The price of Bitcoin once fell below the key support line of $76,000, and the world's largest publicly traded Bitcoin company faced its first unrealized losses, with over $2.3 billion in leveraged positions being forcibly liquidated within 12 hours.

Once regarded by the market as a "benchmark of institutional faith," MicroStrategy's average holding cost line (approximately $76,037) was completely breached by the end of January 2026. Bitcoin has retraced from its high of nearly $126,000 in October 2025, with a decline of over 30%, triggering the largest scale of leveraged liquidations since November 2025.

The risks of a high-leverage environment, insufficient exchange liquidity, and highly concentrated institutional holdings were fully exposed during this round of decline.

1. Market Flash Crash: Key Support Levels Lost and Leverage Bubble Burst

● The market underwent a brutal stress test. The price of Bitcoin has continued to decline since its peak in November 2025, with a cumulative drop of over 30%. During the decline, several key psychological and technical support levels were breached one by one.

● The first to fall was the psychological barrier of $80,000 and the previous trading concentration area. Subsequently, the average holding cost line of MicroStrategy (approximately $76,037), regarded as the "benchmark of institutional faith," was also breached.

● This means that as the publicly traded company with the largest Bitcoin holdings globally, its Bitcoin holdings have entered an unrealized loss state for the first time.

● The price falling below key levels triggered a chain liquidation in the high-leverage derivatives market. Within 12 hours on the morning of February 1, 2026, the total liquidation amount across the network reached $2.367 billion, with over $2.2 billion being long positions forcibly liquidated.

● This "drop-liquidation-further drop" vicious cycle quickly drained the liquidity of the order book in a short time, exacerbating the price decline.

2. Core Issue: Institutional Holding Costs and Old Narratives Collapse

● The core contradiction of this market adjustment points directly to the "institutionalization" narrative that has been central to the bull market over the past year. When institutions shift from being drivers to potential sources of selling pressure, the inherent fragility of the market structure is fully exposed.

● Key institutional holdings are now overall at a loss. Analysis shows that MicroStrategy and 11 spot Bitcoin ETFs collectively control about 10% of the circulating Bitcoin supply, with a combined average purchase cost of approximately $85,360.

● At current prices, these institutional holdings are overall at a loss of about $7 billion.

MicroStrategy's safety cushion has essentially disappeared. The company has adopted an aggressive financial strategy of issuing high-yield preferred shares for financing to continue purchasing Bitcoin, raising the dividend rate to 11.25%.

This high-cost financing method is feasible when prices rise, but it severely squeezes the company's cash flow and increases financial risk when prices fall.

3. Liquidity Risk: Pro-Cyclical Effects and Exchange Dilemmas

● Liquidity exhaustion has amplified this round of decline. Data shows that the spot trading volume on major centralized exchanges (CEX) has plummeted from about $2 trillion in October 2025 to the $1 trillion range in January 2026, falling to its lowest level since 2024. Bitcoin's liquidity has declined by over 30% compared to the peak in October 2025.

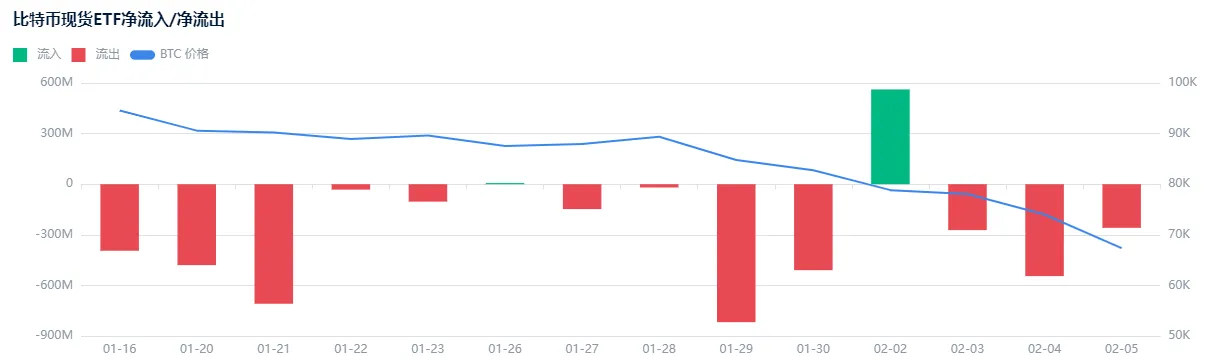

● The "buying engine" that previously drove prices up—the spot Bitcoin ETFs—has recently seen continuous net outflows for several trading days. The total outflow over the past five days amounts to approximately 1.7 trillion Korean won, reflecting a simultaneous shrinkage in sentiment among institutional and individual investors.

● The high-level trapped positions in ETFs are forming a "redemption exacerbates the decline" counter-cyclical effect. This is in stark contrast to the earlier pro-cyclical effect of "buying driving up," amplifying the downward pressure on the market.

● Meanwhile, the technical weaknesses of some centralized exchanges have also been exposed under extreme market conditions. During the market crash, exchanges like Binance experienced system delays and trading interruptions, preventing users from managing accounts and placing orders, leading to escalating losses.

4. Market Outlook: Possibility of Deep Declines and Exchange Transformations

Opinions on the market outlook are divided, but there is a general acknowledgment of significant short-term pressure. On-chain data analysts believe that even if 2026 continues to be bearish, Bitcoin is likely to bottom out within the $70,000-$80,000 or $60,000-$70,000 strong support ranges.

● Some analysts have provided more detailed probabilistic forecasts, suggesting that the most likely bear market low (60%-70% probability) is in the $58,000-$65,000 range.

● In response to the slowdown in core crypto business growth, major exchanges are actively seeking incremental growth. Precious metals, commodities, and tokenization of U.S. stocks have become new battlegrounds for various platforms. For example, Binance has offered zero order fees for perpetual contracts on gold (XAU) and silver (XAG); the TradFi segment of Gate exchange has surpassed $20 billion in total trading volume.

● Platforms like Robinhood and Kraken are also vigorously promoting the tokenization of U.S. stocks. This transformation allows crypto users to settle with stablecoins in USD and participate in trading external assets with high leverage without leaving familiar platforms.

5. Fragile Balance: Potential Triggers for the Next Round of Liquidations

● The market is in a state of fragile balance. The real risk lies in the lack of new large-scale buying at current price levels. The market suddenly realizes that the highly institutionalized holding structure is like a double-edged sword: it acts as a booster during price increases but may turn into concentrated and massive potential selling pressure during declines.

● If prices continue to fall, it may trigger a new chain reaction. If Bitcoin remains below MicroStrategy's cost line for an extended period, the sustainability of its aggressive high-yield financing strategy will face severe challenges. If the ongoing net outflow trend of spot ETFs cannot be reversed, it will continue to deplete the already insufficient market liquidity.

● Additionally, changes in the macroeconomic environment are also key variables. The strong dollar narrative, geopolitical risks, and potential liquidity tightening in traditional financial markets may further suppress the preference for global risk assets, including cryptocurrencies.

A mysterious whale address quietly acted during the market crash, using the codename "7 Siblings" to counter-trend purchase 12,806 ETH, continuously placing unfilled orders to accumulate.

On the other hand, over 200,000 traders were forcibly liquidated during the weekend's liquidation wave, with many retail investors who entered the market in the late bull phase suffering losses of over 30%. The balance of the market is being readjusted, and those relying on a single narrative and high leverage are being accelerated out.

Join our community to discuss and become stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。