Suddenly, so many announcements from domestic central banks and eight ministries have emerged:

Could this information be the cause of the sharp decline?

I. Let's first take a look at what has been said—

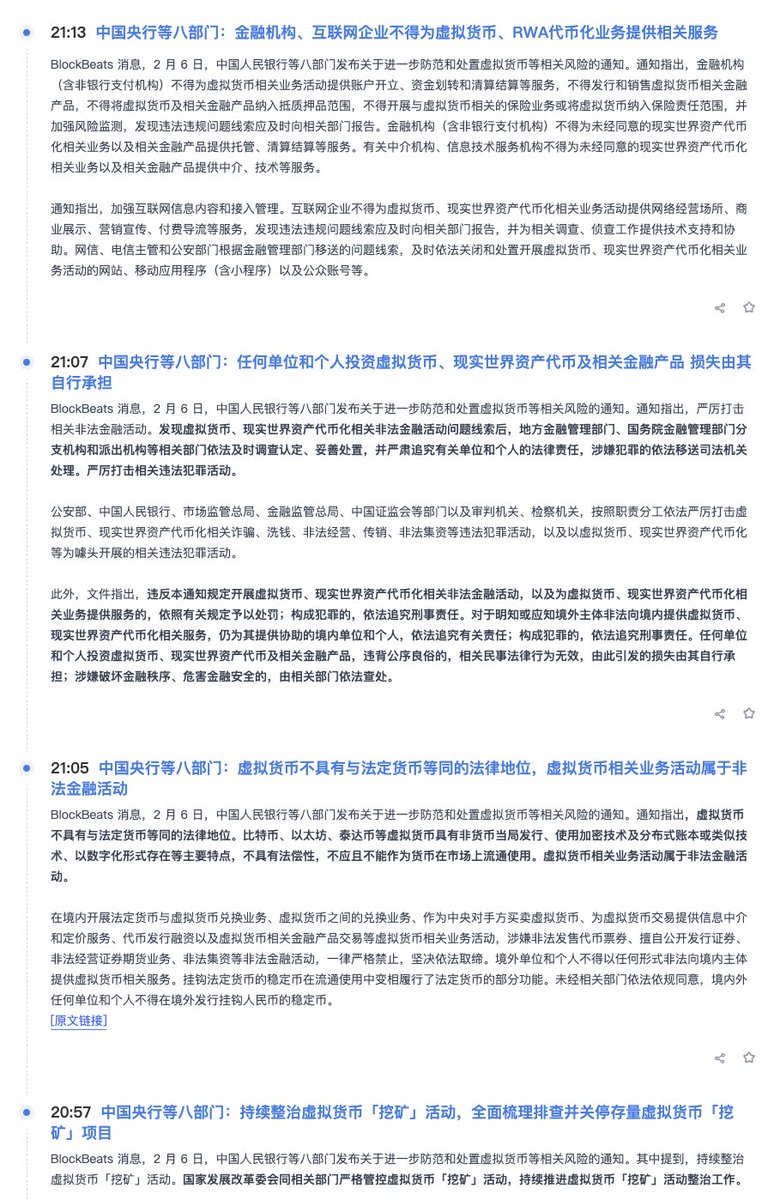

1️⃣ Legal Definition: Virtual currencies do not have the status of legal tender, and their related activities are overall recognized as illegal financial activities within China.

2️⃣ Financial System Isolation: All financial institutions and payment systems must completely sever ties with virtual currencies and RWA tokenization businesses.

3️⃣ Internet Access Blocking: No internet platform is allowed to provide display, promotion, traffic diversion, or operational space for virtual currencies or RWA.

4️⃣ Complete Responsibility Segregation: Any unit or individual participating in virtual currency or RWA investment bears their own losses and is not protected by financial or civil law.

5️⃣ Assistance Equals Responsibility: Those who knowingly or should have known and still provide assistance to overseas virtual currency or RWA projects may be held legally accountable.

6️⃣ Stablecoin Red Line: Without approval, any form of RMB-pegged stablecoin is strictly prohibited both domestically and internationally.

7️⃣ Mining Industry Cleanup: Virtual currency mining and its upstream and downstream industrial chains are being continuously and systematically phased out within China.

8️⃣ Long-term Governance Signal: This is not a short-term tightening of regulations, but a reaffirmation of China's long-term governance structure regarding virtual currencies.

II. Warnings from industry practitioners:

I believe the most critical opportunity clause clearly states: even if the entity is overseas, as long as it provides services or assistance to domestic users, the responsibility may fall on individuals within China.

Especially for financial institutions or individuals, if they knowingly provide technical support for virtual currency or RWA tokenization for financial purposes, they cannot be exempt from liability.

As long as your actions constitute assistance, organization, or dissemination of financial activities, they may be classified as illegal financial activities.

Therefore, businesses similar to leading trades, traffic diversion, or organization, or KOLs involved in such businesses may face certain risks.

III. Structural Warnings for the Entire Industry:

Regardless of the market conditions, the boundaries within China have been firmly established. China has chosen "isolation + cleanup," not "regulatory coexistence," so there should be no further illusions about the future.

China has chosen not to allow it to become a part of finance, industry, and the internet.

This is a structural choice, not a cyclical policy.

Information From @BlockBeatsAsia

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。