Author: Yi He

This article investigates Morgan Stanley's stance on cryptocurrencies and examines the current developments in the cryptocurrency industry. The leadership of Morgan Stanley (CEO James Gorman and Chief Investment Officer Lisa Shalett) acknowledges that cryptocurrencies are no longer a fleeting trend but emphasizes their high volatility and speculative nature. Internally, Morgan Stanley's research and wealth management departments view cryptocurrencies (especially Bitcoin) as an emerging asset class—similar to "digital gold"—that can provide portfolio diversification for suitable investors[1][2]. The company is gradually expanding client access: by 2025, all Morgan Stanley wealth clients (including retirement accounts) will be able to invest in Bitcoin and Ethereum funds[3][4], although the bank recommends a conservative allocation (0-4% of assets)[5][6]. Morgan Stanley also emphasizes that regulatory clarity (such as new U.S. stablecoin laws and ETF approvals) is accelerating institutional adoption[7][8].

The main legal foundations include U.S. securities and commodities laws (the 1933 Securities Act/1934 Exchange Act under SEC jurisdiction, the 1940 Investment Company Act, and the Commodity Exchange Act under CFTC jurisdiction), U.S. anti-money laundering rules (the Bank Secrecy Act managed by FinCEN[9]), and specialized legislation (such as the 2025 stablecoin "GENIUS Act"[10]). Globally, the EU's Markets in Crypto-Assets Regulation (MiCA) (effective in 2025)[11], the Payment Services Directive (PSD2), and anti-money laundering directives provide a framework. Key regulatory bodies include the U.S. SEC, CFTC, FinCEN, and OCC[12][9]; European regulators ESMA and EBA (overseeing MiCA)[11]; the UK's Financial Conduct Authority (FCA); and international organizations (BIS, Basel Committee, FATF) that set standards[13][14]. These laws and institutions shape the legal environment for cryptocurrencies globally.

Key global regulators: the U.S. SEC (securities regulator) and CFTC (commodities regulator) are crucial; FinCEN (Department of the Treasury) enforces anti-money laundering/KYC rules; OCC, FDIC, and the Federal Reserve oversee bank participation. In the EU, ESMA/EBA supervise the implementation of MiCA and anti-money laundering rules. Asian regulators include the Monetary Authority of Singapore (Payment Services Act) and the Financial Services Agency of Japan; the UK's FCA regulates exchanges and is drafting a stablecoin framework. International organizations such as the Financial Action Task Force (FATF)—and its "travel rule"—as well as the Bank for International Settlements (BIS)/Basel Committee provide cross-border guidance[15][13].

References: This analysis draws on Morgan Stanley's research and news sources. Key references include Morgan Stanley Wealth Management reports[1][2], Morgan Stanley podcast transcripts[16][17], and financial media coverage of Morgan Stanley's cryptocurrency strategy (Reuters, Business Insider, Blockworks)[18][19][5]. The regulatory context is supported by legal analyses[12][9][11] and cryptocurrency industry reports[20][10]. Each reflects the latest data on the cryptocurrency market and policy.

I. Morgan Stanley's Views and Strategies on Cryptocurrency

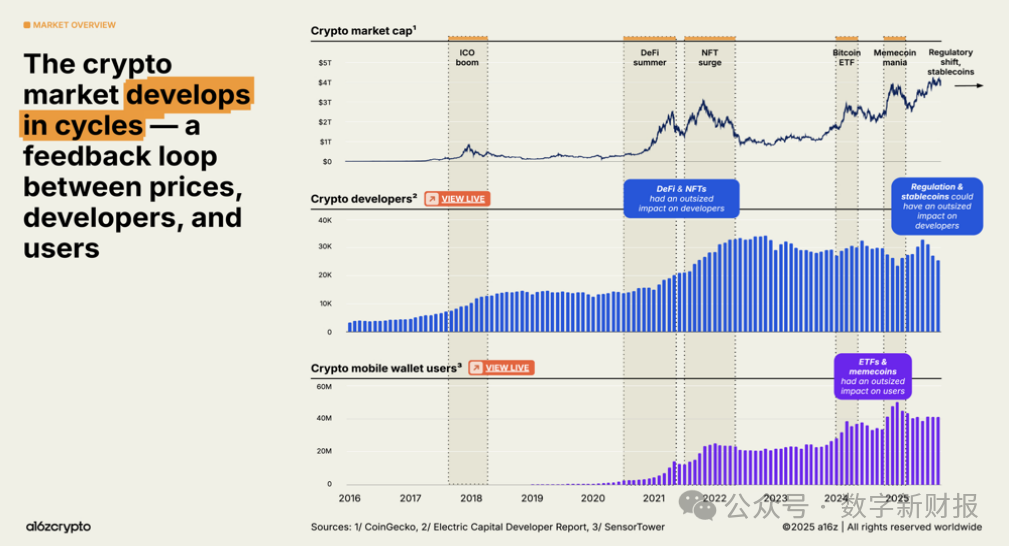

Morgan Stanley's leadership has been cautious but is gradually accepting cryptocurrencies. Former CEO James Gorman (now Executive Chairman) noted that "Bitcoin is not going away," but described it as "pure speculation," suggesting it should only play "a very small role" in the portfolios of wealthy investors[19]. He warned of "huge regulatory changes and industry disruptions" and a lack of intrinsic value in cryptocurrencies[19]. Consistent with this cautious stance, Morgan Stanley's Global Investment Committee (GIC) explicitly views cryptocurrencies as speculative assets; its October 2025 report describes cryptocurrencies as "an emerging, speculative, and increasingly popular asset class," focusing on Bitcoin as scarce "digital gold"[1]. The GIC does not recommend mandatory allocations but suggests a cap of 2-4% in the most aggressive model portfolios[1][6]. In practice, Morgan Stanley Wealth Management recommends a moderate cryptocurrency exposure (typically 0-3%), depending on risk tolerance[6]. The following chart illustrates the cryptocurrency market cycle and adoption (2016-2025).

At the same time, Morgan Stanley's research team emphasizes the transition of cryptocurrencies to mainstream finance. The November 2025 Morgan Stanley podcast (hosted by Morgan Stanley analysts Michael Cypris and strategist Danny Galindo) pointed out that cryptocurrencies have "transitioned from the fringes of finance to being viewed as a legitimate part of mainstream asset allocation"[21]. They noted that both retail and institutional clients have shown increasing interest following recent U.S. elections and legislation (such as the "GENIUS Act" on stablecoins)[21][22]. Morgan Stanley now allows financial advisors to discuss Bitcoin funds with all clients (not just ultra-high-net-worth clients) and has expanded access to consultations[17][3]. Morgan Stanley has also authorized clients to trade certain cryptocurrency products: for example, starting in late 2025, advisors can recommend Bitcoin exchange-traded products (ETPs) in brokerage or retirement accounts[3], and in early 2026, the company plans to offer direct trading of Bitcoin, Ethereum, and Solana through its E*Trade platform[23][4].

Financially, Morgan Stanley's internal research (as well as research from partners like BlackRock and Fidelity) now views cryptocurrencies as part of a broader category of tangible assets. The GIC refers to Bitcoin as "a form of digital gold," categorizing it under tangible assets[24][2]. The bank's Chief Investment Officer Lisa Shalett recently wrote that cryptocurrencies are "a speculative and increasingly popular asset class that many—but not all—investors want exposure to"[5]. However, the company advises extreme caution: Morgan Stanley's portfolio models place cryptocurrencies at the lower end of the risk spectrum. For moderate-risk clients, it recommends that cryptocurrency exposure not exceed 0-2%, with even aggressive allocations capped at 4%[6][5], echoing similar guidelines from other Wall Street banks.

II. Market Adoption and Development

The global cryptocurrency market has seen significant growth, although price volatility remains high. The total market capitalization of cryptocurrencies recently surpassed $4 trillion for the first time[20]. A16Z's 2025 report emphasizes that cryptocurrencies are now "an essential part of the modern economy": leading institutions like Visa, BlackRock, Fidelity, and JPMorgan offer cryptocurrency products, and blockchain processes thousands of transactions per second[25]. In particular, stablecoins support trillions in transaction volume (comparable to major payment systems)[26]. By the end of 2025, there are estimated to be 40 to 70 million active cryptocurrency wallets (out of approximately 700 million cryptocurrency users)[27], indicating that adoption, especially in emerging markets, is accelerating.

As seen in the above chart of the cryptocurrency market cycle and adoption (2016-2025), volatility is significant, but the overall trend is upward.

Over the past decade, cryptocurrencies have exhibited repeated cycles of growth and adjustment. The above chart (from industry data) shows how major price peaks (the 2017 ICO boom, the 2021 DeFi/NFT surge, and the recent Bitcoin/ETF rebound) coincide with surges in active developers and user wallets. Notably, the 2025 cycle reached record metrics: market capitalization exceeded $4 trillion, and tens of millions of users held cryptocurrencies. These trends support Morgan Stanley's view of cryptocurrencies "moving toward the mainstream"[21].

Institutional participation is also on the rise. Since 2024, dozens of large asset management firms (like BlackRock and Fidelity) have launched spot Bitcoin/Ethereum ETFs, driving billions in inflows[22]. Morgan Stanley itself filed an S-1 in early 2026 to launch Bitcoin and Solana ETFs[18], reflecting a broader shift: banks are transitioning from passive custodians to active advisors in cryptocurrencies. In terms of exchanges, trading volumes are climbing: the Chicago Mercantile Exchange's cryptocurrency futures and options trading volume tripled in 2025, and U.S. brokers report dozens of tokens available for clients.

For example, about 20% of Robinhood's revenue comes from cryptocurrency trading[29]. Traditional brokers like Charles Schwab now hold billions in cryptocurrency ETFs[30] and are moving toward offering spot cryptocurrency trading by 2026. Morgan Stanley analysts note that regulatory easing (such as 24/7 trading on CME starting in 2026 and new U.S. listing rules) is expected to further unleash cryptocurrency trading volumes[31][32].

Despite the enthusiasm, Morgan Stanley emphasizes that adoption is still in its early stages. Research analysts observe that early growth in cryptocurrencies was primarily driven by retail demand, with institutions only recently beginning to experiment with small allocations[33][34]. Most institutions today have very modest cryptocurrency allocations (typically only 1-2% in Bitcoin) and target specific objectives (inflation hedging, diversification)[35][6]. Morgan Stanley points out that institutional allocations "will not happen overnight"—they require regulatory certainty and macro clarity[34]. Consistent with this, Morgan Stanley's current recommendation is conservative: clients should not "always over-allocate" but should only consider cryptocurrency exposure when it aligns with their risk profile (e.g., digital gold enthusiasts, tech believers, or diversification seekers)[17][6].

III. Regulatory and Legal Background

The development of the cryptocurrency industry largely depends on the legal framework and regulatory clarity—Morgan Stanley frequently points this out. In recent years, significant regulatory progress has instilled confidence in institutional investors. For example, in 2024, the U.S. SEC approved the first spot Bitcoin and Ethereum ETFs, which Morgan Stanley analysts described as a milestone that "legitimizes cryptocurrencies as an investable asset class"[36]. In early 2026, Morgan Stanley itself applied for Bitcoin and Solana ETFs[18], reflecting a broader transformation: banks are shifting from passive custodians to active advisors in cryptocurrencies.

In the United States, cryptocurrency regulation currently relies on existing laws and institutions. The SEC views many tokens as securities (leading to enforcement actions against exchanges like Coinbase and Binance[12]), while the CFTC regulates cryptocurrency derivatives and generally classifies Bitcoin as a commodity under the Commodity Exchange Act[37]. The Treasury's FinCEN enforces anti-money laundering rules (treating cryptocurrency companies as money service businesses since 2013)[9], and the IRS taxes cryptocurrencies as property (capital gains)[38]. Other U.S. initiatives include the 2025 GENIUS Act (creating a federal framework for stablecoin issuers)[10] and proposals like the Infrastructure Act (tax and reporting rules). Even without a single "cryptocurrency law," regulators are applying securities, commodities, banking, and money transmission laws to digital assets[12][9].

Globally, regulatory frameworks are evolving. The EU's Markets in Crypto-Assets Regulation (MiCA) will fully take effect in 2025[11], creating the first unified framework for crypto asset service providers and stablecoins. Implementation varies, but regulators (ESMA, EBA, and national regulators) are refining technical rules[11]. Japan and Singapore have also developed comprehensive cryptocurrency laws (such as Japan's Virtual Asset Service Provider rules and Singapore's Payment Services Act), regulating exchanges and token issuance. The People's Bank of China has banned private cryptocurrencies but is promoting its digital yuan CBDC. Many countries—from the UK and South Korea to Australia and Canada—are actively drafting cryptocurrency-specific regulations (often focusing on anti-money laundering/KYC, consumer protection, and stablecoins). Notably, Asia has taken steps regarding stablecoins and interoperability: for example, Hong Kong implemented a stablecoin regulatory framework in 2023, and Singapore is finalizing its own stablecoin rules[10].

International organizations also influence cryptocurrency policy. The Financial Action Task Force (FATF) has extended its anti-money laundering/anti-terrorist financing "travel rule" to cryptocurrency transfers[39]. The Bank for International Settlements (BIS), Basel Committee, and Financial Stability Board (FSB) have issued standards for bank exposure and stablecoins[13][14]. For instance, Basel is reviewing its prudential capital rules for banks' cryptocurrency holdings[40], and the BIS has published recommendations on tokenization and CBDCs. Morgan Stanley analysts closely track these developments: they note that each step toward clarity (such as the GENIUS Act or SEC guidance on tokenization) tends to trigger more institutional interest[7][10].

IV. Investment Risks and Considerations

Morgan Stanley repeatedly warns that cryptocurrencies are highly volatile and speculative. In its wealth management disclosures, Morgan Stanley emphasizes that cryptocurrency products carry the risk of total loss due to volatility, custody issues, uncertain valuation models, and limited regulatory oversight[41]. Internally, Morgan Stanley research highlights that while Bitcoin "has proven its technological viability," it remains a speculative investment until its volatility decreases[42][43]. Morgan Stanley strategists describe three main investor mindsets: Bitcoin as digital gold (inflation hedge), cryptocurrencies as risk technology (growth play), or cryptocurrencies as portfolio diversification tools[44]. To hedge risks, the company's Global Investment Committee recommends regularly (e.g., quarterly) rebalancing cryptocurrency exposure and maintaining small allocations[5]. Lisa Shalett's October 2025 statement classifies Bitcoin as a "tangible asset," advising against fixed allocations; instead, advisors may consider cryptocurrencies only as part of a diversified portfolio rather than core holdings[5]. The overall message is that while cryptocurrencies are recognized for their potential, they must be approached with caution: Morgan Stanley emphasizes portfolio balance and risk monitoring (e.g., using automated tools to prevent over-concentration)[5][45].

V. Morgan Stanley's Shift from Skepticism to Detailed Recognition of Limited Allocations

In summary, Morgan Stanley views cryptocurrencies as an evolving emerging "mainstream" asset class—one with a strong investment narrative but also profound risks. The company's official stance has shifted from skepticism (emphasizing the speculative volatility of cryptocurrencies) to a detailed recognition of limited allocations. Morgan Stanley now provides its advisors with the ability to serve clients interested in cryptocurrencies (especially Bitcoin funds) while imposing conservative guidelines[6][5]. This reflects the current state of cryptocurrencies: major financial institutions and billions of dollars are flowing into digital assets, global regulation is moving toward clearer rules, and blockchain technology has proven scalable. Nevertheless, the market continues to grapple with booms and busts (as evidenced by recent cycles), and the legal framework is still evolving.

For investors, Morgan Stanley's message is clear: cryptocurrencies are worth studying and may play a small role in diversified portfolios—but one must be fully aware of the legal, regulatory, and volatility risks[19][42].

[1][2][42][43]Asset Allocation Considerations for Cryptocurrency

[3][5]Morgan Stanley opens crypto fund access to all wealth clients - Blockworks

[4][8][18]Morgan Stanley files for bitcoin, solana ETFs in digital assets push | Reuters

[6][7][16][17][21][22][28][29][30][31][32][33][34][35][36][44]Cryptocurrencies: Going Mainstream

[9][12][13][14][37][38]Cryptocurrency laws and regulations

[10][11][15][39][40]2025 Crypto Regulatory Round-Up

[19]Morgan Stanley's Gorman on Bitcoin, Bank Failures, Recession, Rate Cuts - Markets Insider

[20][25][26][27]State of Crypto 2025: The year crypto went mainstream - a16z crypto

[41]Investing in Crypto: Diversifying Your Portfolio | Morgan Stanley

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。