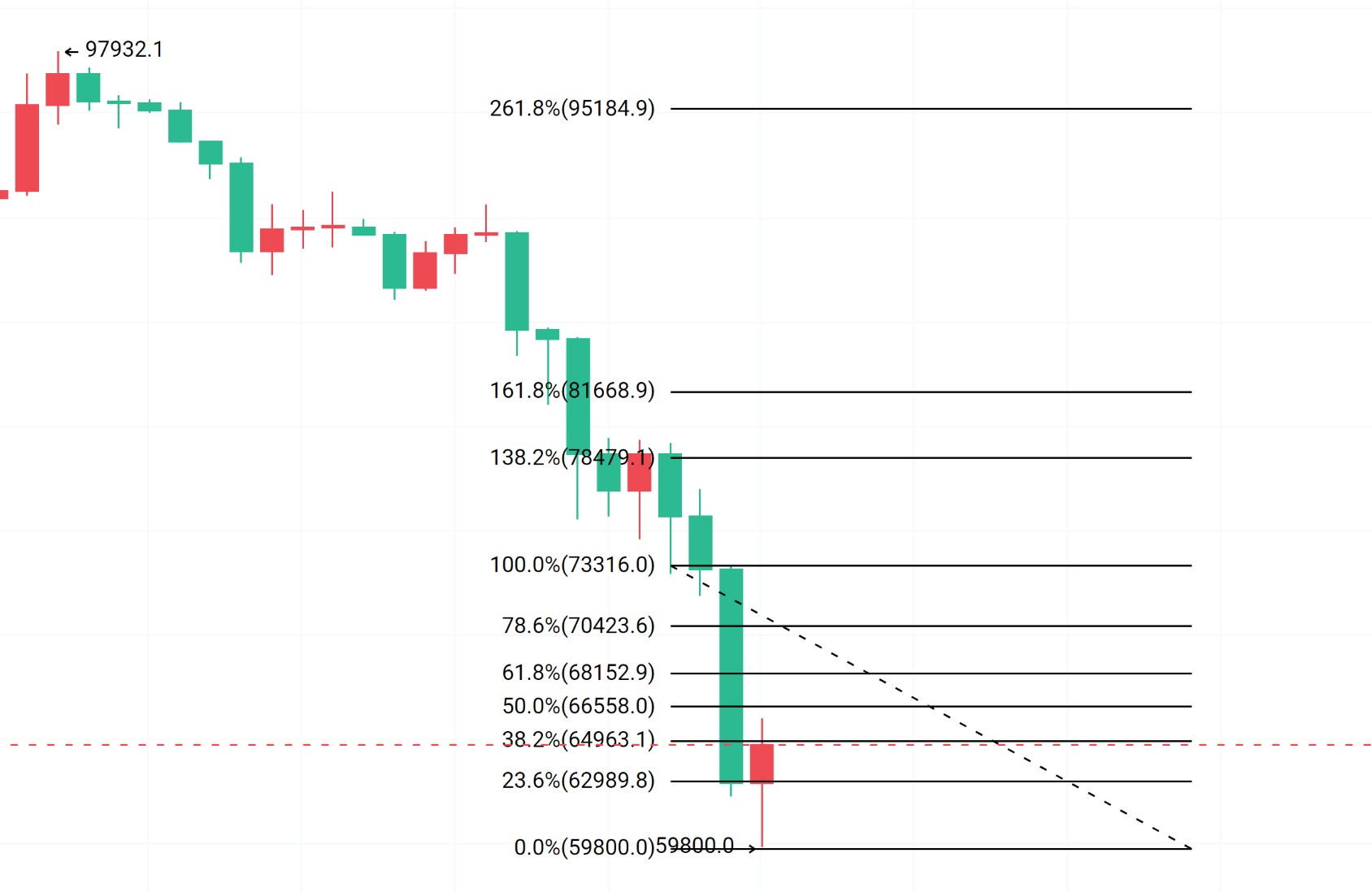

Bitcoin briefly dipped to around 59,800 this morning before stopping the decline, and then started to rebound, forming a V-shape at around 65,969, pulling up over 6,000 points. Is this a bull return, a quick recovery, or a correction after an oversold condition?

Indicators

The indicators are severely oversold. If we continue to analyze the market using indicators, even Zhongliang is unsure of their reliability. Zhongliang's view remains bearish. If the indicators are still valid, then the middle band of the Bollinger Bands on the hourly chart is suppressing around 66,300, while the middle band on the 4-hour chart is suppressing around 72,500. If we use the Fibonacci retracement tool, taking yesterday's high and this morning's low as reference points, the 0.5 level corresponds to around 66,500, the 0.618 level corresponds to around 68,100, and the 0.786 level corresponds to around 70,400. These are all resistance levels above. Which level will hold and push the market down will need time to verify!

In the Ethereum hourly chart, the middle band is suppressing around 1,950, and the 4-hour chart's middle band is suppressing around 2,150. If we look at the Fibonacci retracement, the 0.5 level corresponds to around 1,953, the 0.618 level corresponds to around 2,005, and the 0.786 level corresponds to around 2,079. These are also resistance levels above. If you are also bearish, then these are the points to pay attention to and reference. If you have long positions, then the resistance levels above are where you should consider reducing your position or taking profits!

Real life always teaches us many lessons. In life, if you are not fully prepared, you will have to endure the heaviest rain; in work, if you are not fully prepared, you will have to bear the harshest criticism; in family, if you are not fully prepared, you will have to suffer the greatest hardships… In many cases, we may not realize this in our daily lives, but when we truly face it, we will find ourselves in a dilemma. This may be human nature, as well as inertia…

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。