At 6:30 AM, the cryptocurrency market was in turmoil, with Ethereum plummeting over 13%. At that same moment, Yi Lihua's phone screen flashed a glaring red warning—his fund, Trend Research, was less than $200 away from a forced liquidation of its massive Ethereum holdings.

In the early hours of February 6, 2026, the cryptocurrency market experienced a complete collapse. Bitcoin and Ethereum led the decline, both dropping over 12%.

In this storm sweeping across the entire market, one name was on every trader's mind—Yi Lihua, the once-ambitious cryptocurrency investment mogul, was now facing the most severe test of his career.

On-chain data showed that the Ethereum positions held by his managed Trend Research fund were approaching a liquidation price range of $1574.23 to $1681.20. As of the time of writing, Ethereum's price had already fallen below $1800.

1. Market Collapse

● The cryptocurrency market on February 6 can aptly be described as "a river of blood." Bitcoin fell over 12% in a single day, with prices dipping to around $63,000. Ethereum's decline was even more severe, with a drop of over 13% causing its price to fall below the $1800 mark.

● Market data indicated that in just 24 hours, over 430,000 investors globally faced liquidation. Another data source even reported that the number of liquidated accounts reached as high as 586,000.

● According to CoinGlass, the total amount liquidated reached $2.069 billion (approximately 14.4 billion RMB). This collapse quickly spread from cryptocurrencies to traditional financial markets, with U.S. stocks, precious metals, and oil markets all affected.

2. Countdown to Liquidation

In this widespread collapse, the crisis faced by Yi Lihua and his managed Trend Research fund was particularly noteworthy.

● According to on-chain analyst @ai_9684xtpa, as Ethereum's price fell to around $1830, the latest liquidation range for Trend Research's six leveraged addresses was “$1574.23 - $1681.20”.

● This means that Ethereum's price only needed to drop by about $200 more for these massive positions to face forced liquidation.

3. Timeline Tracking

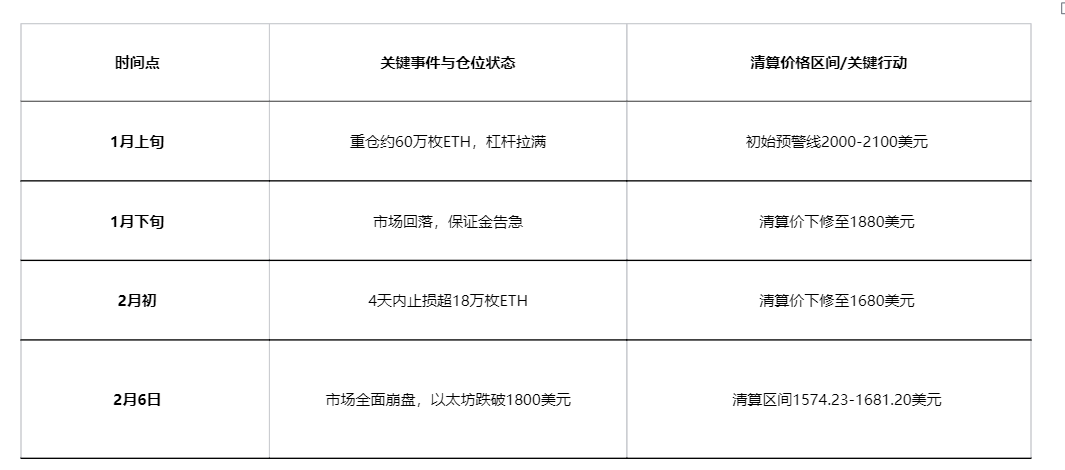

Looking back at the trajectory of Trend Research's liquidation price changes, it is clear how the risk has been tightening. This process can be presented in a simple timeline table:

Faced with the tightening liquidation line, Yi Lihua did not remain inactive. Monitoring data showed that Trend Research took notable action in the early hours of February 6—withdrawing 7.989 million USDT from Binance, only to later deposit it back into the exchange.

This action was interpreted by the market as an attempt to supplement margin or adjust positions, but ultimately may have been abandoned due to adverse market conditions.

4. Market Resonance

Yi Lihua's predicament is not an isolated case; many well-known institutions and companies suffered heavy losses in this storm sweeping through the cryptocurrency market.

● Bitmine, a digital asset company led by Wall Street bull Tom Lee, disclosed that as Ethereum's price plummeted, the company's losses had ballooned to $8 billion based on market capitalization.

● Unlike Trend Research, Bitmine emphasized that its Ethereum acquisitions were made through equity financing rather than leveraged loans, thus facing “no liquidation pressure.” However, the company's stock price still took a severe hit, dropping 14.29% on the day.

5. Roots of the Crisis

● Multiple factors are intertwined behind this round of cryptocurrency declines. U.S. Treasury Secretary Scott Basset recently made it clear that the U.S. government will not bail out the cryptocurrency market. This statement shattered some investors' illusions of government support. Basset emphasized during a debate in the House Financial Services Committee: “I do not have the authority to do that.”

● Bloomberg data showed that over $800 million flowed out of Bitcoin exchange-traded funds during the three trading days from February 3 to 5. Meanwhile, weak U.S. employment data further exacerbated market risk aversion.

6. Warnings from the Titans

● In the face of the market's extreme volatility, well-known investors have issued warnings. Michael Burry, famous for predicting the 2008 financial crisis, pointed out that the continued decline in Bitcoin prices could “trigger a death spiral, leading to a massive collapse in value.” He described Bitcoin as “a purely speculative asset,” far from achieving the hedging function of precious metals like gold.

● Michael Novogratz, CEO of fund management company Galaxy Digital, observed: “In the past, there was an almost religious belief in the market that ‘you must hold Bitcoin at all costs.’ But somehow, that belief or fervor has faded.”

Ethereum's price briefly dipped below $1700 on February 6, just a step away from Yi Lihua's core liquidation range. Users on trading platforms predicted: “It looks like there will be a complete liquidation today; tens of billions of dollars have vanished in just a few days!”

The fear and greed index for the entire cryptocurrency market has dropped to 10, indicating an “extreme fear” state. Regardless of whether Yi Lihua's positions can withstand this storm, the high-leverage risks in the cryptocurrency market have once again been laid bare.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。