Author: Liang Yu

Editor: Zhao Yidan

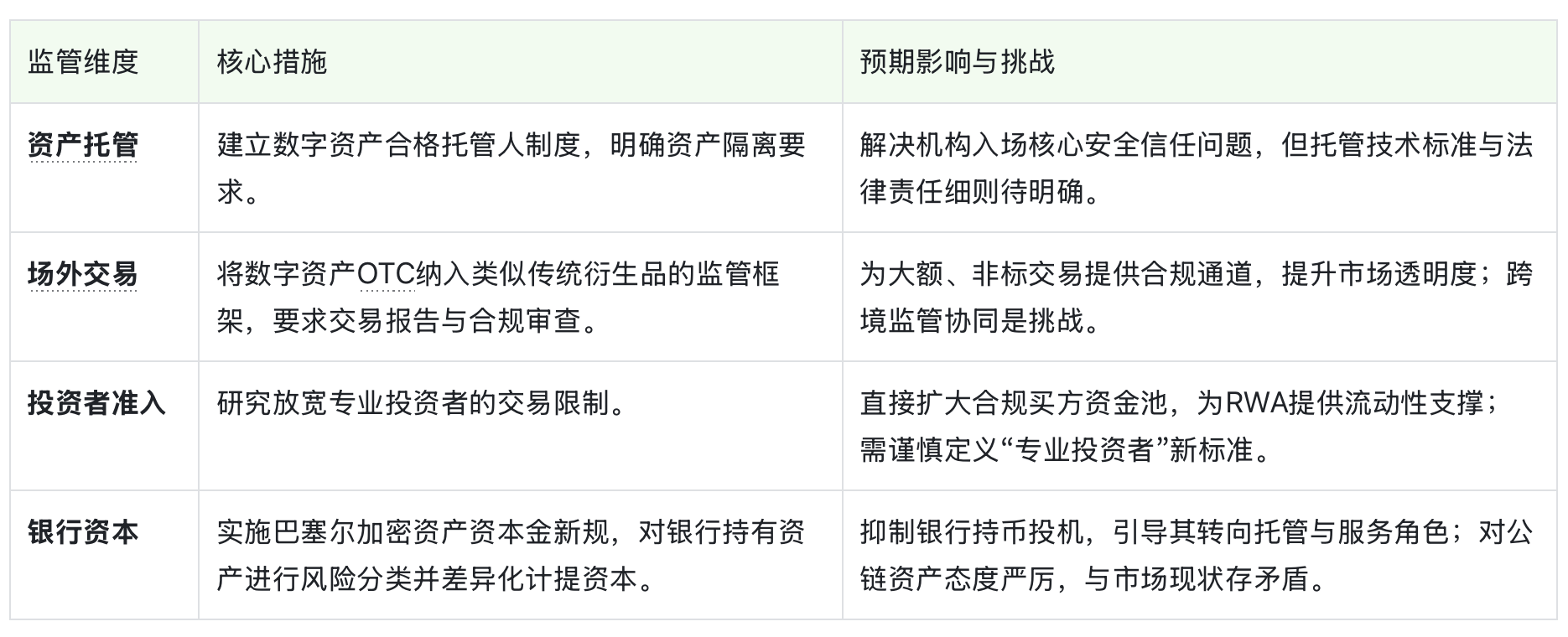

In early February 2026, Hong Kong Legislative Council member Wu Jiezhuang clearly stated during an industry exchange that Hong Kong is expected to launch a dedicated regulatory framework for digital asset custody and over-the-counter (OTC) trading within the year, and is studying the relaxation of trading restrictions for professional investors. This policy signal quickly attracted widespread attention in the financial and technology sectors, seen as a key step for Hong Kong to solidify its position as a global digital financial hub.

This is not an isolated policy trend. Previously, the Hong Kong Monetary Authority confirmed that new capital requirements for banks regarding crypto assets, based on Basel Committee standards, will officially take effect on January 1, 2026. A series of rapid institutional developments point to a clear strategic direction: Hong Kong is committed to building a clear and reliable institutional loop for institutional-level digital assets represented by real-world assets (RWA), which require high compliance standards.

The essence of the rules is to build trust, and what Hong Kong is writing is a "safety manual" that allows traditional world capital to enter the digital new world with peace of mind. Its regulatory approach is becoming increasingly clear: it does not encourage short-term speculative trading but instead guides financial resources towards real assets and sustainable innovation by building solid infrastructure. When the safety locks of custody, the compliance channels of trading, and the lifeblood of long-term funds are all in place, an "institutional-level entry" serving the trillion-dollar RWA market is beginning to take shape.

1. Policy Direction: Three Pillars of Hong Kong's Digital Financial Regulation

Hong Kong is trying to answer a question that has troubled global financial markets: how to ensure the security, liquidity, and compliance of traditional assets when they enter the digital world in token form?

Member Wu Jiezhuang positions Hong Kong as a "super connector" that links Eastern and Western markets and integrates traditional finance with crypto innovation. Whether this role can be successfully played depends on whether a "pipeline" and "gate" can be built to allow institutional funds to enter and exit with confidence.

The regulatory blueprint for 2026 is a systematic response to this question. It focuses on three core pain points: how to securely custody assets, how to conduct large transactions in compliance, and who is qualified to participate in this game.

Hong Kong's Financial Secretary Paul Chan emphasized at the Davos Forum that Hong Kong promotes market development based on the principle of "same activity, same risk, same regulation." The upcoming custody and OTC regulations are a concrete implementation of this principle in the digital asset field.

2. Why is Custody Regulation the Lifeline for Institutional Entry?

For financial institutions managing billions in funds, asset security is a non-negotiable red line. In the traditional financial world, this function is performed by custodial banks with strict qualifications. However, in the digital asset field, compliant custody services have long been lacking, becoming one of the biggest "roadblocks" for institutional entry.

The upcoming custody regulatory framework aims to establish a "qualified custodian" system in the digital world. Its significance goes far beyond providing a safe deposit box.

First, it addresses the fundamental trust issue of "bankruptcy isolation." According to clarifications from the Basel Committee and the Hong Kong Monetary Authority, as long as a client's crypto assets are effectively isolated from the bank's own assets, providing custody services typically will not trigger additional credit or market risk capital requirements. This clears a key obstacle for banks to engage in such business.

On a deeper level, compliant custody provides a crucial legal basis for "asset confirmation" for tokens backed by real underlying assets like real-world assets.

When a commercial property or a bond is tokenized, the custody solution needs to clearly define the ownership mapping relationship between on-chain tokens and off-chain physical or legal rights, ensuring that this relationship is legally enforceable and traceable in the event of a dispute. This is the technical prerequisite for bringing the confidence of traditional asset holders into the digital world.

If custody services create a static safety pool for assets, then OTC trading is the key lifeblood for the dynamic circulation of assets. For large, non-standardized inter-institutional transactions (such as bulk RWA product trades), public order book trading markets often struggle to accommodate, making OTC negotiation a necessary choice.

However, the OTC market, which has long been in a regulatory gray area, also comes with counterparty risks, lack of transparency, and compliance uncertainties. The upcoming OTC regulatory framework in Hong Kong aims to provide a "compliance counter" for such transactions "in the sunlight."

Hong Kong has mature experience in regulating traditional financial OTC derivatives. The Hong Kong Securities and Futures Commission and the Monetary Authority have established a multi-layered regulatory system, including mandatory reporting and mandatory clearing, and continue to optimize it. Recently, regulators have proposed improvements to the calculation cycle of clearing rules for standardized OTC derivatives to enhance market efficiency and certainty.

Incorporating digital asset OTC into a similar regulatory framework means that large inter-institutional transactions will face a series of normative requirements such as transaction reporting, anti-money laundering reviews, and transaction record retention.

A regulated OTC market can not only significantly reduce compliance risks in trading, but the accumulated transparent trading data will also provide valuable bases for asset pricing and risk assessment, thereby attracting more traditional financial institutions that have been on the sidelines.

Once safe custody and compliant trading channels are established, the market needs sufficient "liquidity" to activate it. Currently, Hong Kong has set high financial thresholds for professional investors in investable virtual assets, effectively keeping many "qualified but non-top-tier" institutional investors (such as small and medium-sized funds, family offices) out of the market.

Researching the relaxation of trading restrictions for professional investors is strategically aimed at systematically expanding the pool of compliant institutional buy-side funds. This move directly responds to the core demand for the development of the RWA market: liquidity.

The value discovery and price stability of RWA products require rational, long-term institutional funding support, rather than short-term speculative funds from the retail market. An expanded and diversified group of professional investors can provide more precise pricing and deeper liquidity support for RWA products with different risk-return characteristics, forming a healthy market ecosystem.

3. New Banking Regulations: How Capital Requirements Affect Market Dynamics

Beyond the three direct regulatory measures of custody, OTC, and investor access, another rule change with far-reaching implications is occurring simultaneously—the Basel capital requirements for crypto assets, which the Hong Kong Monetary Authority will fully implement on January 1, 2026.

This new regulation categorizes crypto assets into two groups and four categories based on asset risk, imposing differentiated capital requirements. Its core impact lies in fundamentally reshaping the costs and willingness of the banking system to hold and treat digital assets.

The most striking aspect of the new regulation is that it explicitly states that all crypto assets issued on unlicensed blockchains, including most stablecoins and RWA tokens, cannot be classified into the low-risk Group 1 and are likely to be classified into Group 2b with a risk weight of up to 1250%.

This means that if banks hold such assets with their own funds, they will need to set aside extremely high regulatory capital. This regulation will undoubtedly greatly suppress banks' enthusiasm for directly holding RWA assets on mainstream public chains.

However, the rules also clarify key exemptions: providing custody services for clients, as long as asset isolation is achieved, typically will not trigger additional capital requirements. This is effectively strongly guiding banks to shift their business focus from "self-holding" to "intermediary services."

The new regulations act like an "invisible hand," pushing Hong Kong's banking system towards a clearer division of roles: becoming a secure gateway and infrastructure provider that connects the traditional world with the digital world, centered on custody and trading services, rather than being the main risk bearer of assets.

4. Why RWA Will Be the Biggest Beneficiary?

When we examine the fourfold transformations of custody security, OTC compliance, expansion of funding pools, and the shift in the role of banks, a clear picture emerges: Hong Kong is committed to creating a complete ecological loop that is "fiat-friendly, regulatory clear, and institutionally trustworthy" for asset classes like RWA that have real underlying assets and seek long-term stable returns.

The logic of constructing this loop is layered. Compliant custody solutions address the fundamental trust issues of asset custody security and legal confirmation, allowing asset holders to confidently "go on-chain."

Regulated OTC platforms solve the problem of how to conduct large transfers in a compliant and efficient manner after assets go on-chain, ensuring smooth value transfer.

Relaxing professional investor thresholds directly introduces more long-term funds seeking stable returns, providing ample liquidity sources and value support for RWA products.

Meanwhile, the Basel capital requirements at the systemic level force financial institutions to adjust their strategies, focusing more on providing custody, settlement, compliance consulting, and other infrastructure services for the entire ecosystem, rather than engaging in speculation.

The effects of this loop are beginning to show. For example, Hong Kong's Ensemble project sandbox has upgraded to the "EnsembleTX" interconnectivity platform trial run, achieving real-time interbank transfers of tokenized deposits among seven banks, including HSBC and Bank of China Hong Kong.

Companies like China Gas have successfully tokenized a credit limit of HKD 100 million from its subsidiary as the underlying asset for RWA. These practices validate the technical and commercial feasibility from asset issuance to trading circulation.

5. Development Path of Hong Kong's RWA Ecosystem

Although the blueprint is clear, the road to 2026 is still fraught with challenges that need to be handled with care. The primary challenge comes from the contradiction between technological paths and regulatory standards. Currently, the most vibrant and innovative RWA projects are often developed on permissionless public chains like Ethereum to achieve global accessibility and interoperability.

However, the punitive capital requirements imposed by the Basel new regulations on such assets directly conflict with the technological choices of the market. Finding a balance between controlling risks and embracing technological innovation will be a significant test for regulators.

Secondly, the complexity of regulatory coordination cannot be underestimated. Digital assets inherently possess cross-border attributes, and Hong Kong's custody and OTC rules need to be coordinated with the regulations of the asset's source and the investor's location. The recent memorandum of understanding on virtual asset regulatory cooperation signed between Hong Kong and the UAE is an effort to address such challenges.

Thirdly, market education and talent reserves are a soft but critical aspect. The understanding, acceptance, and participation of traditional financial institutions are the foundation for the prosperity of the entire ecosystem. This requires time and a large number of professionals who understand both financial compliance and blockchain technology.

Looking ahead, as the regulatory framework gradually clarifies in 2026 and beyond, Hong Kong's digital asset ecosystem may present the following development trends:

A digital financial intermediary service system centered on licensed custodians, compliant OTC platforms, and professional legal and auditing services will rapidly professionalize. The issuance structure of RWA may tend to adopt a hybrid model, where the underlying asset rights and legal structures rely on Hong Kong's mature trust or SPV systems, while tokens representing beneficial rights are issued on permissioned chains or specific public chains based on target investors and liquidity needs.

At the same time, the inter-institutional market will mature first. As industry insiders have pointed out, in the foreseeable one to two years, starting with an institutional-to-institutional model and first building the "highway for money" on-chain is the most pragmatic and effective path.

A series of regulatory measures in Hong Kong are essentially paving the way for the scale of digital finance using the rules of traditional finance. It does not encourage pure speculation but is committed to providing a stable and trustworthy arena for innovations based on real value.

For the global RWA track, Hong Kong's exploration has significant signaling meaning. It validates a feasible path to bring traditional financial giants into the digital asset realm through progressive regulatory innovation. This path may not be as "disruptive" as some regions' declarations, but it is perhaps more robust and sustainable.

For market participants, 2024 to 2025 is a critical preparation period. Asset issuers need to reassess the legal structure, digitalization plans, and target markets of their assets.

Financial service providers should begin developing custody, trading, and compliance solutions that meet regulatory expectations. Investors need to evaluate their qualifications and enhance their understanding of this new asset class. What Hong Kong is building is not just the infrastructure of a regional market, but it may also become an important component of future global digital financial asset standards.

When the closed loop of custody, trading, and access finally comes together, what Hong Kong may showcase to the world is an Eastern model of how trust can migrate from offline to online, and how value can flow safely and efficiently under new rules.

In the Hong Kong Monetary Authority's "Ensemble" sandbox, HSBC assisted Ant International in completing a cross-bank transfer of a tokenized deposit amounting to HKD 3.8 million, with funds arriving in real-time.

This seemingly small step is backed by years of collaboration between the regulatory framework, banking system, and blockchain technology, pointing to a future where trillions of dollars in assets await reactivation.

Some sources of information:

· "Wu Jiezhuang: Hong Kong will launch custody and OTC-related regulations this year and study the relaxation of trading restrictions for professional investors"

· "Davos Forum: Hong Kong outlines a new path for fintech, promoting the construction of a gold trading hub"

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。