Original author: Ma He, Foresight News

If someone told you that there are some smart traders who can make money by predicting the weather and temperature, would you believe it?

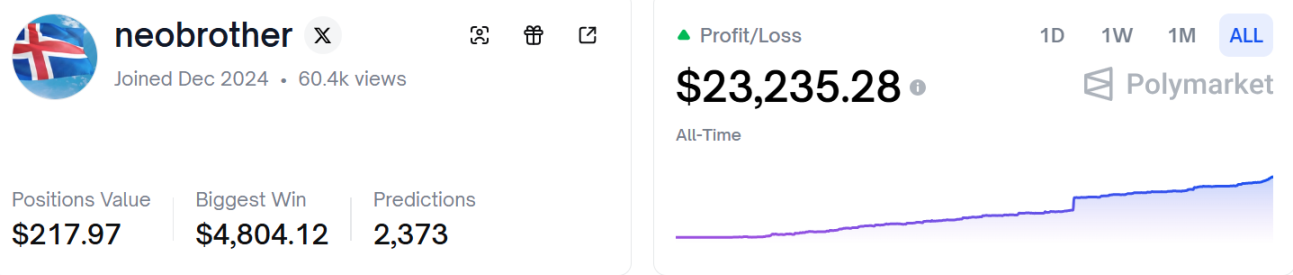

The trader named neobrother in the image above has been making crazy bets on the weather in various cities on Polymarket, currently accumulating profits of over $20,000. He is not a blind speculator but a highly data-driven expert who specializes in vertical segmentation and is skilled in leveraging odds. neobrother's trading records are almost entirely focused on weather predictions, particularly the daily maximum temperatures in major cities around the world (Buenos Aires, Miami, Ankara, Chicago, New York).

He does not bet on the "trend," but rather on "accuracy," like a grid arbitrageur in the field of meteorology.

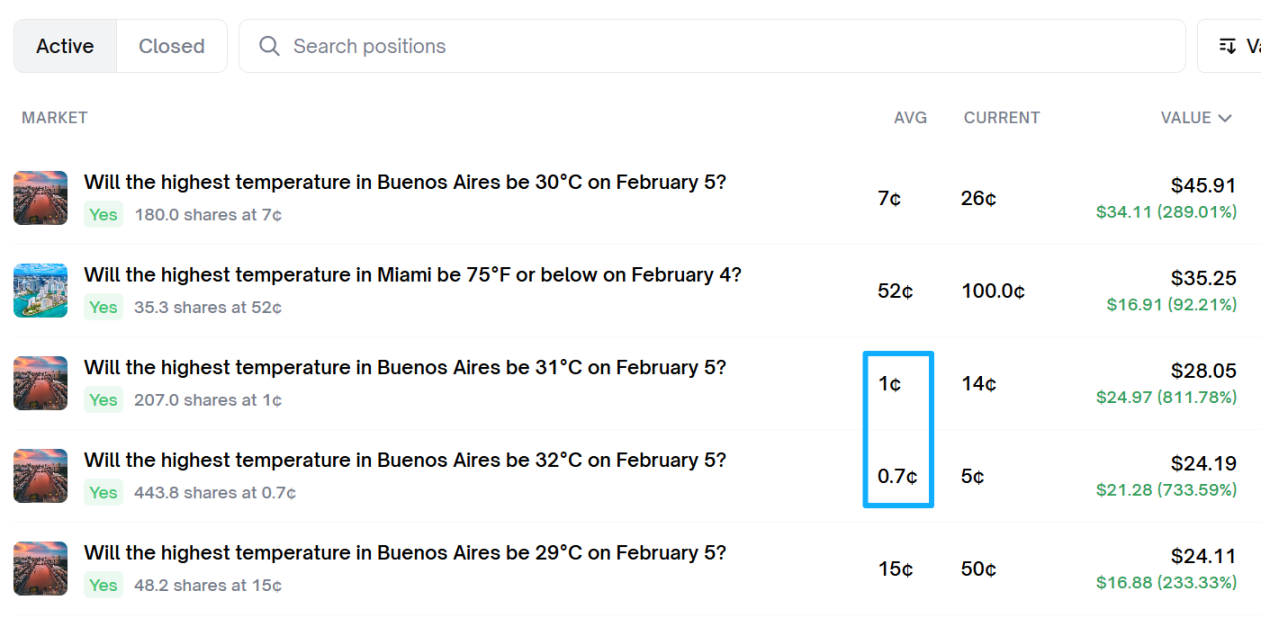

Taking the temperature prediction for Buenos Aires as an example, he did not just bet on a single temperature but used a "Laddering" strategy, simultaneously buying Yes bets for 29°C, 30°C, 31°C, 32°C, 33°C, and even 34°C+. This approach is similar to "wide straddle arbitrage" or "grid trading" in options. By placing dense low-priced orders (0.2¢ - 15¢) within a highly probable temperature range, as long as the final temperature falls within this range, the super high returns from one or two positions (such as the 811.78% return from 31°C) can cover the losses from all other ladders and achieve substantial profits.

In addition, he is also skilled at capturing some extremely low-probability money-making opportunities. Most of the positions he buys in the prediction market have very low prices. For example, on his position for 32°C in Buenos Aires, his average purchase price was only 0.7¢. This purchase price means he has obtained a potential odds of nearly 142 times. Screenshots show that this position has currently risen to 5¢ (an increase of 733%).

He can leverage minimal costs to bet on the price volatility caused by deviations in weather forecasts. This style requires a deep understanding of meteorological models (such as ECMWF or GFS) and the ability to act decisively when market prices react slowly.

These 2,373 predictions indicate that his trading is extremely frequent and highly automated/systematic. He is likely a quantitative or semi-quantitative trader who monitors changes in weather forecasts in real-time through scripts and places orders. He does not put a large amount of capital into a single position but continuously seeks hundreds of times returns through small costs, quickly withdrawing profits or reinvesting for compound interest.

He may have a set of weather prediction sources that are more accurate and real-time than most retail investors on Polymarket (possibly connected to meteorological station APIs). Politics and sports have too much noise, while weather is purely physics and mathematics; as long as the model is accurate, this is his endless ATM.

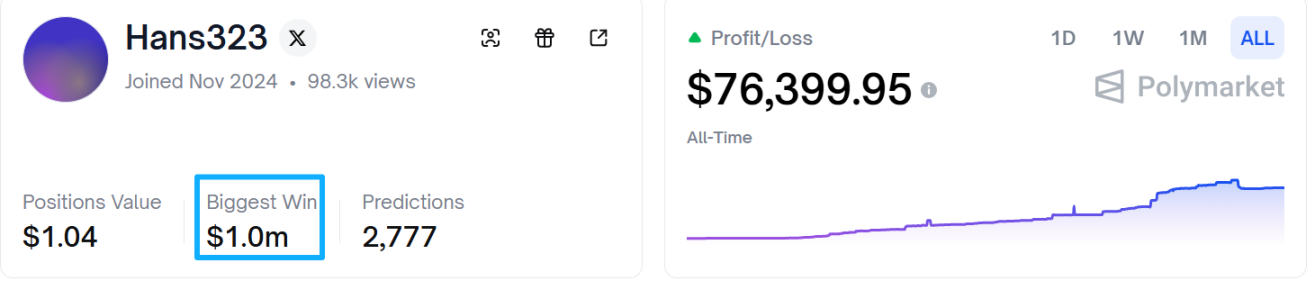

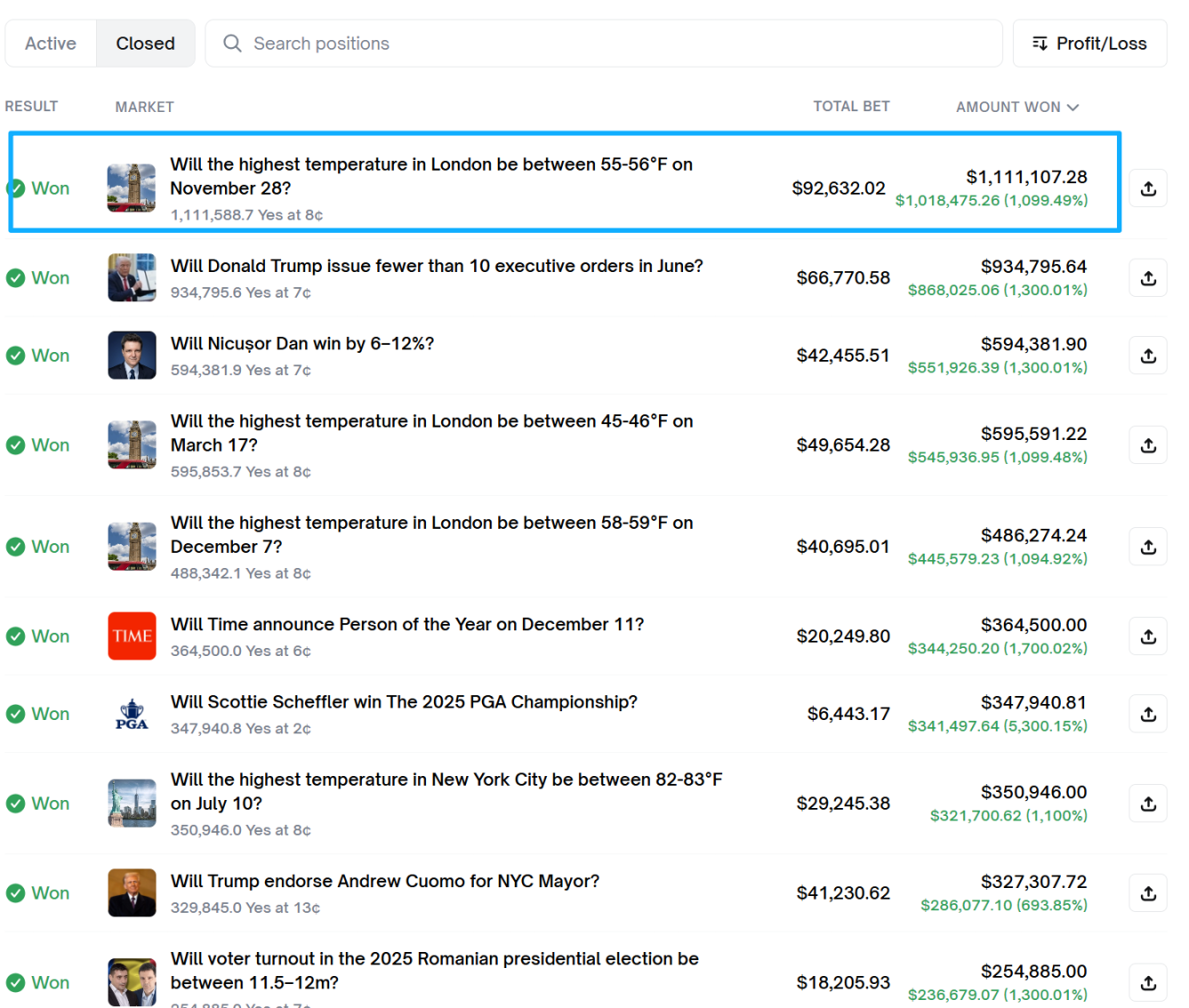

If this trader is a "weather geek" who precisely calculates the winds and clouds in a laboratory, then Hans323 is the "black swan hunter" and "top odds master" on Polymarket. He dared to place a single bet of $92,000 on a London weather prediction with only an 8% win rate, crazily profiting $1.11 million.

Hans323's operations have moved beyond simple predictions; he is utilizing extremely asymmetric risk-reward ratios for large-scale capital harvesting.

Observing his winning records, the buying prices are usually between 2¢ - 8¢. In the prediction market, this represents that the market believes the probability of the event occurring is only 2% - 8%. An ordinary player might only bet $10 on a 2¢ order, but Hans323 dares to invest $92,632 at the 8¢ position (London temperature bet).

This strategy is similar to hedge fund manager Nassim Taleb's "leveraged investment." He does not care if 90% of predictions fail because hitting once with a return of 1,100% or even 5,300% is enough to cover the costs of thousands of trial-and-error attempts.

Unlike neobrother's "ladder full coverage," Hans323 prefers to invest large sums at specific, statistically biased narrow points, which requires strong confidence and underlying model support.

Additionally, reviewing all his past trading records, this trader may be a versatile player, possibly backed by a strong data scraping team or intelligence sources in vertical fields. For example, in the political field: betting that Trump would issue fewer than 10 executive orders in June (entry at 7¢), in sports, decisively buying when Scottie Scheffler's odds of winning the PGA were extremely low (2¢), and successfully predicting Time magazine's Person of the Year (6¢) in the cultural field, all of which yielded good results.

While making money is important, ordinary users tracking the trading records of Polymarket experts should not only look at their win rates but also pay attention to their capital skewness and their own risk control. Because the same large loss can be handled very differently by different people.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。