Family, nowadays whether it's buying funds or making investments, isn't the first question everyone asks when they meet, "Can we still buy gold?" Are the folks in the discussion area feeling the same? Many friends outside the crypto circle have also jumped on the gold buying bandwagon, but most are just buying blindly—either afraid to buy at a high or panicking after getting stuck at a high point, especially friends trading contracts, where a small mistake with 20x leverage can lead to significant losses!

Today, let's get practical and use technical indicators to help everyone accurately pinpoint gold buying and selling points!

First, let me be honest: for us in the crypto circle trading gold contracts, the first choice is still Hyperliquid!

I just tested it before the live stream; trades are executed in seconds, supporting up to 20x leverage, flexible and safe. I will explain the platform's features in detail later, but today we will focus on technical analysis—using AiCoin's K-line tool to teach everyone the winning techniques for day trading gold!

First, let's find the gold market on AiCoin and follow my steps: open the AiCoin app, click on "Market," then click on "Index."

Inside, the London Gold and London Silver are the real-time K-line prices, so hurry and check it out.

Those with PRO membership have an even better experience, as they can see major orders, on-chain whale movements, and customize indicators. If you want to accurately grasp the gold market, this membership is a must!

If your friends are buying gold funds, just send them the AiCoin London Gold K-line; it's very intuitive.

Now that the gold price has dropped, isn't this a great opportunity to "pick up people on the way back"? Surely some are worried about "whether this is chasing the high." I will analyze it from both fundamental and technical perspectives to ease your concerns.

First, let's look at the fundamentals: gold is no longer dictated by the old logic of "real interest rates"; now it has multi-dimensional hard support!

First, central bank gold purchases are the most stable "floor demand"—global central banks have been buying gold for 15 consecutive years, and after 2022, they have been aggressively increasing their holdings. Countries like China, India, and Poland are buying in large quantities every month, averaging over 1,000 tons a year, which is the fundamental support for a bull market.

Second, the credibility of the US dollar and US debt can no longer hold up—US debt has skyrocketed, and the only way to dilute the debt is through printing money. The market has long factored in "long-term depreciation of the dollar" into gold prices, which is why gold prices can still reach new highs even with high real interest rates.

Third, geopolitical risks have never stopped—conflicts like the Russia-Ukraine situation and tensions in the Middle East mean that the more turbulent the world gets, the more people want to buy gold for safety, creating a positive cycle of "panic → buy gold → gold price rises → more funds enter the market." Fourth, USDT companies in the crypto circle are secretly hoarding gold; smart money has already taken action!

So the conclusion is clear: gold is worth investing in for the long term, though there may be fluctuations in the short term. Ordinary investors can dollar-cost average into physical gold, while we crypto elites have more flexibility—trading spot, playing contracts, letting funds move with the market. After all, gold has been in a super cycle since 2018, continuously reaching historical highs; it's not too late to get in now!

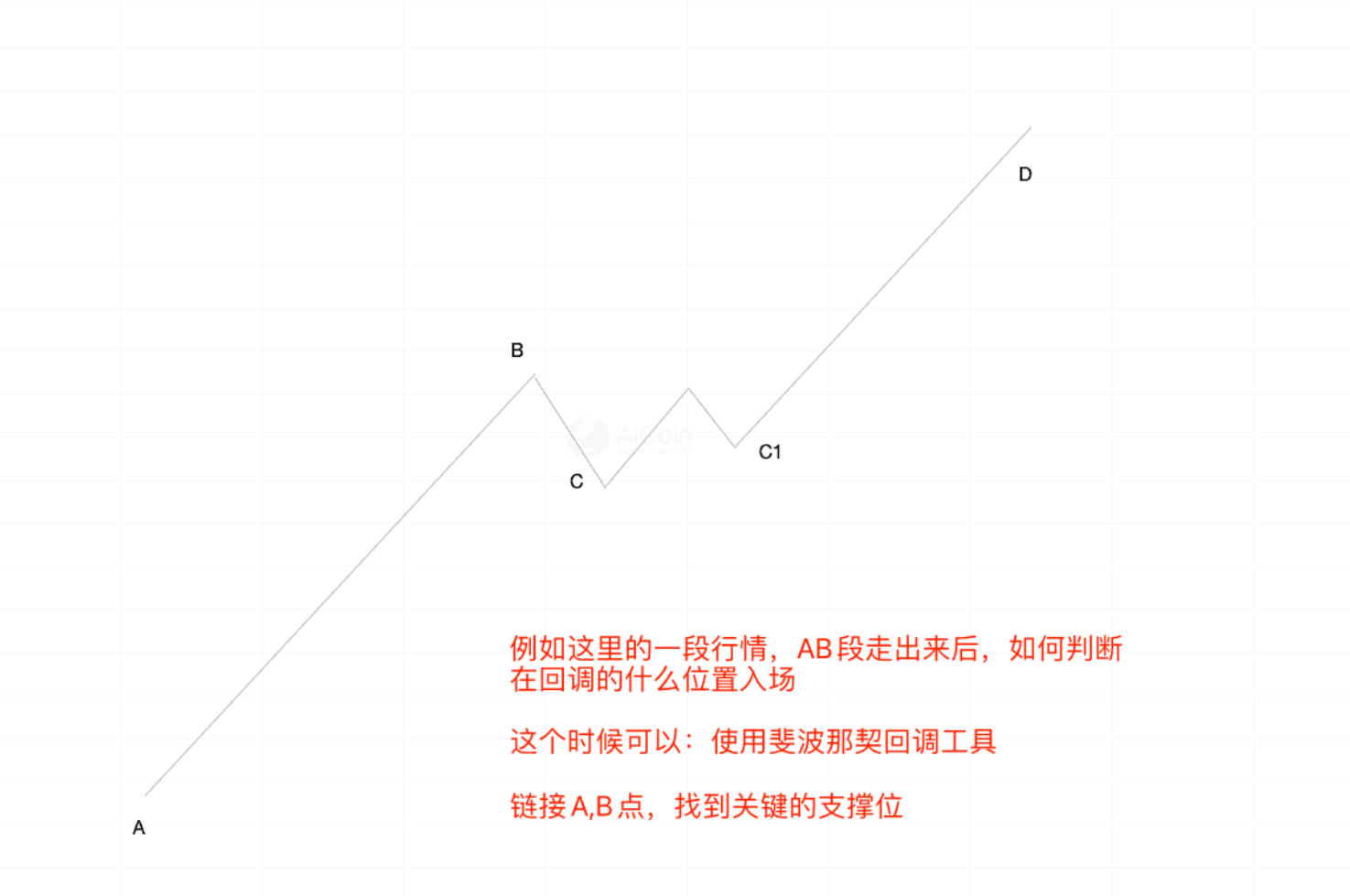

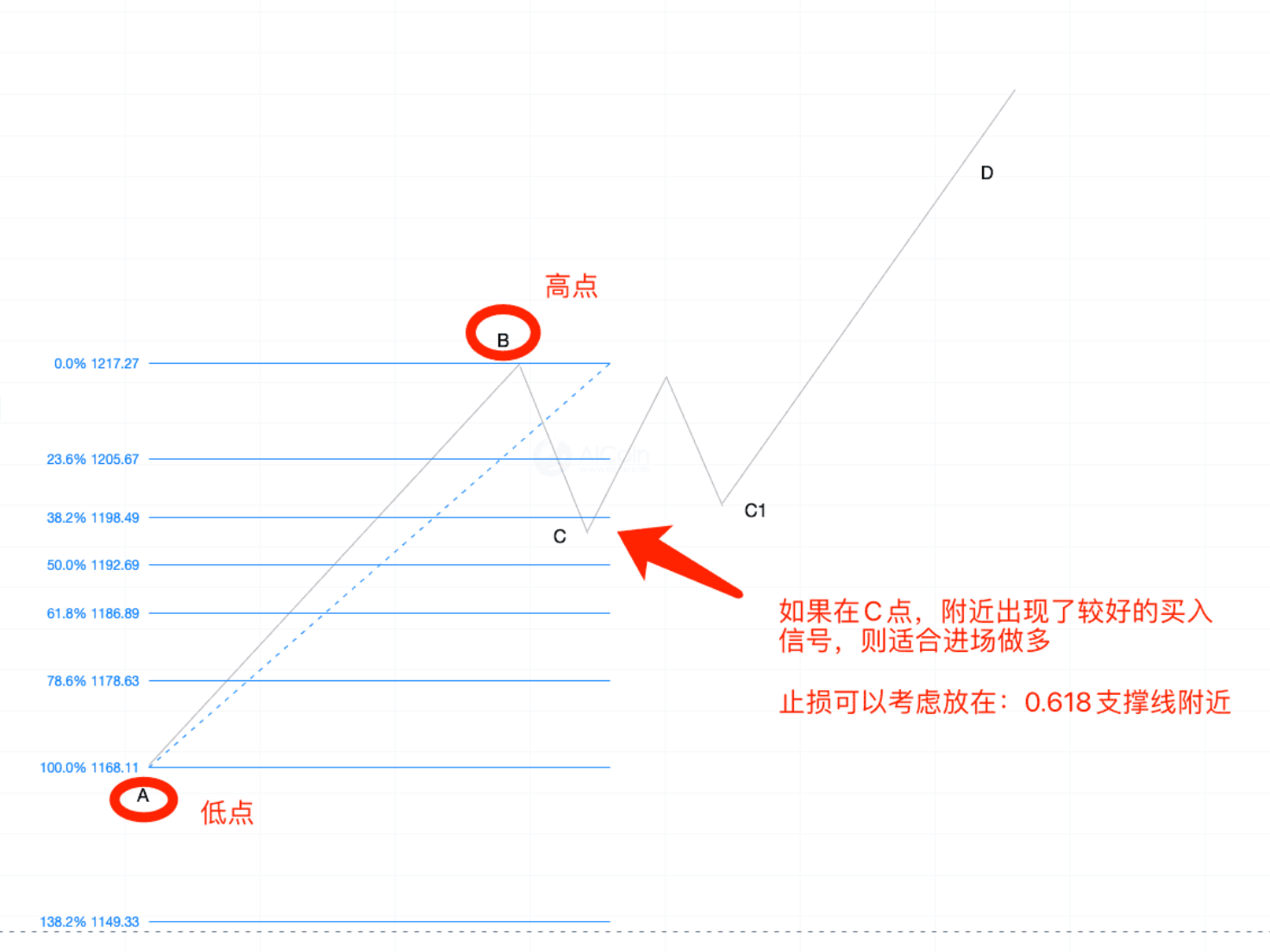

Here comes the key! The "golden indicator" for trading gold is Fibonacci—also known as the golden ratio, specifically designed to capture retracement entry opportunities, which is when "gold is picking you up" to enter the market, reducing the probability of loss by half! Today, I will teach you how to use it for 1-minute contract trading during the day, making quick money with leverage.

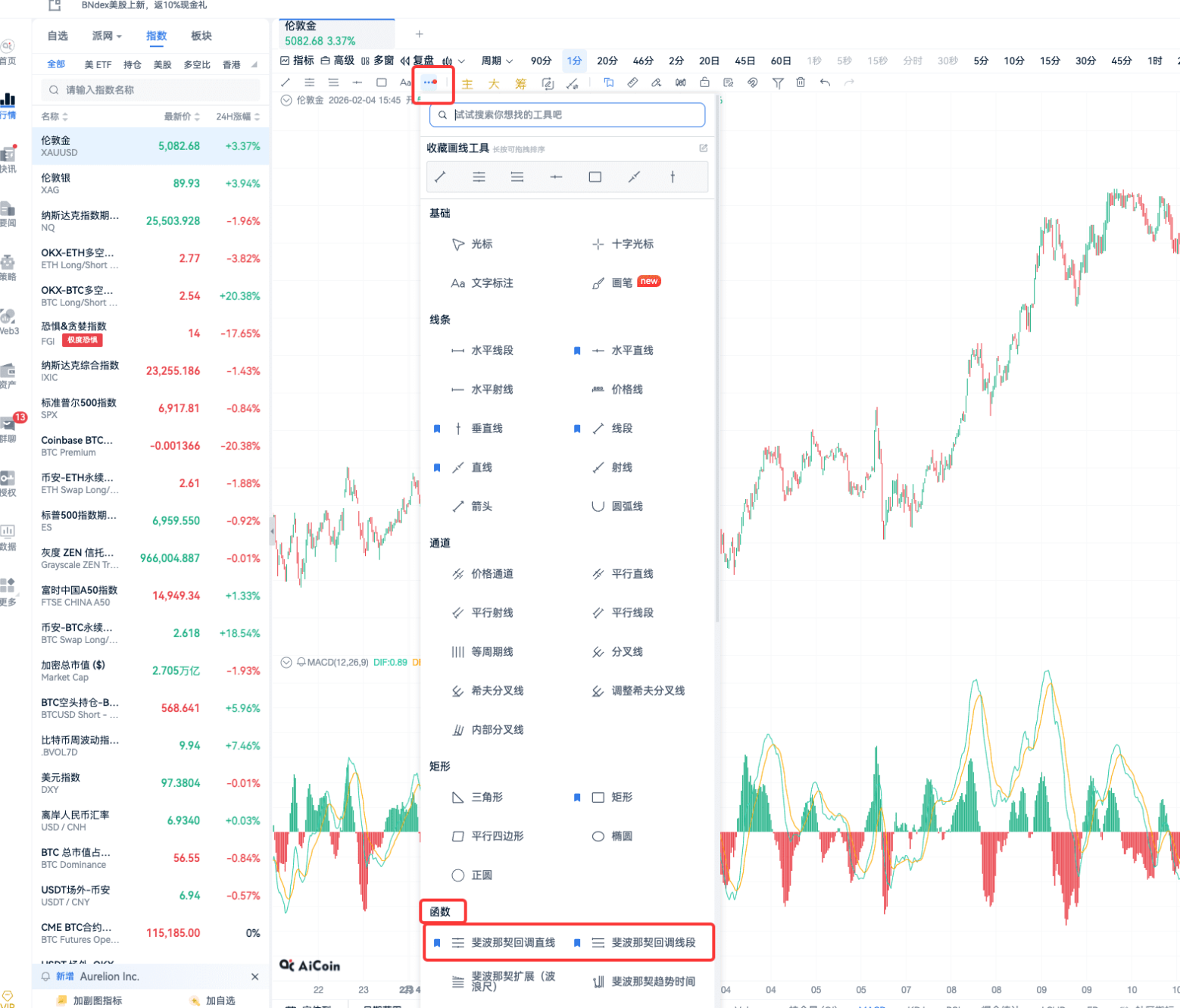

First, let me teach you how to add indicators: open the 1-minute K-line for London Gold on AiCoin (for day trading, just look at the 1-minute), find "Fibonacci Retracement Line" or "Fibonacci Retracement Segment," and add it to your quick tools for easy access next time.

Many people are afraid they won't be able to pick high and low points, but it's actually super simple! For 1-minute day trading, just find the recent low points and the latest high points from the past few days; no need to worry about perfect points: for example, the retracement at 2 AM today was to 4881.

That's the low point; wait until 9:25 AM to form a new high point, and just connect these two points.

There are two methods for drawing lines: either include the upper and lower shadows or only look at the K-line body. Beginners can choose either method to start using it; the key is to get familiar with the tool first!

After drawing the lines, focus on three support levels: 0.382, 0.5, and 0.618! The current gold market is strong, and if it retraces to 0.382, you can enter the market; that's the best cost-performance ratio. If it falls below 0.618, quickly stop loss; don't hold on stubbornly, just wait for the next opportunity. Those with ample funds can look to 0.786 at the lowest, but generally, this risk is not recommended.

Let me show you an example of today's actual market: the low point at 4881 in the early morning, and after forming a new high point at 9:25 AM, the result was that the gold price was so strong that it didn't even retrace to 0.236 before going straight up.

This is a signal of a strong market. Next time you encounter this situation, if it retraces to 0.382, decisively enter the market without hesitation! If you want to trade shorter trends, you can also just find the high and low points after waking up that day and adjust flexibly.

Our research institute has previously released three or four issues on the professional use of Fibonacci. If you want to learn more in-depth, you can check them out: https://www.aicoin.com/zh-Hans/article/321247、https://www.aicoin.com/zh-Hans/article/322252

Let's seize the opportunity to enter the gold pit together and make some quick money with precise day trading!

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

This article only represents the author's personal views and does not represent the platform's stance or views. This article is for information sharing only and does not constitute any investment advice to anyone.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。