Tether’s USDT closed out 2025 with a string of milestones, reinforcing its position as the dominant stablecoin despite a cooling crypto market. According to Tether’s Q4 2025 Market Report, USDT’s market capitalization rose to $187.3 billion, up $12.4 billion during the quarter, marking another period of expansion even as total crypto market capitalization fell more than one-third after October’s liquidation cascade.

Q4 also marked the eighth consecutive quarter in which USDT added more than 30 million users. Total estimated users climbed to 534.5 million, while onchain holders increased by a record 14.7 million to 139.1 million wallets. Wallets holding USDT now represent over 70% of all stablecoin-holding wallets, underscoring its continued dominance.

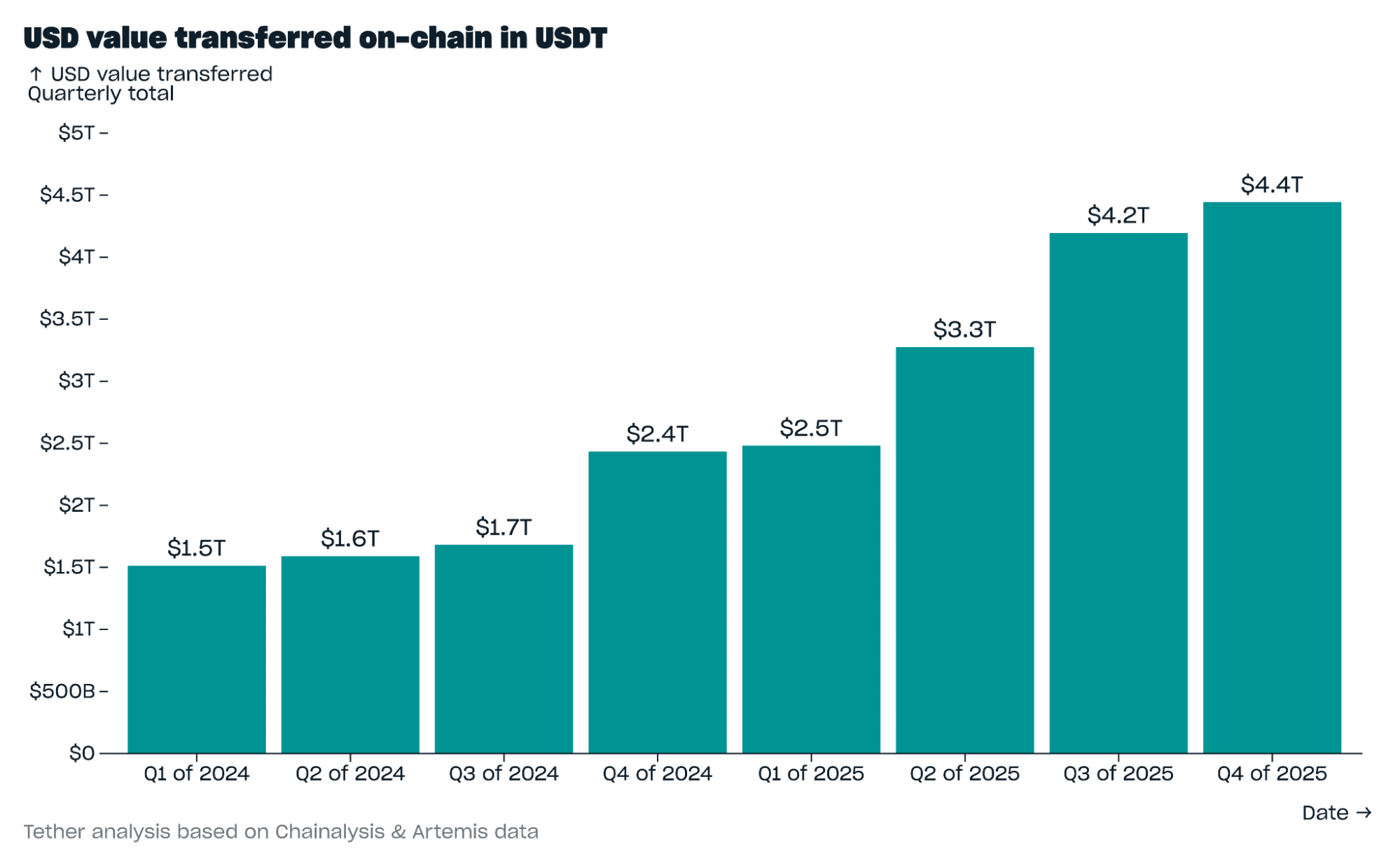

Activity onchain reached new highs as well. Monthly active USDT wallets averaged 24.8 million during the quarter, accounting for roughly 68% of all stablecoin activity. The total value transferred onchain rose to $4.4 trillion, the highest level ever recorded, while the number of transfers reached 2.2 billion, most of them transactions under $1,000, reflecting widespread everyday usage.

On the balance sheet side, Tether reported total reserves of $192.9 billion. Exposure to U.S. Treasuries climbed to $141.6 billion, positioning Tether as the equivalent of the world’s 18th-largest holder if it were a sovereign entity. Over the full year, Tether added $28.2 billion in Treasuries, making it one of the largest buyers globally. Reserves also include 96,184 bitcoin and 127.5 metric tons of gold.

While growth slowed following the October 10 liquidation event, USDT still expanded by 3.5% between then and early February 2026. Tether attributes its resilience to demand beyond crypto trading, with users increasingly relying on USDT both as a store of value and a medium of exchange.

The data suggests that USDT’s mix of low-velocity savings use cases and high-velocity transactional flows continues to provide stability and liquidity, allowing it to grow even when the broader market contracts.

- Why did USDT grow while crypto markets slowed?

Demand for USDT as a store of value and payment tool stayed strong after October’s liquidation. - How large is Tether’s USDT market cap now?

USDT reached a record $187.3 billion market cap by the end of Q4 2025. - What’s driving USDT’s on-chain activity surge?

Everyday transactions dominate, with most transfers under $1,000 and usage at all-time highs. - How solid are Tether’s reserves?

Tether holds $192.9 billion in reserves, led by $141.6 billion in U.S. Treasuries.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。