Written by: Little Bear Biscuit | Bitpush

On February 5, 2026, the cryptocurrency market experienced "Mad Thursday."

During the early trading hours in New York, Bitcoin broke through the psychological barriers of $70,000 and $68,000 in just a few hours, then fluctuated back down to below $63,000, with an intraday low reaching $62,353.54, the lowest level since October 2024. Since hitting a historical high of $126,000 last October, BTC has retraced by as much as 50% in just four months.

From the fervent expectations of the "Trump Bull Market" to the current liquidity crunch, the market narrative is undergoing a dramatic shift. With the U.S. Clarity Act stalled in the legislative process, the previously anticipated policy benefits have significantly cooled. Meanwhile, a recent poll by the Pew Research Center on January 29 shows that Trump's approval rating has dropped to a yearly low of 38%.

Currently, 60% of investors in the prediction market are betting that the price will fall below $55,000.

This sharp decline has caught many newcomers who entered at last year's highs off guard, while veterans in the industry have expressed differing views.

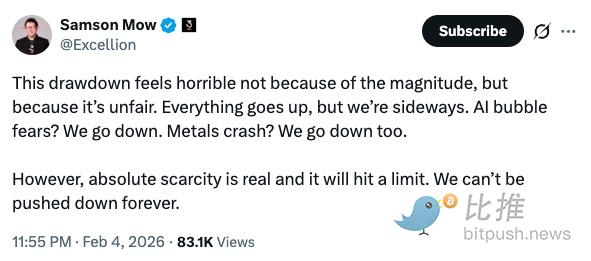

Samson Mow, CEO of Jan3 and a staunch supporter of Bitcoin, stated: "This pullback feels bad, not because of the magnitude, but because it is unfair. When everything is rising, we are flat; when there are concerns about the AI bubble, we fall; when the precious metals market crashes, we also drop."

This divergence of "falling with the market but not rising with it" reflects the awkward position of current crypto assets in the macro liquidity redistribution.

The Cost of "Begging" Wall Street?

For a long time, the crypto market has yearned for the "coronation" of traditional finance (TradFi), but this crash has led some analysts to begin reflecting on the cost of such "submission."

Market analyst Jim Bianco expressed strong disdain for the narrative that has prevailed over the past year regarding "traditional finance/baby boomer entry": "Cryptocurrency was built on the principle of permissionless; it aims to disrupt the traditional financial system. I believe in this mission. In many ways, the traditional financial system does need to be disrupted. Seeking validation from Larry Fink, Powell, or Trump is the opposite of the crypto spirit. The next bull run will never come from more suited elites endorsing Bitcoin."

Bianco believes that if the crypto industry cannot return to its original intention of "building an alternative financial system" and instead waits for the benevolence of giants like BlackRock, then the "crypto winter" will continue.

The Warning from the "Big Short": The "Death Spiral" of Corporate Balance Sheets

Michael Burry, the prototype of "The Big Short," recently issued a warning, suggesting that Bitcoin could trigger a "self-reinforcing death spiral." His core concern is that Bitcoin's volatility is spreading to risk assets through corporate balance sheets.

Currently, nearly 200 publicly traded companies (represented by MicroStrategy) have heavily invested in Bitcoin. These companies have effectively evolved into "leveraged Bitcoin ETFs." When BTC drops by 10%, the stock prices of these companies could fall by 25% or more.

Burry pointed out that as prices continue to decline, company boards and risk management managers will have to choose to reduce holdings to protect capital and meet risk management policies. This "forced selling," not based on strategy but on survival, will deliver a devastating secondary blow to Bitcoin prices. Burry believes that Bitcoin has failed as a digital safe-haven asset or gold substitute, and he considers the recent rise driven by ETFs to be speculative rather than evidence of lasting, real-world adoption.

Cycle Recurrence: Opportunity or Abyss?

Despite the widespread despair, some OGs remain calm.

Former Coinbase CTO Balaji Srinivasan maintains his consistently "highly bullish" stance: "I have never been more optimistic about Bitcoin because the order based on rules is collapsing, while the order based on code is rising. Short-term price fluctuations are meaningless."

Focus on the 200-Day Moving Average

Given the current market environment is extremely fragile, with insufficient depth in buy and sell orders to buffer trades, even moderate selling could trigger severe price volatility, leading to deeper liquidation waves.

"Liquidity scarcity is one of the main causes of volatility," noted Adrian Fritz, Chief Investment Strategist at 21Shares. "In the current environment, once selling pressure appears, it can easily trigger large-scale chain liquidations. There are currently no clear signs of a bottoming rebound, and it is too early to assert a 'reversal.'"

Investors need to pay close attention to the 200-day moving average (currently around $58,000 to $60,000), which is a key support level. Adrian Fritz stated that this level closely aligns with Bitcoin's "realized price" (the average holding cost of all holders) and is expected to form a strong, cross-year long-term support range.

Diana Pires, Vice President of sFOX, believes: "Bitcoin is currently testing the key technical support level between $60,000 and $70,000, which is the bottom of the rally before Trump's victory. If it continues to fall below this range, it will increase the risk of a long-term price decline; if the price stabilizes here, it indicates a correction rather than a structural change."

Conclusion

History does not repeat itself simply, but it often carries similar rhymes. Looking back:

In 2014, Mt. Gox was hacked, and the market crashed.

In 2018, the ICO bubble burst, and Bitcoin lost three-quarters of its value.

In 2021-22, from regulatory pressure to the collapse of FTX, confidence was repeatedly hammered.

Each time, people thought "this time is different," but looking back, after each deep decline, Bitcoin did indeed recover and reached new highs. Typically, it takes about a year to a year and a half, but there have been longer instances—like in 2013, which took nearly three years.

So now that this drop has reached $60,000, it feels uncomfortable, but it's not a new plot we haven't seen before.

What is most important right now?

First, save your bullets. Don’t exhaust all your chips in panic; the market never lacks opportunities, only patience.

Second, stay at the table. Many people's failures are not due to misjudging the direction but being forced to exit at the bottom of the cycle.

Balaji Srinivasan put it succinctly: "I have never been more optimistic about crypto… because the order based on code is rising."

Look at short-term sentiment, but long-term rules. As long as the hard cap of 21 million Bitcoins remains, the game is far from over. If it drops, endure; surviving is more important than anything else.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。