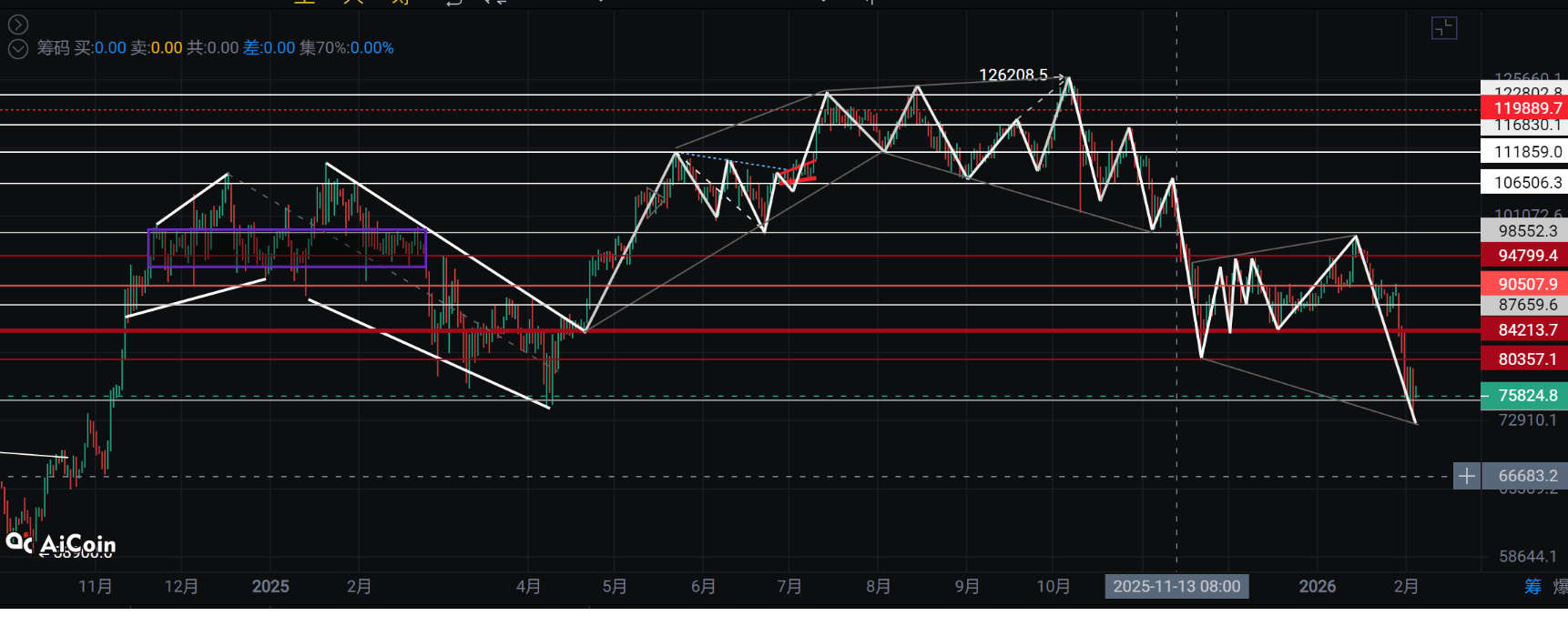

Bitcoin (BTC): Signs of a Bottom Rebound Emerging, but Risks Remain

Bitcoin has fallen over 15% this week, sliding from last week's high to a low of $73,000, marking a new low since November 2024. Although it rebounded slightly to around $77,000 today, macro factors such as the Federal Reserve's lack of interest rate cuts and potential government shutdown risks continue to exert pressure.

The current price is still hovering around the weekly support level. If it breaks down, Bitcoin may test the $60,000-$68,000 range to establish a bottom. In the short term, if it consolidates above $75,000, it may rebound to $82,000-$85,000.

Ethereum (ETH): Largest Decline, Institutional Sell-offs Intensifying

Ethereum plummeted 9.6% within 24 hours, with the price falling to $2,100, accumulating a weekly decline of over 20%. The ETH/BTC ratio continues to decline, resembling levels from the summer of 2016, reflecting a lack of confidence in Ethereum from the market.

Although the DeFi ecosystem remains active, overall corrections and leveraged liquidations have dragged down performance. If the macro environment continues to deteriorate, ETH may further test below $2,000. If it effectively breaks below the $2,000 mark, it could drop to $1,500-$1,600. In the short term, if it can effectively stay above $2,400, there is a chance to touch $3,000.

Analysis of Small Coins

TAMA: Price around $0.00005474, down 19.40% in 24h. News: Weak ecological demand, no major updates; Technical: Oversold signal (RSI 32.46), low liquidity, support at $0.00004, short-term consolidation.

PIP: Price around $0.0002291-$0.000256, low volatility. News: Solana ecosystem meme coin, no hot topics; Technical: Neutral RSI, support at $0.0002, short-term fluctuations.

BNB: Price around $753.58-$761.20, down 2.02% in 24h. News: Blue-chip asset, but ETF outflows lead to a bear market; Technical: Below EMA line, RSI ~29 oversold, support at $736.

Potential Influencing Factors and Outlook

This adjustment stems from macro headwinds, including the Federal Reserve's hawkish shift, geopolitical tensions in Iran, ETF outflows, and concerns about a crypto winter. The U.S. Senate Democrats will discuss the cryptocurrency market structure bill today, which may bring regulatory clarity.

In the short term, if BTC stabilizes at $75,000 and ETH holds above $2,100, a technical rebound can be expected; otherwise, the risk of further declines increases. However, in the long term, further downside risks to $65,000 should be monitored. It is recommended to pay attention to the Federal Reserve's dynamics and global indicators, maintain a light position, prioritize spot trading, and consider light positions for contracts. (Remember to control contract positions within 10% and set stop-loss orders.)

Disclaimer: The above content is personal opinion, and strategies are for reference only, not as investment basis. Any risks taken are at your own discretion.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。