The Dow jumped 758 points by mid-morning, or 1.6%, on Feb. 6 to trade at 49,655.20, nearing a new all-time high and securing a weekly gain of more than 1%. The S&P 500 added 1%, while the Nasdaq Composite rose 0.7%, though both indexes still posted weekly losses following earlier volatility from the so-called ‘tech rout.’

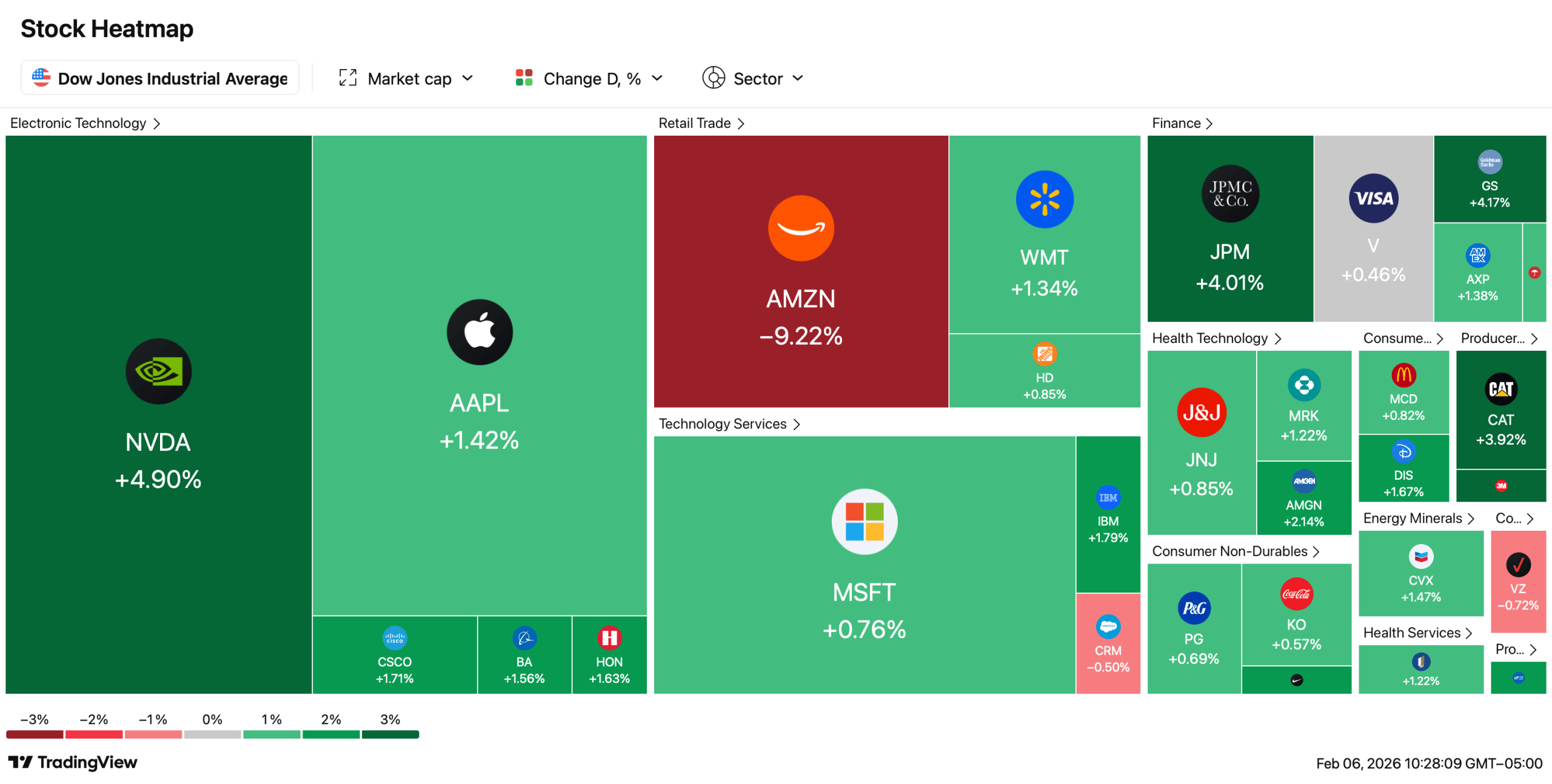

Dow Jones at 10:30 a.m. EST on Feb. 6, 2026.

The rebound followed a turbulent week dominated by sharp declines in technology, artificial intelligence (AI), and software stocks. Investor concerns intensified after artificial intelligence developments raised fears that AI tools could disrupt traditional software business models, pressuring major tech firms and triggering broad sell-offs across the sector.

Heavy capital expenditure guidance from large technology companies further weighed on sentiment. Elevated spending projections raised questions about future free cash flow, while mixed earnings results from several major firms deepened investor caution and accelerated the retreat from high-growth names.

Friday’s turnaround was driven in part by improved economic data. February consumer sentiment rose above expectations, while short-term inflation expectations declined to their lowest level in more than a year, easing pressure on interest rates and supporting confidence in economic stability.

Investors also rotated aggressively into economically sensitive sectors. Industrials and financials led gains, with large blue-chip companies contributing heavily to the Dow’s advance, reflecting a shift toward companies viewed as more resilient to AI-related disruption.

Technology stocks stabilized but remained mixed. Software shares rebounded modestly from steep weekly losses, while select megacap names posted gains as executives and analysts pushed back against concerns that AI would erode core business models.

Additionally, precious metals—both gold and silver—have logged solid gains on Friday and the crypto economy saw a modest improvement of around 1.5%. Bitcoin managed to rise around 2.3% after yesterday’s market carnage.

Also read: Report: China’s Central Bank Leads New Crackdown on Crypto, Stablecoins and Offshore Tokens

Moreover, broader market conditions also improved. Earlier in the week, manufacturing data exceeded expectations, and a trade agreement between the U.S. and India helped reduce concerns over global trade friction, supporting sentiment by Friday.

Despite the strong close, markets remain focused on upcoming economic data, including labor market reports, which could test the durability of the rebound following one of the most volatile weeks of the year.

- Why did the Dow rise to a record on Feb. 6?

Easing inflation expectations, stronger consumer sentiment, and gains in industrial and financial stocks drove the rally. - Why did tech stocks fall earlier in the week?

Concerns over AI disruption, heavy spending forecasts, and mixed earnings pressured software and technology shares. - Did all major indexes recover Friday?

Yes, though the S&P 500 and Nasdaq still finished the week lower despite Friday’s gains. - What could affect markets next week?

Upcoming labor market data and economic reports may influence investor confidence and volatility.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。