Original Title: Crashes, Manias and Panic's

Original Author: @RaoulGMI

Translated by: Peggy, BlockBeats

The feeling outside is too brutal, there is no hope. Everything is over. You missed it. You messed it up again.

Everyone is angry and confused. Even those who foresaw all this may feel a bit smug, but many also understand how much damage such price movements can cause. These moments always make one feel like it’s the worst of times.

I have been in the market for 38 years (today's sell-off is a "birthday gift" for me, along with food poisoning last night!). I have seen all kinds of crashes and panics.

They all feel the same, terrible.

I entered the crypto market in 2013, buying Bitcoin for the first time at $200. After buying, it rose for a while, then fell 75%… and that was still during a bull market, ultimately the price was more than 10 times higher than my purchase price. I didn’t sell because this was a long-term investment, and I understood the risks. Then in the bear market of 2014, it fell 87%.

Next, during the bull market leading to 2017, I experienced three pullbacks of 35%–45%… brutal. Ultimately, due to the Bitcoin fork wars, I sold near $2000 (the previous high in 2013). Compared to my initial purchase price, I had made 10 times my investment. But then it rose another 10 times by the end of the year (!!), and then kicked off a new round of a big and ugly bear market.

I managed to avoid that entire bear market, and it felt great at the time.

During the pandemic crash, I bought back in at $6500 (3.5 times higher than my selling price). It turned out to be an expensive mistake of "thinking I did the right thing."

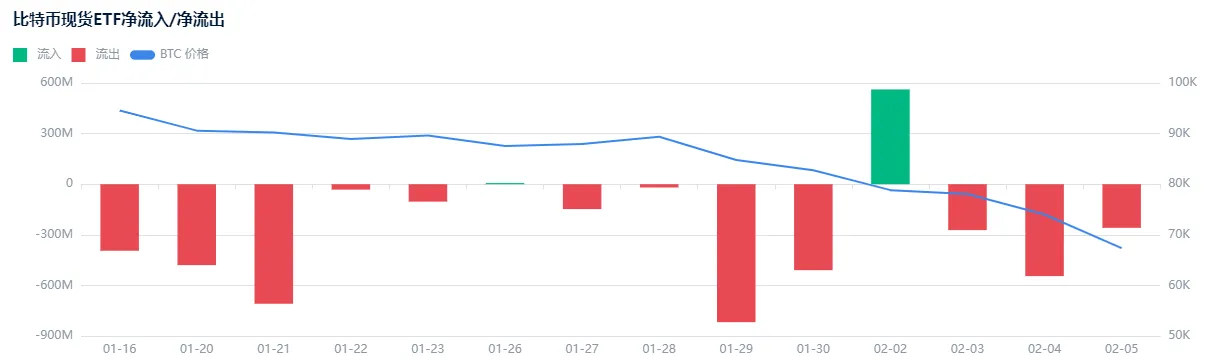

From April to July 2021, Bitcoin fell 50% in a market environment similar to now. The sentiment on Twitter was terrible, really terrible. But during that round, the market wasn’t as severely oversold as it is today…

By November 2021, the market returned to a historical high: SOL rose 13 times from its low, ETH doubled, and Bitcoin reached a new high with a 150% increase.

I have experienced all of this firsthand; all those terrifying, heart-wrenching moments happened during a long-term bull market.

I bought for the first time at $200, and now the price is $65,000. I even missed a 3.5 times increase in the middle due to poor timing.

The first key lesson (for me): In a long-term upward asset, the best strategy is often to do nothing. "HODL" has become a meme for good reason. It is more powerful than the "four-year cycle" meme.

The second lesson: Be decisive in adding to your position during a downturn. Even if you can’t perfectly time the bottom, continuously adding to your position as it weakens will, in the long run, have a compounding effect on returns that is even stronger than dollar-cost averaging (DCA).

I don’t always have enough cash to buy heavily during a downturn, but I always buy a little—this is very important for training your psychology.

It always makes you feel: the opportunity has been missed, it won’t come back, everything will completely collapse.

But that’s not the case.

Ask yourself two questions: Will tomorrow be more digital than today? Will fiat currency be worth less tomorrow than today?

If the answer is "yes" to both, then keep moving forward. BTFD, let "time in the market" beat "timing the market," because it always does. Adding to your position during significant pullbacks will significantly lower your cost basis, and that difference is huge.

Stress, fear, and self-doubt are the inevitable "taxes" of this journey.

The size of your position should match your own risk tolerance. Don’t worry, when prices fall, everyone feels their position is too heavy; when prices rise, they feel their position is not enough. All you need to do is manage these emotions and find your own "sweet spot."

Another key point: Don’t borrow other people's beliefs.

"DYOR" is a very important meme; without it, you simply can’t get through these phases. You need to earn your own beliefs. Borrowed beliefs are like leverage—they will eventually blow you up.

Remember: When you are busy blaming others, you are actually blaming yourself.

Yes, it feels dark right now. But soon, the sun will rise again, and this will just become another scar on the journey (as long as you haven’t used leverage! Leverage can lead to permanent capital loss—you will lose your chips at the casino). Never lose your chips.

When will all this end? I don’t know, but I feel it’s more like the panic from April to November 2021—a panic within a bull market. I believe it will end soon. Even if I’m wrong, I won’t change my approach: as long as I have some cash, I will keep adding.

But for you, the situation may be different. Try to build a "regret minimization" portfolio: Can you withstand a 50% drop from here? If not, then reduce your position, even if it seems foolish to do so. The right mindset is crucial for survival. My mindset is "How can I buy more," while yours may be the exact opposite.

There will always be some timing experts who can accurately catch the downturn, liquidate, or short. They will always exist. But honestly, you just need to tell yourself: This can happen at any time. That way, when it happens, you won’t be so anxious because you anticipated it! It’s just part of the story, not the whole story.

So what am I doing now?

I’m starting to buy some digital art (which also increases my ETH allocation) and plan to continue increasing my crypto asset allocation over the next week—just like I do every time I encounter such an opportunity.

I bought during the pandemic crash, the 2021 pullback, the 2022 downturn, and the 2023 decline, and I will do the same in 2024 and 2025. This time I will do it again. Each time, my gains and losses will set new highs before the market, it’s almost like magic. Once again: BTFD!

Good luck. It’s never easy.

Volatility is the price we pay for long-term compounding returns. Embrace it.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。