Article edited on February 6, 2026, at 18:30. All opinions do not constitute any investment advice! For learning and communication purposes only.

Self-discipline hides infinite possibilities in life, and its depth also measures the height of life. Every step of deep cultivation has its own echo; the more disciplined one is, the further they go. I am Fu Zhu, deeply engaged in analyzing mainstream cryptocurrency trends, breaking down market logic based on professional accumulation, and providing pragmatic trading ideas.

Market Overview

Today, the cryptocurrency market experienced severe volatility. In the early session, it sharply declined, with Bitcoin dropping below $60,000, hitting a 15-month low, and rebounding after reaching a low of $59,800 to around $66,000. Ethereum fell even harder, with a daily drop of over 23%. In the past 24 hours, over 430,000 people in the market were liquidated, totaling more than $2 billion. The overall market capitalization is approximately $2.32 trillion, with a cumulative decline of over 20% this week and trading volume reaching $362 billion.

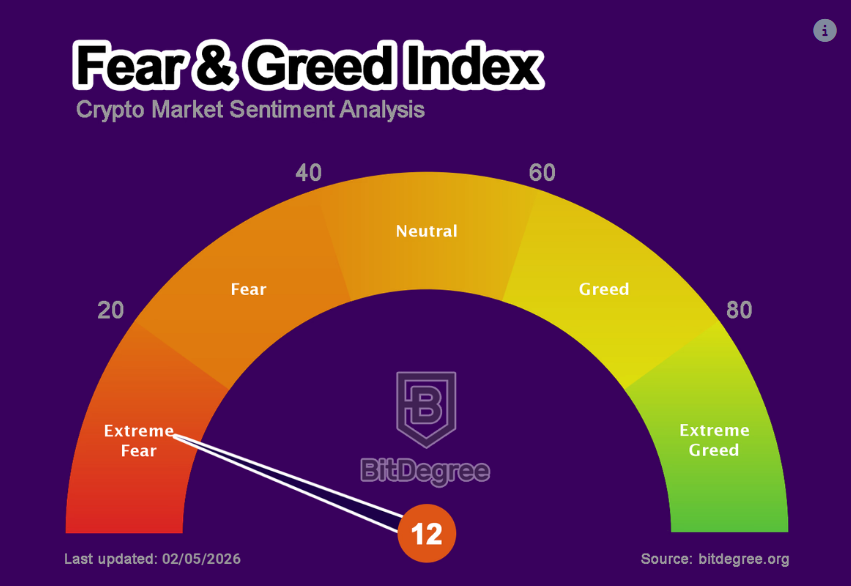

The Fear and Greed Index remains at 12, indicating extreme fear. The retreat of risk assets continues to dominate the market in the short term.

Trend Analysis

Bitcoin (BTC): Rebound after a plunge, increased volatility

Bitcoin has accumulated a decline of over 25% this week, touching below $60,000 in the morning, similar to the volatility during the FTX collapse in 2022. Coupled with leverage liquidation and pressure from tech stocks pushing downward, the leverage liquidation has entered a vicious cycle: the market decline triggered a chain of liquidations of high-leverage positions (in just the past hour, the total liquidation reached $555 million), and the selling pressure was automatically amplified, forming a vicious cycle of "decline → liquidation → further decline."

However, the short-term rebound indicates that there is buying interest. If Bitcoin can consolidate above $65,000, it may test $70,000. Otherwise, if it effectively breaks below $60,000, it could drop to $55,000.

Ethereum (ETH): Following the market's sharp decline, confidence is low

Ethereum has accumulated a decline of over 30% this week. It directly broke below the $1,800 support in the morning, rebounding after hitting a low near $1,736, and is currently fluctuating around $1,950. If it can consolidate above $1,800 in the short term, there is a chance to challenge $2,000. If it effectively breaks below $1,800, it could drop to the $1,600-$1,400 range.

Potential Influencing Factors

This volatility stems from the global tech retreat, the Federal Reserve's hawkish stance, and geopolitical risks, leading to a 20% reduction in market value over the week. In the short term, the market may fluctuate around $65,000. However, it should be noted that it may again challenge $60,000. This position is not easy to operate; it is still advisable to focus on short positions, entering and exiting quickly, with Bitcoin around $67,000 as a reference and Ethereum around $2,000. (Remember to control contract positions within 10% and set stop-loss orders.)

Disclaimer: The above content is personal opinion, and the strategies are for reference only and should not be used as investment basis. Any risks taken are at your own discretion.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。